How identity verification technology is transforming the payments sector

As customers increasingly adopt peer-to-peer (P2P) payments, P2P providers must strike a balance between offering a seamless customer experience, preventing the risk of fraud, and achieving compliance. Discover how identity verification (IDV) can help today's providers to optimize processes and scale in the time ahead.

Chris Hooper

The peer-to-peer (P2P) sector is experiencing tremendous growth, mostly as a result of consumers' rising confidence in using their smartphones for tasks like banking, shopping, and buying and selling. Done correctly, today's P2P payments can offer a faster, easier, more dependable, and cost-effective service compared to payments methods of the past.

Additionally, consumers' bank information is kept private while the money transfer is instantaneous. However, alongside the need to scale to remain competitive, P2P providers have to strike the right balance between providing a seamless customer experience, preventing fraud, and achieving compliance.

Alongside the need to scale to remain competitive, P2P providers have to strike the right balance between providing a seamless customer experience, preventing fraud, and achieving compliance.

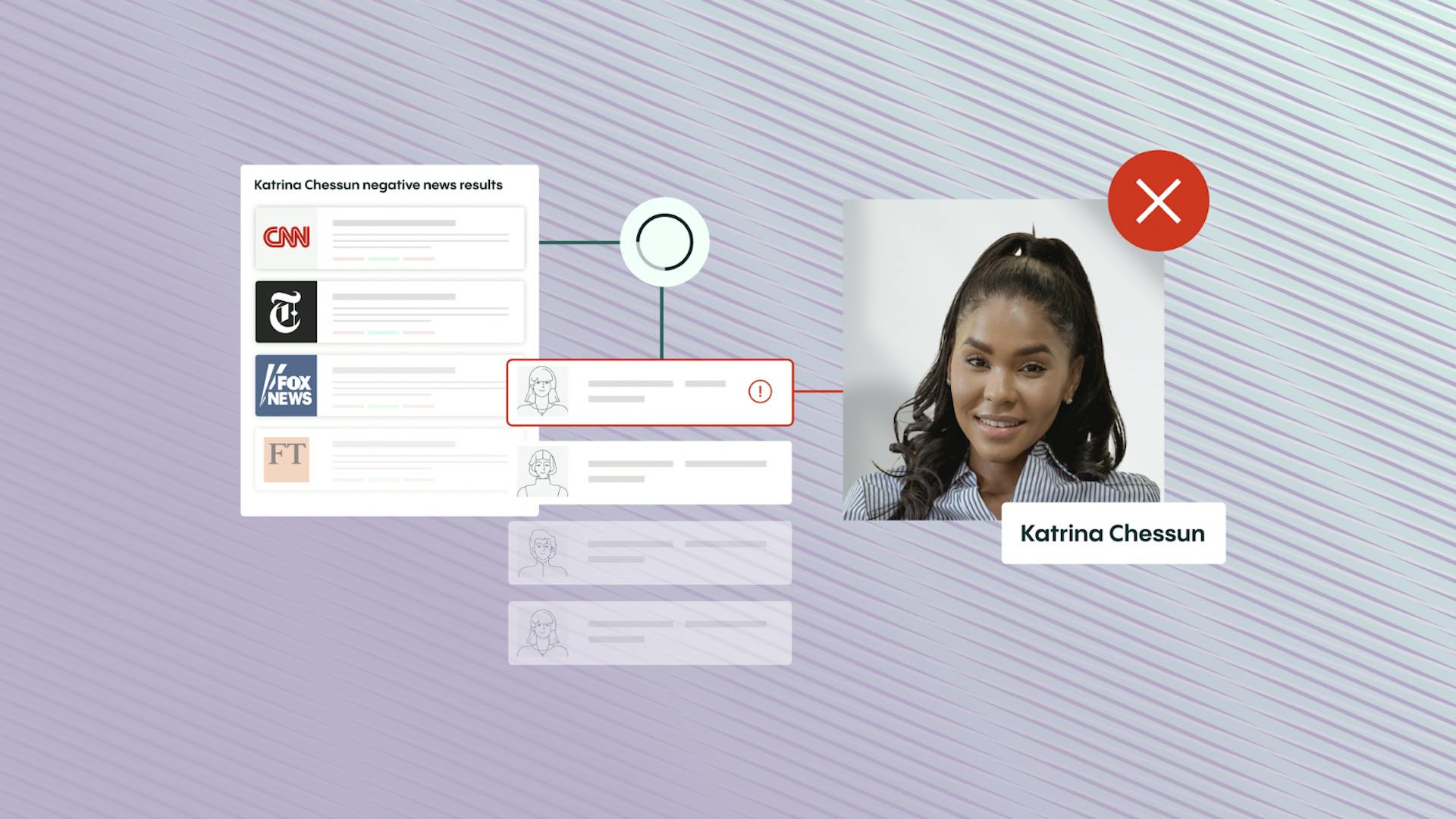

For instance, as customers increasingly expect an optimized UX for online services, there is a need to minimize friction while ensuring that effective identity verification is taking place. Additionally, instant transactions are appealing to customers due to sheer efficiency, but then there's less time to perform anti-money laundering (AML) and counter-financing of terrorism (CFT) checks. Lastly, P2P providers are seeking out innovative features and processes to gain a commercial advantage, but this creates new avenues for bad actors to strike.

P2P providers that can quickly and reliably confirm customers' identity will be able to reduce risks, offer a swift, seamless, and secure customer experience, and position themselves to grow in the years ahead. To discover how Veriff is helping today's payments businesses to scale, stay secure, and achieve compliance, download our new eBook on-demand.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.