How to grow your gaming business across Africa

Boasting millions of prospective customers, countries across Africa present remarkable potential for today's gaming operators. However, operators must overcome several challenges to realize success. Read Veriff's new eBook to find out more.

Chris Hooper

A diverse continent with 54 nations, more than 1,000 languages, and 1.4 billion people, gaming operators view Africa as an exciting region for commercial expansion. South Africa, Ghana, Nigeria, and Kenya are striking examples of countries with size, wealth, and potential, alongside markets to watch like Morocco and Rwanda. Despite the prospects, operators face a number of obstacles, such as maximizing customer conversions and navigating gray or unregulated markets.

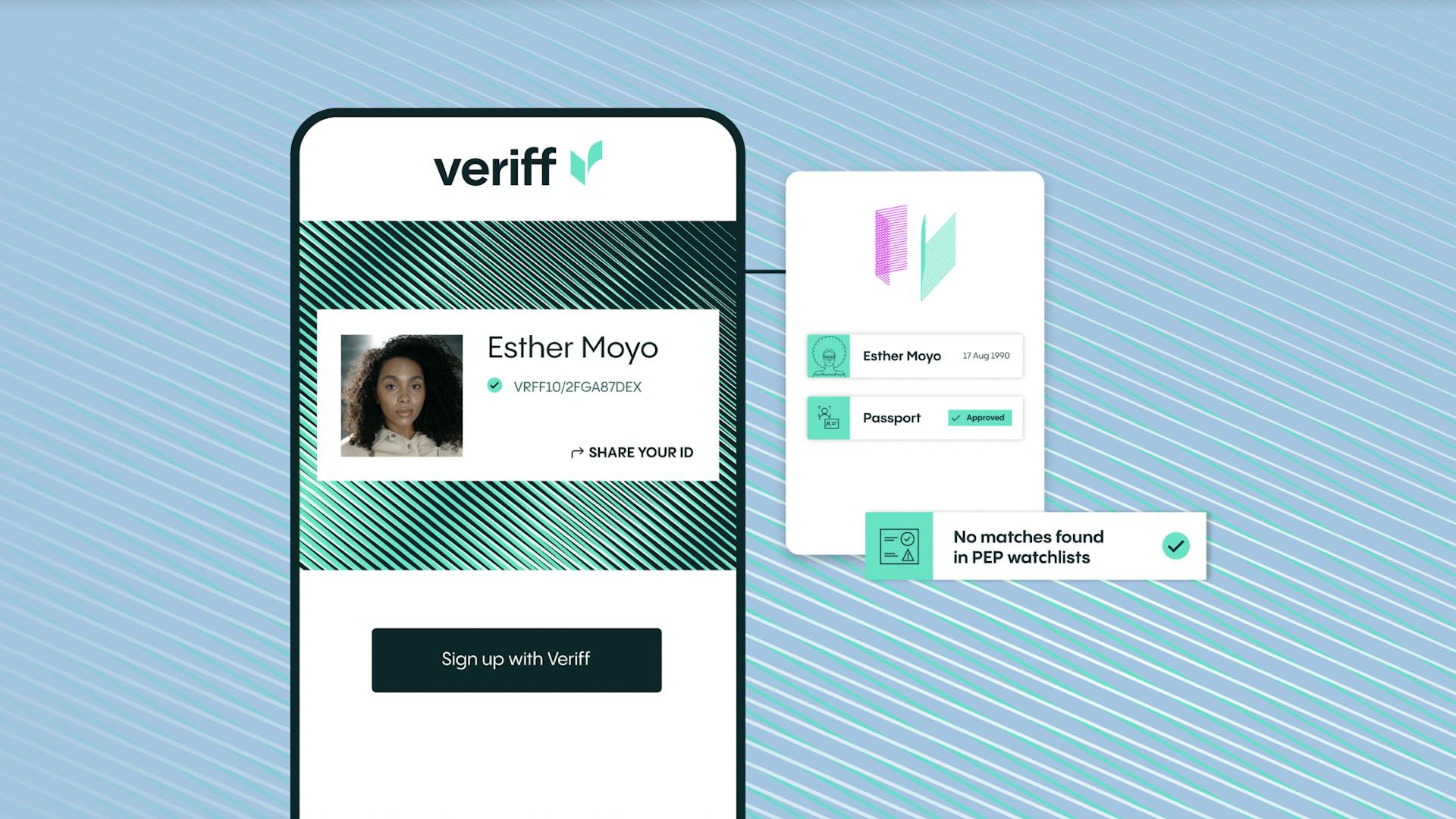

Having established themselves in mature, highly regulated markets like Europe, operators should prioritize customer expectations to win in emerging markets. To meet customer expectations, an important factor is implementing a swift, seamless, and secure onboarding process, ensuring that as many genuine, age-appropriate customers as possible can access services while achieving compliance with local regulations. This is achievable through using an innovative identity verification (IDV) solution like Veriff.

An important factor is implementing a swift, seamless, and secure onboarding process, ensuring that as many genuine, age-appropriate customers as possible can access services while achieving compliance with local regulations.

Building trust through technology

The onboarding process is strongly tied to trust. People might be happy to give their data to a bank, but could take a different approach when it comes to a gaming company. This is a core focus for Veriff – demonstrating trust for both operators and customers, by being transparent and proving a commitment to protecting data, which is only used where appropriate. Additionally, as operators aim to build their brand in emerging markets, they'll be keen to choose partners that are reputable and reliable.

To discover more about growing gaming operations across Africa, we encourage you download our new eBook with the link provided. It offers actionable insight into topics such as audience personas, ensuring the effectiveness of age verifications, and key elements of the customer journey.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.