Online identity verification methods

Online identity verification is an essential practice for navigating the digital world, from engaging in commerce to accessing age-gated material. Discover more about the different types of online identity verification and the technology that drives it.

In the 21st century, the majority of business is done online. Whether customers are looking to do their weekly shop, open a new bank account, or buy a property, there’s a website that can help them do just that.

But, if your business doesn’t see customers in person and you’re offering a financial service, how can you verify their identity?

Well, online identity verification methods are the answer. Here, we’ll take a detailed look at popular online identity verification methods and outline how they can help your business.

What solutions are available to help verify identities online?

A number of different online identity verification methods are available, including options that require a phone number, a government-issued ID, or biometrics.

The right solution for your business will depend on the information you need to verify, your compliance obligations, and your budget. Let’s take a look at each method in greater detail, so you can work out which is best for your needs.

Verify by phone

Although they’re not used to verify the identity of a new customer, one-time authentication codes sent via SMS (text messages) are often used for ongoing authentication purposes.

With this online identity verification method, a customer is asked to confirm their phone number when they attempt to log into their account or use a product or service. The business then sends a one-time authentication code to the number provided. If the customer then inputs this code, the business can verify that the customer has control over the phone number provided.

Some businesses include an additional step in this process, which makes it more useful for identity verification purposes. Before the business sends the code to the customer, they verify that the phone number in question belongs to the individual they’re claiming to be.

Now that customers have become more accustomed to using their phone for authentication purposes, this approach to identity verification has become more popular. Plus, when it’s combined with an additional data point such as a verified address, this method can offer a strong multi-factor approach.

Verify by ID

One of the most popular online identity verification methods is ID verification. Once a customer has taken a picture of their government-issued ID, you can check their details. You can also check that the data they’ve provided you with is legitimate and that their ID hasn’t been forged.

Using ID verification software, you can verify IDs in seconds. Our software can verify more than 12,000 forms of ID from over 230 countries and territories. It can help you detect fake and tampered IDs, extract and verify document data, and ensure you comply with AML and KYC regulations.

Verify by documentation

Similarly, documents such as utility bills can also be used to verify your customers. By taking a photo of a phone bill, electricity bill, internet bill, or bank statement that is dated within the last three months, your customer can show you where they live.

Once your customer has snapped a picture of their utility bill, it can be uploaded to your verification flow. Using Proof of Address Capture, you can verify that they live in a location or region where you can operate. You can also ensure that you are complying with local customer due diligence requirements.

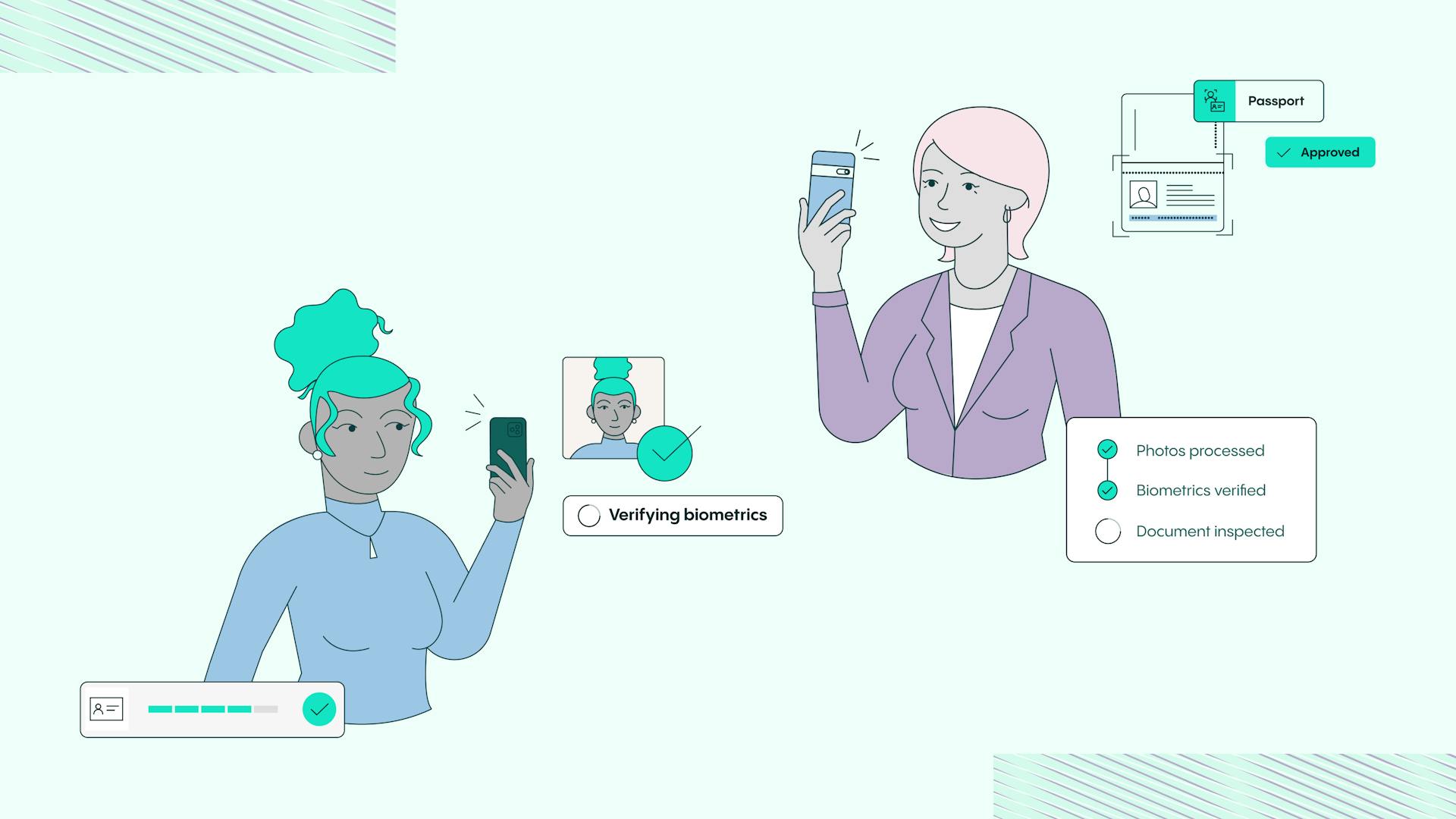

Verify by using face match or biometrics

Need to verify that your customer is exactly who they’re claiming to be? Then verifying their identity using Face Match is the perfect solution.

By using facial biometric technology, you can match a person’s face to an identity document that you already have on file. As a result, Face Match can help you identify and mitigate fraudulent activities such as account takeover and identity theft.

Face Match is easy for the user, too. All they need to do is quickly snap a selfie in order to keep their account or transaction safe and secure. Our industry-leading facial recognition technology returns a conclusive decision via webhook or API in a matter of seconds.

Identity verification tools and software

Identity verification tools and software provide a comprehensive way of verifying the identity of your customers.

For example, our online identity verification solution provides an end-to-end verification service. This means that it gathers user data, analyses the data provided against criteria you’ve outlined, and shows you live session statuses and results.

Plus, by using a full-service identity verification solution like ours, you can also ensure compliance and make sure that you always know your customers. As an added bonus, by leaving your identity verification to experts like us, you can get on with doing what you do best.

Book a consultation with Veriff

Want to learn more about which online identity verification method is best for your business? Book a consultation with Veriff today. We’ll provide you with a personalized demo that shows you exactly what we can do for you. Alternatively, take a look at our pricing plans and find a solution that works for you and your budget.