Why a killer KYC strategy matters to neobank customers

Consumers demand swift onboarding, but they’ll soon bank elsewhere if security is compromised or reputational harm occurs.

Chris Hooper

The rise of neobanks has transformed how everyday customers access a range of services in banking. By its proximity to sensitive data and money, plus the potential for bad actors to strike, neobanks must ensure that proper Know Your Customer (KYC) compliance is instituted. This involves verifying customer identity by processing personal information such as full name, address, and date of birth. This process helps neobanks ensure that their customer base is sound while identifying and preventing bad acts, such as money laundering or terrorism financing.

Traditional banking has long been used as a primary source for providing banking services such as debit cards, checking and savings accounts, and money management tools. However, the growth of neobanks offering digital solutions, like mobile apps with no physical branch presence required, has driven firms like traditional chartered banks to provide an even better range of services, while also ensuring compliance with anti-money laundering (AML) regulations through effective KYC processes .

When done correctly KYC onboarding is a slick, speedy and pain-free process which mirrors the effortlessness of leading ecommerce interactions.

With well over over one million customers already using various online products offered by today’s neobanks and traditional banking institutions, customers have grown accustomed to a seamless style of banking. An effective ‘Know Your Customer’ (KYC) strategy has the potential to make or break a neobank. While some unenlightened legacy institutions see KYC as a regulatory chore, the new breed of digital banks recognise it as a powerful opportunity to win customers.

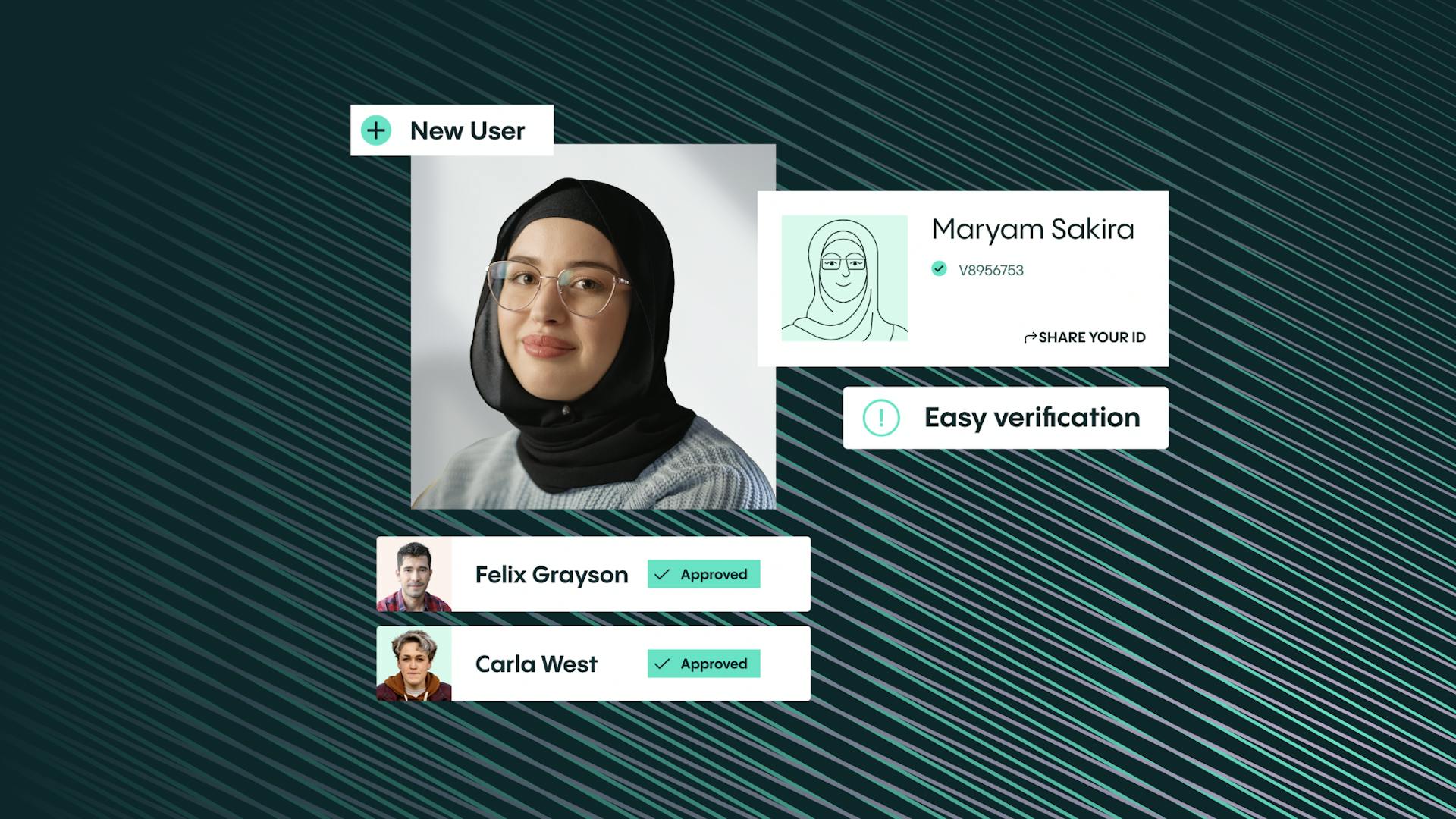

When done correctly KYC onboarding is a slick, speedy and pain-free process which mirrors the effortlessness of leading ecommerce interactions. In fact, leading neobanks now compete on the number of customer clicks required to access new accounts, products and services.

This is a major selling point for time-poor and admin-intolerant consumers raised on a digital diet of Amazon one-click purchases and Uber taxi rides. But friction-free experiences are not without significant risks.

Scaling onboarding without strong controls creates risk

Weaknesses in KYC processes are more likely to develop as the speed and volume of new applications ramp up. This up-tick in risk is illustrated in the disproportionately high incidence of fraud among neobanks compared to traditional institutions.

If a neobank’s controls for onboarding are lax, then there’s a risk of giving fraudsters illegitimate access to services, which creates substantial legal, financial, and reputational risks for the neobank. If a neobank’s authentication controls are lax, then legitimate customers are put at risk of acts of fraud including account takeover scams.

Reputation is critical, whether an institution is a century old or a year old – as many neobanks are. For newer banks, however, the risk of losing customers is much greater, as individuals have fewer ties, less loyalty and are willing and able to switch at speed. The side effects of weak KYC systems also impact merchant confidence.

It’s clear that the security and continuity of service made possible by a comprehensive KYC strategy matters a huge amount to neobank customers, but what does an effective, fit-for-purpose KYC solution look like?

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Verifying identity securely at speed

Market-leading KYC solutions use AI technology to automate customer onboarding so that it is both speedy and secure. That means no laborious form filling, manual processing and long wait times for final customer verification.

They achieve this balancing act thanks to a system called identity verification (IDV), which involves the customer taking photos of their government-issued identity documents (such as a driver’s licence and passport) and then taking a selfie of themselves in real time. The most effective IDV solutions capture and verify key information from these photos in just six seconds – maximising both customer experience and anti-fraud security measures.

Another major customer experience benefit of IDV is that customers no longer have to remember answers to stock security questions (their favourite food, first school, mother’s maiden name, credit card transaction history etc) in order to verify their identity. Instead they just need to take a simple selfie.

Recent research by Forrester shows that Veriff’s IDV platform cuts revenue lost to fraud by 20% – which is great news for neobanks and security-conscious customers alike.

Joining forces to allay customer security concerns

Data security is clearly a huge challenge, but it is also a huge selling point for neobanks, when done correctly.

Part of the challenge for neobanks is that unlike sector incumbents, they don’t necessarily have the deep pockets needed to develop their own KYC processes.

Instead the most cost-effective way to allay customer’s concerns over fraud is to partner with a market-leading KYC solution provider, which has the industry reputation, expertise and experience to deliver the secure and seamless KYC experiences that customers expect and demand.