KYC Article

What is KYC in crypto?

KYC is a requirement you’ll encounter on almost all centralized crypto exchanges. That said, it is still possible for customers to purchase crypto without going through a crypto KYC process. However, these methods are far more complicated and much riskier. Read on to find out more.

Cryptocurrencies are disrupting the world of finance. However, because cryptocurrencies are cryptographically secured on their blockchains, transactions between users are generally anonymous and take place in an instant. Due to this, crypto transactions provide opportunities for criminals who are looking to evade conventional AML/CFT controls.

Global regulators are now paying greater attention than ever to crypto. For example, in 2019, the SEC, FinCEN and CFTC classified crypto exchanges as money service businesses (MSBs). This meant that these businesses became subject to know your customer (KYC) and anti-money laundering (AML) rules under the Bank Secrecy Act of 1970.

Due to this, before any customer opens an account on a cryptocurrency exchange, they’re now asked to go through a KYC process. This crypto KYC process involves the exchange verifying your identity and proving that you are who you’re claiming to be.

How does KYC work with crypto?

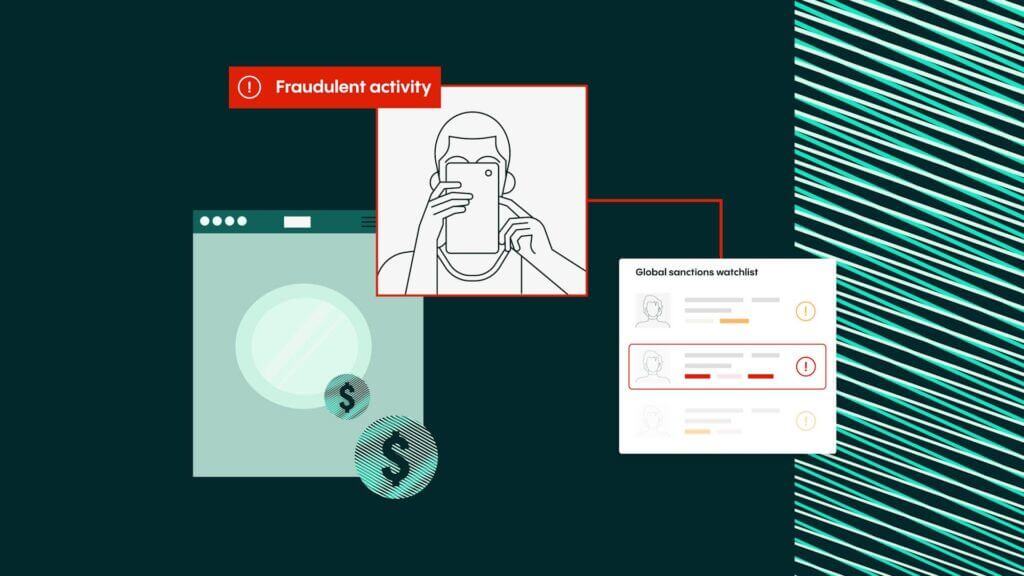

By confirming the identity of a customer, KYC in crypto aims to prevent illegal activities such as money laundering, terrorist financing, and tax evasion.

Some exchanges may allow a customer to create an account before they go through the crypto KYC process, but these accounts are usually highly restricted until the identity verification process is complete. For example, many exchanges won’t allow a customer to actually purchase cryptocurrency or withdraw funds until their identity has been verified. Others will place a limit on deposits.

Every crypto exchange will handle KYC slightly differently. However, generally speaking, during the KYC process, you will need to provide the cryptocurrency exchange with your:

- Full name

- Date of birth

- Residential address

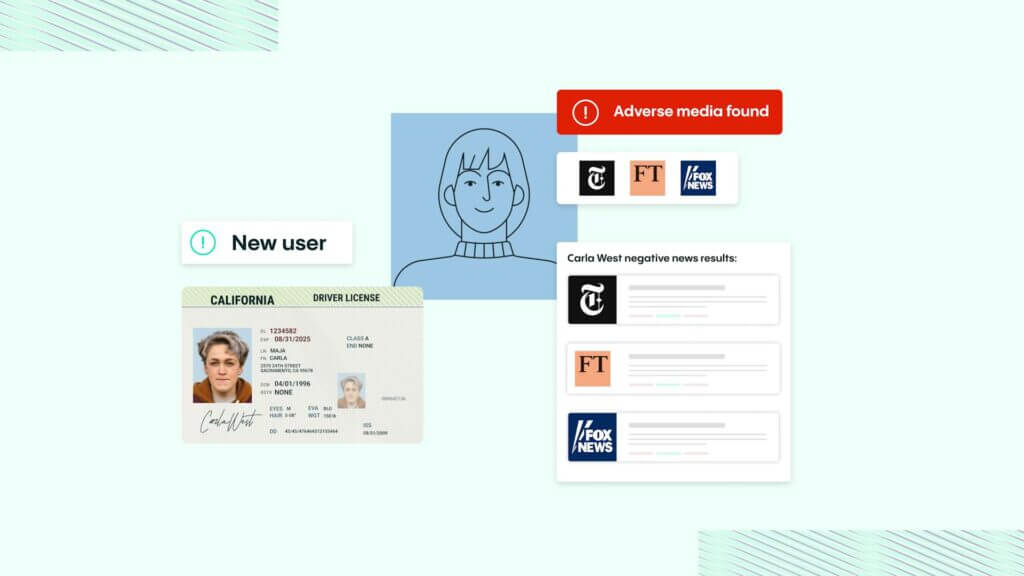

Following this, the crypto exchange will ask you for a photo of a valid government-issued ID card, such as a driver’s license or a passport. They will then use this information to verify your identity. When your identity is successfully verified, they will provide you with access to their services.

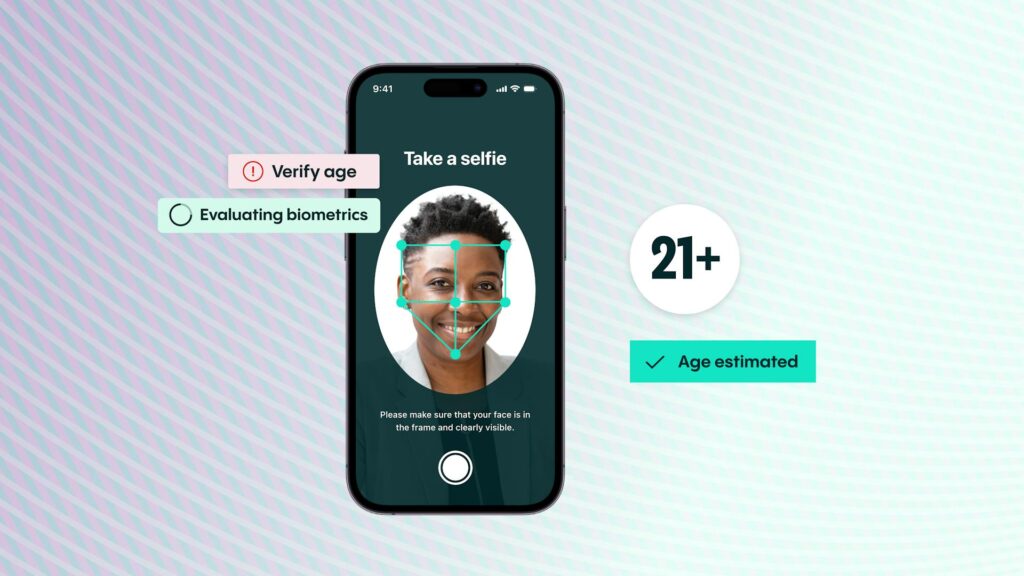

In some instances, a cryptocurrency exchange will go through an enhanced customer due diligence process. In these instances, you may also be asked to provide them with a selfie and some additional information. Financial Action Task Force (FATF) recommendations suggest that crypto exchanges should adopt a risk-based approach to crypto KYC compliance. This means that low-risk customers will face simpler measures, while high-risk customers will have to meet more intensive crypto KYC compliance measures.

In addition, FATF guidelines also suggest that crypto exchanges should monitor their customers on an ongoing basis. They should also:

- Screen customers to make sure they’re not subject to international sanctions

- Ensure they’re not a politically exposed person (PEP)

- Screen the customer for adverse media

Can you buy crypto without KYC?

KYC is a requirement you’ll encounter on almost all centralized crypto exchanges. That said, it is still possible for customers to purchase crypto without going through a crypto KYC process. However, these methods are far more complicated and much riskier.

Buyers who prefer to stay anonymous can buy cryptocurrency using decentralized exchanges and bitcoin ATMs. Although decentralized exchanges do have security measures in place that are designed to prevent fraud, there’s still a possibility that the customer will be scammed. On top of this, decentralized exchanges tend to be less user-friendly than quality centralized exchanges and they cost users more in transaction fees.

For this reason, even though buyers do have options in place if they wish to stay anonymous, it’s far better for legitimate buyers to go through the crypto KYC process with a regulated exchange. This is particularly the case because the process can be completed incredibly quickly.

Does KYC affect anonymity and decentralization?

By its very nature, the decentralized economy is prone to problems regarding KYC. After all, decentralized services are designed to allow customers to remain anonymous and keep their personal information private from any central authority. Due to this, many crypto firms cannot identify who their customers are.

However, regulators have become increasingly unhappy with this situation and, although it affects anonymity, even the most reluctant crypto exchanges have been compelled to introduce steadily more stringent crypto KYC measures after facing pressure from regulators.

That said, it’s important to point out that KYC requirements do not apply to decentralized exchanges (DEXs). This includes all companies that organize trades through smart contracts instead of a central trading desk.

These institutions are not subject to current regulations because they are not considered to be financial intermediaries or counterparties. This is because their users trade directly with one another by leveraging the infrastructure provided by the DEX.

However, although DEXs are not currently bound by KYC requirements, regulators around the world are continually altering the laws and regulations that govern crypto KYC. As a result, DEXs may be regulated in the future.

What are the benefits and why does crypto need KYC?

The KYC process is a foundation of AML/CFT compliance regulations. These regulations require financial institutions to identify their customers and understand their relationship with them.

KYC is important in financial contexts because criminals employ a range of strategies to evade AML/CFT controls. Thankfully, by building a rich and accurate risk profile of each customer, a crypto exchange can easily identify users that are misusing their services, and prevent crimes like money laundering and terrorism financing.

KYC helps to form trust and transparency with clients

Verifying the identity of a user can help improve transparency and build customer trust. After all, if a customer is confident that your cryptocurrency exchange is taking proactive and precautionary measures to protect their accounts, they’re more likely to continue using your service.

KYC lowers the risk of financial crime

Since 2016, cryptocurrency fraud has been on the rise. In fact, Forbes suggests that there were 80,000 cases of cryptocurrency fraud in the US alone in 2020. This represents a 24,000% increase on the same figure from 2016. Further research has also suggested that illicit cryptocurrency transactions totaled around $14 billion in 2021 – a rise of 79% from $7.8 billion in 2020.

This shows exactly why regulators are so keen for cryptocurrency exchanges to implement robust identity verification and KYC procedures. With the help of these measures, not only can crypto exchanges reduce the likelihood of financial crime taking place, but they can also reduce fraudulent activity and boost market reputation.

KYC assists in the stabilization of cryptocurrency exchanges

The cryptocurrency market is known for its volatility. However, some of this volatility is fueled by anonymous transactions that are illegal in nature.

If cryptocurrency exchanges embrace KYC and customer verification methods, then the market will become more stabilized. This will increase the value of the market and will attract new customers to the space.

Robust KYC policies ensure future compliance for companies

Legal expectations surrounding KYC compliance continue to change and evolve, and many exchanges have struggled to embrace these policies. Due to this, cryptocurrency exchanges that implement effective KYC policies are ahead of the curve. This means that instead of trying to catch up, these cryptocurrency exchanges can instead focus on improving conversion rates and streamlining transactions.

Of course, these companies do still need to ensure that they continue to comply with evolving international guidelines. However, by demonstrating their KYC credentials, they can reduce their risk of legal challenges or regulatory penalties.

Let Veriff help you with seamless onboarding

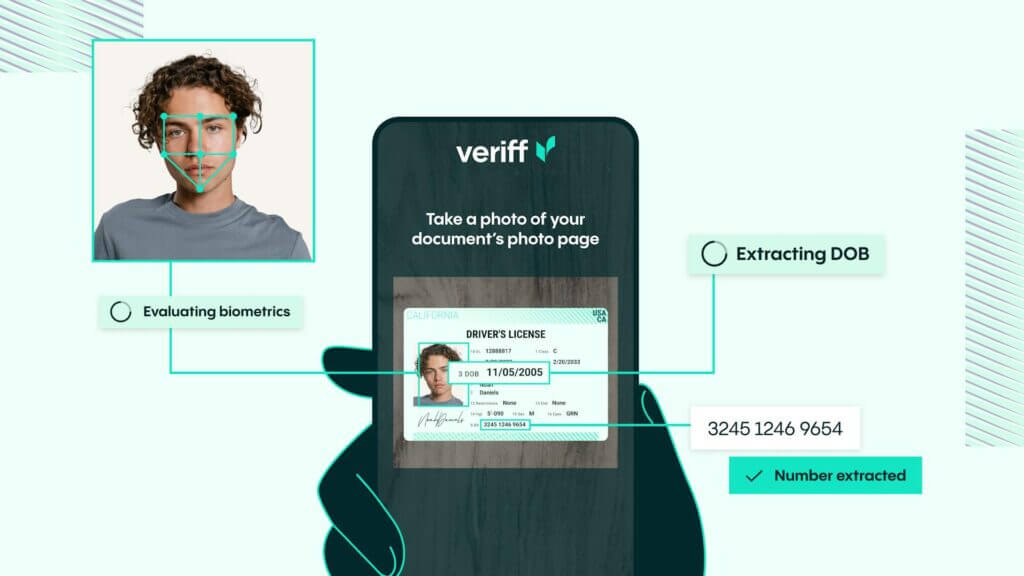

At Veriff, we help make investing in crypto safe and easy. Our AML and KYC compliance solution can not only help prevent fraud, but it also provides industry-leading conversion rates.

Our crypto solution also includes a decision-making engine that can confirm a verification quickly. What’s more, our user flow gets customers through the verification process seamlessly, and 95% of customers are verified on the first try, with the average verification taking only six seconds.

On top of this, our solution also guarantees compliance and integrates within your existing system.

Speak with the KYC compliance experts at Veriff

Interested in learning more about your crypto KYC compliance obligations, or want to discover how our solutions can help you? Speak to our compliance experts today.

We’d love to provide you with a personalized demonstration that shows you exactly how our solutions can help you stay compliant and fight fraud.