Dominando a integração KYC: Seu guia definitivo com uma lista de verificação abrangente

O processo de integração KYC é o processo de diligência devida do cliente (CDD) que entidades reguladas, como bancos, são obrigadas a realizar antes de integrar um novo cliente. O objetivo final do processo de integração KYC é combater fraudes, lavagem de dinheiro e evasão fiscal.

Maksim Afanasjev

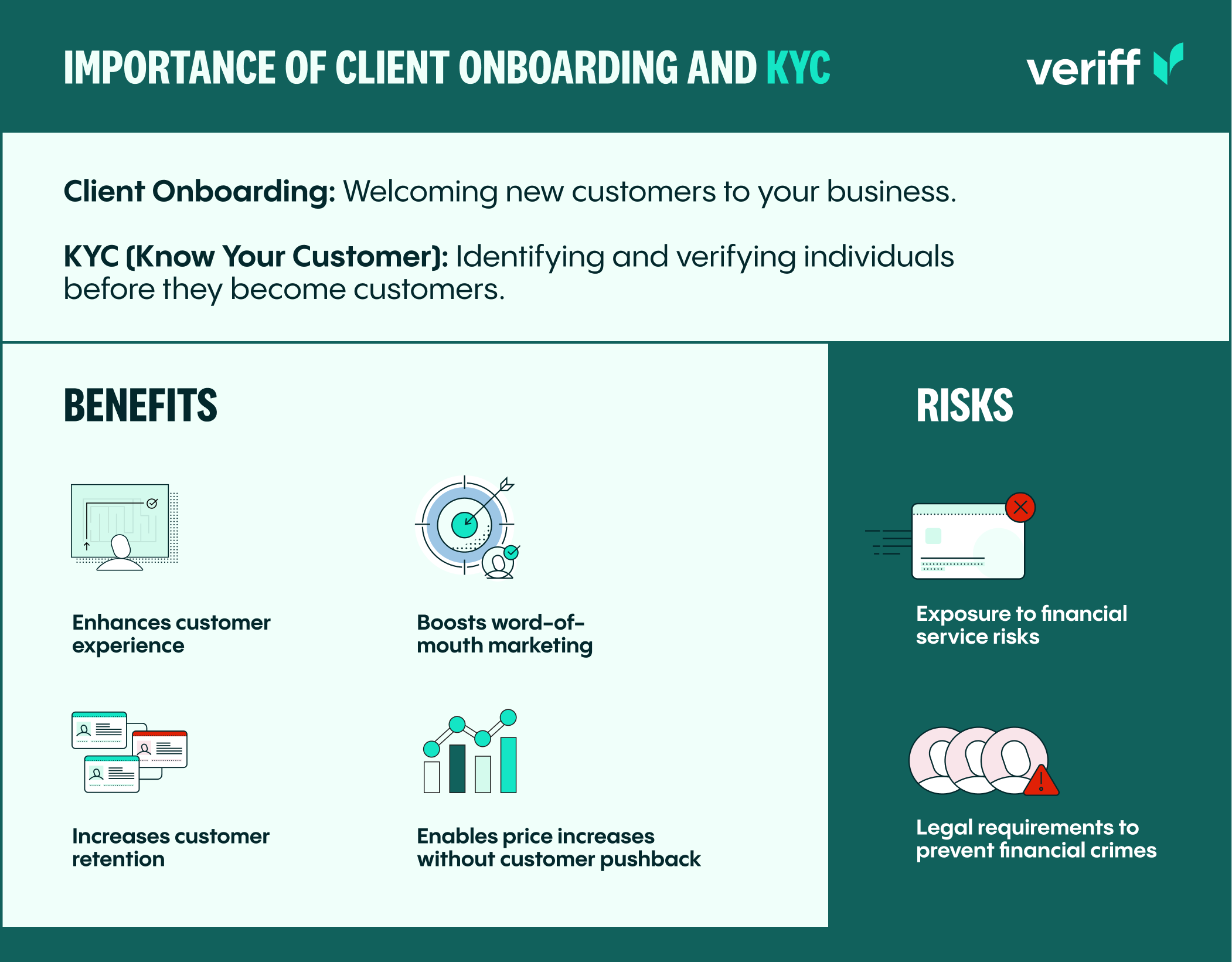

A integração de clientes é o processo de acolhimento de novos clientes em seu negócio, enquanto KYC (Conheça Seu Cliente) é um processo de identificar e verificar indivíduos e seu nível de risco. É importante notar que nem toda integração de clientes envolve KYC.

