Elder abuse: a digital epidemic

The vulnerability of many elderly people has always made them a popular target for criminals. However, the issue is exacerbated online, where teams of tech-savvy fraudsters can exploit older people’s lack of confidence and proficiency. So, what can Veriff do to address the problem?

Chris Hooper

What is elder abuse?

When someone with power over an elderly person intentionally harms them or puts them at risk of harm, their actions are considered elder abuse. This can take many forms, including financial, physical, sexual, psychological and emotional abuse, neglect, abandonment and loss of dignity.

Aging populations in many countries mean elder abuse is predicted to increase significantly. In fact, the World Health Organization estimates that the global population of people aged 60 years and older will double by 2050, to around two billion.*

Online financial abuse: a growing problem

One type of elder abuse that’s becoming easier to perpetrate as goods and services move online is financial abuse. Again, rather than a single activity, financial abuse of elderly people can involve anything from family members or friends borrowing money and not giving it back to bank scams or traders coercing payment for goods and services they never provide.

Most online financial abuse involves some form of social engineering, whereby criminals manipulate a target into revealing information or performing an action that results in the victim losing money. Methods vary and are constantly evolving, but may include fake shopping websites, tech support scams, and phishing scams purporting to be from banks, charities, healthcare providers and even government bodies.

Recent trends highlighted by UK consumer magazine Which?** include:

- Fake social media appeals about missing elderly people or children: once posts gather likes (and thus credibility) and reach, they are edited into a straightforward investment scam

- Pig butchering: A hybrid of romance and investment scams whereby victims are ‘fattened up’ with love and attention on a dating site before being coerced into fake investments

- PayPal Scam: Scammers use a genuine PayPal address to send out fake payment requests demanding overdue tax payments, or urging victims to call a fake fraud line

- Fake apps: Malware available via legitimate app stores disguised as apps such as two-factor authenticators are used to take control of your phone and steal personal data

- Phone scams: Scammers call an elderly person, purporting to be from a financial institution, and convince them to move their money to another account

The combination of emotional manipulation and technology employed in many of these scams makes them particularly effective in tricking elderly people.

Who is vulnerable?

Older people are particularly susceptible to being exploited online for several reasons. Having not grown up with the technology or been trained to use it, they may not fully understand how email, apps and browsers work. They may also be less aware of the issues and more prone to trust apparent authority figures.

Abuse can happen to any older adult, but particularly those who are more socially isolated or dependent on others for help with everyday activities.

How do Veriff’s solutions help?

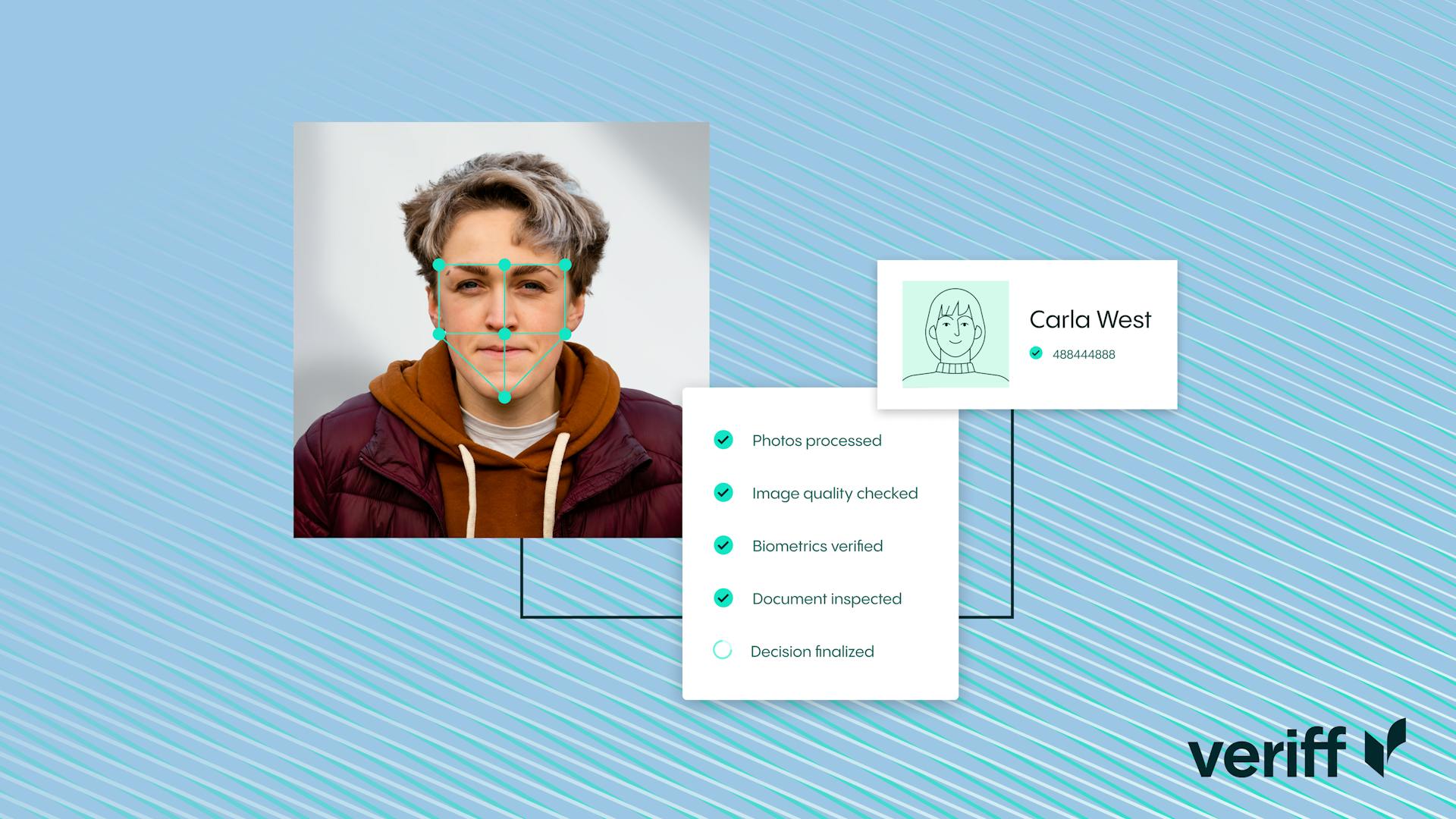

The anonymity and opaqueness of the digital world is a gift to dishonest people who want to obscure their identity and motives to trick the unwary and the vulnerable. The ability to confirm who people really are is therefore a vital weapon in countering online fraud. That’s where Veriff’s identity verification (IDV) solutions come in.

Veriff was founded to put transparency at the heart of every online interaction, so genuine people can prove who they are, while malicious actors have nowhere to hide. Our technology mitigates fraud through a combination of liveness detection, face blocklisting, device fingerprinting and dynamic fraud checks. And our biometric authentication ensures only genuine and verified users are able to make transactions or access services. In an increasingly complex digital world, Veriff is making an important contribution to ensuring that online financial abuse is more difficult and less profitable for criminals.

* https://www.who.int/news-room/fact-sheets/detail/abuse-of-older-people

Explore me

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms