Fraud detection and intelligence to stay ahead of evolving threats

Strengthen your fraud strategies with greater intelligence, data, and expertise from Veriff

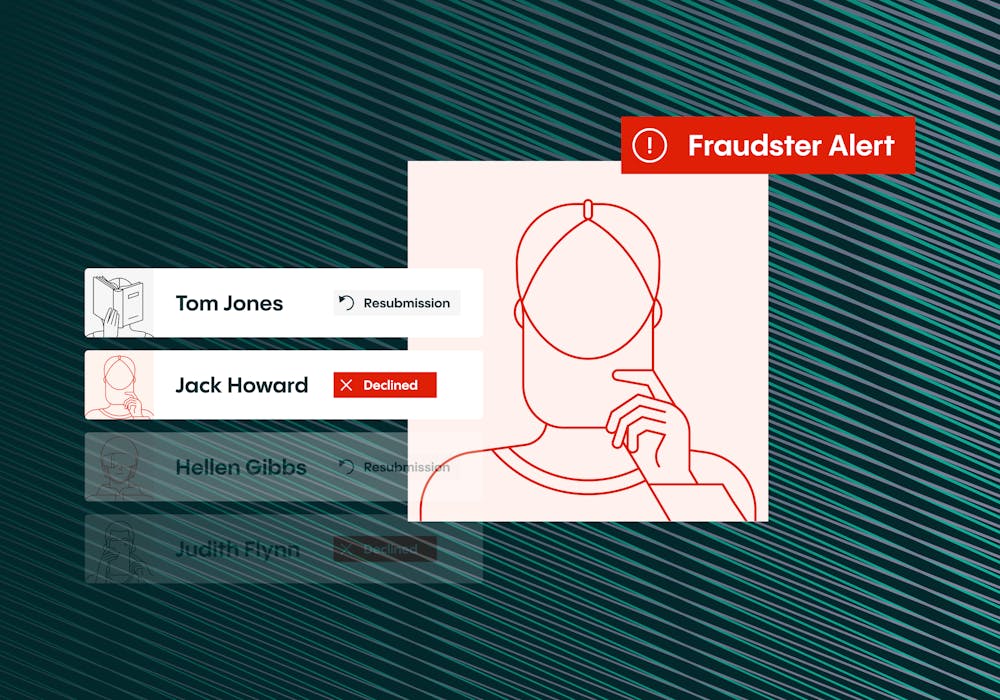

Better intelligence, better fraud mitigation

Fraud Intelligence is a powerful package of fraud mitigation features and risk insights. It analyzes risk signals during the identity verification process to detect fraud while surfacing actionable risk-related intelligence and insights. This intelligence and a consolidated RiskScore are available in Veriff Station or via API to your in-house systems, enhancing your investigations and informing your decisions.

Talk to us

To discover more about how our fraud mitigation packages can help secure your business, get in touch.

Certificates

Veriff is compliant with CCPA/CPRA, GDPR, SOC2 type II, ISO 27001, and WCAG Accessibility Guidelines.

©2025 Veriff. All rights reserved