How to spot a fake ID by state across different states

Fake IDs are widely used in the U.S. to buy alcohol or access age-restricted services, posing challenges for businesses and authorities. Let’s take a detailed look at how to spot a fake ID by state.

Iryna Bondar

The fraud rate of identity documents varies widely across regions in 2024, with different documents targeted for forgery. According to the Veriff Identity Fraud Report 2025, 0.97% of verification attempts in North America involved document fraud in 2024. While this may seem small, it’s 40% higher than the global average, making North America the most fraudulent region for forgeries. In North America, residence permits lead with the highest fraud rate of 8.22%, making them the most forged document type. Passports and driver's licenses also show notable but lower fraud risks. In Latin America, driving licenses are most vulnerable, with a fraud rate of 1.63%, followed by visas at 2.70%, reflecting a distinct focus on forgery. In the European Union, fraud rates are more evenly spread—passports and driving licenses both have a fraud rate of 0.82%, while ID cards show slightly higher risks. These patterns highlight the need for region-specific identity verification strategies to effectively combat document fraud. Fake IDs are commonly used across the US to purchase alcohol or access age-restricted services, creating challenges for businesses and law enforcement.

Here's an in-depth guide on identifying fake IDs by state.

Fraud rate by document type in 2024 - by region

Fake IDs are a growing concern for businesses, law enforcement, and individuals alike. With the rise of advanced technology, creating high-quality fake IDs has become increasingly easier. These counterfeit IDs can be used for various purposes, including identity theft, underage drinking, and financial fraud. Understanding the different types of fake IDs and their characteristics is crucial for spotting them.

High-quality fake IDs often mimic the appearance and feel of genuine IDs, making them difficult to detect. However, by familiarizing yourself with the common types of fake IDs—borrowed, altered, and forged—you can better identify these fraudulent documents. Borrowed IDs involve using someone else’s ID, altered IDs have modified information and forged IDs are entirely fabricated. Recognizing these distinctions is the first step in effectively spotting fake IDs.

Let's take a detailed look at detecting fake IDs by state.

Across the US, fake IDs are regularly used by members of the public to try to obtain alcohol or sign up for new services.

The three most common fake IDs are:

- Borrowed IDs: this is when a minor borrows or takes an ID from an older sibling, a friend, or a stranger and pretends to be that person. Borrowed IDs are the most frequently encountered in ID fraud cases.

- Altered IDs: this is when the genuine ID of a person has been changed. For example, a minor may keep all the information on their ID the same, except for their date of birth.

