Chris Hooper

BNPL ballooned during the pandemic, taking large chunks out of the credit card sector, and growth is continuing unabated to this day. People love the simplicity, the terms, and the fact it lets them make purchases with payments in small installments. So much so that 44% of people in the US say they would abandon their shopping carts if BNPL wasn’t available.

But what makes BNPL so attractive to consumers is also making it an enticing prospect for cyber-criminals as a vehicle for illicit profit-making. A separate study by GIACT revealed that, in 2021, 23% of US victims of application fraud had their information used to open a BNPL account.

A study by GIACT revealed that, in 2021, 23% of US victims of application fraud had their information used to open a BNPL account.

The challenge of changing regulations

Market growth is one draw for the fraudsters, another is market immaturity. BNPL is still comparatively new and as such enjoys a relatively light touch when it comes to regulation, at least when compared with more established parts of the financial services industry.

But all this could change soon with global regulators sharpening their pencils to create protocols for checks and balances. It could be that your organization plans to expand into the lucrative unsecured loans market, in which case it will likely have to deal with tighter rules anyway.

More security, big wins

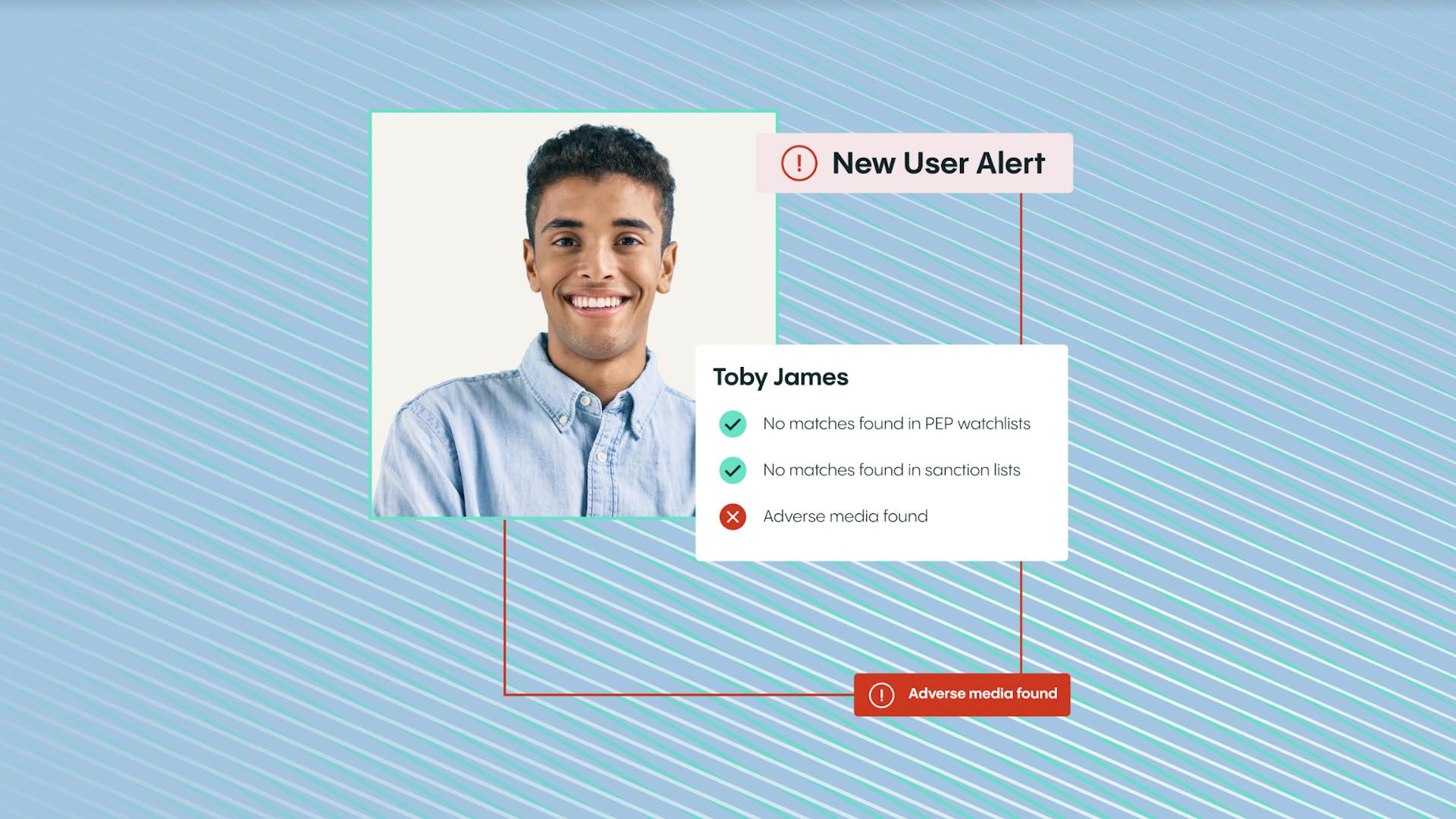

Fraud prevention and anti-money laundering rules require most lenders to know their customers and take steps to ensure people aren’t using their platforms and services to launder dirty money. Failing to do so comes with a multitude of risks, from fines and other sanctions to severe reputational damage.

One ideal way to guard against either crime is to equip your business with a comprehensive suite of identity verification (IDV) tools. These help ensure people are who they say they are and prevent known criminals from gaining access. But the process of identity checking risks harming conversions unless it is intuitive, easy and quick. Customer onboarding teams won’t thank you if the process puts people off, so look for a platform that ticks the customer experience box as well as the security one.

That means looking out for IDV solutions that facilitate conversions with clear and intuitive design and a quick process that leaves out unnecessary steps. Pick one that provides a breadth of language options, customer support and that integrates easily into your existing platform. In doing so, you’ll keep the criminals at bay, while freeing up customers to buy what they want, when they want.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.