How IDV lowers risk and raises compliance standards

Regulators are clamping down on money laundering, while fraudsters are busy coming up with clever ways to extract money from your business. How can you guard against financial crimes at the same time as keeping customers happy?

Chris Hooper

Globally, financial crimes are growing in both number and sophistication. According to PwC’s Global Economic Crime and Fraud Survey, fraud and economic crime were already at record highs before the Covid pandemic hit. Its latest findings, however, reveal that 51% of organizations experienced fraud in the last two years, the highest number ever.

This is a worry for any business, but in the unsecured lending market, the risks are particularly acute. With responsibility to reduce your business’s exposure to criminals, you’ll know the landscape is shifting, with bad actors attempting to wrestle money from your organization in a range of increasingly creative and devious ways.

You want to eliminate the risk of non-compliance, thereby reducing the chances of fines and reputational damage, while shutting the door to fraudulent claims, which also come with financial losses and a risk to your brand.

Minimizing risk, driving growth

If your role involves heading up compliance, then you’ll understand the vital importance of safeguarding against money laundering, a perennial problem regulated by global anti-money laundering (AML) rules. Fall foul of these and it could be curtains for your entire operation.

You want to eliminate the risk of non-compliance, thereby reducing the chances of fines and reputational damage, while shutting the door to fraudulent claims, which also come with financial losses and a risk to your brand.

But, although no one would question the importance of preventing losses and meeting your obligations, customers often just want a quick loan. It’s a tension that presents significant challenges: how can you prevent crime, optimize sales and keep everyone happy?

Letting genuine customers in

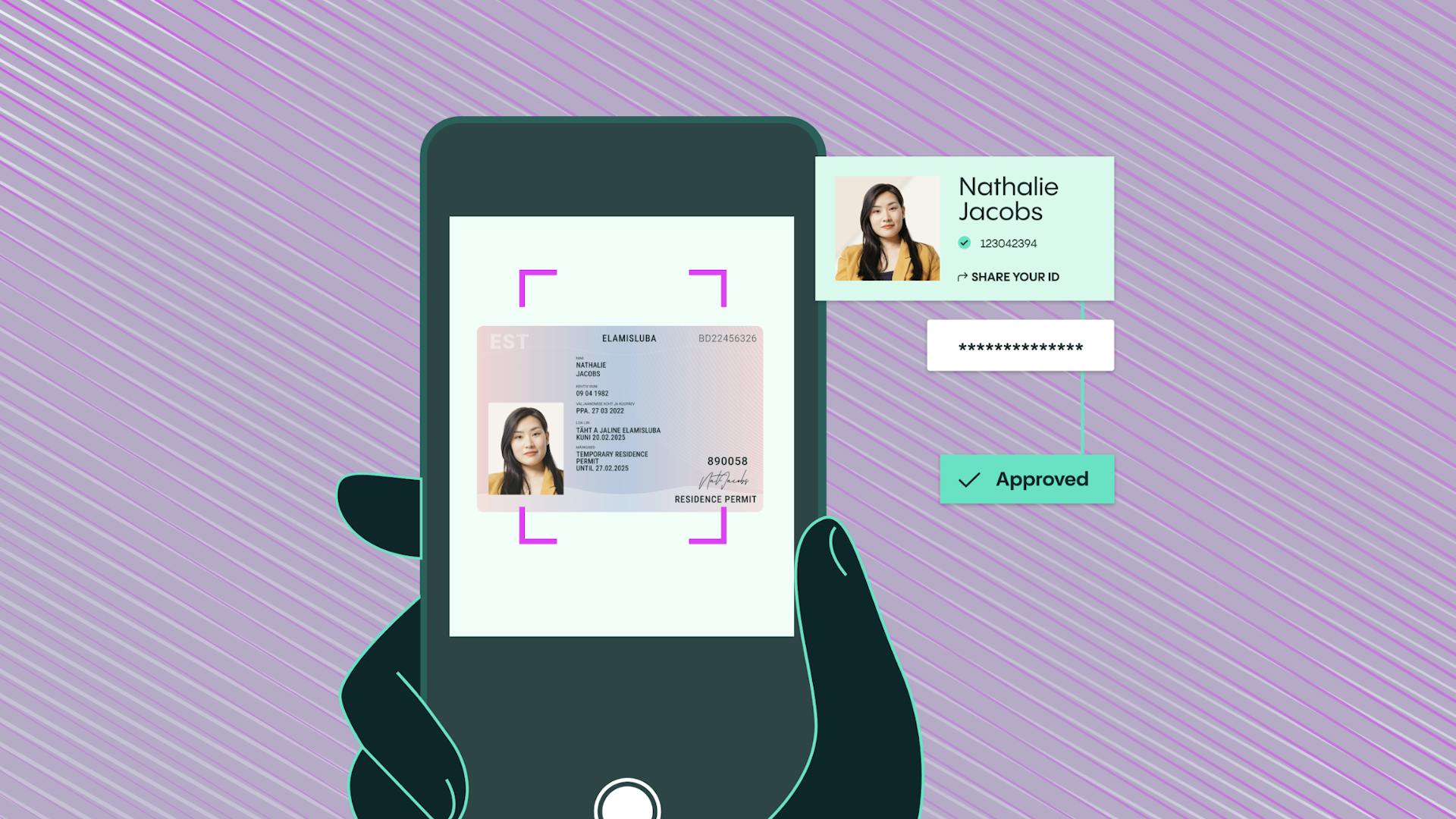

Identity verification represents an important tool in your financial crime prevention mix. The best software can verify identities quickly and efficiently, weeding out fraudulent applications while also preventing money laundering by deterring criminals.

The best IDV solutions should be able to confirm details including that:

- A government issued identity document is genuine and not altered

- The information on the ID matches the individual in question

- The person using the ID is the person described on it

- They are not prohibited or sanctioned from using your service

- The ID verification is happening live and not recorded or deep-faked

IDV tailored to your business needs

The question of how to verify user identity doesn’t come with a binary answer, because it depends on the needs of each individual business, balanced against the unique blueprint of your customer base. For unsecured loan providers, the process must be secure, but intuitive, welcoming and easy to navigate with the quickest possible time-to-value ratio for loan applications.

By selecting a comprehensive IDV solution that covers all the bases without compromising customer interactions, you’ll be a step closer to keeping the fraudsters at bay, appeasing the regulators and keeping business booming.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.