What is AML layering?

To put an AML program in place, a business must first understand exactly what the money laundering process involves. In doing so, they can improve their risk assessment processes, develop internal practices, and improve the ways they detect suspicious activities.

Criminal enterprises or individuals who are involved in financial crime usually end up with large amounts of cash. However, as this money comes from the proceeds of criminal activities, they cannot simply take it to the bank and deposit it into their account.

Due to this, criminals aim to conceal the money they’ve obtained, “wash” it within the financial system, and then get it back in a “clean” way. This process is known as money laundering and it’s highly illegal.

To try and prevent money laundering, many businesses are now subject to anti-money laundering (AML) regulations. As part of these, businesses must put processes in place that ensure they’re adhering to legal requirements. These are geared towards preventing, monitoring, and reporting illegal activity.

But to put an AML program in place, a business must first understand exactly what the money laundering process involves. In doing so, they can improve their risk assessment processes, develop internal practices, and improve the ways they detect suspicious activities.

With this in mind, let’s take a detailed look at layering in AML. We’ll cover where it sits in the money laundering process, the signs to look out for, and the tools that can help you stop it.

What is layering in money laundering?

Layering is one of the three stages of money laundering. These are:

- Placement

- Layering

- Integration

Although money laundering is usually considered in these three distinct stages, the actual process is complex.

Understanding placement and layering in money laundering

Placement is the first of the three money laundering stages. At this point, “dirty” money is placed into a legitimate financial system. To do this, a criminal will “wash” the cash and disguise its origins in order to make it look like a legitimate source of income.

During the placement stage of money laundering, the criminal is at their most vulnerable. This is because they’re moving a large bulk of money and placing it directly into the financial system. If the criminal can successfully place this “dirty” money in the financial system, they can move onto the next stage of money laundering.

Layering follows placement in the money laundering process. It involves turning “dirty” money into large sums of “clean” and untraceable funds. The layering process is incredibly complex and can be very difficult to understand. This is because it involves criminal actors making multiple small transactions, often across borders. This means it’s also very difficult to spot.

How layering works

As we’ve mentioned, layering is the second part of the money laundering process. Once a criminal has successfully placed “dirty” money into the financial system, they then use layering. This is the process of making multiple small transactions in different markets and across borders. The goal here is to distance the funds from their origins as far as possible and it’s not uncommon for some advanced and complex criminal actors to make hundreds of transactions.

The more transactions a criminal can make, the more obscure they can make the audit trail. Layering is carried out strategically in order to spread funds and prevent patterns from occurring. The tactic usually occurs alongside the practice of fraudulent bookkeeping.

If a criminal effectively carries out layering, the original source of the funds is concealed entirely. This means it becomes nearly impossible for investigators to prove who owns the money. This is especially the case when criminals spread funds across borders. This is because it is incredibly difficult for anti-money laundering officials to spot foul play.

Examples of layering in money laundering to look out for

As we’ve mentioned, layering in money laundering is complex. Due to this, it takes many different forms. Added to this, many techniques are also used side-by-side. This makes the process even harder to spot.

That said, tactics used during the layering process include:

- Moving money electronically between different countries using loopholes in legislation

- Converting money into stocks and other financial instruments

- Investing in real estate or “shell” companies with a functional front

When carrying out layering, criminals will intend to make as many transactions as possible. In doing so, they will increase the number of “layers” in order to make the initial funds harder to trace.

Layering prevention solutions

If your customers pose a risk of money laundering, then you’re required to implement an anti-money laundering compliance program. This will help your business detect, respond, and avoid money laundering and fraud-related risks.

To prevent your business from inadvertently facilitating placement and layering, you must:

- Put a reporting structure in place: If any activity that may indicate money laundering is detected by your business, you must swiftly report it to the relevant authorities

- Risk assess your customers: Before you onboard any new customers, you must accurately assess the level of money laundering risk they pose. You must then process and monitor them accordingly. For example, high-risk customers should face more stringent checks and monitoring than low-risk customers

- Employing a compliance officer: You should also employ an AML compliance officer who is responsible for creating procedures and overseeing their implementation. This individual should also be responsible for reporting obligations and keeping abreast of the regulations and laws surrounding money laundering

