EM DESTAQUE

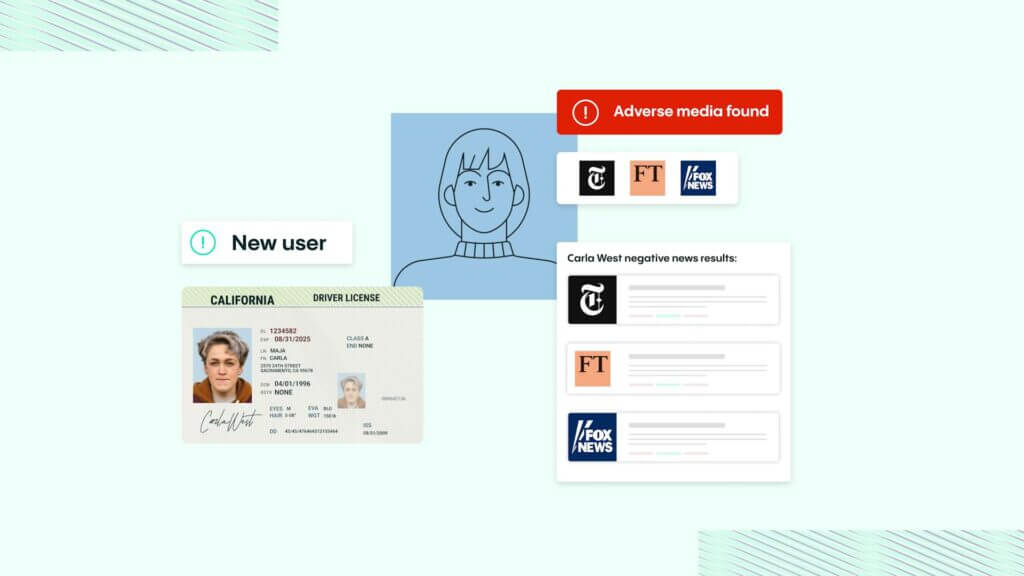

Relatório da Veriff sobre inteligência biométrica

Obtenha nosso relatório sobre inteligência biométrica, que inclui uma visão geral detalhada sobre a biometria e um resumo das vantagens que ela oferece a empresas em um mundo digital cada vez mais perigoso.

Inscreva-se para obter insights

Comece a construir com a Veriff de graça

Sua jornada em direção a uma verificação de identidade mais rápida e precisa começa aqui.