How to prevent multi-accounting in 2024

In the realm of online activities, terms like "gnoming" and "gubbing" might evoke whimsical fantasies akin to a journey through Middle Earth. However, these peculiar terms harbor a darker reality, emblematic of a fraudulent practice known as multi-accounting. Far from a mere jest, multi-accounting poses a significant threat, estimated to incur billions in losses annually for the iGaming industry alone.

Chris Hooper

1. How to prevent multi-accounting in 2024

“Gnoming” and “Gubbing” are strange terms and sound like activities you would find in a Lord of the Rings film. But behind these funny terms lies a fraudulent online activity called multi-accounting. Multi-accounting is no laughing matter and is estimated to cost the iGaming industry billions yearly. The exact cost is hard to estimate as there is no single data source, and, understandably, operators tend to under-report it to protect their reputations. At the same time, multi-account fraud causes financial losses for businesses, distorts market dynamics, and erodes customer trust.

This article looks at how multi-accounting works, the damage it does, and the challenges in preventing it. Finally, we outline the various measures operators can take to keep bad actors off their platforms so that genuine users have a safe and fair experience.

2. What is multi-accounting or gnoming?

Multi-accounting or gnoming is a fraudulent practice in which a person creates multiple accounts with the same provider to game a system. This can be done in a variety of contexts, but it is most commonly seen in online gambling and matched betting.

In online gambling, multi-accounting is often used to take advantage of welcome bonuses and other promotional offers. For example, a player might create multiple accounts with a platform provider to claim the welcome bonus using different names or someone else's name.. to claim the welcome bonus from each one. This can be a very profitable play, but it is also considered cheating and a breach of the platform's terms of service. It can lead to the player's accounts being banned.

In matched betting, multi-accounting is used to guarantee a profit. Matched betting is a betting strategy that involves betting on both sides of an outcome in order to guarantee a profit, regardless of the outcome. By creating multiple accounts, matched bettors can increase their profit chances.

Gnoming is a specific type of multi-accounting that is often used in matched betting. It involves using someone else's identity to create a betting account. This is done because many bookmakers will only offer welcome bonuses to new customers. By using someone else's identity, gnomers can get around this restriction and claim the welcome bonus multiple times.

Multi-accounting and gnoming are considered fraudulent practices and can lead to the player's accounts being banned. If you are caught engaging in multi-accounting or gnoming, you could also face legal consequences.

3. What is gubbing?

"Gubbing" is a term commonly used in the context of sports betting, particularly in the United Kingdom. It refers to the practice of a bookmaker restricting or placing limitations on a customer's account. When an account is "gubbed," it means that the bookmaker has imposed certain restrictions on that account, typically with the aim of reducing the customer's ability to profit from promotions, free bets, or arbitrage betting.

Some of the common restrictions include Reduced or Restricted Promotions when gubbed accounts are no longer eligible for promotional offers, such as free bets, bonuses, or enhanced odds. This is done to prevent customers from repeatedly taking advantage of these offers. Bookmakers may also Lower Maximum Bets, which reduces the maximum stake or bet limit for gubbed accounts. This makes it difficult for customers to place large bets and potentially win substantial amounts.

Another restriction is Limited Access, where gubbed customers may have restricted access to certain markets or events. They may not be allowed to bet on specific sports or events where they have consistently been successful. The most severe restriction is Account Closure, where bookmakers close a customer's account entirely if they believe the customer is engaging in sharp or profitable betting practices.

Bookmakers typically gub accounts when they suspect that a customer is consistently exploiting their promotions or offers or when they believe the customer is engaging in arbitrage betting (placing bets on all possible outcomes of an event to guarantee a profit). Gubbing is a way for bookmakers to protect their profitability by limiting exposure to sharp or professional bettors.

It's important to note that gubbing can be frustrating for bettors simply trying to make informed and legitimate bets. To avoid being gubbed, some bettors employ strategies such as "mug betting," which involves placing bets on various markets and events that are less likely to attract the attention of bookmakers looking to restrict accounts. However, bookmakers continually monitor accounts and may apply restrictions if they suspect irregular or profitable betting patterns.

4. How does gnoming or multi-accounting work?

The first step in gnoming and multi-accounting is to create multiple betting accounts. This can be done by using different names, addresses, and other personal information. Once the accounts have been created, the gnomer or multi-accounter can start using promotional offers. This could include welcome bonuses, free bets, or other incentives. Gnomers and multi-accounters may also spread their risk by placing bets on different accounts. This can help to reduce the chances of losing all of their money on one bet. Gnomers and multi-accounters may also try to avoid being gubbed by using different betting strategies. For example, they may only bet on certain events or they may only use certain promotional offers.

It is important to note that gnoming and multi-accounting are not the same as matched betting. Matched betting is a legitimate betting strategy that does not involve cheating. However, if caught engaging in gnoming or multi-accounting while matched betting, you could still face the consequences mentioned above.

5. In which industries is multi-accounting / gnoming used?

Multi-accounting or gnoming can be found in various industries and online contexts, both for legitimate and illegitimate purposes. This article focuses on online gaming where players create multiple accounts to gain unfair advantages, such as cheating, exploiting in-game rewards, or avoiding penalties.