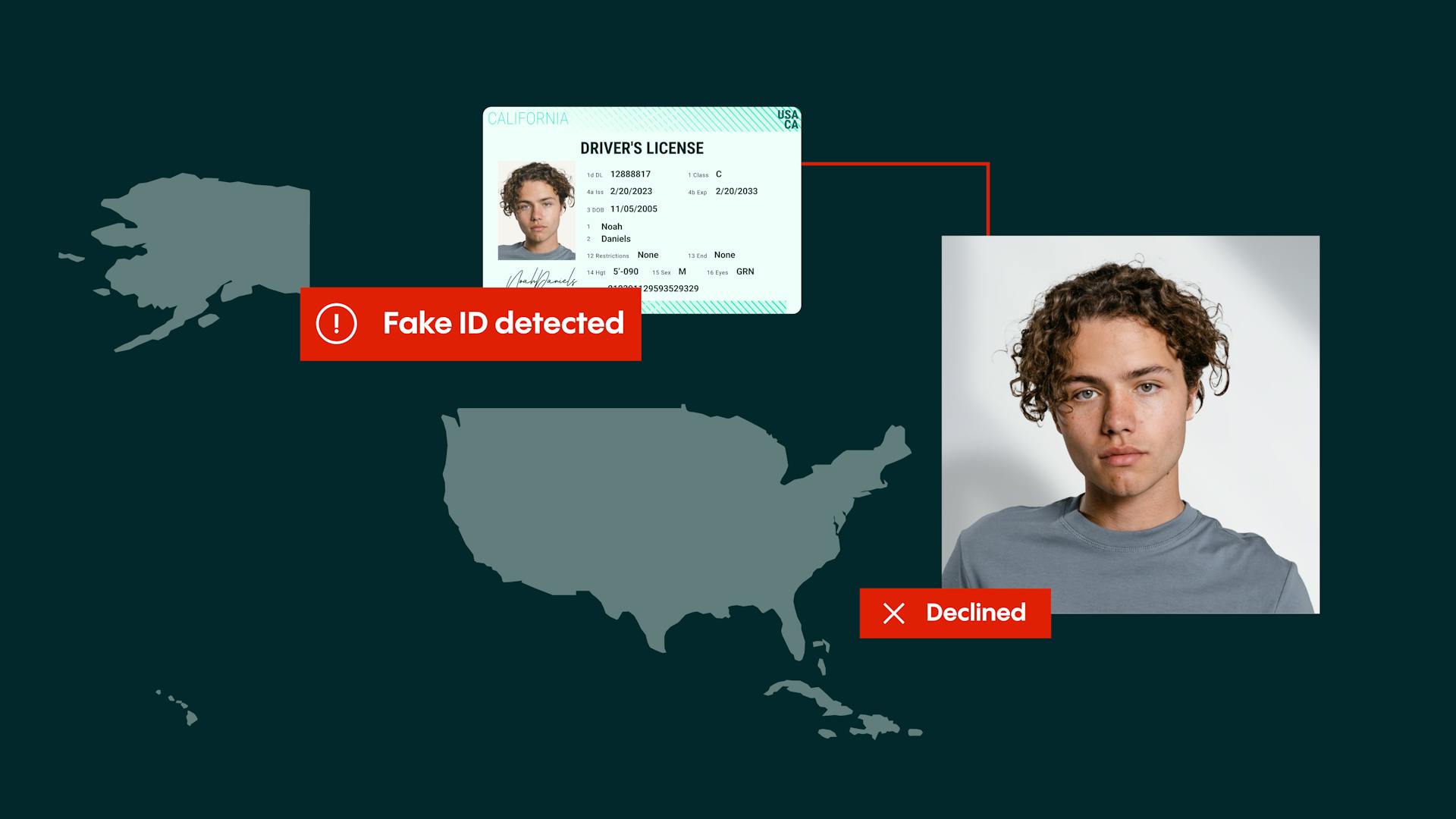

- Forged IDs: this is when a new fake ID is made to create a false identity. Here is an example of a forged California Driver's License generated by Only Fakes.

What to look for

Detecting fake IDs has become increasingly complex, but there are reliable methods to identify forgeries. Physical inspection remains a key step: examine the card's texture, scan the barcode for inconsistencies, and check for errors such as misspellings or missing information. Behavioral analysis is equally critical; nervous behavior or vague responses from the cardholder may warrant further investigation.

Another significant threat is identity theft, often involving stolen IDs obtained through phishing schemes or illicit marketplaces on the dark web. These stolen identities are frequently used for financial crimes, with attackers exploiting personal information acquired through manipulation or familial breaches.

Understanding these tactics and honing detection techniques are essential for maintaining security and trust. Enhanced scrutiny and awareness of ID verification processes across states can help mitigate the risks associated with both fake and stolen IDs.

State-specific security features

Each state has its unique security features on driver’s licenses and ID cards, designed to prevent tampering and ensure authenticity. Familiarizing yourself with these features can significantly help identify fake IDs.

- Laser perforation analysis: Hold the ID up to direct light to check for precise and clean perforations. These tiny holes often form a specific image or pattern unique to the state.

- State-specific hologram features: Holograms should change appearance smoothly when viewed from different angles. Each state has a distinct hologram design that is difficult to replicate.

- Embossing and tactile elements: Real IDs have specific raised areas that can be felt. For example, some states use raised lettering for the cardholder’s signature or date of birth.

- Document format and layout: The text spacing, image placement, and overall design of the ID should match the state’s standards. Any deviation from the standard format can indicate a fake ID.

- UV light responses: Some states embed specific patterns or images that are only visible under UV light. These hidden features are a reliable way to verify the ID’s authenticity.

By understanding and recognizing these state-specific security features, you can more effectively spot fake IDs.

Tips for spotting fake IDs

Spotting fake IDs requires attention to detail and knowledge of the security features of different states. Here are some practical tips for identifying fake IDs:

- Check the physical description: Compare the physical description on the ID to the person in front of you. Discrepancies in height, weight, or eye color can be a red flag.

- Look for spelling errors: Legitimate agencies do not produce IDs with spelling errors. Any misspellings or grammatical mistakes can indicate a fake ID.

- Check for signs of tampering: Look for peeling or damaged laminate on the card, blurry or smeared text, or a second photo pasted or glued on top of the original. These are common signs of altered IDs.

- Verify the ID’s authenticity: Check the ID’s security features, such as holograms, embossing, and UV marks, to ensure they match the state’s standards. Use direct light to check for precise and clean perforations.

