When In-House Identity Verification Hurts Your Business

Handling identity verification alone can be risky. Here’s how and why an in-house solution doesn’t always work.

Chris Hooper

The digital economy is booming.

Celebrating its 30th anniversary this year, the internet has a total of 5.1 billion active users in 2019, a 9.1% increase compared to the year before. While more users result in more cash flow, it also comes with the inevitable wave of criminals looking for illegal ways to benefit.

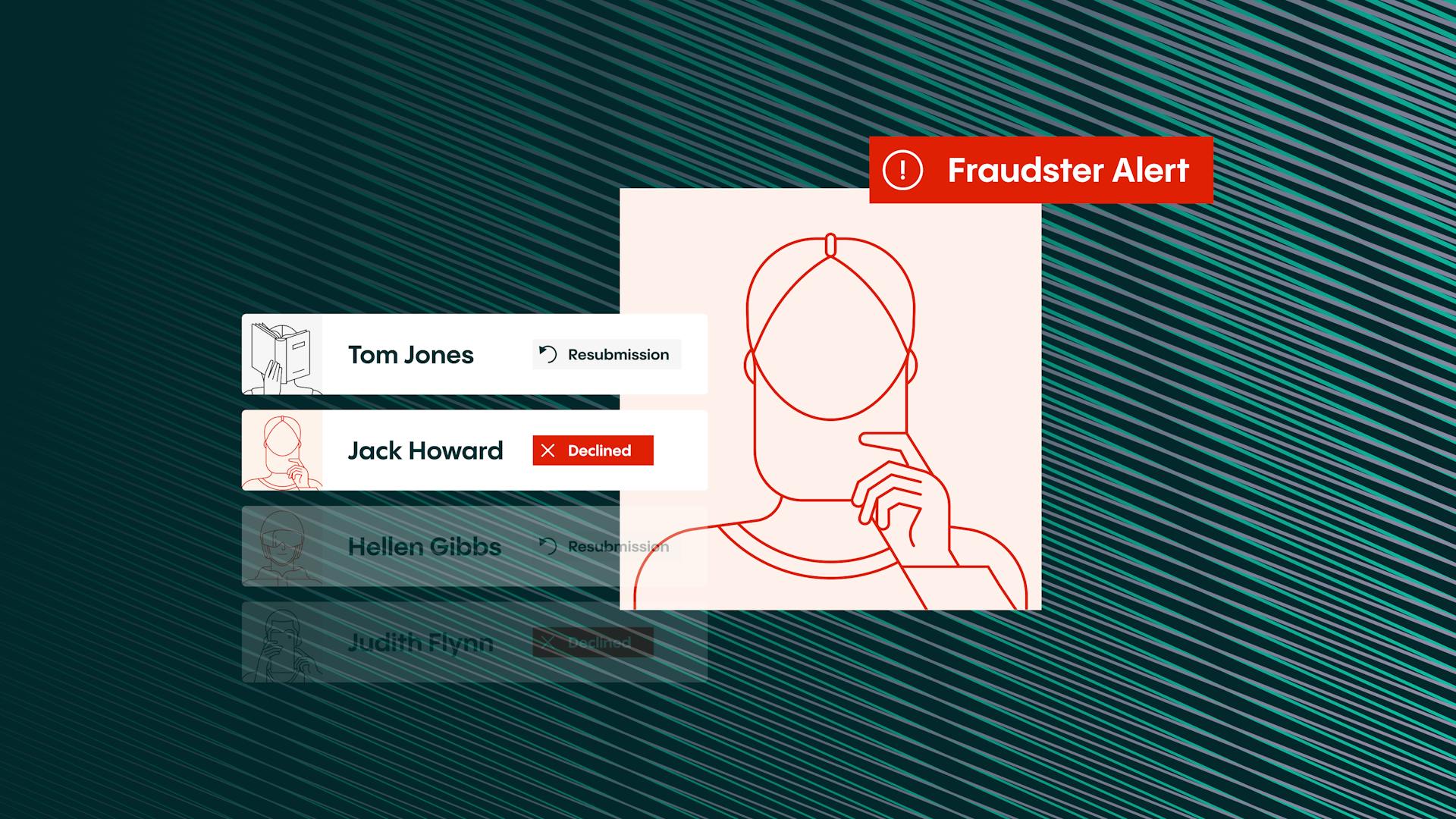

In 2018, a staggering $1.48 billion in losses resulting from online fraud complaints reported to the Internet Crime Complaint Center, a 28% increase compared to their 2017 numbers. Veriff’s data gathered from millions of verifications a year in mobility, fintech, blockchain, gaming, and more industries detect that as much as 5% of all attempted verifications are fraudulent.

