How Identity Verification Combats Fraud and Powers Growth for BNPL Providers

Buy Now Pay Later (BNPL) is growing rapidly due to customer demand, but online fraudsters pose a significant threat to today's providers. Discover why identity verification can ensure a swift, seamless, and secure process for businesses and customers.

Chris Hooper

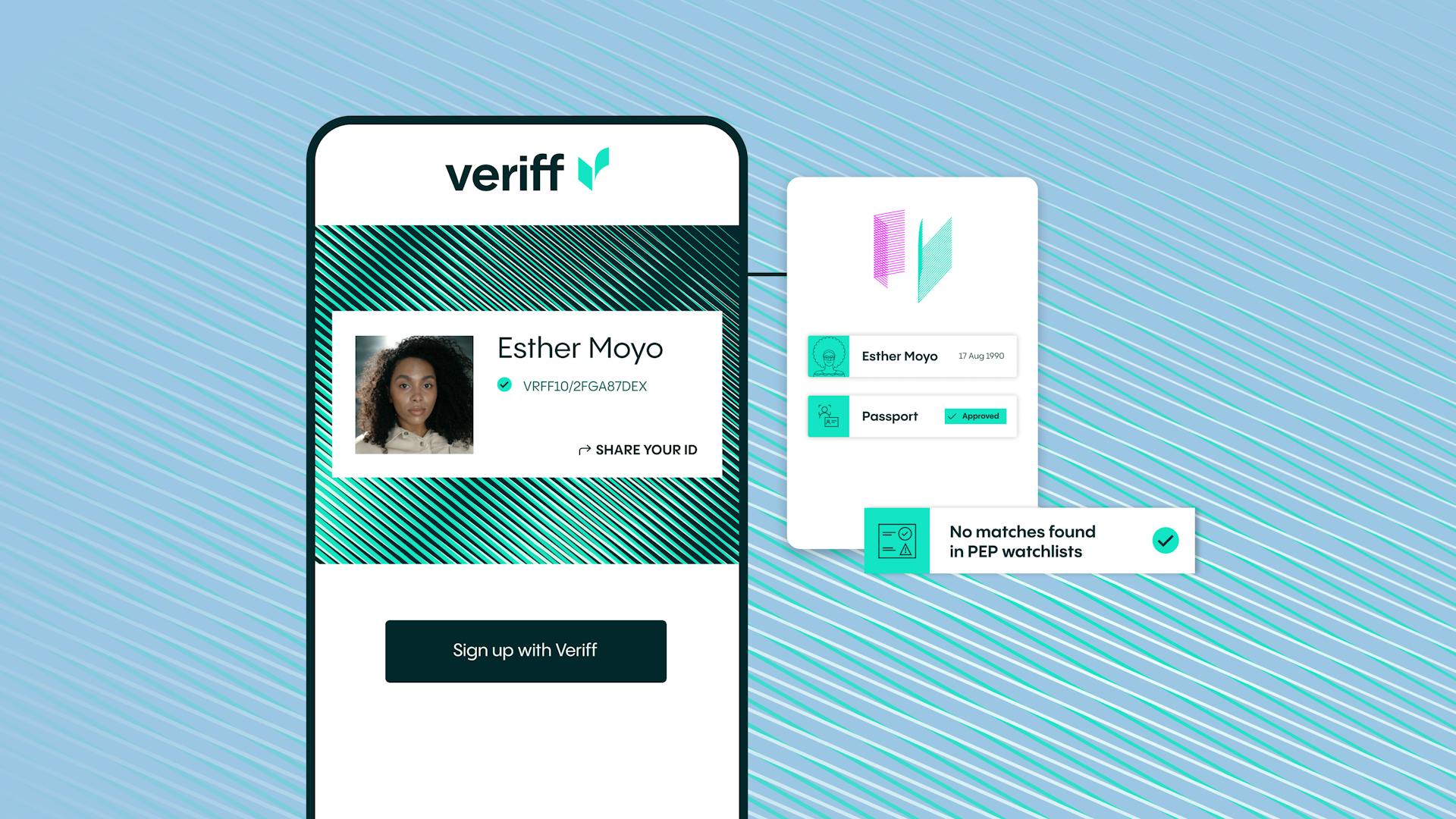

As a result of customer demand, the Buy Now Pay Later (BNPL) companies are set to grow astronomically within the next few years. However, this attracts the attention of online fraudsters, endangering businesses and legitimate customers. Soft credit checks, or surface-level searches looking at a customer's credit card worthiness, are not strong enough on their own to protect a business from fraud risk. The main types of BNPL fraud are account takeover fraud, synthetic identity fraud hich entails stealing of personal information, and friendly fraud. Discover how identity verification offers the key to fraud prevention and helping to improve BNPL companies to enhance their onboarding process, but also preventing BNPL fraud, minimizing the risk of harm, and helping to prevent potential monetary and customer loss with account takeover fraud solutions.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.