Top 5 unique types of identity documents in the UK for financial services: proof of identity documents UK

The UK’s proof of identity framework for financial services extends beyond passports and driving licenses to include unique documents like Biometric Residence Permits, Citizenship Certificates, and the Northern Ireland Electoral Identity Card. These identity documents play a crucial role in fostering financial inclusion and meeting regulatory demands. Discover the top five unique types of ID in the UK and how they enhance compliance, inclusivity, and trust in the financial sector.

Aizaz Ahmad

In the diverse landscape of UK financial services, identity verification is crucial for compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. With no universal national ID card or system, financial institutions must rely on various documents issued by multiple authorities. While this ensures broad coverage, it also creates unique challenges in verifying identities and meeting regulatory requirements. Additionally, the diversity of these documents can hinder financial inclusion, making it difficult for some groups—like non-citizens or those without traditional IDs such as passports and driving licenses—to access essential financial services.

The UK proof of identity checklist includes acceptable documents for verifying identity for individuals, companies, and other legal entities. Individuals must provide separate documents for KYC verification: one primary document to authenticate their full name and date of birth (e.g., a passport or UK birth certificate) and another document to validate their residential address (such as a utility bill or council tax statement). When dealing with complex entities like trusts and partnerships, financial institutions are required to conduct Enhanced Due Diligence (EDD) to identify the Ultimate Beneficial Owners (UBOs) and individuals who exercise control.

While standard identity documents such as passports and driver’s licenses are widely used, certain unique documents provide enhanced security and inclusivity, catering to diverse demographic groups, non-citizens, and specific verification requirements.

Here, we explore five unique but significant identity documents that financial services may encounter in the UK:

1. Biometric Residence Permit (BRP)

The Biometric Residence Permit is issued in lieu of a visa to non-British citizens who will be living in the UK for more than six months, allowing them to work and reside in the country long-term. This photo ID contains biometric data and fingerprints along with the individual’s immigration status, which indicates their right to work, study, or remain in the UK.

Unique Value: Institutions must verify the identities of long-term non-UK residents who might lack access to standard UK identity documents.

Key Use: Proof of residency and immigration status verification for foreign nationals residing in the UK.

2. Citizenship Certificate

The UK Citizenship Certificate is a key document for individuals who have gained British citizenship, especially for those who haven’t yet obtained a British passport. It offers legally binding proof of nationality, often requested when citizenship is newly granted.

Unique value: Unlike a passport, which is typically issued after citizenship is granted, the Citizenship Certificate is often available sooner. This makes it useful for confirming citizenship status promptly, particularly for financial institutions needing to validate new citizens who may not yet have other forms of UK ID.

Key use: Proof of British citizenship for individuals who have recently obtained nationality status.

3. Northern Ireland Electoral Identity Card

The Northern Ireland Electoral Identity Card is a photo ID given out by the Electoral Office for Northern Ireland. It’s mainly used to prove who you are when voting at a polling station in Northern Ireland.

Unique value: This card is a distinctive document specific to the region, crucial for financial institutions in Northern Ireland. It promotes financial inclusion by providing a free government-issued photo ID, enabling more residents to access vital services.

Key use: Primarily, the card ensures individuals can confirm their identity when voting at polling stations in Northern Ireland. It is an essential tool for maintaining the integrity of the democratic process.

4. HM Armed Forces Veteran Card

Issued to members of the UK armed forces, the HM Armed Forces Veteran Card serves as both an official identity document and a record of military service. This ID card includes details on an individual’s rank, branch, and service number, which can be essential for verifying employment status in KYC processes.

Unique value: Beyond confirming identity, this document also establishes employment status, which is valuable for financial institutions serving military personnel. It also supports institutions that offer military-specific services, ensuring they meet targeted needs.

Key use: Verification for military personnel.

Financial institutions, particularly those offering services geared toward the military, can use the UK Forces ID Card for KYC purposes, verifying both identity and active duty status. For example, a bank providing military-specific financial products could use this card to confirm eligibility for special accounts or home loans.

5. European Union Settlement Scheme (EUSS) ID

With the UK's exit from the EU, the EUSS ID has become a significant document for verifying the residency rights of EU nationals in the UK. This ID confirms that the individual has applied for or been granted settled or pre-settled status, which is essential for those intending to stay in the UK post-Brexit.

Unique value: The EUSS ID is particularly valuable as it provides proof of residency rights post-Brexit, ensuring EU nationals’ legal status. It is indispensable for compliance, especially for institutions with a significant EU national client base. For example, a mortgage lender may use the EUSS ID to confirm an EU citizen's legal residency status before approving a home loan, ensuring compliance with UK regulations.

Key use: Proof of residency rights for EU citizens residing in the UK after Brexit.

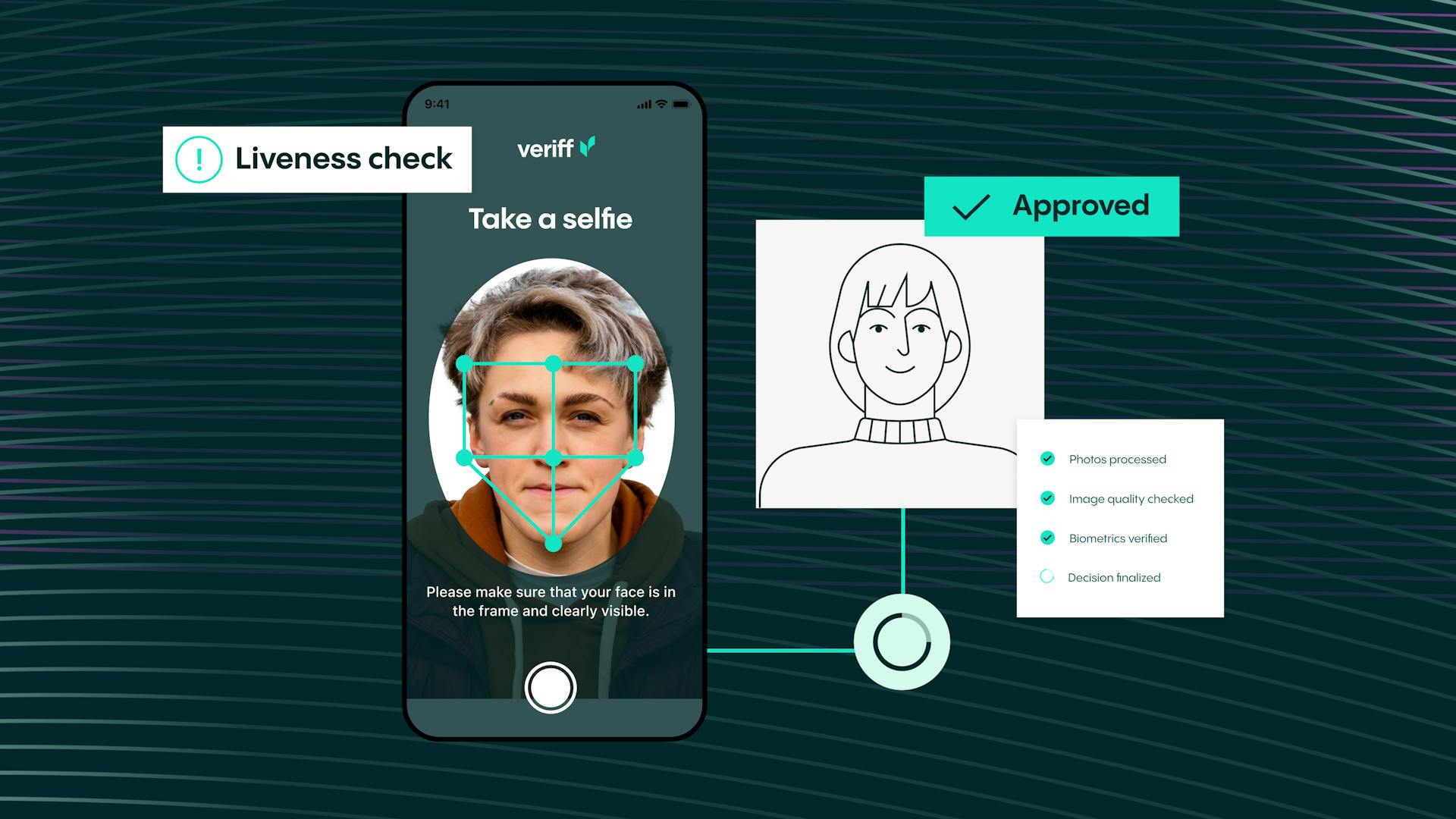

How Veriff can help

Veriff promotes financial inclusion by verifying various documents, enabling institutions to serve diverse clientele, such as non-citizens, long-term residents, and EU nationals after Brexit. This helps institutions maintain a balance between compliance and inclusivity, while also cutting operational expenses..

Here’s a list of supported UK documents by Veriff:

- UK Driving Licence: Veriff verifies driver’s licenses from all UK regions, ensuring thorough compliance.

- UK Passport: A standard and widely used form of ID, the UK passport is fully supported for identity verification.

- Biometric Residence Permit (BRP): Veriff assists institutions in verifying non-UK nationals' identities through BRPs.

- European Union Settlement Scheme (EUSS) ID: Veriff helps financial institutions verify EU nationals’ residency status post-Brexit.

- Northern Ireland Electoral Identity Card: Veriff supports identity verification for residents of Northern Ireland, enhancing accessibility.

By offering robust identity verification solutions, Veriff can help financial institutions ensure compliance and streamline onboarding for diverse customer demographics across the UK.

Veriff & Webull partnership

Among Veriff's financial services case studies, the collaboration with Webull stands out as particularly relevant. Webull, a commission-free trading platform, partnered with Veriff to enhance its identity verification processes, aiming to secure its platform and streamline user onboarding. This partnership not only bolstered fraud prevention but also improved user trust and conversion rates.

This case study exemplifies how robust identity verification can address common challenges in the financial sector, such as fraud mitigation and regulatory compliance, while simultaneously enhancing the user experience. Webull's Chief Risk Officer, Brendan Fuller, emphasizes the company's commitment to security, stating, "Providing our users with a safe and secure platform has always been a top priority at Webull, and Veriff has helped us to do so. Compared to previous partners, Veriff has been able to support us in identifying fraudulent activity accurately and effectively – even as platform user numbers climbed.”

"Providing our users with a safe and secure platform has always been a top priority at Webull, and Veriff has helped us to do so. Compared to previous partners, Veriff has been able to support us in identifying fraudulent activity accurately and effectively – even as platform user numbers climbed.”

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms