Is your marketplace facing challenges balancing marketplace fraud protection and customer experience?

A recent spike in criminal activity suggests marketplaces are headed for a new era of industrialized fraud in which organized crime gangs mass-produce fake identities and launch attacks on an epic scale.

Chris Hooper

The Veriff Identity Fraud Report, reveals a 17.9% uptick in fraudulent online activity across all sectors of the economy during the past year, with marketplaces one of the biggest hits within the ecommerce sector. This surge in fraud equates to nearly one-in-ten verification requests seen by Veriff now being fraudulent.

The Veriff Identity Fraud Report 2023 also reveals that:

- Document fraud is a massive problem, growing by 79% during 2022.

- Organized crime groups are ramping up activity with a 49% increase in so-called recurring and pattern fraud across all sectors

- Marketplace attacks are now being launched on an industrial scale. The report reveals that 9% of all identity fraud now involves mass-produced fake identities – a process known as identity pharming.

So, what steps should marketplaces take to protect their platforms and customers?

Walking the identity verification tightrope

In theory, online marketplaces can enable marketplace fraud protection - lockdown their platforms, introducing passwords, knowledge-based security questions and multi-factor authentication at every step of the buyer and seller journey, making fraud virtually impossible. This approach, however, would deal a severe blow to user experience, making day-to-day marketplace interactions slow and stressful, and customer onboarding tortuous, increasing churn and drop-off.

Instead, marketplaces need to walk a tightrope, finding the perfect balance between effectively addressing the rising tide of identity theft and fraud, while also delivering the slick and intuitive customer experiences that marketplace users have grown accustomed to.

Marketplaces that can successfully walk this verification tightrope have a golden opportunity to excel at a time when marketplaces are set to become the world’s biggest ecommerce channel by 2027. To do this they need a verification solution that works with, rather than against, existing infrastructure, while also introducing a fundamental step-change in security.

