In trading and brokerages, IDV helps beat the fraudsters

Trading and brokerage platforms are a clear target for fraudsters, money launderers and other criminal elements. With robust identity verification (IDV) tools, you’ll know exactly who is accessing your service, and can root out potential threats.

Fin Murphy

Fraud is a significant danger in the trading and brokerage domain, given the sheer volume of transactions and the levels of finance involved. This could make your service a target for criminals who want to hide their ill-gotten gains, those who wish to steal from honest customers, and even elements involved in terrorist financing.

To address such dangers, trading and brokerage firms must comply with a wide range of legislation across the world; failure to do so can have serious legal consequences, hurting your business on several levels.

Global regulators have long focused on the danger of such crimes in the trading and brokerage spaces and other financial industries. In the US, for instance, broker dealers must contend with the Bank Secrecy Act – the basic framework for AML obligations imposed on financial institutions – and the USA Patriot Act, which was adopted after the terrorist attacks of September 11, 2001.

There are various other demands to consider in the US alone. In the EU, trading and brokerage firms must operate with an investment firms’ licence and comply with the fifth AML directive (AMLD5).

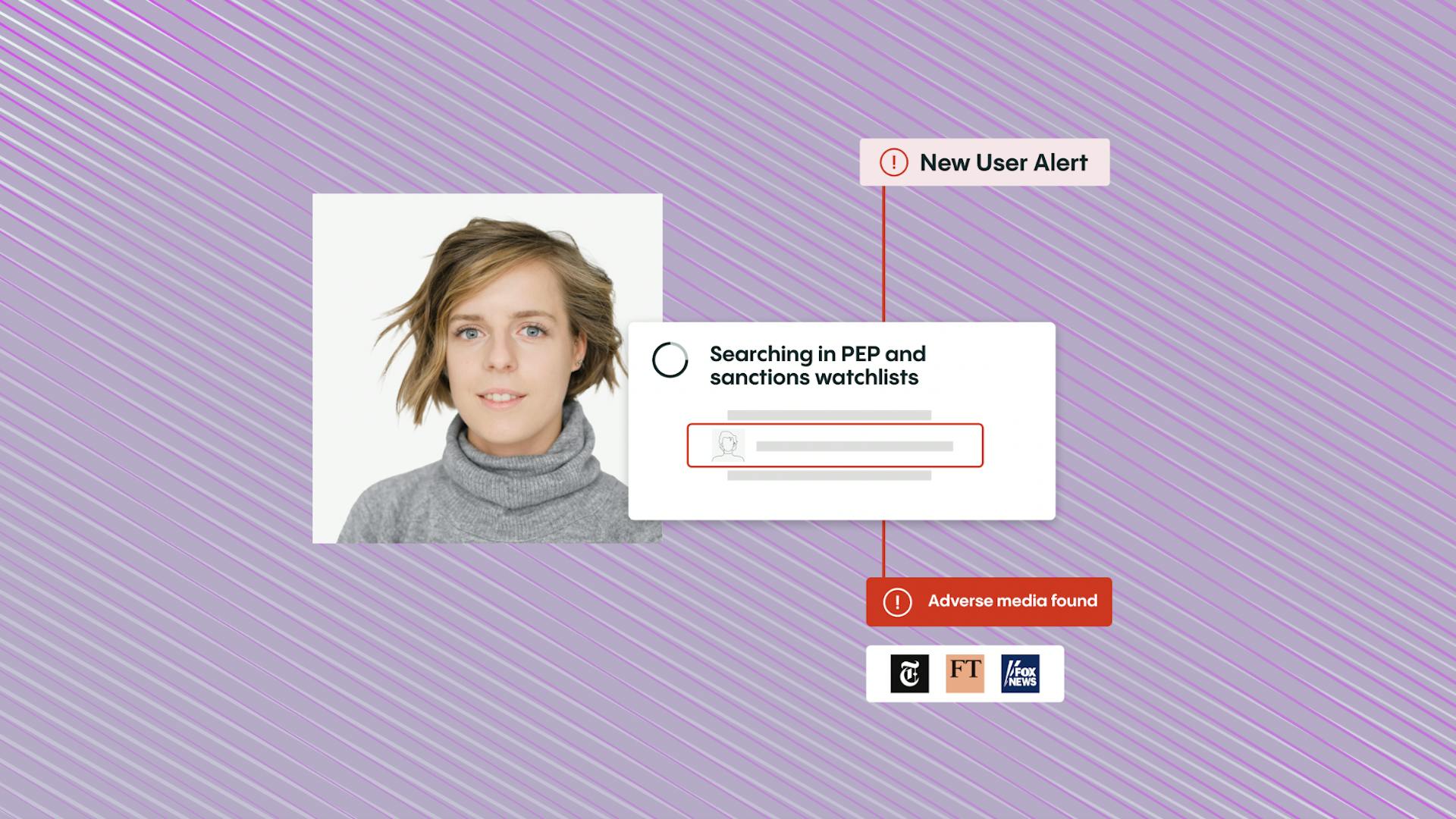

It is a complex field, with various demands around AML, know your customer (KYC), politically exposed persons (PEPs) and sanctions checks. And a one-time solution just isn’t enough. Anti-fraud and AML solutions must constantly evolve and adapt, protecting business as new criminal methodologies are deployed.

So how can IDV help? At Veriff, we provide AI-powered IDV solutions to combat identity fraud and ensure KYC compliance, while meeting demands around sanctions and PEPs. The technology is secure and easy to use, providing real-time feedback based on an extensive database of identity documents from around the world.

These solutions are global in reach, built on a database of more than 12,000 government-issued IDs from more than 230 countries and territories. By using AI, machine learning and biometrics, we quickly extract data from an ID and compare it with a live selfie, ensuring that a person is just who they claim to be.

This technology leads to a 98% check automation rate, enabling genuine and honest customers to pass through the process very quickly. If there are any issues, we offer real-time feedback and tools such as Assisted Image Capture (AIC) to guide them. All of this means that the vast majority of users – 95% - go through on the first time.

Essentially, the aim is to combine security in AML and anti-fraud efforts with convenience for the user. By enhancing their experience, boosting accuracy and ensuring the highest levels of security, you can increase customer conversions by 30% and realize the business benefits of cutting-edge IDV.

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms