The Evolving Threat: 10 Key Online Frauds Shaping the Digital Landscape

Online fraud has been a persistent threat for many years. However, with the impact of increasing digitization and economic uncertainty, Veriff’s Senior Director of Fraud Prevention and Experience, David Divitt, outlines key online fraud trends to watch today.

Fin Murphy

In today's digital world, it is vital for customers to protect their personally identifiable information and for businesses to prioritize user safety. Indeed, the increase in internet crime, including the use of data breaches (f.e. phishing emails) to obtain personal information such as credit card numbers and email addresses, has severely hampered trust in the digital world. Card fraud is a growing problem, with bad actors using stolen credit card information to obtain goods and services illegitimately. Since 2000, the crime complaint center IC3 in the United States has received complaints crossing the spectrum of cyber crime matters, including online fraud in its many forms including Intellectual Property Rights (IPR) matters, Computer Intrusions (hacking), Economic Espionage (Theft of Trade Secrets), Online Extortion, International Money Laundering, Identity Theft, and a growing list of Internet-facilitated crimes.

For better perspective on the growing trends in internet fraud, we spoke to Veriff’s Senior Director of Fraud Prevention and Experience, David Divitt. Divitt offered insight into the rise of ‘AI warfare’ between bad actors and businesses to the collapse of the online user experience; read on to find out more.

Faster services mean faster fraud

“One benefit of digitization is speed - speed to market, speed of services. You can now get your identity validated for a new product in seconds. But faster services mean faster fraud – these things just go hand in hand. So, while faster services are hugely beneficial for society and enable us to do so many more things, they also enable bad actors to commit fraud very, very quickly.”

Prevention is about changing the ROI for the fraudster

“At the end of the day, what you're really aiming to do is to put more roadblocks in place for bad actors. Basically, change the ROI for the fraudster, that's the name of the game. Unfortunately, it's close to impossible to completely stop fraud. But you can make it much less attractive so that fraudsters go elsewhere.”

It’s best to stop fraud before it can get started

“In a digital world, once money is stolen, it can be laundered very efficiently. Once that’s happened, it’s extremely difficult to get it back. So, the best approach is to stop the issue before it can even get started. If fraudsters can’t set up fraudulent accounts, they can’t use them to commit fraud. With effective verification you're addressing the issue at its root, before it can become a bigger problem.”

Humans are the weakest link in the chain

“Because technology has done such a good job at stopping a lot of fraud, unfortunately fraudsters are now directly targeting the humans involved. The locks on the door are very good, so you get the person who owns the actual key to open the door for you. That’s perhaps the most concerning trend that we've seen across financial crime and non-financial crime. People need to be more aware that they are the targets.”

The collapsed user experience is a major issue for legacy authentication methods

“Two-factor authentication, which typically uses a one-time passcode (OTP) sent by text to your mobile, is going to become less and less effective. That’s simply because the intended separation between the two factors often isn’t there anymore – quite often we do things like buying online directly via our phones, so if your device has been compromised, two-factor authentication won’t protect you.”

‘AI warfare’ is increasingly a feature of online fraud

“Machine learning is a powerful tool for fraud prevention, but fraudsters also use this technology. There's a lot of evidence of bad actors training combative machine learning models using live customers or active fraud detection models. So, you start to get into a kind of AI warfare between the two sides, which is why it's so important to continue to invest and develop your solution to stay on top of it.”

Fraud can be double trouble for businesses

“For smaller businesses, paying a large invoice to a fraudster can lead to bankruptcy pretty quickly because not only have you lost that money, but you also still have to settle your invoice with the real supplier. So, cash flow right away becomes an issue. Even for larger businesses, if you get hit by fraud, and it doesn't look like you've done everything you can to prevent it, that can have a very bad reputational impact. Not to mention potential fines for legal breaches around money laundering, terrorist financing, human trafficking, and so on.”

