Troubleshooting KYC: Optimizing process, powering growth, and improving user experience

Know Your Customer (KYC) standards and requirements can prove a friction-filled and complex challenge for companies. Discover how identity verification (IDV) is transforming KYC, helping to drive growth while achieving compliance.

Chris Hooper

Across the world, legal authorities enforce Know Your Customer (KYC) standards and requirements on certain sectors, like financial services and gaming, to protect customers and companies and tackle financial crime, from money laundering to terrorism financing. While KYC is stringent and well-established in some sectors, like financial services, they are patchy and constantly shifting in other industries, like gaming.

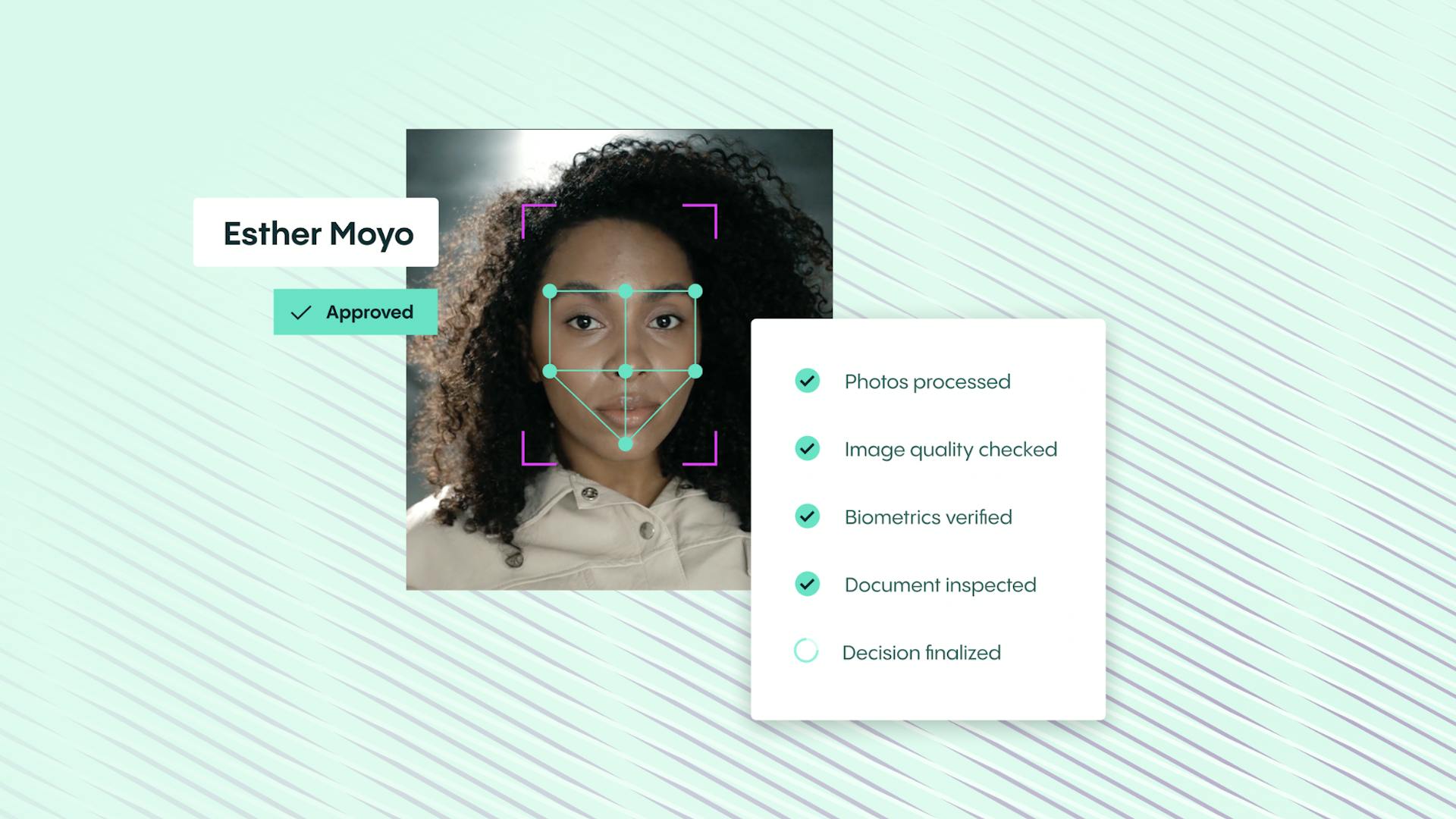

While an important part of a company's operations, outdated KYC processes have proven to be cumbersome, costly, and friction-filled, potentially hampering customer onboarding and scalability, harming growth prospects. However, innovations in identity verification (IDV) have been shown to optimize KYC, helping to onboard more genuine customers faster, reduce the risk of fraud, and ensure legal compliance.

Innovations in identity verification (IDV) have been shown to optimize KYC, helping to onboard more genuine customers faster, reduce the risk of fraud, and ensure legal compliance.

With accurate, automated decision-making, an online IDV service like Veriff stops bad actors from exploiting financial services, gaming operators, and a host of other companies. Beyond Veriff’s identity verification processes, other tools include PEP and sanctions checks, adverse media screenings, and ongoing monitoring of possible bad actors to keep these companies and their customers safe. This coverage is updated in real-time and creates more confidence in any company's KYC process. If a company fails to keep up-to-date with KYC requirements, severe financial, legal, and reputational repercussions could occur.

To learn more about how companies can optimize processes, drive further growth, and improve the user experience, while achieving KYC, read Veriff's new eBook today.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.