How to build a best-in-class KYC approach for your neobank

Getting your Know Your Customer (KYC) strategy right is a key element in giving your customers the smooth onboarding process they increasingly expect.

Chris Hooper

KYC requirements are a fact of life for today's financial institutions, many of which are digital banking operators. While traditional banks have relied on KBA practices, many neobanks have embraced a fully digital KYC process, which is customer centric, accessible, and completed in real time. That said, optimizing KYC is vital during the customer onboarding process, where customers may delay or abandon signing up if it doesn't live up to the expected customers' experience. As such, a challenge emerges: how can banking services firms prevent serious crimes like money laundering, complete processes like transaction monitoring, and guarantee their their KYC process is customer friendly?

In today’s on-demand world, consumers want a speedy, seamless experience in every aspect of their interactions with businesses. At the same time, customers are understandably wary about the security of their data, and that concern is never stronger than when it comes to banking.

Know Your Customer (KYC) is too often treated simply as a means to protect businesses, rather than as a method of ensuring the security and integrity of financial transactions for both parties. The result is often that customers are made to feel frustrated and unwelcome, just at the moment when you are trying to establish a relationship with them.

What’s the problem with traditional KYC approaches?

Traditional approaches such as Knowledge Based Authentication are often more a source of frustration for genuine customers than a deterrent for fraudsters. Research shows that consumers often struggle to recall the responses they choose for common security questions like ‘what was your favourite food as a child’, let alone information about their credit history or their family members. At the same time, data breaches, phishing and the sheer accessibility of people’s personal information through their social media presence undermines the viability of such questions as a security measure.

Many banks also rely on one-time passcodes sent by SMS or email as part of onboarding and authentication. These methods are not secure and leave clients’ accounts vulnerable to hacking and phishing attacks. They also add friction into the verification process as the potential customer has to swap from one app to another to capture information sent by email or SMS.

For ambitious businesses who want to keep up with regulatory demands while minimizing risk and maximizing growth, an effective IDV service is an essential element of your KYC strategy.

What are the advantages of an IDV approach for KYC?

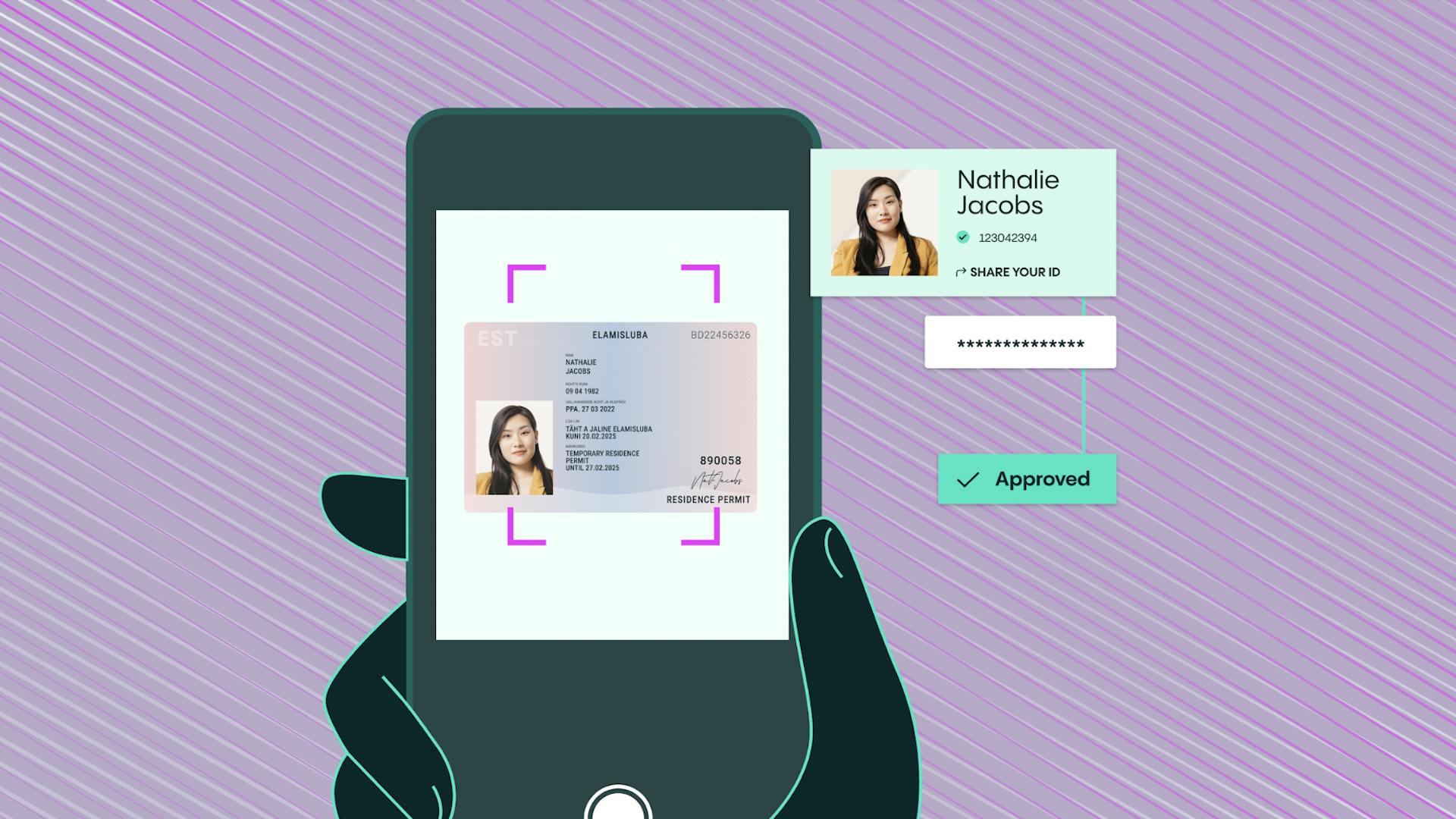

Selfie-based identity verification (IDV) used by Veriff is a far more secure approach that uses facial recognition technology combined with government-issued identity documents to match a customer’s face to their photo ID. It leverages diverse network, device, document, video, biometric and behavioural information for maximum effectiveness.

Veriff’s latest IDV software removes the need for manual form filling and processing. It provides a decision in seconds, minimizing friction and significantly reducing the risk of losing potential customers at this crucial stage of the onboarding process.

Using the camera on their chosen device, users can take a photo of their approved identity document plus a quick selfie. These are then cross-referenced in real time, with a decision made in seconds. The best systems employ AI to provide user feedback on issues, significantly reducing the risk of false declines, but also have a layer of in-house human support to check and verify issues the AI cannot understand.

The range of information used in the process helps to keep a balance between speed, accuracy and effective fraud prevention, ensuring verification is both quick and accurate. What’s more, the application of machine learning to the verification process means that the more data systems gather, the more accurate they become.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 10K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Benefits for both parties

The result is a better outcome for both bank and customer alike. Customers substantially reduce the risk of losing money, exposing their sensitive personal information and losing their confidence in online processes. For banks, IDV reduces the risk of reputational damage from adverse media and even legal action, along with loss of growth through failure to convert.

For ambitious businesses who want to keep up with regulatory demands while minimizing risk and maximizing growth, an effective IDV service is an essential element of your KYC strategy.

There is also a need here for a resilient solution that can scale with your business and manage planned or unexpected spikes in customer applications, all while being secure and adaptable to evolving fraud threats. Part of this includes sandbox environments where new products and solutions can be made and tested prior to launch.