What are the penalties for money laundering?

Money laundering encompasses a range of criminal acts, with each carrying different legal penalties based on the degree of severity. What constitutes money laundering today? How are investigations carried out? Plus, what do businesses need to do to achieve legal compliance? Read this blog to find out more.

Ever since the Bank Secrecy Act was enacted in 1970, money laundering has been in the spotlight. Now considered a serious financial crime, those found guilty of money laundering face severe penalties that include huge fines and lengthy prison sentences.

But, what exactly are the penalties for money laundering? In this guide, we take a detailed look. In doing so, we’ll answer a number of popular customer queries, such as ‘what are the most common types of money laundering offenses?’, ‘who prosecutes money laundering?’, and ‘what are the penalties for money laundering?’ We’ll conclude by looking at what a money laundering investigation involves and why anti-money laundering regulations are so important.

Types of money laundering offenses

Before we discuss common types of money laundering, we first need to quickly look at the main pieces of legislation and regulatory provisions that outline the offenses. They are:

- Money Laundering Control Act of 1986 (18 U.S.C. §§ 1956–1957)

- Bank Secrecy Act (BSA) (31 U.S.C. §§ 5311–5331)

- Bulk cash smuggling (31 U.S.C. § 5332)

We’ll talk through these in greater detail later, but for now we’ll discuss the main types of money laundering they cover. These are:

Domestic money laundering

18 U.S.C. § 1956(a)(1) prohibits a person from conducting or attempting to conduct a financial transaction if they know that the property involved represents the proceeds of unlawful activity.

In order to convict an individual of domestic money laundering, a prosecutor must prove that the defendant conducted a financial transaction while knowing that the money was linked to a specified unlawful activity.

Added to this, the government must also prove that the defendant engaged in the transaction with the intent to promote the illegal activity, violate tax law, conceal the origin of the money (or illegal activity), or to avoid a reporting requirement under federal or state law.

International money laundering

As the name suggests, international money laundering transactions involve multiple countries and bank accounts. Due to this, to track international money laundering efforts, cooperation is required between nations and regulators.

To prove international money laundering under 18 U.S.C. § 1956(a)(2), the government must prove that a defendant transported, attempted to transport, or transferred monetary instruments or funds. The transportation, transmission, or transfer must either originate or terminate in the United States and cross a border.

On top of this, the prosecution must prove that the defendant engaged in the activity with the intent to promote the illegal activity, to conceal or disguise the proceeds as originating from the illegal activity, or to avoid a reporting requirement under federal or state law.

Finally, the government must also show that the defendant knew the monetary instrument or funds represented the proceeds of some form of unlawful activity.

Money laundering sting operations

Defendants can also be charged with money laundering as the result of a sting operation.

Section 1956(a)(3) of the Money Laundering Control Act of 1986 governs undercover operations. In the typical case, law enforcement officers make a representation to a suspect for the purpose of investigating money laundering. This usually involves the officer inviting the suspect to transport money or otherwise participate in the money laundering process.

Under federal law, a defendant can be convicted of money laundering from a sting operation if the prosecutor proves that the suspect conducted, attempted, or conspired to conduct a transaction.

The suspect can be convicted if the conduct was performed with the intent to promote the carrying on of the illegal activity, to conceal or disguise the origin of the money, or to avoid a reporting requirement under state or federal law.

Money laundering spending

18 U.S.C. § 1957 of the Money Laundering Control Act of 1986 prohibits a defendant from knowingly conducting a monetary transaction in criminally derived property in an amount greater than $10,000.

The most significant difference between § 1957 and § 1956 prosecutions is the intent requirement. A prosecutor does not need to prove any intent to promote, conceal, or avoid the reporting requirements. However, the defendant must still know that the money came from illegal activity.

Other money laundering-related crimes

On top of this, other crimes are also linked to money laundering. These include:

Bank Secrecy Act (BSA) violations

Any violation of the Bank Secrecy Act (1970) can also be considered a money laundering crime. In these instances, liability arises when a person willfully fails to file a necessary report or otherwise violates the requirements of the BSA or related regulations.

Bulk cash smuggling

Finally, individuals can also be prosecuted for the bulk smuggling of cash across the border.

In order to generate a conviction, the government must establish that the defendant intended to evade a currency reporting requirement and knowingly concealed and transported, or attempted to transport, more than $10,000 in currency across the US border.

Crime of laundering money and enforcement

In the United States, the Department of Justice (DOJ) has the jurisdiction to prosecute money laundering crimes. As part of this, the DOJ has the power to bring civil, criminal, and forfeiture actions against suspected money launderers.

