A importância do KYC e CDD na conformidade com a PLD: O que sua empresa precisa saber

Neste blog, vamos explorar a base das medidas de Conheça seu Cliente (KYC) e Diligência Prévia do Cliente (CDD) e como esses processos apoiam as funções de prevenção à lavagem de dinheiro (PLD). Vamos aprofundar o que as empresas precisam saber e fazer para cumprir suas responsabilidades regulatórias.

Dmytro Sashchuk

Introdução

Você se lembra da última vez que foi fisicamente ao banco para enviar dinheiro para algum lugar?

Embora muitas respostas "sim" possam ser esperadas, é inegável que hoje em dia abrir sua conta bancária online e enviar dinheiro pode ser feito em questão de minutos - e tudo do conforto da sua casa. As causas subjacentes para essa rápida digitalização podem ser muitas e complexas, mas claramente a pandemia de COVID-19 e o aumento substancial no número de FinTechs com certeza contribuíram para que movêssemos nosso dinheiro online.

Katharina Cera, Allegra Pietsch e Andrzej Sowiński em seu artigo preparado para o “Relatório de Estabilidade Financeira, Novembro de 2023” observaram essa tendência ao mostrar que “a digitalização está avançando tanto na banca tradicional quanto nos serviços de investimento”. Ao mesmo tempo, os mesmos autores abordam adequadamente a digitalização como uma espada de dois gumes - traz muitos benefícios enquanto simultaneamente amplifica os riscos para os sistemas financeiros.

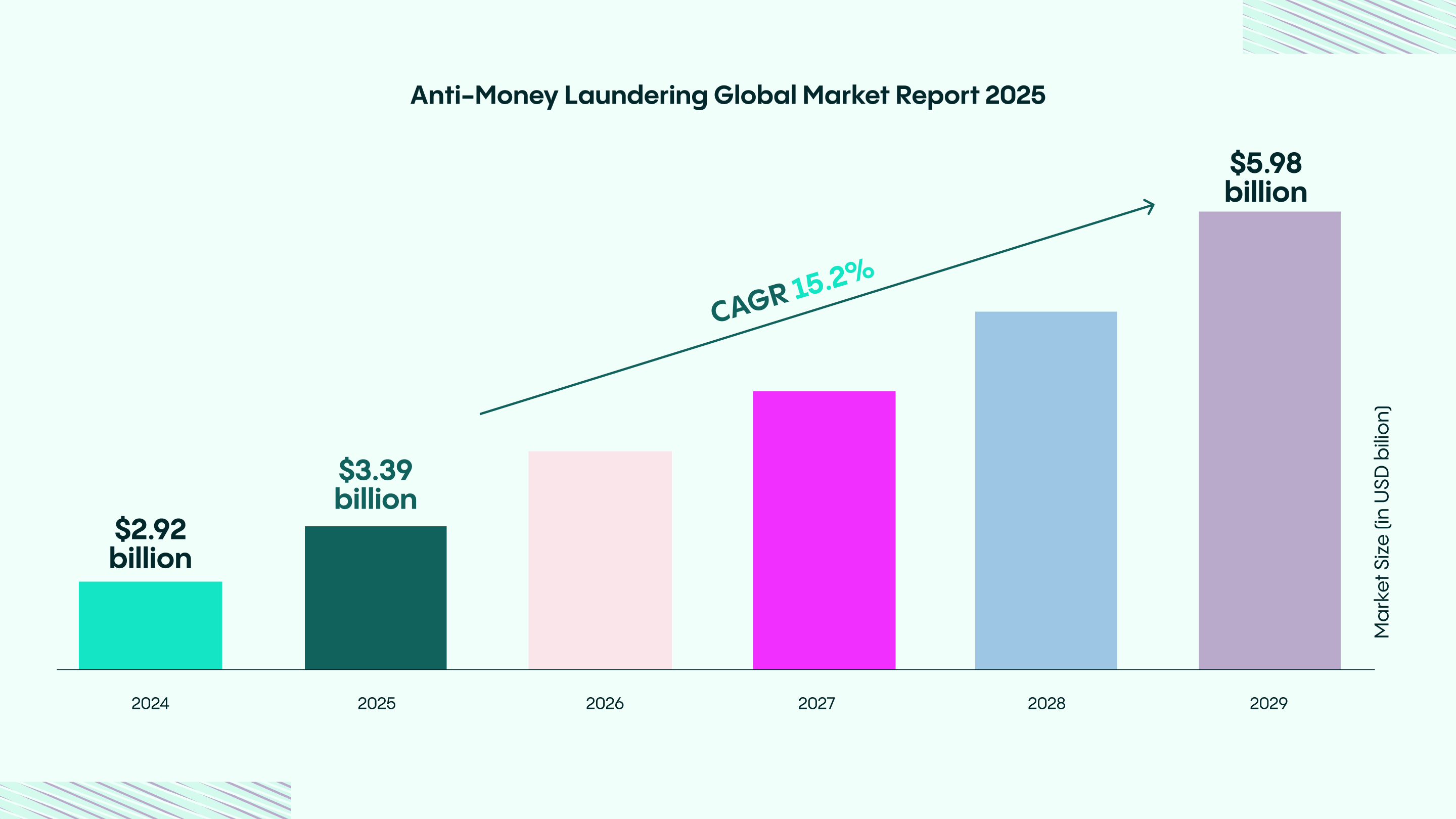

Como resultado, o combate à lavagem de dinheiro se tornou uma preocupação crescente para governos, reguladores e instituições financeiras em todo o mundo. Relatórios indicam que os casos de lavagem de dinheiro estão aumentando, conforme evidenciado por dados do Relatório de Lavagem de Dinheiro 2022 da Eurojust e outras fontes globais. De acordo com O Relatório de Mercado Global de Combate à Lavagem de Dinheiro de 2025 da Business Research Company, o mercado deve crescer de US$2,92 bilhões em 2024 para US$3,39 bilhões em 2025, a uma taxa de crescimento anual composta (CAGR) de 16%.

Esse aumento reflete uma ênfase crescente na segurança financeira e na conformidade, alimentada por fatores como globalização, transações digitais e requisitos regulatórios mais rígidos. Iniciativas de fiscalização do governo e avanços na tecnologia regulatória (RegTech) estão moldando ainda mais o cenário das soluções de PLD.

Para as empresas sujeitas a regulamentos de PLD, garantir a conformidade é mais crítico do que nunca. Além do risco de multas regulatórias, a falha em implementar medidas robustas de conformidade pode erodir a confiança do cliente - um ativo crucial no setor financeiro.

Neste artigo, nosso objetivo é equipá-lo com o conhecimento mais importante em relação às obrigações de PLD, especificamente as medidas de CDD e os procedimentos de KYC, suas diferenças e como eles permitem que sua empresa assegure a conformidade com as obrigações de PLD.

Três siglas sofisticadas: sobre o que se tratam

1. Obrigações de prevenção à lavagem de dinheiro: onde tudo começa

PLD refere-se a um conjunto de leis, regulamentos e procedimentos projetados para prevenir a lavagem de dinheiro e o financiamento do terrorismo. Essas obrigações se aplicam a instituições financeiras e outras empresas designadas (referidas como "entidades obrigadas") que devem identificar e mitigar os riscos associados a crimes financeiros.

As obrigações principais de PLD incluem:

Algumas das obrigações de PLD que as entidades obrigadas precisam cumprir incluem, mas não se limitam a:

- Realizar avaliações de risco;

- Desenhar e implementar um sistema de políticas, controles e procedimentos para garantir a conformidade;

- Designar um funcionário responsável por monitorar e facilitar a conformidade;

- Implementar um processo de devido cuidado do cliente levando em consideração os riscos identificados;

- Manter registros de clientes; e

- Registrar relatórios de transações ocasional e suspeitas.

Embora os princípios de PLD sejam reconhecidos globalmente, a implementação varia de acordo com a jurisdição. A maioria dos países alinha suas estruturas às recomendações do GAFI, mas os requisitos regulatórios específicos podem diferir com base nos riscos locais.

2. Cuidado do Cliente: um "scanner de segurança de aeroporto" para a prevenção da lavagem de dinheiro

O CDD é um conceito de duas faces que se apresenta como o elemento central da conformidade com a PLD e é especialmente importante para todas as entidades obrigadas.

De um lado, o CDD pode ser caracterizado como um conjunto de medidas que as entidades obrigadas devem implementar para mitigar os riscos de seus serviços serem explorados para lavagem de dinheiro, incluindo a verificação da identidade do cliente, enquanto, por outro lado, é também um processo de aplicação contínua dessas medidas.

Sinais de alerta no CDD

Os sinais de alerta no CDD são indicadores de advertência de atividades potencialmente suspeitas ou de alto risco. As instituições financeiras devem estar atentas para identificar esses sinais de alerta para prevenir a lavagem de dinheiro e outros crimes financeiros. Sinais de alerta comuns incluem:

- Padrões de transações incomuns.

- Detalhes de identificação inconsistentes.

- Transações envolvendo jurisdições de alto risco.

- Estruturas de propriedade complexas.

- Relutância em fornecer informações necessárias.

Reconhecer esses sinais de alerta é crucial para que as instituições financeiras tomem as ações apropriadas, como conduzir investigações adicionais ou relatar atividades suspeitas às autoridades relevantes. Ao estarem cientes desses indicadores, as instituições financeiras podem se proteger melhor e proteger seus clientes contra crimes financeiros.

Devido Cuidados Aprimorados (EDD)

Devido Cuidados Aprimorados "EDD" é uma forma de devido cuidado mais abrangente e aprofundada aplicada a clientes com um perfil de risco mais alto. As instituições financeiras devem implementar EDD para clientes considerados de alto risco, como pessoas politicamente expostas ("PPE"), indivíduos de países de alto risco, ou situações onde há um risco significativo de lavagem de dinheiro. EDD envolve um exame minucioso do histórico comercial e financeiro do cliente, que inclui:

- Obter informações adicionais sobre as atividades comerciais e financeiras do cliente.

- Conduzir monitoramento mais frequente da atividade da conta do cliente.

- Exigir que o cliente forneça documentação ou informações adicionais.

EDD é um componente essencial de um programa robusto de Cuidado do Cliente (CDD). Ajuda as instituições financeiras a entender melhor os riscos associados aos clientes de alto risco e a tomar medidas apropriadas para mitigar esses riscos. Ao implementar EDD, as instituições financeiras podem garantir que não estão inadvertidamente facilitando a lavagem de dinheiro.

3. Conheça Seu Cliente (KYC): O primeiro passo no CDD

KYC é um componente fundamental de CDD, garantindo que as empresas verifiquem e entendam seus clientes antes de realizar transações. Envolve dois elementos principais:

- Identificação: Coletar detalhes essenciais como nome, data de nascimento, endereço e nacionalidade.

- Verificação: Verificar as informações fornecidas contra fontes independentes e confiáveis.

Os requisitos de KYC variam de acordo com a jurisdição. Por exemplo, nos EUA, o Programa de Identificação de Clientes (CIP) é uma parte integrante do KYC, enquanto na UE, os requisitos diferem entre os estados membros.

Sem um processo de KYC robusto, as empresas não podem afirmar ter medidas eficazes de CDD, que são essenciais para a conformidade plena com a PLD.

É importante ressaltar que a conformidade sempre começa pelo menor elemento, e, de fato, sem ter um processo de KYC adequado, as empresas não podem afirmar ter abordado as medidas de CDD, portanto, não alcançando a conformidade com a PLD. Portanto, há uma inter-relação inerente entre todos os elementos discutidos neste blog.

Insights regionais: Estatísticas de lavagem de dinheiro por país

É essencial examinar as estatísticas de várias regiões para obter uma compreensão abrangente das tendências de lavagem de dinheiro. Essas estatísticas fornecem percepções cruciais sobre a escala das atividades de lavagem de dinheiro e a eficácia das medidas implementadas para combatê-las.

Estados Unidos

A lavagem de dinheiro continua sendo uma preocupação crítica nos Estados Unidos. As Avaliações Nacionais de Risco de 2024 do Departamento do Tesouro dos EUA sobre Lavagem de Dinheiro, Financiamento do Terrorismo e Financiamento de Proliferação identificam ameaças, vulnerabilidades e riscos-chave dentro do cenário de finanças ilícitas. Esses relatórios fornecem percepções atualizadas sobre riscos em evolução, reafirmando a importância de enfrentar esses desafios com precisão e urgência.

Os Estados Unidos lideram globalmente em eventos de Combate à Lavagem de Dinheiro (AML), com mais de 11.472 incidentes reportados — o equivalente a 3,5 eventos por 100.000 pessoas. Anualmente, aproximadamente US$300 bilhões são lavados nos EUA, representando 15% a 38% da atividade de lavagem de dinheiro global. Em 2022, as autoridades dos EUA impuseram US$14 bilhões em multas por violações de AML, sublinhando os riscos financeiros e regulatórios da não conformidade.

Reino Unido

O Reino Unido, classificado em segundo lugar em violações de PLD, também experimentou um aumento na atividade de lavagem de dinheiro. A lavagem de dinheiro representa 27,5% de todos os eventos de PLD no Reino Unido, com 1.664 incidentes registrados - aproximadamente 2,5 eventos por 100.000 pessoas. Mais de 75% desses eventos estão diretamente ligados à lavagem de dinheiro, sublinhando os desafios contínuos na mitigação dessa ameaça. Para abordar esses riscos, o Reino Unido implementou estruturas robustas de PLD, enfatizando a identificação e verificação dos Beneficiários Últimos (UBOs).

Medidas proativas e adesão a práticas rigorosas de PLD permanecem essenciais para mitigar esses significativos riscos financeiros e regulatórios.

Passos principais para alcançar a conformidade com a PLD e mitigar riscos

As entidades obrigadas devem abordar estrategicamente os passos necessários para atender à sua conformidade com os requisitos de PLD aplicáveis. Gostaríamos de fornecer algumas percepções sobre quais passos as empresas precisam considerar para mitigar os riscos de seus serviços serem usados para fins de PLD.

Coletar informações detalhadas sobre os clientes antes de estabelecer relacionamentos comerciais é crucial. Esse processo ajuda a verificar identidades e avaliar perfis de risco, garantindo a conformidade com as regulamentações de PLD e KYC.

1. Avaliação de risco

Realizar avaliação de risco e implementar estratégias de gerenciamento de risco, identificando métricas-chave de risco relevantes para o negócio, como tipos de clientes, ofertas de produtos, serviços prestados e localização das operações. Incentivamos as empresas a levar em conta as avaliações de risco nacionais (algumas das quais podem ser encontradas no site do GAFI). Essa informação pode se revelar útil à medida que as entidades obrigadas são obrigadas a levar essas avaliações em conta ao elaborar suas próprias avaliações de risco.

2. Medidas eficazes de devido cuidado do cliente

Concluir a avaliação de risco e obter uma compreensão aprofundada da estrutura legal aplicável são elementos subjacentes para determinar o design adequado das medidas de CDD. Por exemplo, isso significa que entender a aplicabilidade e o escopo dos requisitos CIP dos EUA para entidades financeiras dos EUA é tão importante quanto para as entidades financeiras da UE entenderem os requisitos do Estado Membro onde estão solicitando seus serviços.

As soluções de cuidado do cliente são ferramentas essenciais para abordar efetivamente os desafios do CDD. Elas ajudam a coletar e verificar informações dos clientes por métodos seguros, como verificações de documentos de identidade e verificação biométrica, para garantir a autenticidade das identidades dos clientes em um ambiente digital.

Não menos importante é implementar medidas eficazes que garantam a conformidade regulatória enquanto preservam o conforto dos usuários. Com a Veriff, cumprir com as obrigações de CDD não significa comprometer a experiência do usuário. A solução de onboarding KYC da Veriff permite que você atenda à conformidade regulatória e onboard mais clientes genuínos, ajudando a reduzir os custos de aquisição de clientes. Com a Veriff, você também pode utilizar verificações opcionais de prevenção à lavagem de dinheiro, como triagem de PPE e sanções, para facilitar ainda mais a implementação de medidas eficazes de CDD.

3. Soluções de conformidade regulatória

Aproveitar tecnologias avançadas, como verificação biométrica, que garante autenticação de identidade segura e precisa, e sistemas de monitoramento automatizados que fornecem supervisão em tempo real e aumentam a eficiência em vários processos.

4. Monitoramento contínuo

Toda empresa em conformidade sabe que o CDD não é um processo único - exige aplicação contínua. Monitorar os comportamentos financeiros dos usuários e garantir que as informações permaneçam atualizadas é tão crucial quanto o onboarding inicial. As soluções de triagem automática de PLD e monitoramento contínuo da Veriff podem ser particularmente úteis para ajudar a manter seu negócio em conformidade, mitigar riscos e manter fraudes enquanto ainda cria uma experiência fluida para seus usuários genuínos.

Conclusão

A conformidade com a PLD é um aspecto dinâmico e essencial da segurança financeira. Com o aumento da sofisticação dos crimes financeiros, as empresas devem estar à frente implementando medidas robustas de KYC e CDD. A conformidade não é apenas sobre atender às regulamentações - é sobre proteger os clientes, os negócios e a integridade dos sistemas financeiros em todo o mundo.

Estudo de caso do mundo real: Veriff & Comun

Comun é uma plataforma de banco digital projetada para comunidades de imigrantes nos EUA. Para garantir a conformidade com as regulamentações de KYC e PLD, Comun integrou as soluções de verificação de identidade da Veriff, permitindo que:

- Verifique identidades de forma rápida e precisa.

- Previna transações fraudulentas e roubo de identidade.

- Fortaleça a conformidade com a PLD em transações transfronteiriças.

Explore mais

Fique por dentro das notícias da Veriff. Assine o nosso boletim informativo.

Veriff só usará as suas informações para compartilhar atualizações do blog.

Você pode cancelar sua inscrição a qualquer momento. Leia nossos termos de privacidade.