Entrada de blog

Por qué la verificación de identidad (IDV) es una situación beneficiosa tanto para prestamistas como para prestatarios

El mercado de préstamos no garantizados está en un periodo de cambio, con tasas de interés más altas y el costo de vida afectando a los clientes en todo el mundo. Un mercado incierto puede aumentar el riesgo de fraude, lo que requiere que las empresas implementen procesos efectivos para mantener la seguridad de ellos mismos y de sus clientes

Con la nueva incertidumbre en el mercado de préstamos no garantizados, causada por el aumento de las tasas de interés y el costo de vida que afecta a los clientes globalmente, el riesgo de estafadores en línea ha aumentado. Sin embargo, las soluciones de verificación de identidad ofrecen a las empresas y a los clientes la oportunidad de mantenerse seguros en medio de la disrupción.

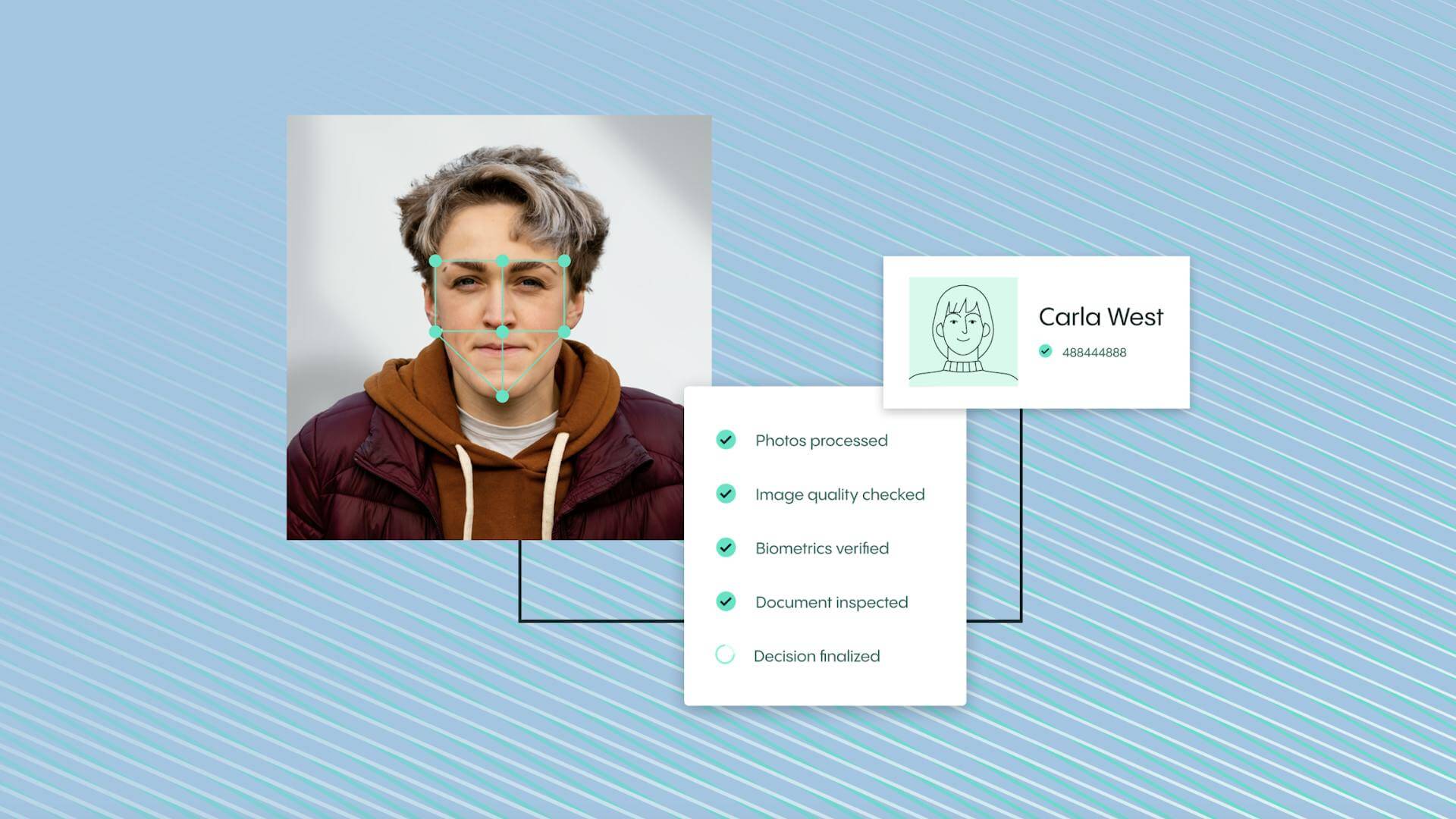

Decisiones rápidas

Experience and expertise

Experiencia simple

Retroalimentación en vivo con menos pasos que aprueba al 95% de los usuarios en el primer intento.

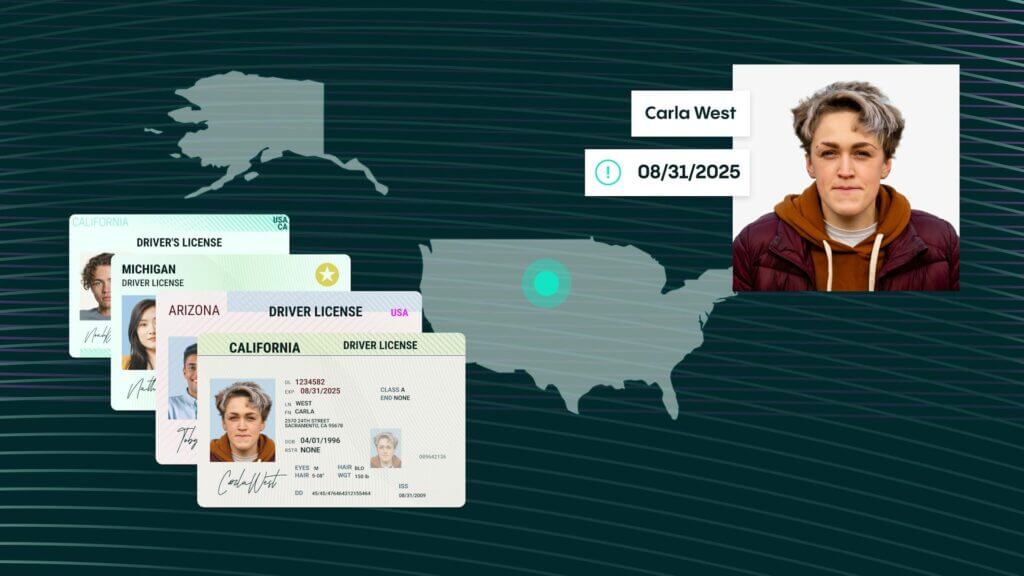

Cobertura de documentos

Cobertura sin paralelo y en crecimiento de más de 12.000 identificaciones emitidas por el gobierno.

Más conversiones

The entire Veriff team from a highly-trained Verification Specialists, our experienced and specialized legal team, and document specialists can help you provide an exceptional service to your users.

Alta detección de fraudes

Además de la velocidad, la detección de fraudes impulsada por datos es consistente, auditable y detecta de manera confiable formas fraudulentas de identificación.

Escalabilidad y crecimiento

El POA de Veriff puede crecer con las necesidades de su empresa y mantenerse al día con tiempos de mayor demanda de usuarios.

Obtén más detalles

Descubre más sobre cómo la verificación de identidad (IDV) está impulsando el crecimiento empresarial y la adquisición de clientes