Onboarding Article

Optimizing gaming customer onboarding in emerging markets

In the drive for international growth, gaming operators must overcome region-specific challenges. However, one consistent element is customers’ expectation for a seamless and secure customer experience. Discover how identity verification enables operators to enhance the onboarding process and boost conversions.

Emerging markets are the future of the gaming industry, but present a complex picture for operators. To succeed, they must adopt the latest advances in customer verification to ensure they onboard more users with speed and accuracy.

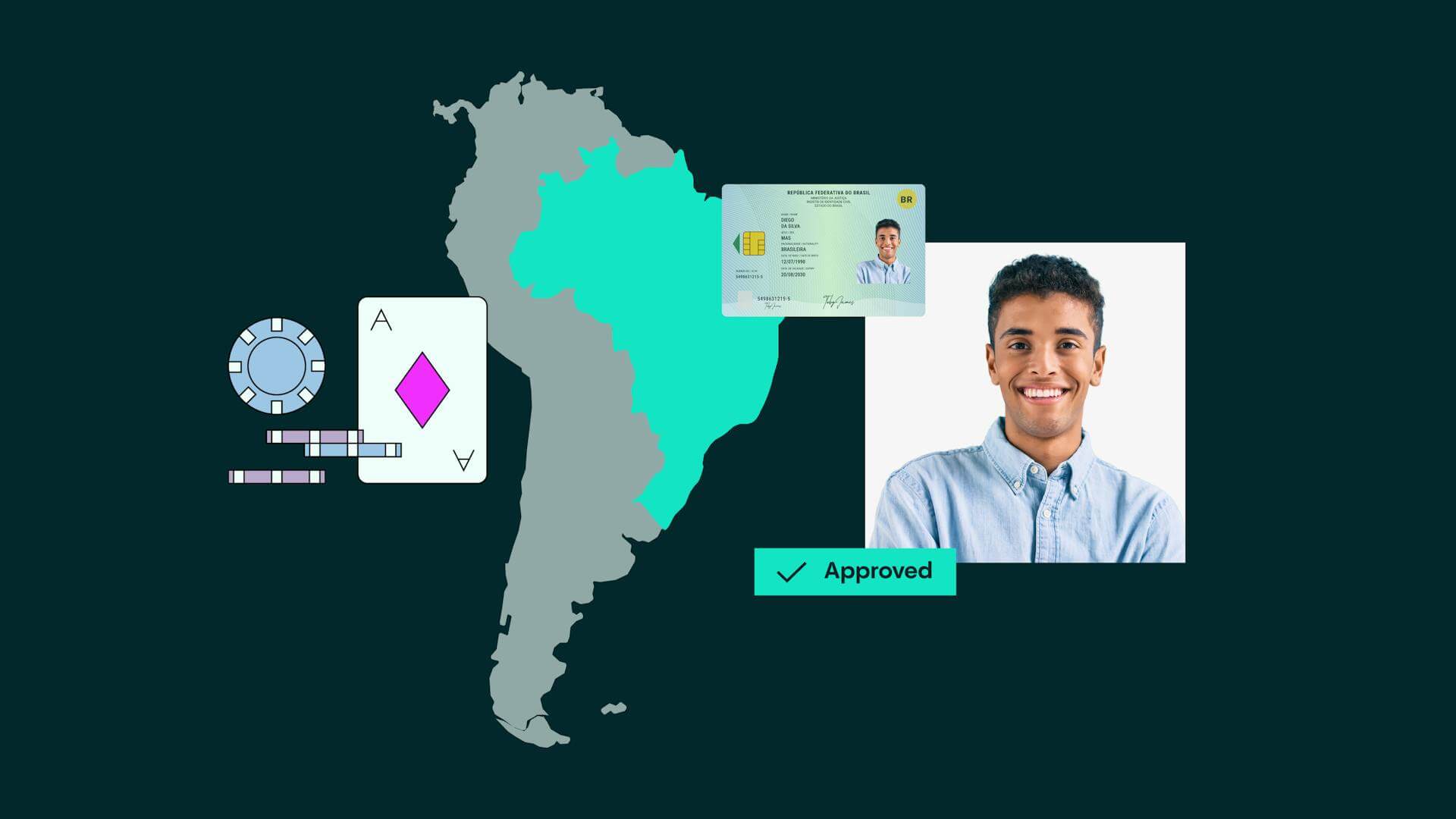

The appeal of emerging markets is obvious, notably Africa and Latin America. The African gaming market is forecast to hit a value of $6.8bn by 2030, almost double its value in 2021. The Latin America market is valued at around $15bn.

However, each region comprises vast populations, with dozens of cultures and languages, varying cultural and business demands, and a range of regulatory regimes. While this variety leads to a diverse range of needs, there is one common theme: to succeed, operators must optimize their processes for onboarding customers.

While this variety leads to a diverse range of needs, there is one common theme: to succeed, operators must optimize their processes for onboarding customers.

Delivering speed and security in onboarding

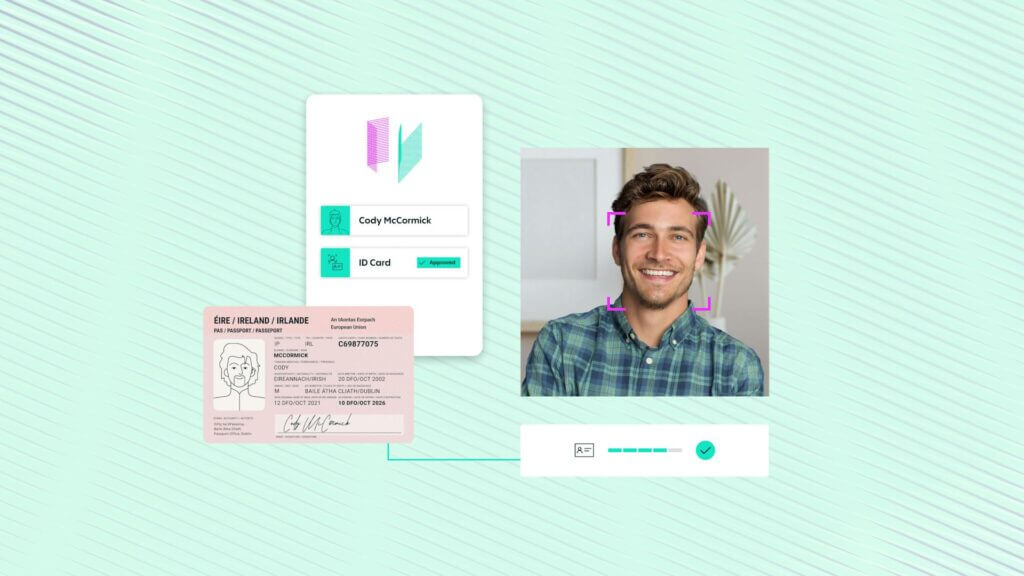

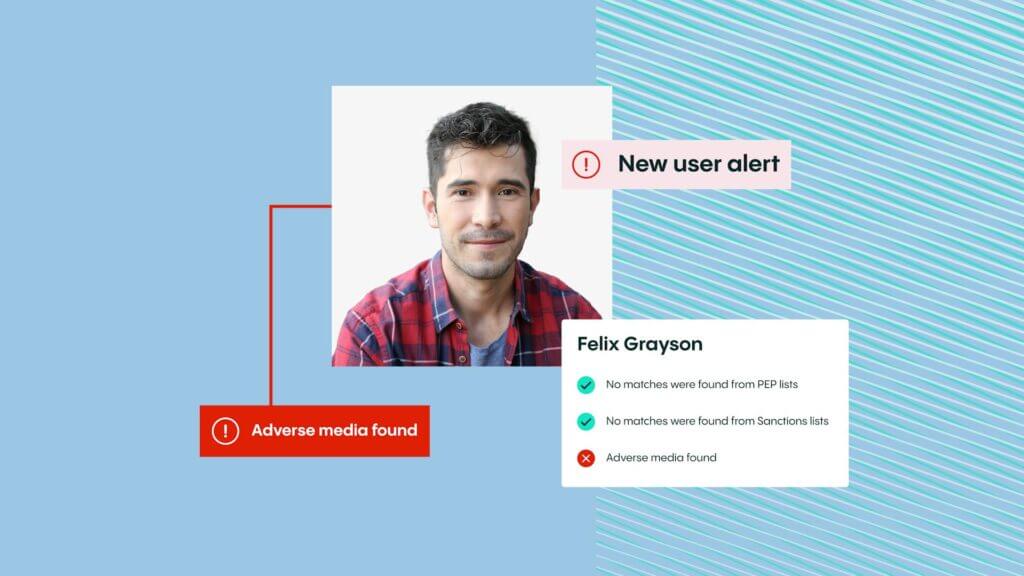

Veriff’s Identity Verification (IDV) is designed to make the process as simple as possible, relying on a simple selfie and a photo of a government-issued identity document. Veriff’s solutions include powerful tools for gaming operators, such as Age Verification, SSN Verification, and Sanctions and PEP screening. This ensures a safe, swift, and accurate verification process, which is vital for gaming operators in emerging markets.

IDV plays an important part in organizations achieving KYC and AML. While it is vital to ensure legal compliance, operators must also prioritize players, and avoid making the process burdensome. The right IDV approach is essentially the best of both worlds, ensuring that players are onboarded as conveniently as possible while also providing robust ID checks, such as by utilizing Veriff’s document database, ensuring that genuine customers access the platform.

Overcoming region-specific challenges

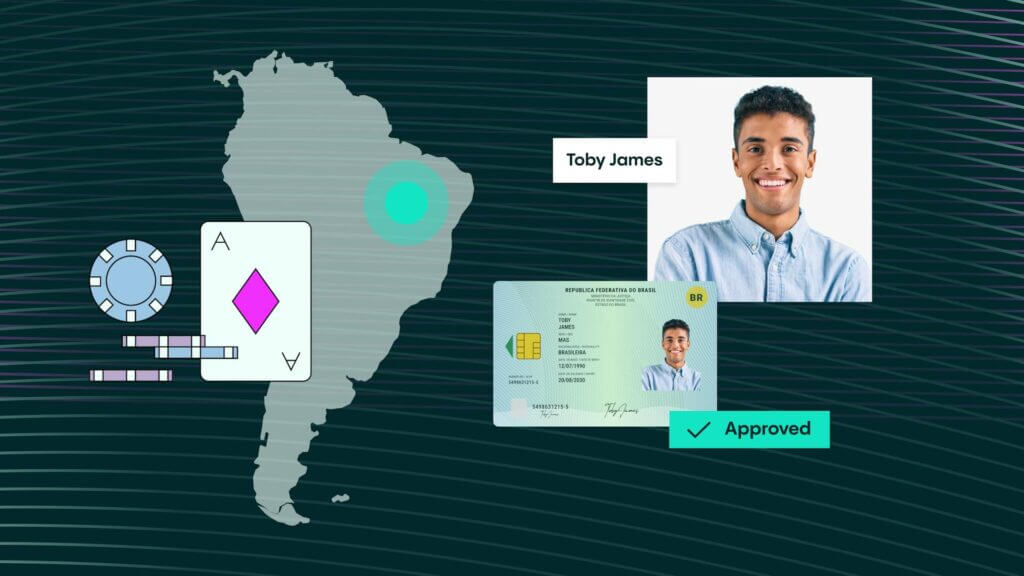

Localization will be crucial to meeting demands for speed, accuracy, and security. Operators must understand the requirements and realities of individual markets. For example, while markets like the UK may have strong, traditional credit rating databases, this may not exist in markets in Africa. In Brazil, for instance, fraud is a significant issue that operators must confront, with issues around chargebacks or bonus abuse.

It is therefore essential that operators can turn to the latest technology and access the right data and documents. For Veriff, IDV is key to the next level of AML screening, KYC compliance and player protection. This will be key in emerging markets, where younger players are driving the evolution of the gaming sector.

Realize commerical potential faster with IDV

In Africa, for example, almost 60% of the population is aged 25 or below, while more than half of sub-Saharan youths aged 17-35 have gambled on sports. These players want a frictionless experience; they do not want to spend too much time getting onboarded. When this happens, it takes longer for operators to realize commercial potential and could entail losing prospective customers to competitors.

If gaming operators want to meet these customers’ demands for speed, while ensuring the accuracy required by regulators, they must prioritize the latest advances in IDV technology.

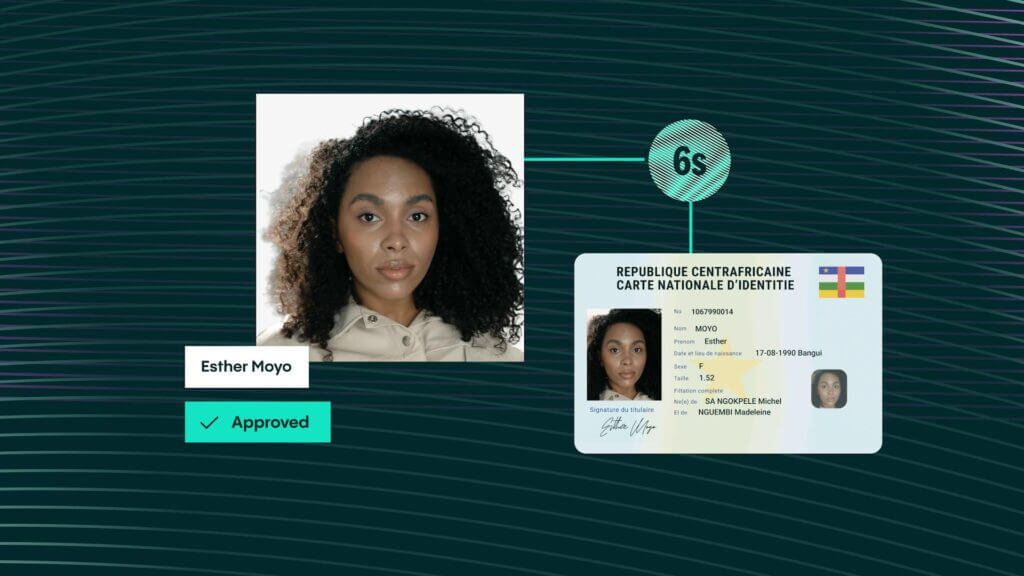

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Get more details

Discover more about how IDV is powering gaming industry growth and customer acquisition.