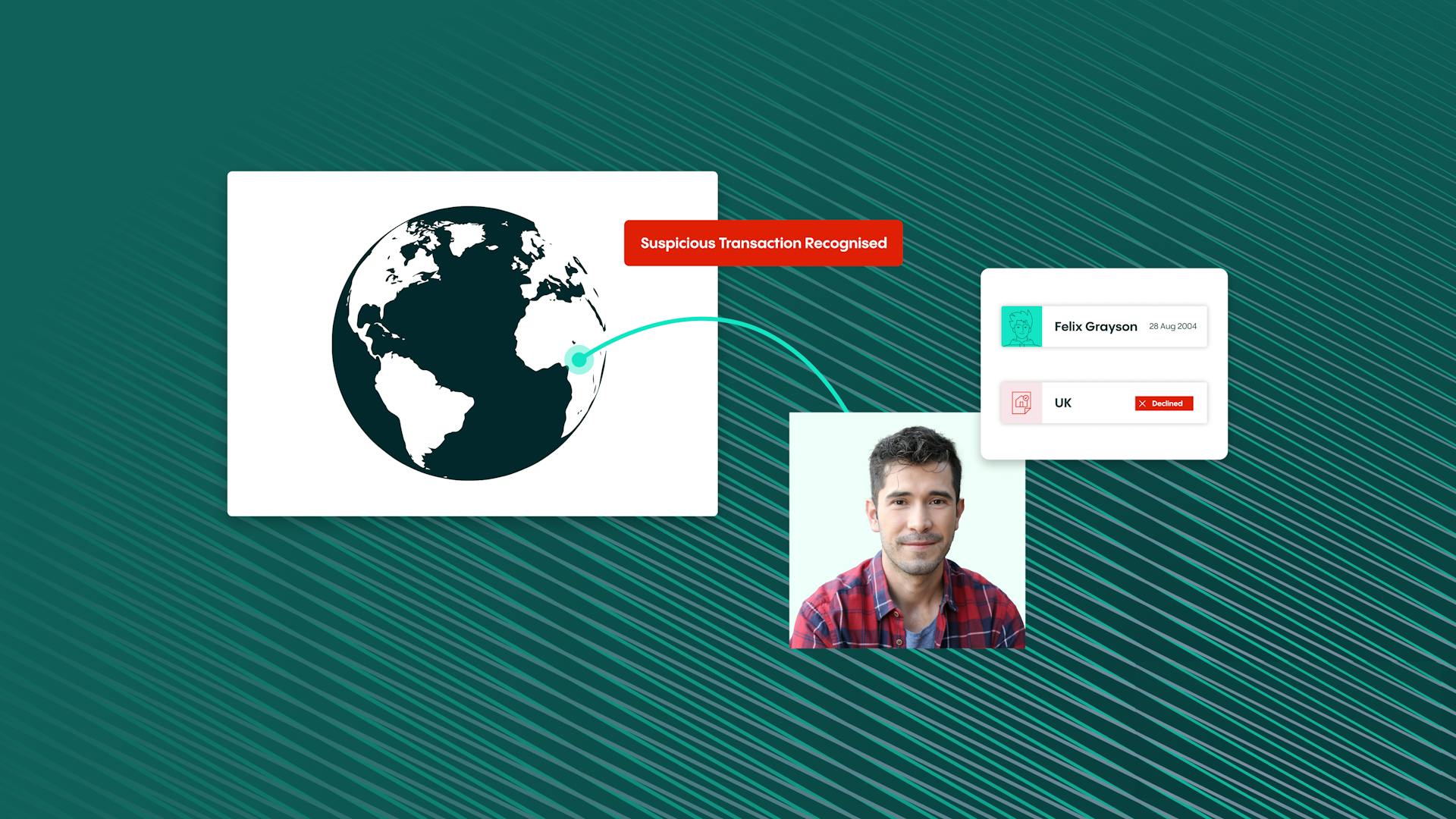

If your business needs to comply with AML regulations, then you should also employ tools that will help you prevent both placement and layering. One great example of this is an identity verification solution, such as our AML Screening solution, which provides end-to-end anti-money laundering compliance.

Our anti-money-laundering (AML) screening tool helps you maintain regulatory compliance while also actively increasing your customer conversions. Our Identity Verification service is deployed alongside Politically Exposed Person (PEP) and sanctions checks, as well as adverse media screening. Plus, ongoing customer monitoring reduces risk for your business at every turn.

What customers are saying about Veriff

We think our solutions are the best on the market. But, don’t just take our word for it, take a look at what our customers say.

We work alongside some of the world’s biggest brands, including companies such as Trustpilot, Blockchain.com and Visa. All of these companies have been glowing about the services we’ve provided. For example, Blockchain.com said “over the past four years we’ve seen a massive growth in our user base and in crypto, and Veriff has been a big part of ensuring that our growth was safe for users and compliant.”

Prevent layering with Veriff’s AML screening platform - Book a demo

With the help of our AML screening platform, you can prevent layering and stop money launderers in their tracks. To discover more about how our class-leading solution can help your business, book a demo with our team of experts. We’d love to show you exactly how you can achieve regulatory compliance while also increasing your conversion rates.