Why a world class KYC strategy matters to gaming customers

Today's consumers expect swift access to gaming services, but they’ll soon go elsewhere if security is compromised.

Chris Hooper

In many markets across the world, customer Know Your Customer (KYC) requirements are placed on gaming firms to verify the identity of their customers. This process helps guarantee customer safety and prevent criminal activities such as money laundering and terrorist financing.

A standard KYC program involves collecting customer identification information such as full name, address, and date of birth, then verifying this information using trusted sources like government issued IDs or utility bills; conducting ongoing monitoring on the customer’s account activity; and adhering to Anti-Money Laundering (AML) regulations.

The KYC process can involve additional checks beyond basic identity verification, like enhanced due diligence (EDD) for high-risk or high-net-worth customers, or individuals involved in industries like gaming, where there is an increased likelihood of fraud or money laundering attempts being made through seemingly legitimate transactions.

Today’s global gaming sector features an ever-evolving array of regulations, plus gray or unregulated markets, posing an often costly and complex issue for operators.

Additional verification methods in this vein can include screening individuals against politically exposed persons lists. When both parties abide by KYC requirements, suspicious activity can be identified and reported quickly, while gaming customers stay safe using a firm’s services.

A swift and secure KYC process is business critical to the success of online gaming companies. Regulations differ across the world, but many firms are going further than what is expected by regulators. With the online gaming market expected to be worth $94bn dollars globally by 2024, there’s lots to play for and those companies looking to differentiate their brand are going beyond basic KYC compliance. The best examples of KYC onboarding are slick, speedy and pain-free, mirroring the effortlessness of leading ecommerce interactions.

This is a major differentiator for time-poor and admin-intolerant consumers raised on a digital diet of Amazon one-click purchases and Uber taxi rides. But friction-free experiences are not without significant risks and any uptick in fraud has been shown to scare customers away and reflect badly on the associated brand.

Overcoming industry-specific compliance challenges

Today’s global gaming sector features an ever-evolving array of regulations, plus gray or unregulated markets, posing an often costly and complex issue for operators. Common operator processes include age and location verification and suspicious activity reporting (SAR), but operators must balance compliance with a seamless user experience.

For instance, it is vital for operators to ensure that their players are age-appropriate; allowing minors to access services can cause serious legal, financial, and reputational damage. To solve this problem, Veriff’s Age Verification offering sends accurately extracted data to operators to help them decide whether a player is allowed to get onboarded. This ensures that only legitimate players have access to age-restricted content and products, avoiding the risk of harm.

In addition, Veriff is able to analyze more than 12,000 government-issued IDs in over 45 languages, allowing companies to have a truly global reach. Lastly, Veriff enables operators and players to abide by self-exclusion lists, helping to ensure that the customer base is above board. These processes provide a smooth customer experience and enhance security for operators.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Fraud continues to pose a significant risk for operators. In its recent iGaming Report, TransUnion reported a 43% increase in online gaming identity fraud, with account takeover the biggest fraud threat. As the name suggests, account takeover involves bad actors using a range of methods (including phishing and log-in credential theft) to take control of user accounts. Once fraudsters have control of multiple accounts, they can then start to influence the game/betting odds, putting legitimate players at a significant disadvantage and ultimately leaving them out of pocket.

Fraud-related press coverage of this kind causes huge reputational damage for gaming firms, but there is good news – a market-leading IDV solution can mitigate many of these risks, onboard customers at speed and give security-conscious consumers the peace of mind they’re looking for.

Verifying KYC data securely at speed

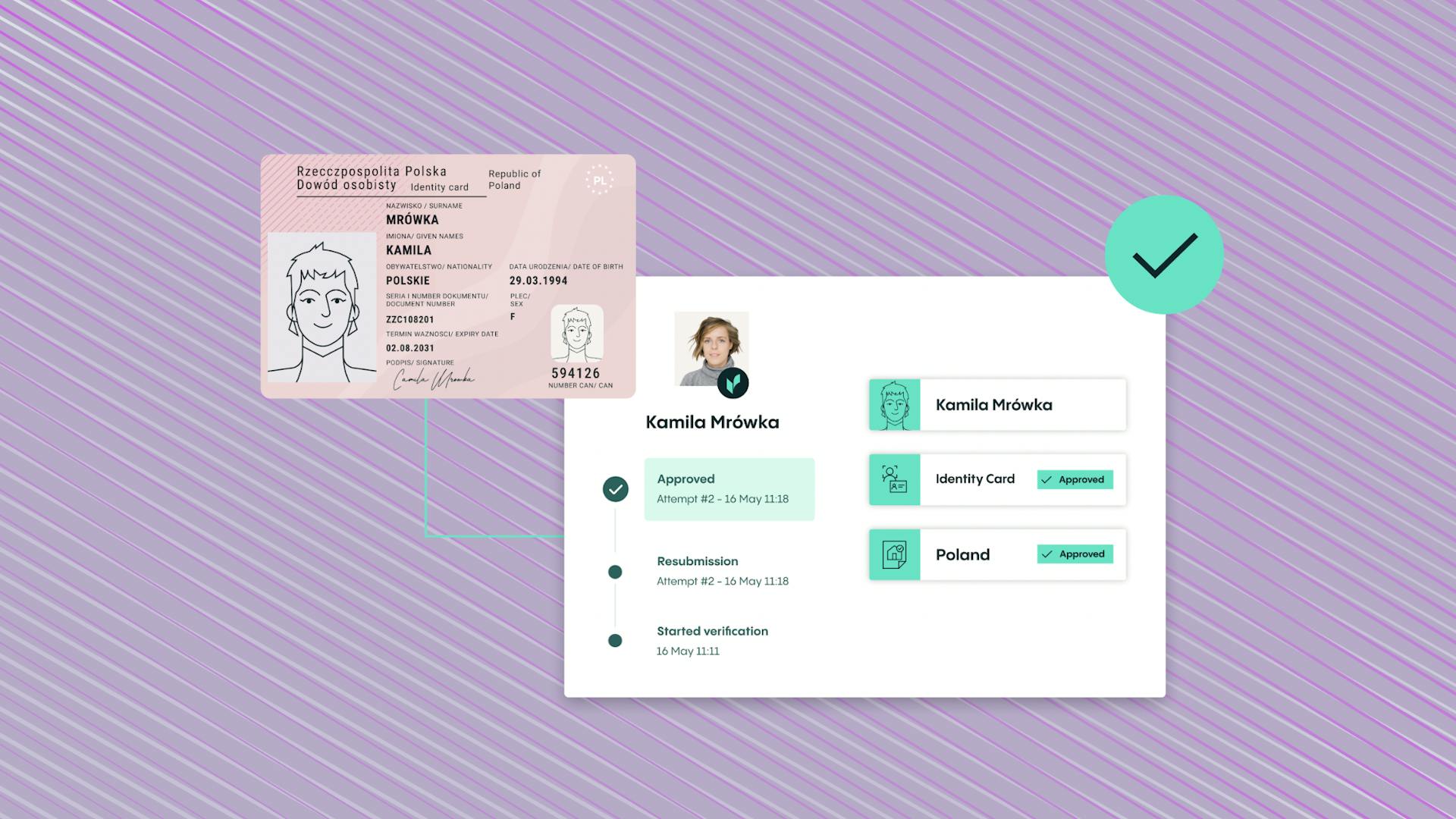

They achieve this balancing act thanks to identity verification (IDV). All a prospective customer has to do is take a photo of their government-issued photo identity documents (such as driver’s licence or passport), take a selfie in real time, and submit for verification.

The most effective IDV solutions capture and verify key information from these photos in just six seconds – maximising both customer experience and anti-fraud security measures.

Another major customer-experience benefit of IDV is that customers no longer have to remember answers to stock security questions (their favourite food, first school, mother’s maiden name, credit card transaction history etc) in order to verify their identity. Instead, they just need to take a simple selfie.

Recent research by Forrester shows that Veriff’s IDV platform cuts revenue lost to fraud by 20% – which is great news for gaming firms and security-conscious customers alike.

Joining forces to allay customer security concerns

Part of the challenge is that many organisations don’t necessarily have the deep pockets needed to develop their own KYC platforms. Instead, the most cost-effective way to allay customers’ concerns over fraud is to partner with a market-leading KYC solution provider, which has the industry reputation, expertise and experience to deliver the secure and seamless KYC experiences that customers expect and demand.