A integração de clientes em KYC é o processo de identificar e verificar indivíduos antes que se tornem clientes de um negócio. Isso envolve validar informações como nome, data de nascimento e endereço para garantir a conformidade com as exigências regulatórias e prevenir crimes financeiros como a lavagem de dinheiro.

Por que a integração de clientes é crucial – e a importância do KYC?

A integração de clientes é crítica para criar ótimas experiências de clientes – ao mesmo tempo em que ajuda sua organização a permanecer segura e em conformidade.

Uma ótima experiência de integração define o tom certo para o serviço que um cliente pode esperar. No entanto, se for mal gerenciada, pode deixar uma impressão negativa sobre a organização. Pesquisas mostram que adquirir um novo cliente é de cinco a 25 vezes mais caro do que reter um existente – portanto, é essencial tornar a experiência de integração o mais suave possível para os clientes.

Na verdade, os clientes que têm uma impressão positiva do processo de integração têm muito menos quedas após 21 dias como clientes em comparação com aqueles que têm uma experiência negativa, enquanto empresas que focam na integração de usuários conseguem aumentar seus preços em 10% sem qualquer resistência dos clientes.

No entanto, o processo de integração do cliente também pode expor as empresas a riscos financeiros. Muitas empresas são obrigadas por lei a prevenir crimes financeiros, como lavagem de dinheiro e evasão fiscal. A falha em cumprir pode resultar em penalidades financeiras significativas e até mesmo na perda da licença. Como resultado, as empresas também são obrigadas a implementar um processo de integração de usuários como um meio de verificar a identidade dos indivíduos.

Para enfrentar esse desafio, as empresas geralmente seguem o processo de integração Know Your Customer (KYC), que inclui o estabelecimento de um programa de identificação de clientes (CIP). Embora o processo varie geograficamente, este é um fluxo de trabalho em quatro etapas que envolve coletar o nome completo, data de nascimento e endereço do cliente. Depois que a empresa tem essas informações, deve então verificar essa pessoa. Para realizar isso na integração remota, normalmente será solicitado ao indivíduo que forneça uma Identificação e uma selfie.

Estabelecer o processo de integração KYC correto é uma parte vital para garantir que sua empresa atenda suas obrigações regulatórias. No entanto, se seus processos de verificação KYC forem muito pesados ou ineficientes, você verá que suas taxas de conversão caem drasticamente.

Enquanto isso, uma integração de clientes bem gerida resultará em clientes satisfeitos. Além disso, clientes satisfeitos têm mais probabilidade de contar aos amigos sobre seu serviço – impulsionando seu marketing boca a boca. Os consumidores também estão mais propensos a pagar um prêmio por um serviço se perceberem que o processo de integração é suave e eficiente.

Por essa razão, você deve considerar como o seu processo de integração KYC pode ser simplificado e automatizado, enquanto atende aos seus requisitos regulatórios.

O que exatamente inclui uma verificação KYC?

O procedimento KYC é um processo em várias etapas que verifica a identidade dos indivíduos. Abrange a verificação de um documento de identidade emitido pelo governo para confirmar a identidade da pessoa, tecnologia de verificação biométrica para corresponder a pessoa com sua foto de identificação, verificações de documentos como contas de serviços públicos para fornecer comprovante de residência e verificações de vitalidade, para adicionar uma camada adicional de segurança. Essas etapas são críticas para ajudar a mitigar fraudes de identidade e crimes financeiros. Como resultado, organizações reguladas, como bancos e instituições financeiras, são obrigadas a aderir estritamente às regulamentações KYC e de prevenção à lavagem de dinheiro (PLD) para proteger tanto suas operações quanto seus clientes.

A era digital facilitou um grande aumento nos bancos online e nas transações financeiras digitais, o que, por sua vez, resultou em um aumento nos cibercrimes e no roubo de identidade. Como resultado, os procedimentos KYC são cada vez mais importantes, ajudando a garantir que sua empresa esteja em conformidade com as regulamentações legais.

Existem três componentes chave do KYC:

- Programa de Identificação de Clientes (CIP): O CIP é o processo de verificar a identidade de um cliente através de documentos como identificações emitidas pelo governo.

- Diligência devida do cliente (CDD): A CDD envolve coletar e analisar informações sobre o perfil de risco de um cliente para identificar quaisquer sinais de alerta ou riscos potenciais.

- Diligência devida aprimorada (EDD): A EDD é um nível mais minucioso de diligência devida que pode ser necessário para clientes com perfis de risco mais altos, como pessoas politicamente expostas ou aquelas envolvidas em transações de alto risco. No geral, esses componentes trabalham juntos para garantir que as empresas tenham uma compreensão completa e possam verificar a identidade e os riscos potenciais associados aos seus clientes.

Como os componentes-chave de uma lista de verificação KYC aumentam a confiança do usuário durante a integração?

Os clientes querem uma experiência de integração sem fricções – mais de três em cada cinco usuários (63%) consideram o processo ao decidir se vão adquirir um serviço ou produto. Quando se trata de completar o processo KYC, os consumidores querem saber que será rápido e eficaz, e que seus dados estarão protegidos.

Para manter a confiança do usuário ao longo do processo, as empresas devem ter em mente os seguintes fatores:

Precisão da verificação

Um passo importante no processo KYC é verificação de identidade. Para verificar se uma pessoa é quem ela afirma ser, o cliente será solicitado a fornecer prova de identidade e endereço. Para acelerar esse processo, as empresas podem implantar uma solução automatizada, para realizar a verificação de identidade em menos de um minuto e integrar clientes em poucas horas. Aqui, o tempo é essencial – os clientes desistem e buscam alternativas se o processo for longo e complicado.

Transparência

É também vital que o processo KYC seja transparente e que todos os clientes entendam como suas informações pessoais estão sendo usadas. Vamos usar a indústria de seguros de vida como exemplo. Ali, os potenciais segurados devem ser minuciosamente verificados antes que uma apólice seja emitida. A identidade deles deve ser estabelecida e seu nível de risco avaliado para prevenir atividades fraudulentas. Mas para o cliente confiar no processo, ele deve ser totalmente transparente – precisa entender quais são os requisitos do segurador e por que está sendo solicitado a compartilhar informações pessoais.

Segurança dos dados

O KYC envolve o compartilhamento de dados altamente pessoais. Todos esses dados coletados – sejam dados pessoais identificáveis coletados de documentos ou informações deautenticação biométrica, devem ser protegidos. Para manter a confiança do usuário, as empresas devem garantir que estão em conformidade com regulamentos de privacidade de dados, como o Regulamento Geral sobre a Proteção de Dados (GDPR) e informar o cliente sobre este fato. O GDPR estabelece normas sobre a proteção de dados pessoais que as empresas manipulam e a privacidade de seus clientes.

Eficiência

Processos KYC prolongados podem frustrar clientes e aumentar as taxas de abandono, especialmente em setores onde uma integração rápida é essencial, como empresas de compra agora, pague depois ou serviços de entrega. É por isso que muitas organizações se afastaram dos processos KYC manuais, que tendem a ser demorados e intensivos em mão de obra. É também fácil para erros e preconceitos inconscientes se infiltrarem no processo manual, o que pode alongar significativamente sua conclusão. O KYC automatizado, por outro lado, pode ter um impacto positivo no cliente, reduzindo significativamente o tempo necessário para verificar a identidade do cliente e avaliar riscos – tudo resultando em uma integração mais rápida, maior satisfação do cliente e aumento da lealdade e retenção de clientes.

Como as empresas garantem uma verificação eficaz da identidade do usuário usando os componentes chave de uma lista de verificação KYC?

Fraude é um problema crescente para empresas e consumidores. De acordo com a Comissão Federal de Comércio dos EUA, as perdas dos consumidores relacionadas à fraude aumentaram 70% em 2021 - para mais de US$5,8 bilhões. Cada vez mais, golpistas estão roubando identidades de pessoas para fins criminosos, um processo conhecido como roubo de identidade. Uma maneira de as organizações prevenirem isso é através da verificação de identidade. Mas para que a verificação de identidade seja eficaz, deve ser incorporada a um processo KYC e tratada de uma maneira particular. Então, quais são os diferentes componentes de uma lista de verificação KYC e como eles informam a verificação de identidade do usuário?

Verificação de documento

A verificação de identidade envolve a apresentação de documentos de identidade, como passaportes e carteiras de habilitação. Isso envolve verificar a autenticidade dos documentos apresentados – através da verificação de fontes, marcas d'água, hologramas e outras características de segurança. Para economizar tempo e esforço, esse processo é frequentemente feito por meio da automação.

Validação de dados

A verificação precisa de identidade depende dos dados que os clientes fornecem. É aí que a validação de dados entra em cena. No contexto do KYC, a validação de dados é o processo de verificar os dados do cliente antes que a identidade do cliente possa ser confirmada. Pode ser tentador pular o processo de validação, mas é um passo vital para garantir que resultados precisos sejam gerados.

Autenticação de identidade

Estabelecer a identidade de uma pessoa pode ser difícil, particularmente online. A verificação de identidade ajuda a garantir que alguém é quem afirma ser. A autenticação é frequentemente realizada usando itens que uma pessoa já possui. Pode envolver tokens, crachás de identificação ou cartões-chave. Alternativamente, a autenticação pode ser baseada em atributos físicos de alguém – razão pela qual informações biométricas e documentos frequentemente são fundamentais para a autenticação de identidade. Qualquer que seja o método empregado, a autenticação é uma etapa vital na concessão a uma pessoa de certos direitos e privilégios – por exemplo, ter a oportunidade de abrir uma conta bancária.

Avaliação de risco

O objetivo da avaliação de risco é identificar e avaliar os riscos potenciais que podem surgir ao fornecer serviços a um cliente específico. Alguns prospectos são então movidos para due diligence aprimorada (EDD). A EDD tem como objetivo mitigar o risco associado a clientes de alto risco e envolve uma análise mais detalhada do perfil de risco de um cliente.

Monitoramento contínuo

A monitoração contínua permite que as empresas identifiquem quaisquer padrões ou mudanças incomuns no comportamento do cliente que possam indicar transações de alto risco.

Quais benefícios de conformidade e KYC a integração eficaz traz para os negócios?

As práticas de KYC desempenham um papel importante no combate a crimes financeiros, como a lavagem de dinheiro. De fato, se uma empresa não realizar corretamente a integração KYC e não cumprir suas obrigações de AML, pode sofrer enormes multas e danos reputacionais significativos.

Qual o impacto que uma integração eficiente combinada com KYC pode ter na prevenção de fraudes e gestão de riscos?

Verificar as identidades dos clientes através da integração KYC pode prevenir que golpistas entrem em seus sistemas. Se a verificação de ID for realizada corretamente, deve identificar informações desatualizadas, imprecisas ou incompatíveis. Uma integração eficiente também pode desempenhar um papel importante na gestão de riscos – toda empresa deve proteger sua reputação a todo custo, e o KYC desempenha um papel importante nesse aspecto.

Como as ferramentas KYC da Veriff podem aumentar a eficiência e a precisão do processo de integração?

A Veriff tem várias ferramentas KYC que podem aumentar a precisão e a eficiência do processo de integração de clientes.

Nossa poderosa solução de verificação de identidade é comprovada para oferecer rapidez, conveniência e baixa fricção para os usuários. Combinando automação apoiada por IA com aprendizado reforçado pelo feedback humano, nossa solução suporta mais de 12.000 espécimes de documentos de mais de 230 países e territórios. Veja o mapa mundial aqui!

Nossa solução de Autenticação Biométrica usa IA e análise biométrica facial para autenticar usuários de forma rápida e segura, concedendo acesso instantâneo a produtos e serviços. Além disso, esse processo rápido e totalmente automatizado pode ser integrado em qualquer estágio da jornada do cliente.

Um aspecto do processo de integração KYC que não pode ser negligenciado é a Prova de Endereço (POA). Nossa solução de POA ajuda você a permanecer em conformidade enquanto obtém uma visão abrangente da identidade de um usuário. Os usuários podem facilmente capturar uma imagem ou enviar uma cópia de um documento POA. O tipo de documento e a data de emissão são verificados para garantir que sejam adequados e válidos.

Nossas soluções de Verificação de Idade completam nossa lista de produtos KYC. A Validação de Idade permite que você confirme de forma transparente se os usuários estão acima de um limite mínimo de idade predefinido, enquanto nossa solução de Estimativa de Idade usa uma única selfie para verificar a idade de um indivíduo sem um documento de identidade.

Saiba mais

Fique por dentro das notícias da Veriff. Assine o nosso boletim informativo

Veriff só usará as suas informações para compartilhar atualizações do blog.

Você pode cancelar sua inscrição a qualquer momento. Leia nossos termos de privacidade.