Digital customer onboarding explained: How it works & solutions

Empower your business with the transformative capabilities of digital onboarding. Uncover the paramount advantages of seamless security by partnering with Veriff. Safeguard your assets effectively and embark on a journey to fortify your business today.

Chris Hooper

1. What is digital onboarding?

Digital onboarding process involves acquiring a new customer to a new company or subscribing a new user to a new service. It can also mean to build new business partners.

As the name implies, it is a fully digital experience. This means that it takes place on websites or in an app – but not in a branch or on a premise. For this reason, it is also known as online or remote onboarding.

The main purpose of the new account onboarding process is to verify a user’s identity to make sure that the individual in question is really who they say they are.

Because of this, a certain level of due diligence is required. If, for example, the company in question is regulated – like a financial institution would be – they may have to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This means that advanced identity verification process needs to be carried out.

Since staff members and/or business partners don’t interact in person with individuals during the user journey, strict security procedures that help verify new customers’ data remotely and automatically have to be put in place. This is done by providing certain details and/or documentation as required.

Identity verification helps to verify onboarding customers by scanning an ID and Veriff compares this identity information against an authoritative database or registry The user is then asked to take a simple selfie of themselves. Veriff’s Assisted Image Capture will let them know immediately if there is something wrong with the image. We quickly detect liveness and realness without asking users to move unnaturally or follow complex instructions. Facial biometrics, digital footprint analysis, and liveness detection technology can also be used, combined with identity document processing.

Because of this automation, digital onboarding simplifies the process of security checks, therefore improving compliance procedures.

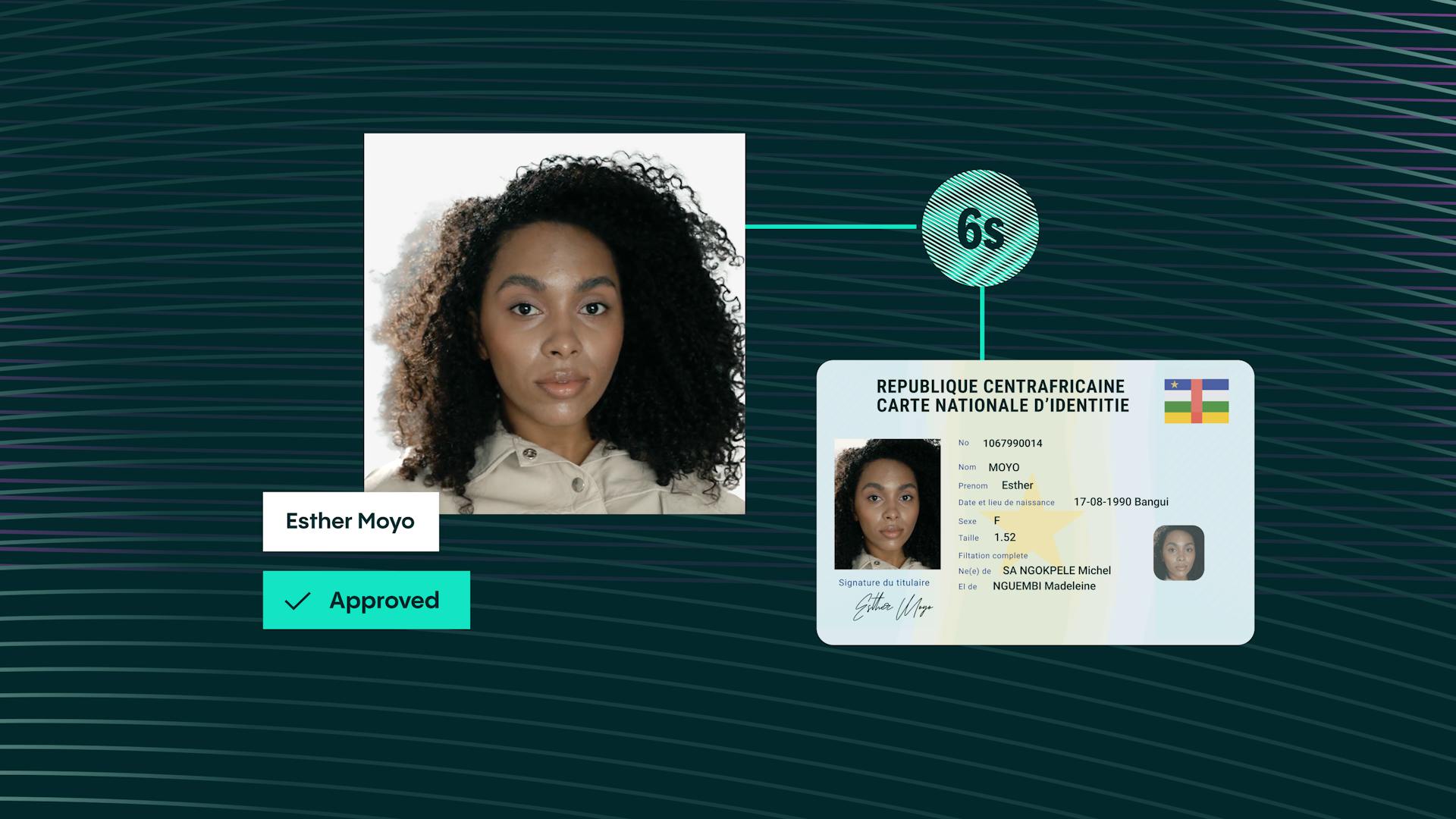

Here’s an example of what a digital onboarding solution could look like:

1. A customer submits all relevant data

Veriff’s Identity Verification solution enables new customers to submit a picture of their identity document. The system captures a face image of them for comparison with the photo in the ID.

2. The system verifies the data of the customer using the submission

The data is then sent to Veriff and our AI-powered identity verification solution. The system then compares the captured document images with the selfie to confirm they match. This includes liveness detection and other fraud prevention features. A decision is then made within a few seconds based on the identity checks your business requires.

3. Further checks are carried out

With Veriff, you can also receive continuous notifications whenever a user’s name matches an updated version on the database in real-time. The system then performs further validity checks to meet compliance regulations. For added protection against fraud and money laundering, companies can add AML screening to the mix. After identity verification, but before formal onboarding, users can be screened against global PEP and sanctions watchlists. For an added layer of security, we can also screen for negative news and information so you can identify customers that have a heightened level of risk associated with them.

2. How does the digital onboarding process benefit your business?

There are a number of business benefits of digital onboarding.

First and foremost, it saves companies time and money. This is because these methods are much more efficient than manual ones and involve less admin and paperwork, decreasing the time employees spend on the processes.

With digital onboarding, everything is stored in a central database. This means that documents can be signed and returned in an instant. This also frees up teams to work on more complex business issues.

Moreover, because they are done remotely, digital processes allow online companies to reach and onboard customers no matter where in the world they are.

Speed is another benefit, too. Digital onboarding can take minutes – making it much faster than conventional methods, which could often take days – if not weeks. The chances of human errors occurring are also lowered – especially when it comes to inputting documents and/or information.

It’s also important to consider the advantages from a customer's point of view. Veriff aims to provide a seamless and user-friendly experience for individuals undergoing identity verification. The process is designed to be quick and easy, minimizing friction for legitimate users while maintaining security. For example, compared to the approaches applied by many traditional banks, interactions between the users and the company are enhanced with Veriff, and the methods are straightforward and user-friendly. The customers can complete the onboarding process virtually anytime and anywhere. This, in turn, means they will be happy with the customer onboarding process, increasing their chances of remaining loyal. Digital onboarding also means that every new customer is taken through the exact same user journey, meaning that you build a consistent brand and experience. And by making the process an engaging one, companies boost new customers’ confidence in them from day one.

Finally, digital onboarding is secure. The processes involved are also updated in line with industry regulations, meaning that high standards are guaranteed.

Overall, digital onboarding allows businesses to provide a customer-centered approach, reduce operational costs, and strengthen compliance.

Veriff is the preferred identity verification partner for the world’s biggest and best digital companies, including pioneers in fintech, crypto, gaming, and the mobility sectors.

3. What are the implications of poor digital customer onboarding for businesses?

Onboarding is a vital phase in the customer journey and experience – and one wrong move can cause a prospect to jump ship to someone who has got it right. It’s thought, for example, that up to 6 out of 10 customers abandon the digital customer onboarding process partway through. This is because many potential users simply assume that a poor onboarding experience will indicate a poor overall user experience.

Speed, simplicity, and security are the key components here. It’s thought that one in five abandonments are caused by lengthy and complicated onboarding processes. Similarly, a company that asks for too much information or is confused about its data needs risks alienating customers.

Online customer onboarding comes with risks and challenges, some of which are unique to the digital environment.

Here are the main risks associated with online customer onboarding:

- 1. Identity Verification and Fraud:

Risk: Online platforms are susceptible to identity theft and fraudulent activities. It can be challenging to verify customers' identity during onboarding accurately.

Mitigation: Implement robust identity verification measures such as advanced AI-algorithms tailored to remote onboarding, sophiticated biometric analysis with liveness and realness checks and use additional data points such as device and network data to detect fraud. - 2. Cybersecurity Threats:

Risk: Online platforms are vulnerable to cyberattacks, including hacking, phishing, and malware, which can compromise customer data and sensitive information.

Mitigation: Employ strong cybersecurity measures, regularly update security protocols, and educate customers on online security practices. - 3. User Privacy Concerns:

Risk: Customers may be hesitant to share personal information online due to concerns about data privacy and security.

Mitigation: Communicate your privacy policies, comply with data protection regulations, and invest in secure, encrypted communication channels

Furthermore, the customer onboarding process can expose companies to additional risks. Many businesses are required by law to prevent financial crimes such as money laundering and tax evasion. Failure to comply can result in significant financial penalties and, in the worst case, loss of license. So, companies are also obliged to use the user onboarding process as a means of verifying the identity of individuals and establishing their identities.

Even after the onboarding process, some business must continue to monitor the customer’s activities on an ongoing basis. The user’s risk profile may be of little concern initially, but it could change significantly as time progresses. It is vital that your company monitors any developments and responds accordingly.

4. What benefits come with effective digital onboarding?

Just as poor digital customer onboarding can lead to prospects shying away from a company, an effective process can give them a positive first experience. This, in turn, could make them more likely to remain loyal to the business in question and leave positive reviews. It could also lead users to recommend the company to friends, family members, colleagues, and peers.

In fact, many people argue that user experience (commonly referred to as UX) might be the single most important feature of any website or software. This is because if it’s not easy to navigate and understand, and if it doesn’t look organized, inviting, and friendly, users just won’t return.

Some of the biggest benefits of a great user experience are:

- Increased ROI (Return on Investment)

- Positive brand reputation

- Customer loyalty

- User engagement

- Conversion and sales

- An edge over competition

Great onboarding UX experience, in particular, is key to encouraging new sign-ups and helping users learn how products and services work – meaning that they can use them effectively once they’re set up. A good user onboarding experience is interactive, intuitive, action-oriented, and educational. Checklists, progress bars, help centers, tooltips, and welcome screens are onboarding UX patterns that help create engaging user onboarding experiences.

Good onboarding offers a unique combination of reassurance and education – ensuring that customers are confident when entering personal details and understand how the app will work once the process is completed.

The key is providing the information needed to help the user without overwhelming them with so much detail that it will deter them. If steps are too complex or forms difficult to complete, they may not make it through the signup process. If the experience is great when they make it on board, they’ll not just keep using the product – but they may suggest others do the same.

However, ensuring a secure and compliant online customer onboarding process is paramount for any business. By implementing Know Your Customer procedures, the company can precisely identify individuals seeking to onboard. It is crucial to verify the authenticity of customers to mitigate the risk of fraudulent activities. Incorporating age verification mechanisms further enhances the onboarding process by ensuring compliance with legal requirements, especially in industries where age restrictions apply. By prioritizing KYC, verifying customer authenticity, and meeting regulatory standards, the business establishes a foundation for a trustworthy and legally compliant onboarding experience, safeguarding the company and its customers.

5. What are the top strategies for fraud prevention through digital onboarding and ensuring business security?

Today's consumers and businesses demand secure yet seamless digital onboarding solutions. Anti-fraud mechanisms, such as AI-powered anomaly detection, biometric analysis, liveness detection, velocity abuse checks, and device and network analysis, should be part and parcel of onboarding systems.

It is also vital to know who is entering your platform to comply with KYC and AML regulations. This will not only keep fraudsters and other criminals at bay – ensuring you remain on the right side of the law – it will also protect your organization financially and your brand value.

However, customers must also be kept in mind. A lengthy, onerous process, perhaps involving a manual ID check, could drive potential customers into the arms of your competitors. If you get it right, on the other hand, new customers will start off on the right track, viewing your platform in a positive light, with all that means for brand value in the years to come.

Tools and processes to consider:

- Document verification and authentication

As part of the customer KYC procedure, during this phase of digital onboarding, a user is required to submit identification documents electronically, such as government-issued IDs or utility bills.

Specialized technologies ranging from optical character recognition (OCR) to artificial intelligence are then used to verify that these documents are genuine, untampered, and belong to the person claiming to be the holder.

- Customer identity verification and KYC

Veriff’s identity verification solutions help businesses meet KYC regulatory requirements and beyond. KYC procedures are essential to any business that wants to accurately assess customer risk and onboard them safely. KYC processes ensure that you know the identity of your customers and the risks they could pose to your organization.

- Artificial Intelligence (AI) and Machine Learning (ML)

By automating customer identity verification and fraud detection, AI and ML eliminate time-consuming manual analysis and reduce the risk of human error.

They use algorithms and predictive models to process, learn, and make decisions from stored data, such as customer information, user behaviors, and more.

Veriff’s AI-backed systems, for example, mean that customers can upload an ID, take a selfie, and obtain an answer in only six seconds.

- Biometric verification

Easy identity verification during onboarding saves time and money. Veriff makes acquiring new customers worth the investment, converting more people into customers while stopping bad actors from exploiting your service.

Revolutionize your digital onboarding experience with cutting-edge biometric verification which taps into the distinctive biological traits of users, like facial patterns ensuring a seamless blend of user convenience and heightened system security.

- Passive liveness detection

With an advancement in biometric technology, passive liveness detection has become a crucial instrument in digital onboarding to combat fraud. This technology ensures that biometric data, such as facial features captured during the digital identity verification process, comes from a live person rather than a photo or video reproduction.

- User guidance

Identity verification can be a sensitive matter, with confusion easily turning to distrust. The right systems, however, can make things simple, providing real-time feedback to customers to help them pass first time.

- Document database

As your platform grows, you will likely work with customers from all over the world, leading to complex demand in areas like government IDs. Your system needs to be capable of handling the demands of different cultures and nations. An extensive document database that supports documents from countries across the globe, ensuring maximum coverage as you expand.

6. How can Veriff's solutions help to ensure a seamless digital onboarding process for your business?

Modern consumers expect a fast, secure, and seamless online experience. For a business to retain customers digitally, they must provide this sought-after experience. Otherwise, customers will leave. Businesses are constantly challenged to get the customer to the next step in the buying process – and if they don’t, it massively affects the business’s bottom line, making better onboarding more critical than ever.

Veriff’s Identity Verification establishes better trust online between a business and its consumers. This process starts with a built-in customer KYC feature, which helps meet stringent regulatory requirements online.

Veriff can provide this best-in-class customer IDV solutions by leveraging video-first technology by:

- Providing a guided AI-powered user experience

- Supporting the most identity verification documents in the industry

- Giving real-time feedback to the user if there are issues

- Handling scenarios where users might make mistakes in order to easily troubleshoot

- Operating on multiple channels (web, mobile, native SDKs)

- Innovating ways to help users further with NFC (Near-field communication) and QR code options

- Providing built-in dynamic fraud prevention tools

- Integrating KYC & AML checks.

Veriff also:

- Verifies the validity of the customer’s document, ensuring the data, the ownership of the document, and the face similarity of the person presenting the document are correct.

- References an extensive Politically Exposed Persons governmental database, sanctions database, and adverse media database, all updated in real-time.

- Ensures that your business is onboarding genuine customers in record time.

- Uses a real-time capturing method to ensure the realness of documents and people and understand context beyond images with real-time image/video capturing.

- Goes beyond the simple document checks to device, network, and browser analytics and identifies the user and their previous activities.

What’s more, Veriff’s device, network, user, and document analytics uses 1000 data points to identify and mitigate fraud, preventing fraudsters from plaguing your platform.

FAQ

1. How do Veriff digital onboarding solutions enhance your business?

Veriff’s Identity Verification system is fast, accurate, and ensures customer satisfaction. It helps keep regulators happy and reduces the cost of customer acquisition by onboarding more users successfully through a reliable process with minimum friction.

As we’ve seen, when online companies begin to onboard new customers, there are a host of problems they can encounter. Veriff can help keep these issues at bay and retain new customers quickly and effectively.

Veriff can help you:

- Know that customers are genuine, ensure proper checks are carried out, and stay compliant.

- Reduce basic errors and cut down on resubmissions so people get verified the first time.

- Convert 30% more users with automatic document recognition and user guidance.

- Improve customer experience – keeping both customers and support teams happy.

- Minimize the cost of compliance – because you only pay for actual verification sessions, not retry attempts.

Veriff supports over 12,000 identity documents from over 230 countries and territories in 48 languages, making it the most comprehensive digital identity verification company across the globe.

Veriff also uses an advanced, guided user experience that gives users real-time feedback to help more of them pass on the first try. Verification, meanwhile, happens in 6 seconds on average. This keeps users moving through the process and gets them interacting with businesses faster.

2. How does the Veriff onboarding process work in your business?

With Veriff's Identity and Document Verification (IDV) solution, you can onboard more genuine customers. It is proven to deliver speed, convenience, and low friction for your users – resulting in high conversion rates, fraud mitigation, and operational efficiency for your business.

Veriff’s Identity and Document Verification solution combines AI-powered automation with reinforced learning from human feedback and, if required, manual validation. With support for more than 12,000 document specimens from more than 230 countries and territories, we offer speed, convenience, and reduced friction to convert more users, mitigate fraud, and comply with regulations.

Explore more

Get the latest from Veriff. Subscribe to our newsletter.

Veriff will only use the information you provide to share blog updates.

You can unsubscribe at any time. Read our privacy terms.