Fraud Article

AI compliance: Why it matters for financial services in 2025?

Dive into the essential aspects of AI compliance, discover why it matters, and explore the groundbreaking legislation defining the future of AI governance. Join Veriff’s AI compliance webinar on February 12th to learn more!

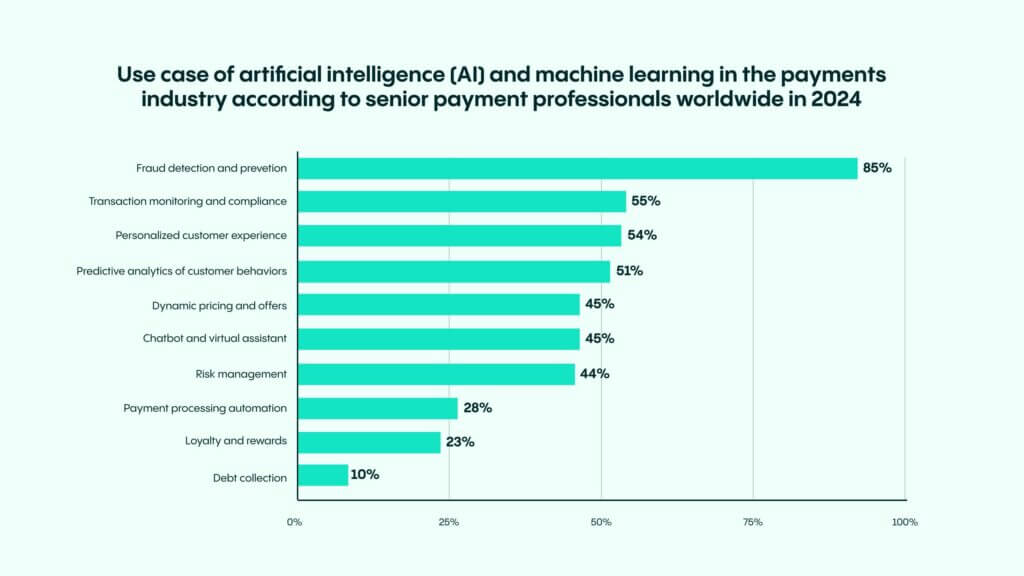

Artificial intelligence (AI) is transforming the payments and financial services industry, offering innovative solutions to longstanding challenges. According to a 2024 survey of senior payment professionals, AI’s most prominent use cases include fraud detection and prevention (85%), transaction monitoring and compliance management (55%), and personalized customer experiences (54%). Fraud detection, in particular, has emerged as a critical application, with generative AI playing a major role in combating payment card fraud—a problem projected to grow by over $10 billion between 2022 and 2028.

As AI adoption accelerates across financial services, so does the need for robust compliance measures. Ensuring that AI systems align with regulations and ethical standards minimizes risks, maintains customer trust, and navigates a rapidly evolving regulatory landscape. Whether you are a manager, developer, or AI enthusiast, understanding the challenges and solutions in this area can save your company significant legal costs and protect its reputation.

This article unpacks the core elements of AI compliance, explores its importance, and reviews key legislation shaping the future of AI governance.

What is AI compliance?

AI compliance is a critical aspect of ensuring organizations remain compliant with regulatory requirements and laws governing the use of artificial intelligence (AI) systems. As AI becomes increasingly prevalent in various industries, effective AI compliance has become a strategic imperative. AI compliance involves ensuring that AI systems are designed, developed, and deployed in a manner that adheres to applicable laws, regulations, and industry standards. This includes ensuring that AI systems are transparent, explainable, and fair, and that they do not pose a risk to individuals or society.

Why is AI compliance important?

AI compliance is critical for several reasons:

- Legal and ethical assurance: It ensures AI-powered decisions comply with laws and uphold ethical standards.

- Risk mitigation: Effective compliance and risk management can prevent fines, penalties, and reputational damage.

- Privacy and security: AI systems process vast amounts of personal data, requiring stringent measures to prevent misuse and protect individuals.

Regional insights for the US, EU, and UK

Several regulatory frameworks have been established to govern the use of AI systems, with also several guidelines and statements issued by industry regulators. These frameworks provide guidelines and standards for ensuring that AI systems are developed and deployed in a responsible and compliant manner. Some prominent AI regulatory frameworks include:

- The US is standing at the forefront of emerging AI compliance initiatives where the new government is taking steps towards de-regulation on the federal level while individual states are still taking the course of regulation. At the same time, the bigger players in the AI industry are calling for a federal approach to preempt the increasing state-by-state regulatory patchwork. That means the US is the place to watch in terms of AI policy development and compliance landscape, however, for financial services companies strong focus should be on the guidelines, reports and statements issued by the US Department of Treasury and its bureaus, e.g. the FinCEN.

- The European Union’s AI Act: This comprehensive framework regulates AI systems within the EU, categorizing them by risk level, and imposing stricter regulations on high-risk applications. Many of the potential applications by financial service providers can find themselves in the high-risk categories.

- The UK Government’s “AI Regulation: A Pro-Innovation Approach” outlines plans to regulate AI by balancing innovation with addressing potential risks, highlighting benefits like improved healthcare, better transport, and increased productivity. While the UK is still relatively light in terms of direct regulation then with the new Government taking office talks have intensified around having some form of a stricter regulatory framework in place. Nevertheless, the financial service providers will need to also align with their regulators. For example, in April 2024, the UK’s Financial Conduct Authority (FCA), the authority supervising financial services and fintech companies in the UK, published its AI update. While looking backwards and forwards, the FCA did stress that they are collaborating with firms to understand the usage of AI in the sector but also clearly focusing on the increase in risks around operational resilience, outsourcing and critical third parties. Companies need to take it into account when asked about their AI usage.

The above does not mean that AI compliance is something that derives only from specific AI laws. All prevalent issues around AI make deep intersections into existing areas of regulation, for example around personal data protection and privacy, copyrights, and protection against discrimination.

The future of AI compliance

AI compliance is no longer optional. As regulatory frameworks tighten and public awareness grows, organizations must integrate legal and ethical considerations into their AI strategies to ensure compliance, build trust, and mitigate risks. Prioritizing compliance is critical for driving sustainable growth and maintaining a competitive edge.

As we look ahead to 2025, businesses must prepare for stricter AI compliance frameworks. Join our expert-led webinar to gain actionable insights on aligning your operations with global AI regulations, minimizing risks, and fostering innovation with confidence.