Within the DOJ, the Money Laundering and Asset Recovery Section (MLARS) is directly responsible for anti-money laundering-related actions. But, US Attorneys may bring independent prosecutions, or work with MLARS on cases.

The Secretary of the Treasury is responsible for civil enforcement of the Bank Secrecy Act (BSA). But, the Secretary has delegated that authority to the Financial Crimes Enforcement Network (FinCEN). Due to this, FinCEN now serves as the primary source for guidance on the implementation of the Bank Secrecy Act and the US PATRIOT Act. It also acts as the financial intelligence unit of the US and assists law enforcement through the collection, analysis, and sharing of BSA information.

Because FinCEN does not have its own examination staff, it delegates BSA examination authority to the federal regulators for the various types of financial institution. These include:

- Banks: The Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve, the Federal Deposit Insurance Corporation, and the National Credit Union Administration

- Broker-dealers: The Securities and Exchange Commission enforces the BSA both through its own regulations and through authority delegated to the Financial Industry Regulatory Authority (FINRA), and the self-regulatory organization for broker-dealers

- Futures commission merchants and introducing brokers in commodities transactions: The Commodities Futures Trading Commission (CFTC) enforces the BSA both through its own regulations and also through authority delegated to that industry’s self-regulatory organization and the National Futures Authority

- All other financial institutions and businesses subject to AML requirements: The Internal Revenue Service (IRS) is the enforcement authority. Entities under the authority of the IRS include money services businesses; casinos; card clubs; insurance companies (for some products); dealers in precious metals, precious stones, and jewels; operators of credit card systems; and non-bank residential mortgage originators and lenders

However, in spite of the fact that it delegates enforcement authority to these federal regulatory bodies, FinCEN may pursue enforcement action jointly or separately through its Office of Enforcement.

Federal charges

People who are found to have committed money laundering offenses face federal charges for their actions.

This is because the primary US authorities responsible for investigating and prosecuting money laundering are the Department of Justice (including the FBI and the United States Attorney’s Offices) and the Treasury Department's Office of Foreign Assets Control (OFAC).

However, several federal agencies have jurisdiction to investigate money laundering offenses. These include:

- The Criminal Investigation Division of the Internal Revenue Service (IRS)

- The Federal Bureau of Investigation (FBI)

- The Drug Enforcement Administration

- Immigration and Customs Enforcement

- Homeland Security Investigations

Overall, the Department of Justice (DOJ) is charged with the investigation and prosecution of violations of federal law, including money laundering violations. At DOJ headquarters, the Money Laundering and Asset Recovery Section focuses on money laundering offenses. It has approval authority for certain prosecutions under the anti-money laundering statutes.

On top of this, many states also criminalize money laundering and have criminal provisions that parallel federal laws. This means that it is possible for someone to be prosecuted at both state and federal levels for the same conduct without the risk of double jeopardy.

Federal laws governing money laundering

We briefly mentioned the laws that govern money laundering at the beginning of this guide. Now, we’ll look at them in more detail.

The cornerstone US criminal money laundering statutes are sections 1956–1957 of Title 18 of the US Code (18 USC), along with other federal criminal statutes.

18 USC section 1956 outlaws:

- Money laundering concealment

- Money laundering promotion

- International money laundering

- Undercover ‘sting’ money laundering

On top of this, the Spending Statute (18 USC section 1957) outlaws anyone knowingly engaging in (or attempting to engage in) a monetary transaction greater than $10,000 that includes the proceeds of crime. This section applies to any deposit, withdrawal, or transfer of funds affecting interstate or foreign commerce that involves a financial institution.

Similarly, 18 USC section 1960 prohibits anyone from operating or owning an unlicensed or unregistered money transmission business. Section 1960(c) also expressly prohibits the ‘transportation or transmission of funds that are known to have been derived from criminal activity’.

Money laundering fines and penalties

If anyone has been found to have broken these laws, then the penalties handed out are incredibly severe. Criminal penalties for money laundering include imprisonment, fines, and forfeiture. The penalties are:

- Domestic money laundering (18 USC section 1956(a)(1)) and international money laundering offenses (section 1956(a)(2)): Incarceration up to 20 years and a fine of up to $500,000, or twice the value of the proceeds involved in the violation

- ‘Sting’ violations (1956(a)(3)): Incarceration up to 20 years and a fine of up to $250,000 (or up to $500,000 for organizations)

- Section 1957 offenses: A maximum period of incarceration of 10 years and a fine of up to the greater of either $250,000 or twice the value of the criminally derived property involved in the offense. Entities can face up to $500,000 in fines or twice the value of the illicit funds involved

- 31 U.S.C. § 5332 (Bulk cash smuggling) offenses: Up to five years' imprisonment. Plus, the person involved must forfeit any property involved in the offense

On top of this, funds that were commingled with illicit proceeds to facilitate money laundering are subject to forfeiture.

However, although the above fines and penalties for money laundering are incredibly severe, it’s important to state that the maximum sentence is not always handed down. In fact, in the fiscal year 2020, the average sentence for money launderers in the US was 64 months. That said, 87.7% of those who were found guilty were sentenced to prison.

Sentencing factors

Although the above money laundering fines and penalties are stated in law, judges can use their discretion when sentencing people for money laundering.

For example, sentences can be increased when the perpetrator:

- Was aware that the laundered funds were proceeds of an offense involving a controlled substance, violence, weapons, national security, or the sexual exploitation of a minor

- Was in a leadership or supervisory role in the offense

- Was obstructing or impeding the administration of justice

- Was laundering monetary instruments

Similarly, sentences can be decreased when the perpetrator only played a minor role in the offense.

Misconceptions

Although money launderers have been prosecuted for decades, there are still several prominent misconceptions about money laundering and how crimes are investigated.

For example, although the prosecution must prove that the money came from illegal activity, they do not have to prove that the money launderer was involved in this illegal activity. Instead, they just have to prove that the person was involved in trying to disguise the illegal origins of the money.

Similarly, many people believe that first-time offenders will not spend time in jail for money laundering. Once again, this is not the case. Although first-time offenders will spend less time in jail than serial offenders, they do usually serve at least some jail time. This is because money laundering is an incredibly serious crime and federal law and federal sentencing can be harsh.

Finally, despite what flashy Hollywood movies might tell you, money laundering is not easy to spot. In fact, of the $800bn to $2tn that’s laundered globally, estimates suggest that only 1% is seized by global authorities.

How money laundering investigations work

Money laundering investigations work differently based on the people and entities involved in the case. For example, a money laundering case against an individual will be built differently than a money laundering case against a large criminal organization. That said, evidence is gathered using similar techniques and processes.

In the US, many different legal authorities have the power to investigate suspected money laundering activities. But, the act of money laundering has become increasingly complex in recent years and these authorities often need help. As a result, international agencies have also been created. Their aim is to help law enforcement agencies identify and pursue money laundering operations. Due to this, it’s now far simpler for agencies in the US to work with Interpol, as well as with domestic police agencies in the G7 nations.

Generally speaking, money laundering investigations follow a similar pattern. This is because all investigations are initially about tracing money through various steps. As a result, the process of conducting a money laundering investigation tends to be very manual and involves collecting financial records from banks and companies. If one of these companies or banks is located in a tax haven, then the process can be incredibly difficult and time consuming.

Plus, even when investigators can access the records, they still need to piece them together. Using techniques such as graph visualization, investigators can build up a comprehensive view of the money laundering scheme. This allows them to track connections and entities from data, understanding how they’re linked and connected.

On top of this, investigators can also take a detailed look at the finances of a particular company that’s within a criminal organization. They then follow the trail of the money to see where that business is funneling cash and unearth the financial records of those companies. By doing this, they can see all the different companies that another company is connected with. If the connections show a structure, with certain companies clearly funneling money to others within a network, this will indicate the layering stage of money laundering and will be investigated further.

All of this information can be used to build a picture of money laundering activities. If money laundering can be proven, then prosecution will begin.

AML requirements

To help combat the threat of money laundering, all financial institutions and other regulated entities must have anti-money laundering (AML) compliance programs in place. They must also report on the effectiveness of their program to FinCEN. This is a key requirement of the Anti-Money Laundering Act.

All institutions must follow numerous policies that are designed to help safeguard the financial system. These include screening clients, monitoring transactions, and being on the lookout for suspicious activities that could indicate money laundering.

Due to this, these companies must have a series of compliance measures in place, including:

- The implementation of an AML program that includes specific policies relating to customer due diligence, transaction screening, and systems for screening for sanctions, negative media coverage, and politically exposed persons

- Maintaining records of transactions for at least five years

- A chief compliance officer who is responsible for overseeing the AML program

- Adequate training for all employees in AML procedures

- Report all currency transactions worth more than $10,000 to FinCEN

- Report any suspicious transactions to FinCEN

Remember, it is a crime for employees of financial firms to show deliberate indifference to a client’s source of funds. Fines may range from $10,000 per day for failures to report foreign financial agency transactions to $100,000 per day for failures in customer due diligence. Individuals can also face imprisonment of up to 20 years per violation.