Seamless and sensitive anti-fraud measures

Seamless and sensitive anti-fraud measures

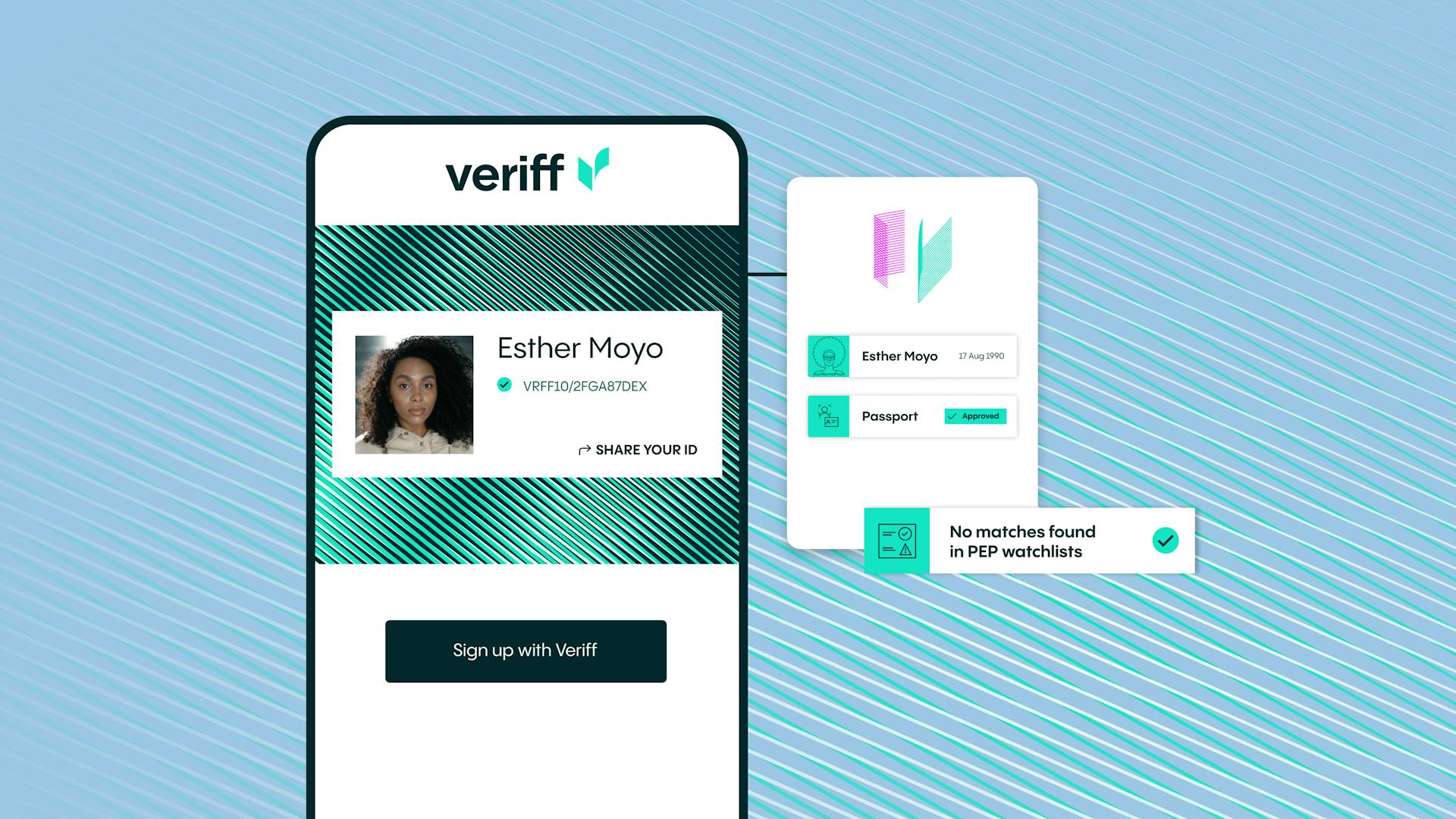

A solution known as identity verification (IDV) is now at the vanguard of this effort to verify customers in a seamless and sensitive way. This far-more secure approach involves the customer taking photos of government-issued identity documents (ie driver’s license and passport) and then taking a selfie of themselves in real time. Market-leading IDV solutions can complete this verification process in just six seconds.

IDV involves no laborious form-filling by the customer, no manual processing by the marketplace and no long wait times for either party. Customers are also spared the fuss and frustration of being locked out of their accounts because they’ve forgotten their mother’s maiden name or their favorite food.

Market-leading IDV solutions are already achieving game-changing improvements for firms in a wide range of sectors, from finance to ecommerce. Forrester recently analyzed the performance of Veriff’s IDV solution, and found that a company partnering with Veriff:

- Reduced revenue lost to fraud by 20%, saving the company $7.4 million over three years.

- Enjoyed customer experience benefits valued at $18.4 million by Forrester over three years, and a total return on investment of 195%.

- Could save $11 million over three years, thanks to efficiencies linked to automation.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 10K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Don’t let fraud stifle growth and innovation

It is clear that online marketplaces face rapidly deteriorating levels of identity theft and fraud, which threaten to curtail innovation and growth among the poorly prepared. Meanwhile, customers expect speed, convenience, and peace of mind, while assuming that marketplaces will protect them from fraudsters. At the very least, if marketplace users’ expectations are not fulfilled, they will vote with their feet and do business elsewhere.

Marketplace fraud often takes the form of fraudsters trying to extract personal information or payment methods from victims. This can take the form of stealing credit cards, impersonating seller accounts through a fake email address and asking for financial information. Fraudsters also sometimes ask for gift cards. And, as well as fake email addresses, fraudsters will use Google voice, fake phone numbers and text messages to extract information. The advice to consumers is that if you receive notification of an offer that seems too good to be true - then it probably is. But online marketplaces can also do more to enhance fraud prevention.

All types of marketplaces that harness solutions such as IDV to significantly reduce fraud, transform onboarding and elevate customer experience in general, will enjoy a significant competitive advantage.