- Be aware of common fake IDs: Familiarize yourself with the most common types of fake IDs, such as altered IDs, forged IDs, and scannable fake IDs. Knowing what to look for can help you spot these fraudulent documents more easily.

By following these tips, you can enhance your ability to detect fake IDs and protect yourself and yourbusiness from fraud.

State's ID security features:

Holograms

Official IDs incorporate holographic images that become visible when exposed to light, serving as a critical security feature. These holograms vary by state, making it essential to know the specific design for your ID. For example, Illinois driver’s licenses display the state name diagonally across the front when tilted under light.

Laser perforation

Laser perforation adds another layer of security to authentic IDs. Tiny, laser-perforated holes are integrated into the card, often forming an image not immediately visible unless held to direct light or closely inspected. These designs are state-specific. In Kansas, for instance, the perforations form a turtle shape in the upper right corner, visible from both the front and back of the license.

UV imagery

UV imagery, or blacklight imaging, is a central feature in combating fraudulent IDs. This technology incorporates ultraviolet images that vary significantly by state. Understanding your state’s UV design is crucial for verification. For example, California licenses display a secondary, lighter image of the driver under UV light.

Tactile features

Most states include tactile elements on official IDs, such as laser engraving or embossing. These features raise sections of the plastic or etch data into the card, making them exceptionally difficult to replicate. Touch detects the embossing and adheres to state-specific standards. In North Carolina, for example, the date of birth is laser engraved for tactile verification, while California licenses use raised lettering for the cardholder’s signature.

These advanced security features ensure IDs are reliable and resistant to fraud. Understanding these details allows for efficient and accurate verification, strengthening trust and security in identity validation processes.

Material integrity

State-issued IDs are sealed with professional-grade laminate, a material not available to the public. The card itself is designed to match the standard dimensions of a credit card, with precisely cut, smooth edges.

To verify the authenticity of an ID, bend it carefully into a “U” shape. High-quality laminates will remain intact, while non-professional or low-quality laminates may bubble under this stress. Additionally, authentic IDs will have smooth edges, while counterfeit ones may feel sharp or uneven.

Book a consultation with Veriff

At Veriff, we understand the challenges organizations face in balancing fraud prevention with a seamless user experience. Businesses need to quickly and accurately distinguish genuine users from bad actors to avoid undermining trust with unnecessary checks or denied access.

As organizations expand into new markets, understanding local fraud risks and delivering consistent, accurate verification processes becomes increasingly complex. Veriff’s IDV solution offers the perfect balance of robust fraud prevention and an optimized user journey. As a global IDV provider, Veriff understands local nuances and has experience handling various fraud types across different regions. Supporting 12,000+ IDs across 230+ countries and territories, our technology automatically recognizes and verifies document authenticity using our global database and additional checks to ensure the person is genuine.

Veriff’s global expertise and extensive document coverage ensure consistent, accurate verification across markets, helping organizations reduce fraud risk and scale securely. Our advanced technology swiftly detects fake or tampered IDs while ensuring a smooth, low-friction experience for genuine users. With Veriff, over 95% of users are approved on their first attempt, with decisions made in as little as 6 seconds. By preventing fraud and accurately verifying real users, Veriff helps you reduce costs, improve conversion rates by 30%, and reinforce trust in your verification processes. Protect your business and community with precision, speed, and reliability, all while enhancing the user experience.

Raenest’s success with Veriff

Raenest, a financial services platform that helps businesses and freelancers manage cross-border payments, partnered with Veriff to streamline its identity verification process. By leveraging Veriff’s AI-powered IDV solution, Raenest was able to reduce onboarding time while maintaining strong fraud prevention measures. With Veriff’s global document coverage and automated verification, Raenest improved customer conversion rates and ensured compliance with financial regulations across multiple markets. The partnership enabled Raenest to scale securely, verifying users efficiently while delivering a seamless experience.

"Our fraud detection rate increased from 10% to 90% following our implementation of Veriff’s platform. Conversion rates were also boosted from 40% to 60% almost overnight and churn rates were reduced from 8% to 5%. Compliance risk was also dramatically reduced, dropping from five cases a month to just one.”

Victor Alade, CEO and Co-Founder, Raenest

"Our fraud detection rate increased from 10% to 90% following our implementation of Veriff’s platform. Conversion rates were also boosted from 40% to 60% almost overnight and churn rates were reduced from 8% to 5%. Compliance risk was also dramatically reduced, dropping from five cases a month to just one.”

Learn more

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms