KYC Article

KYC issues and challenges

Putting proper KYC processes in place is essential if you’re looking to ensure compliance with anti-money laundering directives. However, when they’re creating AML and KYC processes, many companies are wasting huge sums of money and countless man hours because their processes are ineffective.

Rising costs, lengthy onboarding processes, and poor conversion rates are all issues that can arise if KYC processes are not carried out efficiently.

Thankfully, KYC issues can be simple to overcome when the right processes and structures are put in place. To help you learn more about how to overcome common KYC issues and challenges, we’ve put together this handy guide.

Common challenges for KYC compliance

Putting proper KYC processes in place is essential if you’re looking to ensure compliance with anti-money laundering directives.

However, when they’re creating AML and KYC processes, many companies are wasting huge sums of money and countless man hours because their processes are ineffective.

Common challenges faced by firms include:

- High onboarding costs

- Low conversion rates

- Lengthy onboarding processes

- Poor record keeping

- An inability to spot a change in circumstances

- Wasting time and money on false positives

How can you prevent these?

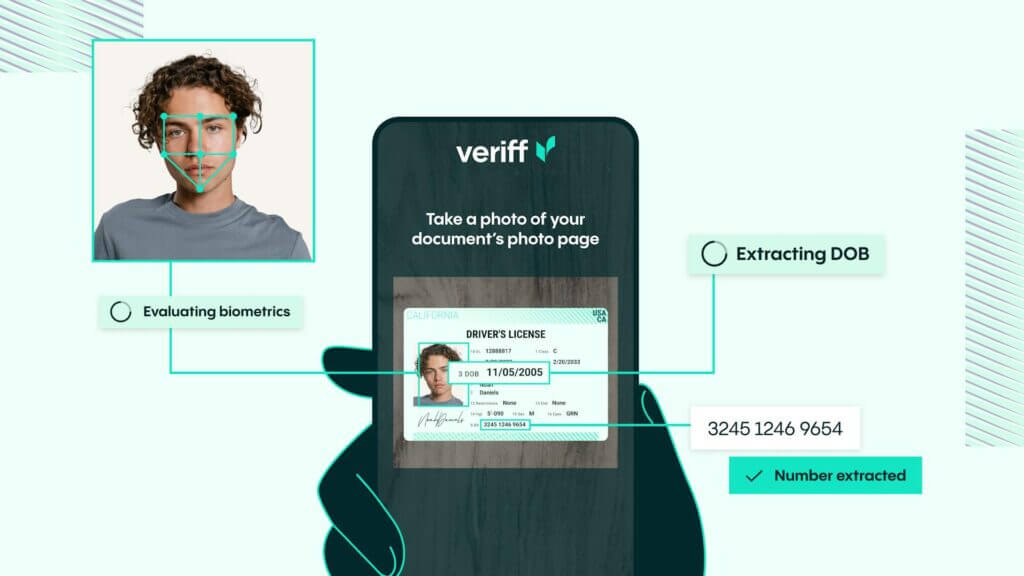

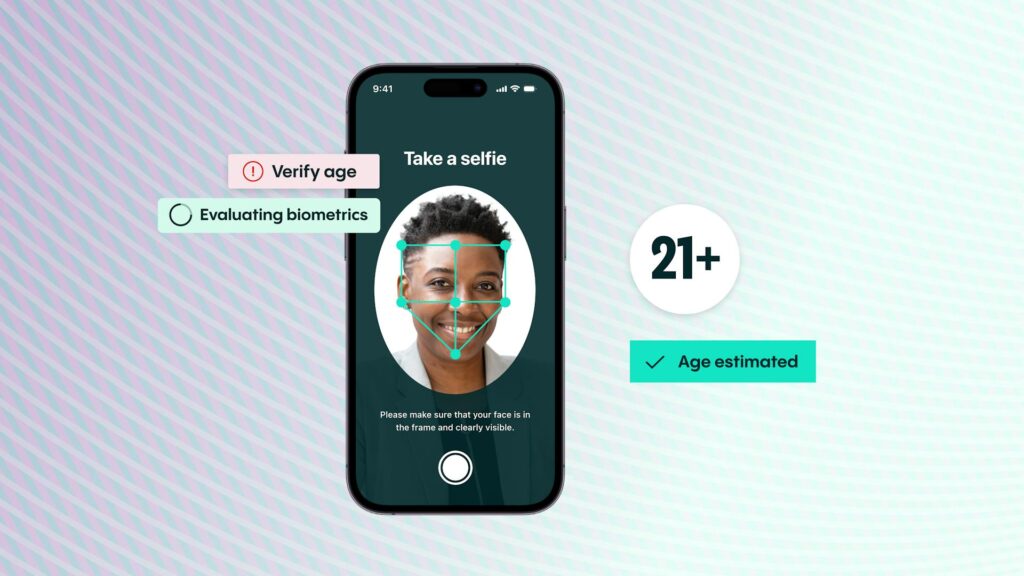

The easiest way to prevent any of these challenges arising is by using a class-leading AML and KYC compliance solution. By enlisting the help of a piece of software such as this, you can automate much of the process and save on man hours. Plus, you can also verify the identity of your customers in as little as six seconds.

By using a dedicated piece of software, not only can you overcome KYC issues, but you can also show regulators that you take financial crime and compliance seriously. On top of this, you can also ensure that you’re only ever asking your customers for the information you actually need, so the process won’t appear burdensome.

KYC compliance checklist

Due to the importance of AML policies, a number of AML fundamentals exist that businesses must follow regardless of the jurisdictions they operate in.

These fundamentals work as forms of best practice and should form the basis of a KYC compliance checklist that you follow on a daily basis. These fundamentals include:

Customer identification program (CIP)

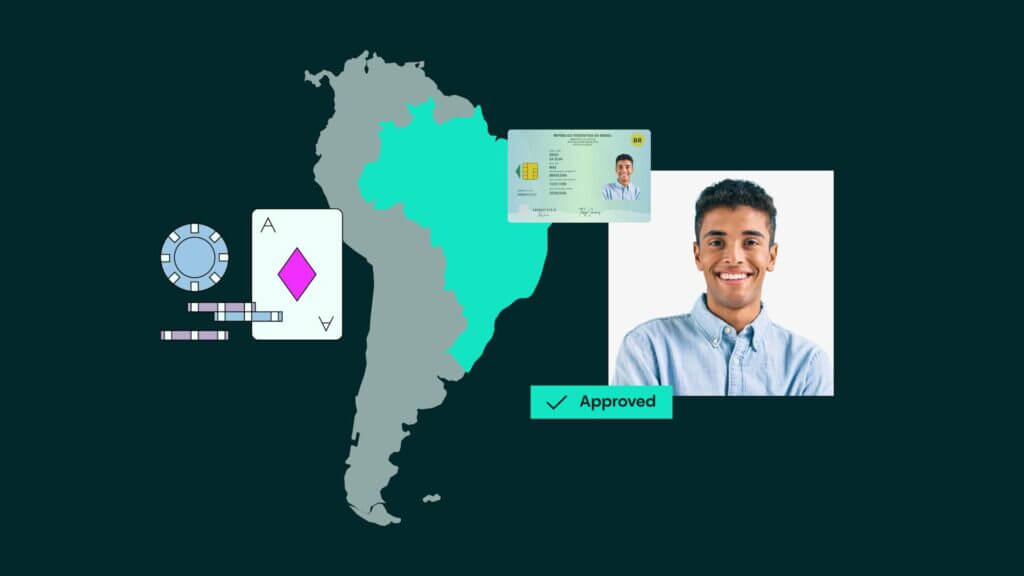

As part of your CIP, you must identify your customers and their financial background. This process will also help you monitor their financial activities once they’ve opened an account.

When onboarding your customers, you must ask them for several key pieces of personal information, including their full name, date of birth, and permanent address. The customer must also provide you with a copy of an identity document, so you can verify this information.

Customer due diligence process (CDD)

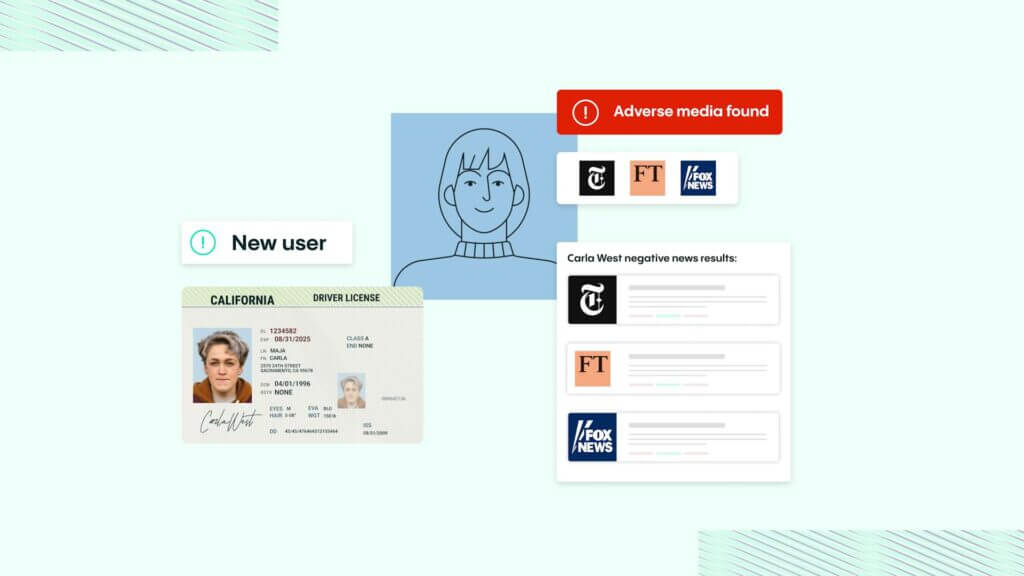

Once you’ve identified your customer, you must then calculate what level of risk this customer poses to your business. Depending on the customer, you can employ one of three levels of CDD. These are:

- Simplified Due Diligence (SDD)

- Customer Due Diligence (CDD)

- Enhanced Due Diligence (EDD)

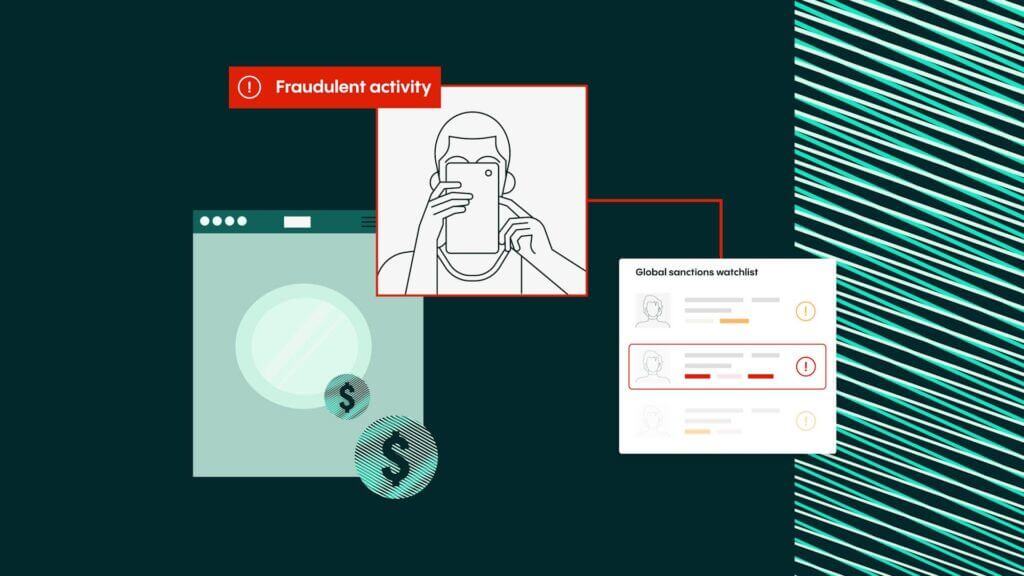

While customers who pose a low level of risk will be subjected to SDD as part of the onboarding process, those who pose a high level of risk (such as a politically exposed person) will be subjected to EDD processes.

Ongoing monitoring

Effective KYC processes don’t stop once a customer has successfully opened an account. Instead, you must monitor your customers on an ongoing basis. This will help you spot whether their risk level has changed or whether their activities are suspicious.

By continually screening your customers, you can keep an eye on their transactions and receive alerts if anything suspicious happens.

Tips for overcoming KYC issues

Although KYC issues can cause headaches for businesses, it is possible to overcome them with the correct planning and organization. Our top tips for overcoming KYC issues include:

Put written policies in place

AML regulations and KYC processes can be complex. Many of them also need to be followed to the letter. As a result, to make sure all staff members understand your processes and follow them correctly, you must put written policies in place. This way, all of your policies can be viewed by both staff members and regulators. Within your written policies, you should include information regarding:

- What your identification processes include

- What reports you create

- What regulations you’re currently complying with and how you ensure compliance

- How you communicate with regulators

- Your record retention policy

- How regularly your policies are reviewed

- Whether your policies have been independently audited

Employing a compliance officer

On top of this, you should also employ an experienced AML compliance officer who can guide your AML and KYC efforts.

A compliance officer should help you put your AML program in place, resolve KYC issues, and regularly review compliance.

Overall, the role of an AML compliance officer is to take ownership over the system and ensure that processes are followed and updated. They must also ensure that reports are filed, training is correct, and that the system is running smoothly.

Use a risk-based approach

As we mentioned earlier, the way you approach KYC and due diligence should reflect the level of risk that your firm faces. Due to this, you should employ a risk-based approach to customer due diligence (CDD) rather than making each customer face the same checks. This way, you can ensure that your approach to KYC and compliance is appropriate and proportional.

By employing a risk-based approach to CDD, you will receive a number of benefits. For example, you can make sure that you’re meeting your compliance obligations.

However, a risk-based approach to CDD will also help you overcome a number of KYC issues. For example, you can lower costs by only paying for the checks you need. You’ll also improve your conversion rates because customers won’t be subjected to onerous checks.

Speak with the KYC compliance experts at Veriff

Here at Veriff, our AML and KYC compliance solution can help you show regulators that you take financial crime and compliance seriously. It can also help you comply with regulations and fight financial crime.

If you’re interested in learning more about how you can meet your obligations while making the process as frictionless as possible for your customers, then talk to the KYC compliance experts at Veriff today.