However, the practice is also common across social media, where individuals use multiple social media accounts to engage in activities like trolling, cyberbullying, spreading disinformation, or impersonating others. This extends to online communities like forums and discussion boards where multi-accounting can be employed for harassment or evading bans. In the online dating world, some users may create multiple profiles to deceive others, evade bans, or manipulate their online persona.

In online surveys, product reviews, or ratings, multi-accounting may be used to manipulate feedback or ratings. People create fake accounts to post positive or negative reviews for products or services. In e-commerce, multi-accounting can be used for fraudulent activities, such as scamming sellers, exploiting refund policies, or manipulating product ratings and reviews. Multi-accounting can also be used to manipulate the outcomes of online contests, polls, or voting.

In some cases, multi-accounting may be associated with financial fraud, where individuals create multiple bank accounts or online profiles to engage in illegal financial activities. Individuals engaging in multi-accounting fraud will sign up for a cryptocurrency exchange using fabricated or modified personal information, ensuring they establish unique usernames for each account. Depending on the specific crypto platform targeted, fraudsters can carry out various deceitful activities when managing multiple accounts. Examples of fraudulent activities include deceiving potential investors into crypto trading, exploiting promotional or signup incentives, or orchestrating sophisticated phishing schemes.

It's essential to differentiate between legitimate and illegitimate uses of multi-accounting. Legitimate reasons for having multiple accounts may include maintaining separate personal and professional online identities or managing multiple aspects of one's online presence. However, when multi-accounting is used for dishonest, harmful, or fraudulent purposes, it can lead to negative consequences, including account suspension, legal action, or damage to one's online reputation. Most online platforms and industries have rules and policies to detect and prevent illegitimate multi-accounting.

6. Why Is multi-accounting prevention important?

Multi-accounting prevention is important primarily for businesses to protect themselves from financial losses when users exploit welcome bonuses or promotional offers. Multi-accounting can also give some users an unfair advantage over others. For example, a user with multiple accounts could place more bets or use more promotional offers than a player with a single account. This can create an uneven playing field and make the experience less enjoyable.

Therefore, multi-accounting can damage the integrity of a platform by creating confusion and suspicion. If a user is caught using multiple accounts, other users may start to wonder if they are also being cheated, and this can lead to a loss of trust and a decline in the number of users. In some industries, multi-accounting is prohibited by regulations. For example, the gaming industry is heavily regulated, and multi-accounting is often prohibited to prevent money laundering and other illegal activities.

By preventing multi-accounting, businesses can protect themselves from fraud, ensure fair play, maintain the integrity of their platform, and comply with regulations.

7. The challenges of multi-accounting

Detecting and identifying multi-accounting can be difficult, as some users may use different devices, IP addresses, emails, or payment methods to create multiple accounts. They may also use fake or stolen identities, such as names, addresses, or ID documents to avoid detection.

Multi-accounting prevention requires flexible and secure verification methods that prevent fraudsters and bonus hunters from abusing the online service while keeping honest users satisfied and loyal. However, balancing security and user experience can be challenging, as some verification methods may be too intrusive, time-consuming, or inconvenient for users. For example, some users may not want to share their personal information or biometric data with the online service, such as face or voice recognition. They may also find it annoying to go through multiple verification steps or wait for manual approval.

Multi-accounting prevention also requires online services to comply with the laws, rules, and regulations that apply to their operations in different jurisdictions. These may include data protection, privacy, anti-money laundering, or consumer protection laws. However, adapting to changing regulations and customer expectations can be challenging, as some laws may vary across different countries or regions or may change over time. For example, some regions may have stricter requirements for identity verification or data storage than others. Some customers may also have different preferences or concerns about how online service collects, use, or share their data.

8. How to prevent multi-accounting

To prevent multi-accounting, online businesses must use effective tools and methods to detect and prevent multiple accounts from being created or accessed from the same device, IP address, email, or payment method. They also need to verify the identity of their customers and prevent fraudulent activities.

Some of the tools and methods that can help prevent multi-accounting are:

- IP and device fingerprinting: This involves analyzing various attributes of the device and the network used to access the online service, such as the browser type, operating system, screen resolution, location, etc. These attributes can generate a unique identifier linking multiple accounts to the same device or IP address.

- Email analysis: This involves checking the validity and uniqueness of the email address used to register or log in to the online service. Some indicators of suspicious email addresses are disposable or temporary emails, emails from unknown domains, emails with random or similar usernames, etc.

- Face authentication: This involves biometric analysis of the user’s face and facial movements to ensure true presence during the account creation or verification process. This, together with the velocity abuse and multi-accounting prevention, can help reduce the risk of users creating multiple accounts using fake or stolen identities.

- AI-driven algorithms: This involves using machine learning and artificial intelligence to monitor and analyze the behavior and patterns of the users on the online service. This can help detect anomalies, such as multiple accounts placing similar bets on the same events, multiple accounts writing fake reviews or feedback, multiple accounts abusing promo codes or coupons, etc.

These are some of the tools and methods that can help prevent multi-accounting. By implementing these solutions, online businesses can enhance their security, profitability, and customer satisfaction.

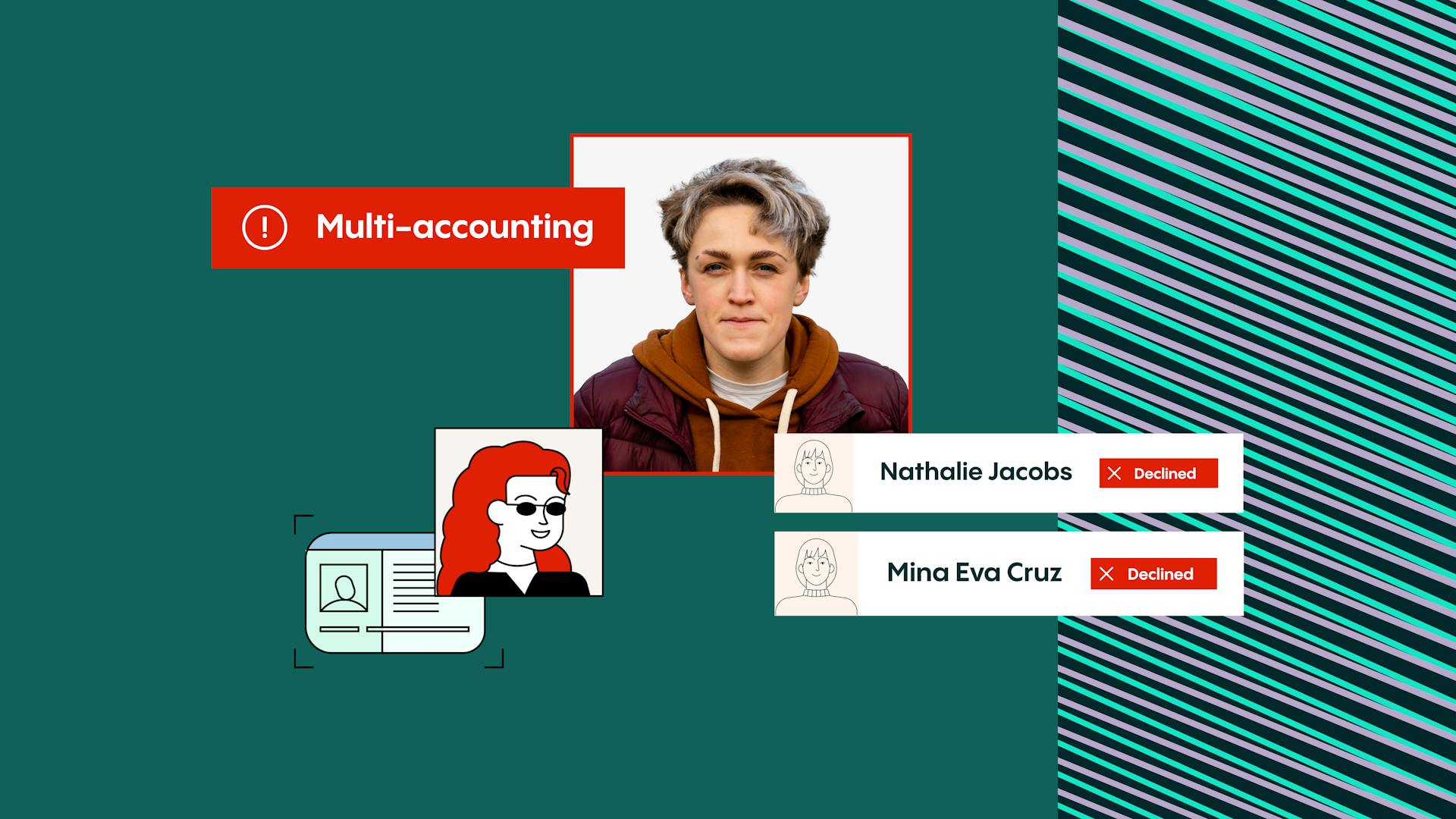

9. How Veriff can help with multi-accounting prevention?

Veriff has broad experience in fighting multi-accounting in different industries, such as gaming. Through the sophisticated use of data points and proprietary technology like our network fingerprinting solution, we can keep bad actors out – and make sure they stay out.

Veriff Fraud Protect anti-fraud package keeps banned users out for good. It utilizes a variety of data points – for example, a face blocklist, a device and network blocklist, and data tied to documents or individuals. This approach can provide layered and robust security. For example, if a person has been banned from a site, FaceBlock takes the selfie images from a fraudulent session and adds the face vectors to a custom blocklist. Face images in future sessions are then checked against this blocklist, and if there is a match, that session can be declined.. When liveness checks are complete, we can use the user’s device and network as a linking element, expanding how we confirm identity – and block multi-account abusers.

We can support your brand in identity verification, regulatory compliance, and more, using cutting-edge biometrics and automated technology to ensure only the right people have access to your platform. Our approach can be tailored to your needs, ensuring you meet security demands while respecting customer data extraction and use needs.

Explore more

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms.