Why IDV ensures trust and safety for today’s gaming players

Today, the gaming industry relies heavily on identity verification (IDV) to meet global and regional regulatory requirements. Additionally, using IDV in the onboarding process can offer a swift and seamless customer experience, ensuring player safety and establishing trust.

Chris Hooper

Identity Verification (IDV) is business critical for the gaming industry today, playing a key role in meeting regulatory demands. However, its importance goes beyond legal requirements, enhancing the customer experience by ensuring their safety and building trust.

A company’s customers are always its biggest assets. In a highly competitive gaming industry in both established and emerging markets, it is no longer enough to treat verification as a simple tick-box procedure.

A company’s customers are always its biggest assets. In a highly competitive gaming industry in both established and emerging markets, it is no longer enough to treat verification as a simple tick-box procedure.

Optimizing onboarding for players

Verification is today a legal necessity, ensuring that only appropriate customers are onboarded to your platform, in terms of their age or any other restriction. However, it is so much more than a simple box-ticking exercise.

The minimum demand is to verify that a customer is who they say they are in a way that adds little or no friction to the onboarding process. This way, players can be onboarded with the minimum of fuss, while reassuring them that their money and data are safe.

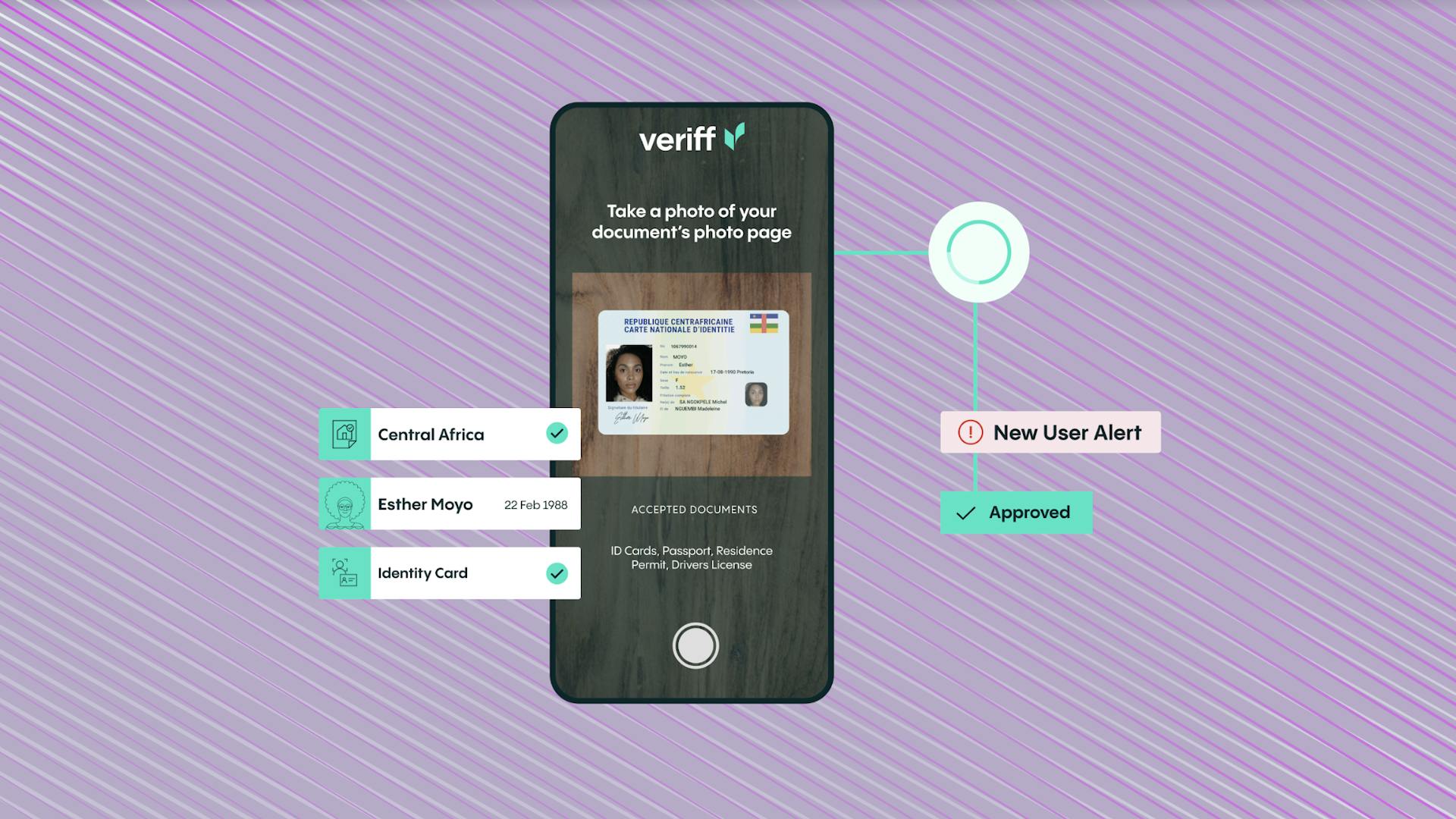

For Veriff, this dynamic and engaging approach is built on several levels. The company’s IDV tools are designed to support operators to onboard people quickly around the world, ensuring that only players who meet your requirements in security, age and location are given access.

Preventing today's fraud risks

Players are onboarded quickly but safely, through a decision engine that can automatically confirm verification in a matter of seconds, making the customer journey as painless and seamless as possible.

The highest levels of IDV security can also prevent account takeovers, a key element of defeating identity fraud. This also helps to streamline the existing customer journey, a vital step in building consumer satisfaction and expanding your business.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.