It may sound like a problem for enterprise companies to deal with, but our numbers show that fraudulent activity does not discriminate based on size. For companies with limited resources doing the bare minimum for identity verification, this is where things can get ugly.

Looking for ways to prevent fraud without losing conversions? Start a free Veriff Station trial.

Identity verification is vital for all digital businesses

If you run or own a business that even partially operates online, including identity verification as a part of your onboarding process is a must. This is true regardless of whether you are obligated to do so by law, and here are just a few reasons why.

1. Identity verification prevents multi-accounting losses

Studies show that the fraudulent new-account trend makes global e-commerce transactions ten times riskier. This risk applies to both businesses as well as their other, honest customers in several ways.

For one, multi-accounting often results in promotion abuse, where users receive a bonus or a one-time offer designed to encourage new sign-ups. This is particularly prominent in blockchain and cryptocurrency services, while small eCommerce sites and marketplaces also left with losses.

Review fraud is another inevitable outcome, and the long-term impact is a pervasive sense of distrust from your online shoppers. Rather than bots, which are easy to detect, most fraudulent reviews are a result of manual fake account creation made possible when onboarding lacks proper vetting practices.

Learn more about identity verification here.

2. Regulatory compliance environments are designed to fine

Paranoia about the law being out to get you aside, global banks paid a staggering $321 billion in fines from the financial crisis in 2008 to 2017.

Bearing in mind that large banks have vast resources to deal with compliance laws and rapidly implement changes means that it is those with limited resources like small fintech firms that are the most susceptible to fines.

Other industries where compliance laws are being implemented like cryptocurrency and mobility services are also vulnerable to a rapidly changing legal environment that uses fines to enforce new legal measures.

3. Identity verification prevents GDPR “Right of Access” abuse

For companies operating within the European Union (EU) or offering services to its citizens, the EU’s General Data Protection Regulation was big news. The laws were designed to protect consumers against data abuse, fining violators hefty fines of up to €20 million or 4% of total annual revenue.

While data minimization was one of the principles behind GDPR, another was giving people the right to access their data. Oxford University student James Pavur found that companies were very eager to comply without confirming the identity of the recipient. In a study conducted by Pavur, he sent 150 GDPR requests under his fiancee's name, and these were the results:

“Almost three-quarters of the companies responded to the requests, and 83 indicated that they had data associated with his fiancée. Of those, nearly a quarter provided Pavur with his fiancée’s data after receiving little more than an email address and/or phone number as verification of identity. Sixteen percent accepted documentation that could be easily forged.”

In light of the serious, and for small to medium-sized companies devastating, consequences for data breaches under GDPR, an identity verification service can prevent what would otherwise be a data-security disaster.

The problem with in-house identity verification

What often happens is that companies wait for something to go wrong before taking identity verification seriously. That something can be anything from disgruntled customers, sky-high overhead costs, or fraud.

If you are already verifying the identities of your customers with an in-house team and growing fast, you may want to change your approach. Simply put, verifying government-issued IDs document is much more challenging than it seems, and it may not be as doable as you think.

1. There are thousands of IDs and each is unique

The number of identification documents currently in circulation runs into the thousands. According to the United Nations, 195 countries produce passports, ID cards, driver’s licenses, and residence permits. Each of these is unique in terms of:

- Photoprotection techniques

- RFID elements

- UV/IR features

- Watermarks

- Security thread

Not to mention the fact that each country is consistently phasing out and introducing new versions of these IDs. This makes it near-impossible for small teams who, not even going into languages and non-Latin-based alphabets, are overloaded with information to keep an eye out for.

2. An in-house team can cost you time, money, and customers

To effectively verify identities, even without the complexity of global reach, you would ideally need to hire a dedicated team. Juggling verification alongside other roles like customer support often results in long queues, lost customers, and operational inefficiency.

As a result, you would need to invest a pretty penny in a full-time team, not to mention training them and ensuring that they are up to speed with regulatory changes. That is why, in the long run, it is both cheaper and easier to outsource identity verification to pros.

ID verification that’s easy on your budget and team

One of the biggest downsides to switching to an identity verification provider is the minimum commitment that comes with the contract. Most providers do not offer a quick and flexible identity verification solution, both in terms of cost and demanding implementation.

Veriff Station was built to address the growing demand for flexible identity verification services without unreal costs and crazy commitments. Our new verification platform is easy to implement into any app or website, available in 23 languages and can handle more than 3,000 IDs from over 190 countries.

Most importantly, it comes with flexible plans and pricing designed to suit any budget.

Get 30 days of free verification services

Sign up for a 30-day free trial to try Veriff Station, our self-service verification platform. Your free trial, including for any plan, comes with:

- 100 free verifications

- 14 days of full integration support

- Real-time user feedback

- Easy liveness checks

- Full fraud prevention

Ready to optimize your verification process? Start your free trial.