What is reverification and how does it fit into Biometric Authentication (US & UK)

Reverification is becoming a vital security measure for businesses across the US and UK. But what exactly is it, and why is it crucial for safeguarding both companies and customers in today’s rapidly evolving digital landscape?

Geo Jolly

In today's digital age, ensuring the highest level of security is essential for protecting both businesses and individuals from fraud and identity theft. Reverification plays a critical role in maintaining ongoing trust in identity verification processes, particularly when enhanced by biometric authentication methods.

What is reverification?

Reverification is the process of rechecking a person’s identity to ensure they are who they claim to be, even after their initial verification. This can be necessary in situations where users repeatedly access a platform, service, or system over time. The goal is to safeguard sensitive information and transactions by periodically confirming the individual’s identity using up-to-date data.

In regulated industries like financial services, digital marketplaces, and online gaming, reverification is key to staying compliant with legal requirements while reducing fraud risk. For companies, it provides a consistent way to meet the expectations of risk management, compliance, and IT professionals who are responsible for maintaining security and regulatory adherence.

Why reverification works for global appeal:

There are several situations where reverification becomes critical, including:

Fraud prevention is universal

In financial services or e-commerce, reverification may be required for high-value transactions or changes to account settings to prevent fraud. Reverification addresses the need for enhanced security in verifying users’ identities, making it a relevant topic worldwide.

Regulatory compliance

While regulatory requirements differ, the general need for compliance with data protection and identity verification laws (such as GDPR, AML, or KYC) exists across the globe. Companies in any area can gain from understanding reverification to ensure compliance.

Scalability

Reverification can be implemented in various markets and regions due to the adaptability of digital identity solutions, especially with biometric authentication becoming more widespread.

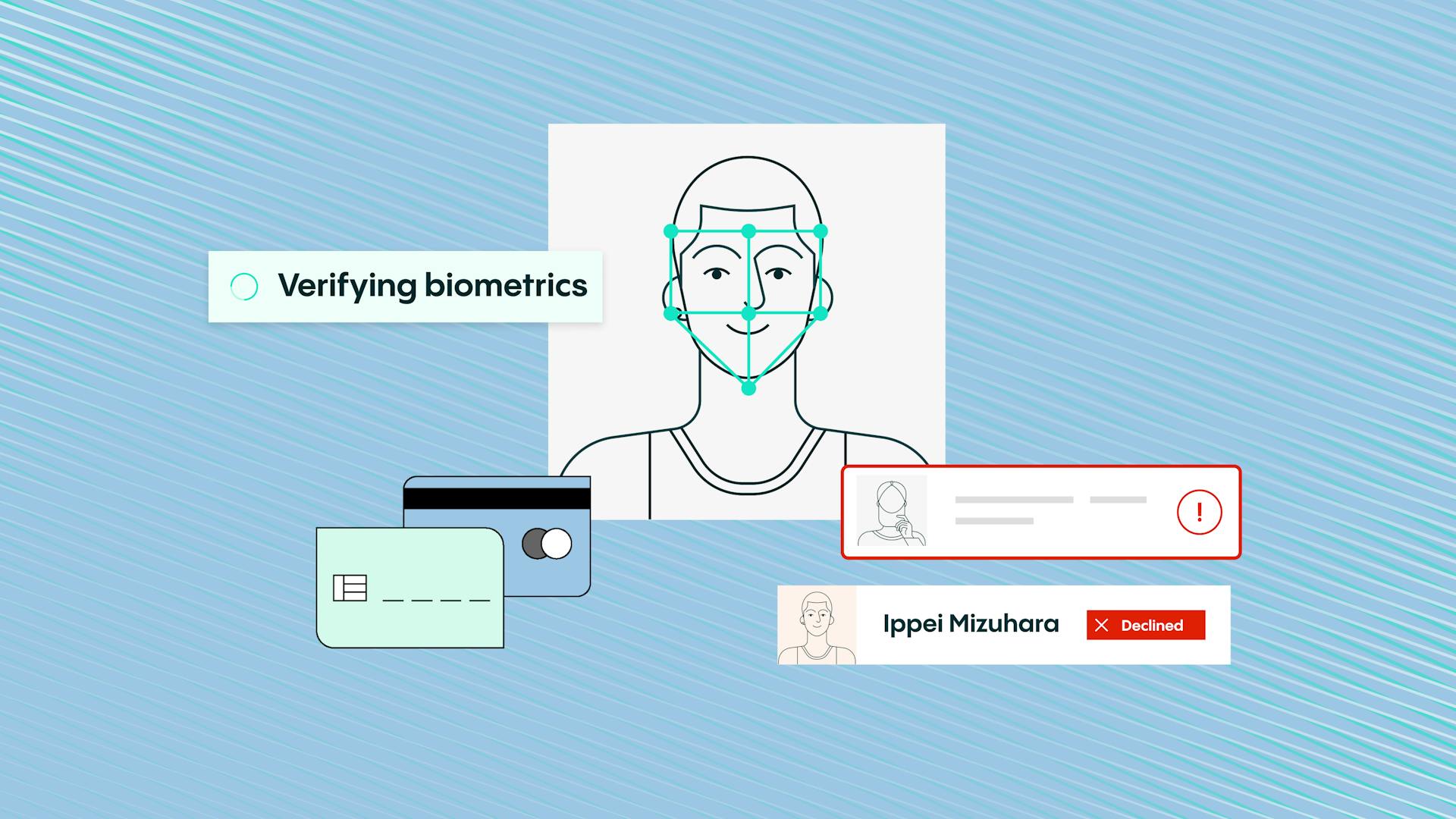

How Biometric Authentication enhances reverification

Biometric authentication, which relies on a user’s unique biological traits like fingerprints, facial recognition, or iris scans, offers a powerful solution for reverification. By integrating biometric data, organizations can add an extra layer of security to their verification processes, reducing fraud risk and making the reverification process more seamless for users.