Book a consultation with Veriff

As our guide has shown, money laundering is a very serious financial crime. As a result, the penalties for engaging in money laundering are severe.

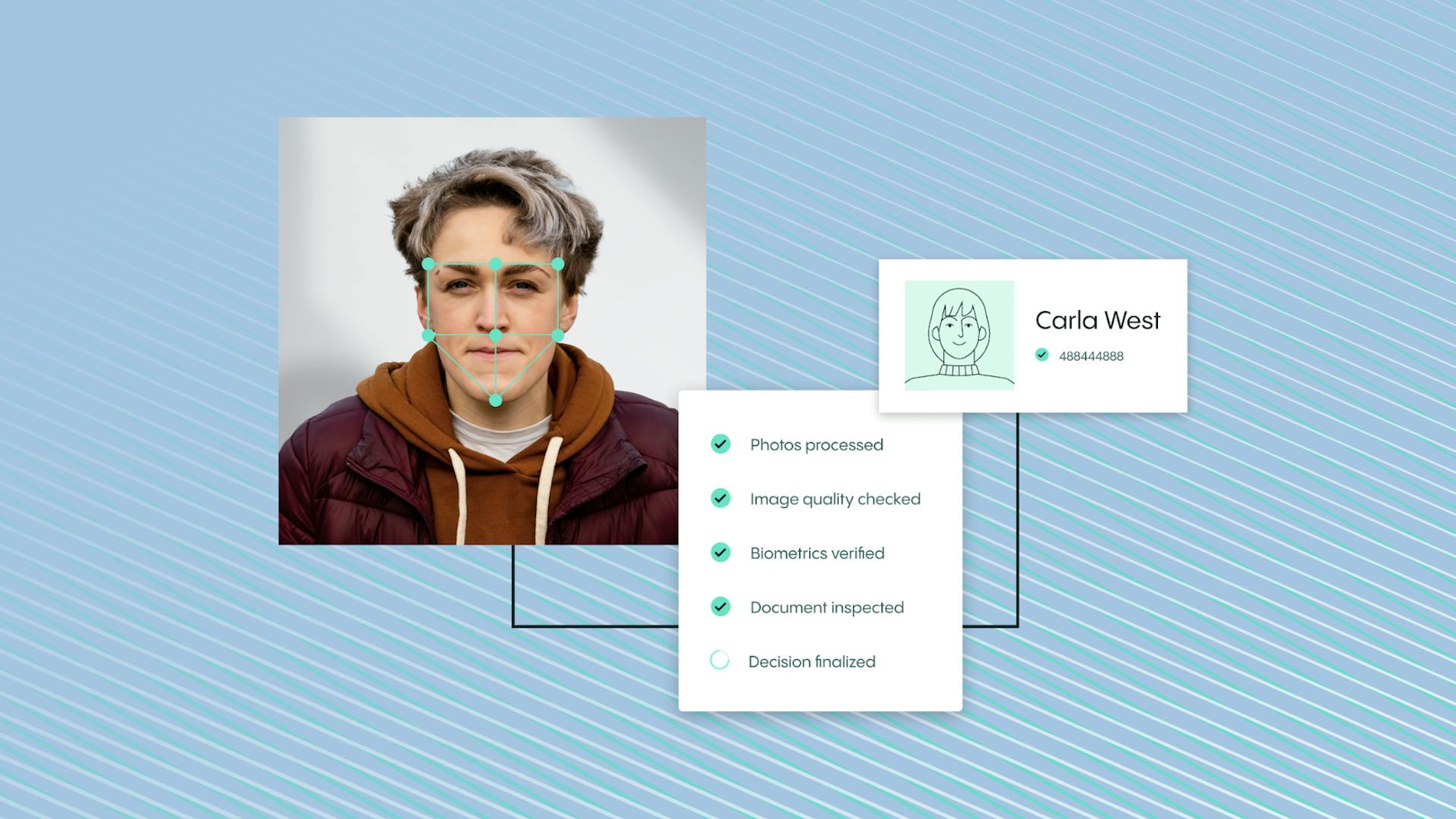

As a result of this, it’s vital that your business shows regulators that it takes its obligations seriously. Thankfully, our AML and KYC compliance solution allows you to do just that. With our tool, you can deploy our identity verification platform alongside PEP and sanctions checks, adverse media screening, and ongoing monitoring. As well as ensuring end-to-end anti-money laundering compliance, you can fight financial fraud.

To discover more about how our AML and KYC compliance solution can help you, talk to us today. Alternatively, take a look at our pricing plans and discover a solution that meets your needs.