Onboarding Article

Enhancing security and trust in the wealth management customer onboarding process through KYC

The journey towards financial success begins with that initial connection between wealth management providers and their prospective customers. It’s the pivotal moment where trust is built, and relationships are forged, setting the stage for a prosperous partnership ahead.

1. What is the wealth management customer onboarding process, and how does it relate to KYC?

A wealth management customer onboarding process is the first point of contact between wealth management service providers and their future customers. It is made up of the first serious interactions between advisors and investors and lays the groundwork for the long-term customer relationship.

Automated digital onboarding can help wealth management firms quickly gather and verify the information needed about customers or potential customers – including helping them to meet Know Your Customer requirements.

KYC is the process of verifying a customer’s identity and financial activities, including where their money comes from and their risk profile. This helps ensure that customers are genuine and compliant with relevant regulations – preventing money laundering and other crimes. Digital onboarding reduces time and effort for the firm and account opener when it comes to KYC.

2. How does KYC enhance security in the wealth management customer onboarding process?

KYC plays a significant part in today’s fight against financial crime and money laundering.

It is the mandatory process of identifying and verifying a customer’s identity – both when opening an account as well as periodically over time. In other words, wealth managers must ensure that their customers are genuinely who they claim to be. They can also refuse to open an account or halt a relationship if the customer fails to meet minimum KYC requirements.

The following steps, which form part of the digital onboarding process, are part of KYC:

-Establishing the customer’s identity

-Understanding the nature of the customer’s activities (i.e. being satisfied that the source of the customer’s funds is legitimate)

-And assessing money laundering risks associated with that customer

Become and stay KYC compliant

Know Your Customer (KYC) procedures are essential to any business that wants to accurately assess customer risk. KYC processes ensure that you know the identity of your customers and the risks they could pose to your organization. Veriff’s solutions help businesses meet regulatory requirements and beyond.

3. How can businesses improve the effectiveness of KYC by prioritizing the wealth management customer onboarding process?

The core pain point of KYC is user friction. No customer wants to encounter this, and no wealth manager wants the onboarding process to be a sticky one.

Traditionally, customer onboarding processes were both manual and time-consuming for everyone involved. They required a great deal of resource, and errors and discrepancies were commonplace. This left businesses vulnerable to fraud and non-compliance as well as at risk of negative customer experiences and high abandonment rates – which could impact their growth and reputation.

But by leaning on savvy anti-fraud mechanisms and digital onboarding solutions, such as AI-powered anomaly detection, multifactor authentication, and encryption, wealth managers can not only keep fraudsters and other criminals at bay – ensuring that they remain on the right side of the law – but they will also improve the effectiveness of KYC.

4. What are the main types of wealth management customer onboarding processes in KYC compliance?

Due diligence

The wealth manager’s first judgment is whether to trust a potential customer —and due diligence is a critical part of this.

Carrying out due diligence will include the following:

- Finding out the location and identity of the potential customer

- Gaining an understanding of their business activities

- Classifying their risk category

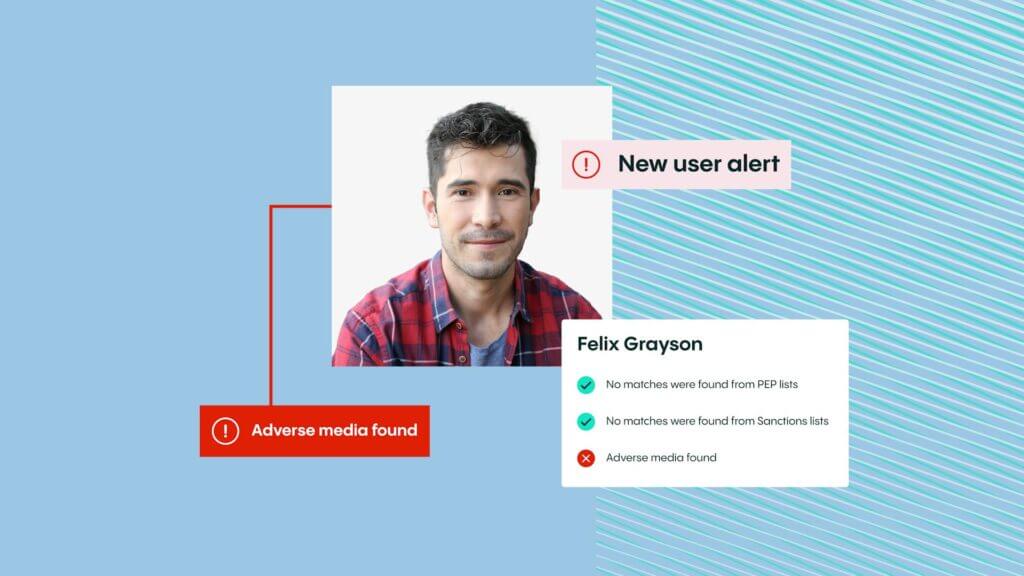

- Carry out a sanctions and PEP check

- And storing all of this information, as well as any additional documentation.

Risk assessment

Risk assessments are a fundamental part of a risk-based approach and help identify potential issues, understand the risk of dealing with a customer, and determine what measures are necessary to counter the threat.

Customers tend to be divided into four buckets, which will indicate how financial institutions should deal with them. These are:

Low: Someone who is easily identifiable and verifiable, meaning that they are of little risk of unwanted or illegal activity.

Medium: A higher than average risk compared to most – meaning that this customer will require further checks and monitoring.

High: These customers will require a great deal of due diligence and monitoring.

Prohibited: Suspicious behavior is strongly suspected and risky transactions may have occurred in the past. Companies would be advised to avoid these customers in order to protect themselves.

Regulatory compliance

As a wealth manager, your digital customer onboarding process will involve collecting sensitive information from your customers. As such, it’s imperative that you are correctly protecting their data and remaining compliant. So, before you start building your digital customer onboarding process, be sure to keep up with evolving local and global regulations.

Account setup

Account set-up is of course part of the customer onboarding experience – and customers will get here once they have made it past the likes of due diligence. This is another touchpoint where user experience is key. This is in a sense the first ‘real’ interaction that a customer will have with an organization – beyond onboarding – and will give them a good indication of what is to come.

The necessary steps should be clearly communicated to customers, potentially via a list of tasks required of them in order to set up their account. As they complete each of these tasks, they should be able to mark them off to show progress towards being ready to freely use the services. This gives them a sense of accomplishment, which is a good feeling to be associated with your offering.

Self-service onboarding

People often refer to two different types of onboarding within financial services sector: white-glove—hand-held, high-touch processes—and self-service. Self-service relies on automated, online services that take place in-app and without help from an employee.

Today, people tend to be time-poor and impatient and, in general, prefer onboarding and KYC processes that are slick, friction-free, and avoid unnecessary human-to-human interactions. As such, self-service onboarding can prove to be an extremely useful tool, allowing potential customers to act on their own accord, in real time, and on their own devices.

5. How does integrating the wealth management customer onboarding process with KYC impact the effectiveness of fraud prevention and risk management?

Smart wealth managers combine customer onboarding and KYC. This can be done by applying KYC guidelines to customer onboarding processes. When done properly, businesses not only gain the information that they need as part of the KYC checklist, they also acquire some of the information needed for the customers to open an account with them.

Efficiencies such as these not only streamline an organization’s touchpoints and improve overall customer experience, they also put less pressure on the potential customer and lower the likelihood of them abandoning the process altogether.

6. How does Veriff’s customer verification enhance the efficiency and accuracy of the onboarding/KYC process?

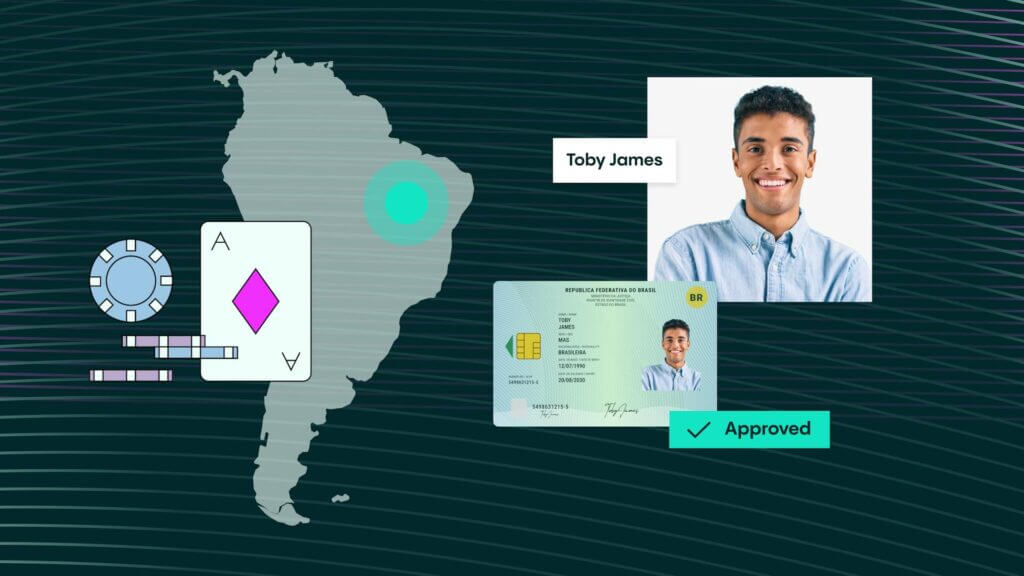

Comprehensive identity verification

Veriff’s Identity and Document Verification solution combines AI-powered automation with reinforced learning from human feedback and, if required, manual validation. This means that ID verification takes place efficiently and comprehensively.

With support for more than 12,000 document specimens from more than 230 countries and territories, Veriff offers speed, convenience, and reduced friction to convert more users, mitigate fraud, and comply with regulations.

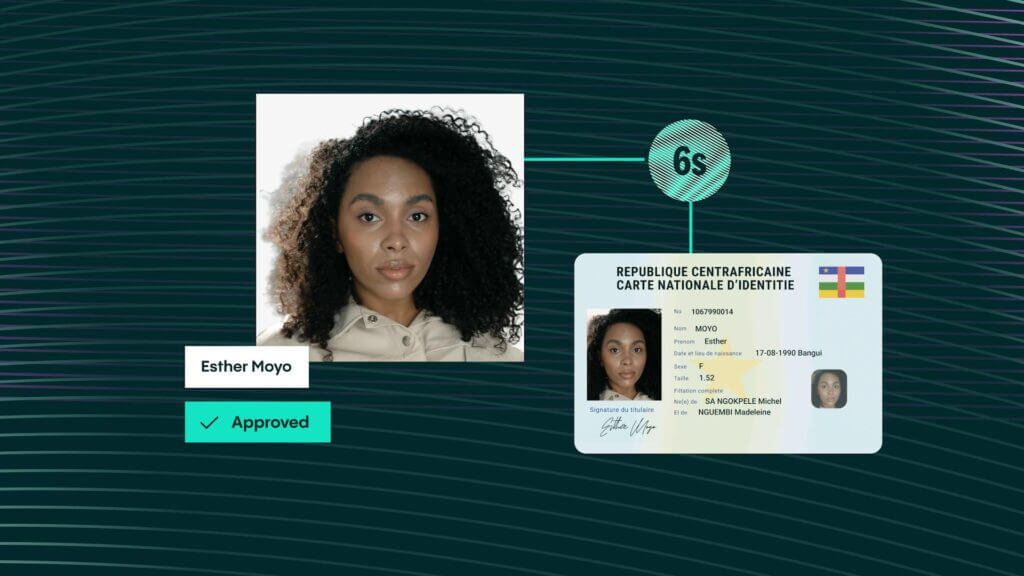

Speedy onboarding

Today, onboarding systems and software are available that are fast and accurate and ensure customer satisfaction. Further results include happy regulators and more successfully onboarded users owing to a speedy and reliable service. Veriff’s verification happens in the blink of an eye — or 6 seconds on average. This keeps users moving through the process and allows them to interact with your business faster.

Compliance with regulations

Complying with KYC regulations doesn’t mean compromising the user experience. With Veriff, automated AML screening and ongoing monitoring solutions help keep your business compliant, mitigate risk, and keep out fraudsters while still creating a seamless experience for your genuine users.

Enhanced security

IDV covers two bases: it verifies that a potential customer who wants to use a service is who they say they are, not a robot or synthetic identity, and it requires them to prove their validity before they can access data or systems. These basic processes alone can prevent fraud by preventing people from using false or stolen personal information to access goods, services, or products.

Improved customer experience

By delivering a safe but speedy process, companies can boost their customer experience, increase conversions, lower abandonment rates – and build their brand. Veriff guides the user through the entire process with real-time feedback and can even automatically identify the document type. This automates any data entry, creating a quicker process, and minimizing typing errors.

Intelligent data capture

With the right partner, manual data inputting can be minimized, and the risk of errors lessened with the likes of pre-filled forms and automatic document recognition.

Veriff’s intelligence data capture automatically identifies which document is being presented and guides the user through the capture process therefore the user doesn’t need to select which document they are using.

Veriff assesses the user session in real-time to guide users during the selfie and document capture. Clear and actionable user feedback due to poor lighting, glare, cropped ID, and obstructed facial images are just a few examples of how Assisted Image Capture pre-validate and boosts first-time pass rates.

FAQ´s

1. Why is KYC important in the wealth management customer onboarding process?

The KYC process is a crucial aspect when it comes to ensuring compliance with AML regulations. Within wealth management, the process takes place before someone becomes a customer for the first time. It ensures that the business has verified the identity of that customer and has acknowledged the level of risk the customer poses.

2. How can digital technology enhance the efficiency of the wealth management customer onboarding process while ensuring KYC compliance?

Today, digital AML and KYC compliance solutions exist to help companies fight financial crime. As well as supporting your KYC onboarding process, these solutions also help provide end-to-end AML compliance.

They can help you verify the identity of your customer, screen them against PEP and sanctions watchlists, check for adverse information and media, and provide ongoing monitoring.