The benefits of biometrics

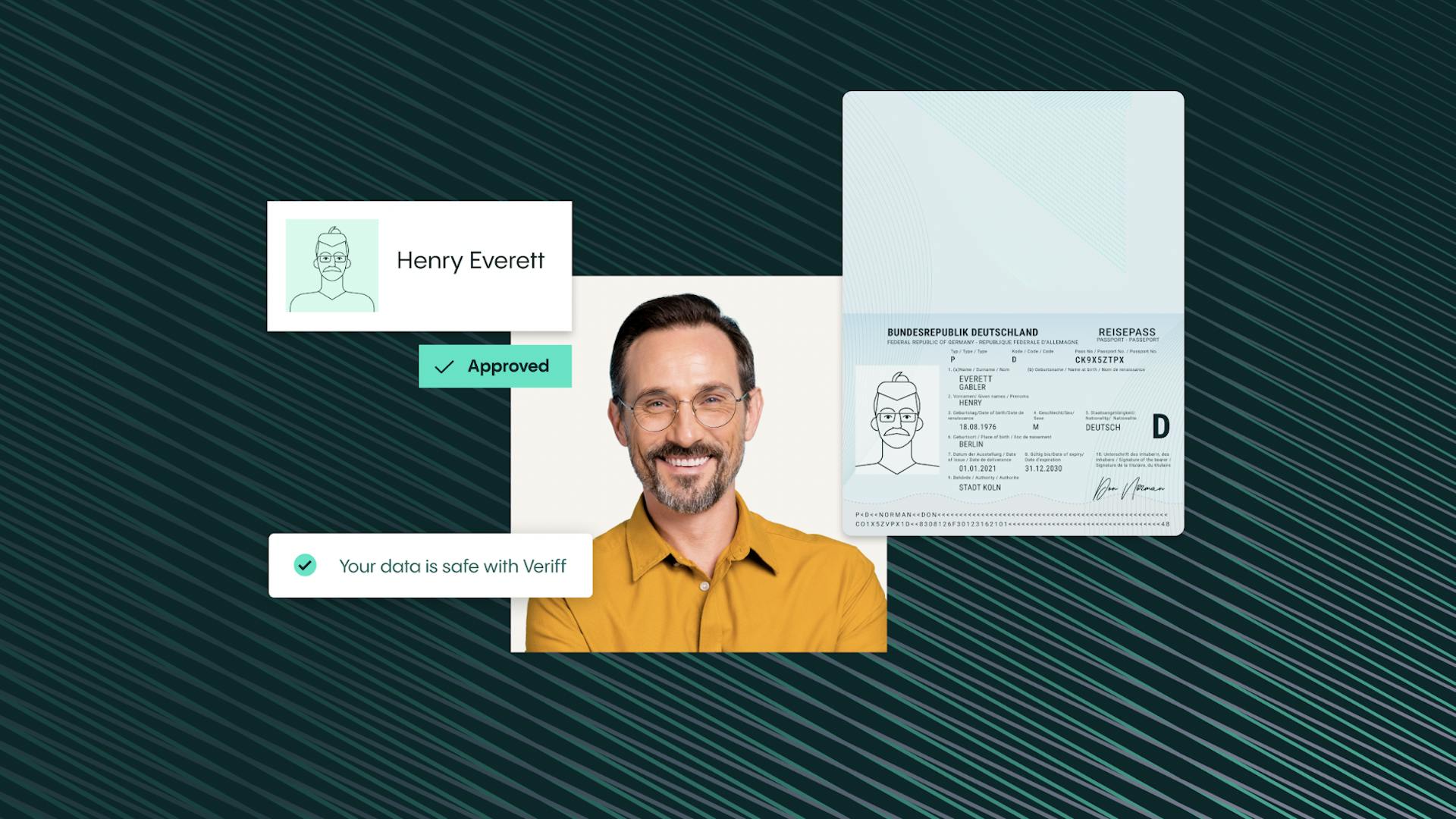

“With effective biometric technology, the collapse of the multi-factor environment becomes less of an issue. It doesn't matter if a fraudster can intercept a one-time passcode if they can’t prove that the real account holder is physically present in real-time. So, it starts to create a separation of the two factors again. Alongside that, you can have things like a digital ID with biometric security wrapped around it to control access, which creates much stronger security than a simple check of a paper ID.”

The need to swing the pendulum

“There’s what I call an eternal pendulum, which represents the compromise between customer experience and risk prevention. As your business changes, as the fraud landscape changes, and as the customer landscape changes, you'll want to be able to swing that pendulum back and forth. You can do a lot that’s invisible to your customers by collecting data on how they interact with your services and using this to tune your tools and strategies. But sometimes the friction has to be there.”

A good fraud experience is a powerful thing

“As a consumer it’s surprisingly easy to be scammed and make a mistake that could prove very costly. So, if a business you're dealing with believes someone might be trying to take advantage of you and they put a pause on things while they clarify the situation, as long as they contact you to let you know, you’re likely to feel they have your back. Businesses that do that well reap the benefits in terms of positive customer relationships.”

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms