KYC Article

AML compliance world-tour: Key identity verification regulations

Anti-money laundering and terrorist financing threats impact global finance, accounting for approximately 5% of GDP. Financial institutions need robust compliance to fight back. Learn about global efforts and regulations in our blog!

Anti-money laundering and the financing of terrorism have long posed major threats to the global financial system. Even within the European Union (EU), often regarded as having one of the most stringent legal regimes for anti-money laundering (AML) and terrorist financing prevention, Europol estimates that around 1% of the EU’s annual GDP is tied to suspicious transactions. On a global scale, the United Nations Office on Drugs and Crime (UNODC) estimates that 2–5% of worldwide GDP may be laundered money.

Therefore, it does not come as a surprise that preventing money laundering activity is a serious and complex issue, being a priority for regulators, law enforcement, and compliance officers around the world. For financial institutions and other regulated entities, maintaining a robust AML compliance program is crucial, thecost of neglecting these obligations can be devastating, impacting not only individual institutions, but the economy as a whole. We have explored in the previous blog the meanings and importance of concepts such as AML compliance, CDD measures, and KYC processes. The points discussed in the previous blog bundled with the rapid digitalization of financial services make it clear – that anti-money laundering compliance must start from smooth and compliant remote identity verification

Anti-money laundering compliance: The global challenge

Financial institutions play a pivotal role in safeguarding the financial system from illicit funds. Their compliance with AML regulations, terrorism financing laws, and customer identification requirements directly determines how effectively banks and financial operators can combat financial crime.Keeping up with fast-changing AML regulation is a constant challenge. As the financial sector rapidly digitizes, implementing seamless and compliant remote identity verification has become a cornerstone of anti-money laundering and terrorist financing controls.

Intent

This overview explores how major jurisdictions regulate identity verification within AML frameworks, helping you understand regional approaches, from the Bank Secrecy Act (BSA) in the United States to the Money Laundering Regulations in the UK.Whether you’re navigating FinCEN rules, identifying beneficial owners, or evaluating your compliance officer’s procedures, this guide can help clarify your obligations. However, due to the complex and country-specific nature of AML laws, it should not be taken as legal advice.

Adopting a risk-based approach is fundamental to meeting your AML obligations. A risk-based approach recognises that ML/TF risks are not the same for every business, customer or transaction. It recognises that you are best placed to understand your particular ML/TF risks with a thorough knowledge of your business.

United States

Regulatory framework overview

The Bank Secrecy Act (BSA) is the cornerstone of BSA/AML compliance in the United States. It empowers the Department of the Treasury and its bureaus, especially the Financial Crimes Enforcement Network (FinCEN), to impose reporting and recordkeeping requirements that detect and deter financial crimes.

While multiple agencies such as the Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation, and National Credit Union Administration issue related rules, FinCEN regulations (codified in Title 31, Chapter X of the Code of Federal Regulations) provide the most comprehensive guidance for a wide range of financial services businesses.

Identity Verification requirements overview

FinCEN regulations are codified in the Code of Federal Regulations in Title 31, Chapter X. Although rules for each type of financial institution are separate and vary, there are quite a few common steps that financial institutions can take before deep-diving into their specific applicable requirements.

Financial institutions must establish and maintain a written AML compliance program that includes:

- Risk-based CDD procedures, including identity verification

- A robust Customer Identification Program (CIP)

- Reporting mechanisms such as the Currency Transaction Report (CTR) and Suspicious Activity Report (SAR)

- Screening for Office of Foreign Assets Control (OFAC) sanctions

Under the CIP, institutions must collect and verify a customer’s full name, date of birth, address, and identification number, verifying this data through reliable documentation or non-documentary methods.

Identity verification requirements overview

FinCEN regulations are codified in the Code of Federal Regulations in Title 31, Chapter X. Although rules for each type of financial institution are separate and vary, there are quite a few common steps that financial institutions can take before deep-diving into their specific applicable requirements.

Firstly, different financial institutions must develop, test, and implement the anti-money laundering program, based on policies, internal controls, and procedures, all designed to prevent the facilitation of money laundering and terrorist financing the the use of financial institutions’ services.

The anti-money laundering programs must, among other things, include appropriate risk-based procedures for conducting customer due diligence, particularly identity verification. For example, financial institutions are mandated to collect the identifying information of their customers, which is typically composed of (i.) full name, (ii.) date of birth, (iii.) address, and (iv) identification number, and reasonably verify the accuracy of these pieces of information.

Talk to us

Our identity verification experts are ready to help build you a solution that gets more honest customers onboarded faster, and more securely, than ever before

United Kingdom

Regulatory framework overview

The Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 form the backbone of the UK’s AML regime. Financial institutions should pay close attention to Part 3, which sets customer due diligence requirements. Supporting materials such as the FCA Handbook and the JMLSG Guidance offer practical direction, often referenced by regulators and courts when assessing AML compliance.

Identity Verification requirements overview

Financial institutions must collect a customer’s name, address, and date of birth and verify the information through government-issued documents or trusted electronic verification systems, ensuring security equivalent to face-to-face verification.

Australia

Regulatory framework overview

In Australia, AML regulation is defined by the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 and Rules Instrument 2007 (No.1). The Australian Transaction Reports and Analysis Centre (AUSTRAC) provides detailed guidance and enforces these laws.

Identity Verification requirements overview

Financial institutions must collect at least the full name and either address or date of birth of customers. Verification can occur through documentary, electronic, or hybrid methods, such as the government’s Document Verification Service (DVS).

Brazil

Regulatory framework overview

The foundation of Brazil’s AML system lies in Law No. 9,613 (1998), which mandates customer identification and reporting of suspicious transactions.

Identity Verification requirements overview

Under Circular No. 3,978 (2020), institutions supervised by the Central Bank of Brazil must follow a three-step process:

- Identify (full name and CPF or equivalent)

- Verify via reliable sources

Qualify the customer, assessing address, economic activity, and risk profile.

Canada

Regulatory framework overview

Canada’s AML obligations derive from the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), administered by FINTRAC.

Identity Verification requirements overview

FINTRAC’s guidance allows identity verification via government-issued documents, whether in person or remotely using approved technology (e.g., Veriff). Key information includes name, document type, number, issuing country, and expiry date.

Germany

Regulatory framework overview

Germany’s Money Laundering Act (GwG) outlines detailed CDD requirements under Section 3. The regulator BaFin issues additional guidance on risk-based procedures and reporting.

Identity Verification requirements overview

Institutions must collect full name, date and place of birth, nationality, address, and document details. Remote verification via live video interviews is permitted under Circular 3/2017 (GW), soon to be expanded to include more technological methods.

Spain

Regulatory framework overview

Spain’s Law 10/2010 and Real Decreto 304/2014 govern AML and CFT requirements, enforced by SEPBLAC.

Identity Verification requirements overview

Financial institutions must collect name, date of birth, document number, nationality, and residence. SEPBLAC-approved methods, such as video identification, enable remote verification using providers like Veriff.

How Veriff can help

Veriff assists customers in navigating the complex terrain of regulatory and compliance obligations with cutting-edge identity verification technology. In industries where knowing your customer (KYC) and anti-money laundering (AML) regulations are stringent, Veriff’s solutions streamline the verification process, ensuring that businesses can remain compliant with local and international laws. By employing advanced AI and machine learning algorithms, Veriff automatically verifies the authenticity of documents and the identity of users, reducing the risk of fraud. This not only fortifies trust and safety online, but also significantly diminishes the legal and financial repercussions associated with non-compliance.

By leveraging machine learning, Veriff ensures robust anti-money laundering and terrorist financing prevention, maintaining regulatory compliance while improving user experience.

Staying compliant with international AML regulations requires more than just verifying identities. Veriff’s AML Screening solution helps businesses automatically check customers against global sanctions, PEP, and adverse media lists, ensuring a complete risk assessment as part of their KYC and AML workflows. Combined with Veriff’s advanced identity verification tools, it enables organizations to build a truly end-to-end compliance process that meets regulatory expectations worldwide.By employing advanced AI and machine learning algorithms, Veriff automatically verifies the authenticity of documents and the identity of users, reducing the risk of fraud. This not only fortifies trust and safety online, but also significantly diminishes the legal and financial repercussions associated with non-compliance.

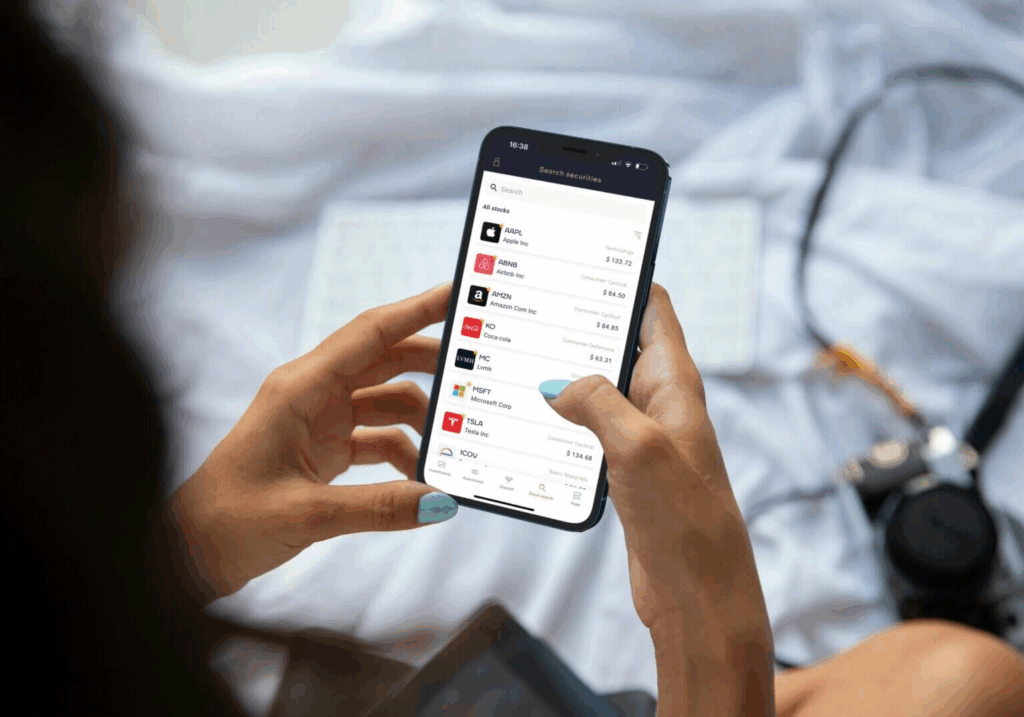

Case study spotlight: Fundvest & Veriff

In the investment-app space, regulatory pressure to balance compliance with user experience is intense. Fundvest is a mobile app founded in 2019 that enables users in Estonia, Lithuania and Latvia to invest in stocks and ETFs, turned to Veriff to win that balance. Veriff’s integrated solution (covering identity checks, document verification, PEP screening and AML checks) allowed Fundvest to automate onboarding from day one, reduce friction, scale rapidly and mitigate fraud — all while meeting KYC/AML obligations.

Frequently Asked Questions

- Why is proper identity verification essential for AML compliance?

Without reliable identity verification, businesses cannot meet CDD or KYC standards, undermining overall AML compliance.

- What challenges do businesses face in global AML mapping?

Each country has different AML frameworks. Compliance officers must map out local AML regulations, ensuring each business line meets its jurisdiction’s requirements.

- How can technology improve AML compliance?

Advanced solutions like Veriff’s AI-driven identity verification streamline CDD, detect anomalies, and simplify SAR and CTR filing—helping you demonstrate compliance to regulators.

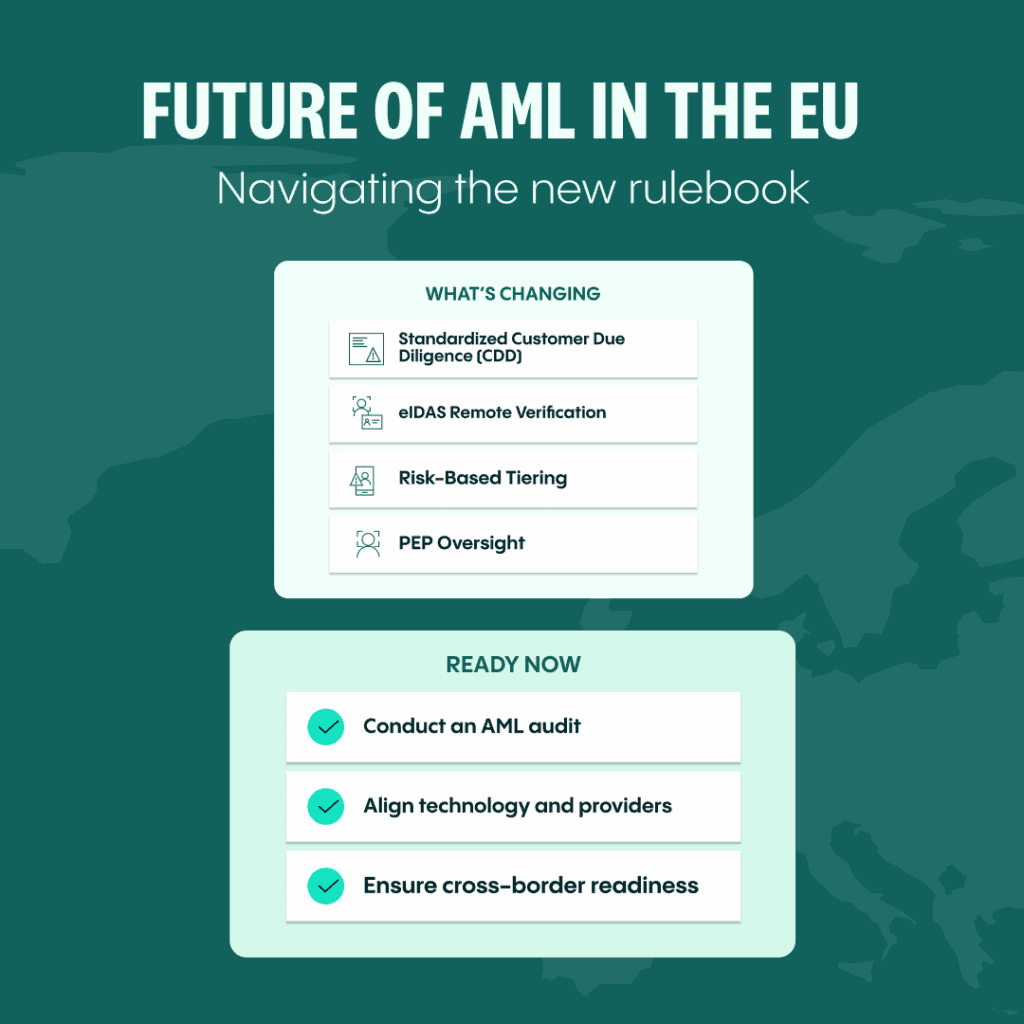

Navigating the new wave of EU AML rules

The European Commission is advancing a unified Anti-Money Laundering Regulation (AMLR) and Regulatory Technical Standards (RTS) to create a single EU rulebook.

Key highlights

- Standardized CDD: Clear identification requirements for individuals and beneficial owners.

- Remote Verification: Recognition of eIDAS-compliant digital onboarding.

- Risk-Based Tiering: Defined rules for simplified and enhanced due diligence.

- PEP Screening: Stronger oversight for politically exposed persons

What to do now: Audit your AML compliance program, assess tech providers, and align with cross-border regulatory expectations.

Disclaimer: Veriff does not provide legal advice. This material is for informational purposes only. Always consult a qualified AML compliance officer or legal counsel regarding your specific obligations.