Here are a few ways biometric authentication improves reverification:

Higher accuracy and security:

- Biometric data is unique to each individual and hard to replicate, making it a more reliable method of confirming identity than traditional passwords or security questions.

Seamless user experience:

- Once biometric data is stored, users can quickly and easily verify their identity through a scan or facial recognition, streamlining the reverification process without requiring them to remember passwords or carry physical tokens.

Continuous trust:

The role of Biometric Authentication in fraud prevention

Fraudsters continually adapt their tactics, making it crucial for businesses to remain proactive with advanced security measures to combat unauthorized access. By integrating biometric authentication into reverification workflows, companies can significantly reduce the likelihood of identity fraud. Biometric data is highly secure and less vulnerable to manipulation than traditional verification methods like passwords or PINs.

Moreover, in industries such as financial services, online gaming, or digital marketplaces, biometric authentication ensures that reverification doesn’t just protect users and maintains the integrity of the platform.

Regulatory frameworks

United States

In the United States, reverification plays a crucial role in ensuring compliance with regulatory frameworks like the Bank Secrecy Act (BSA) and KYC (Know Your Customer) regulations. These guidelines are essential for preventing fraud and maintaining secure transactions in sectors like financial services and e-commerce. Fraud risks, such as identity theft and account takeover, are particularly high in the US, making reverification a key step in safeguarding both consumers and businesses. For example, US-based fintech companies leverage reverification to meet compliance standards while enhancing trust with their users.

United Kingdom

In the UK, reverification is vital for adhering to GDPR (General Data Protection Regulation) and AML (Anti-Money Laundering) directives, especially after Brexit. The UK government mandates strict data protection measures, and reverification helps companies ensure ongoing compliance while minimizing the risks of fraud and identity theft. Fraud risks such as phishing and synthetic identity fraud are growing concerns, making reverification essential for e-commerce and financial institutions. An example is UK-based e-commerce companies, which use reverification to protect their platforms from fraudulent activities while complying with data protection regulations.

Conclusion: Strengthening trust with Biometric Authentication

Biometric authentication represents the future of secure, reliable reverification. By utilizing biometric data, businesses can significantly enhance their security measures while providing users with a seamless and convenient experience. This approach not only mitigates fraud risks but also ensures compliance with key regulatory requirements like the Bank Secrecy Act (BSA) and KYC in the US, and GDPR and AML directives in the UK. These regulations demand stringent verification processes to protect both businesses and consumers, making biometric authentication an ideal solution for staying compliant and secure.

In an era where digital identity is becoming increasingly vital, biometric authentication ensures that reverification evolves beyond a simple security measure into a powerful competitive advantage. It protects businesses from rising fraud threats, aligns with regional regulatory requirements, and fosters user trust. By integrating biometric authentication into your reverification strategy, your business will remain resilient and secure in an ever-changing digital landscape.

How Veriff can help your business?

At Veriff, we understand that organizations need to securely authenticate users and verify their identity without disrupting the users’ experience. This applies across the entire user journey, particularly at critical steps such as account access, undertaking a high-risk activity, or recovering an account.

Veriff Biometric Authentication is a fully automated solution that uses AI and biometric analysis to authenticate users. The solution analyzes the user’s facial biometrics from a selfie and matches it to a previously verified biometric template to check if it is the same person.

Biometric facial authentication mitigates the risk of fraudsters taking over accounts, committing suspicious activities through continuous authentication, and securing high-risk activities such as transferring a high-value amount or adding a new payee. The user simply takes a selfie, making it more convenient and secure than knowledge-based authentication methods such as passwords, PINs, or shared secrets.

Reverification FAQ

1. What is reverification?

Reverification is the process of confirming a person’s identity or verifying certain information again after an initial verification. This may be necessary due to expired documents, security updates, compliance regulations, or changes in personal data.

2. Why is reverification necessary?

Reverification is necessary to ensure that the information and documentation provided remain accurate and up to date. It helps maintain compliance with legal requirements, protects against fraud, and ensures that the individual’s identity remains valid over time.

3. How often do I need to undergo reverification?

The frequency of reverification depends on the specific policies of the organization, the type of information being verified, and legal requirements. For example, identity verification may need to be renewed when a document, such as a passport or driver’s license, expires.

4. What documents are required for reverification?

Typically, reverification may require the same documents used for initial verification, such as:

- Government-issued ID (e.g., passport, driver’s license)

- Proof of address (e.g., utility bill)

- Other relevant documents depending on the specific purpose of reverification.

Learn more