IDV Article

Top 5 unique US identity documents essential for financial services

In today’s U.S. financial services, identity verification isn’t just about the familiar driver’s licenses and passports. With strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, financial institutions often encounter unique and less conventional forms of identification. These documents, though lesser-known, provide critical identification options for serving specific communities and situations, playing a pivotal role in compliance and security.

In the complex landscape of U.S. financial services, identity verification plays a critical role in ensuring compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

In the United States, ID verification is a crucial process across various sectors, from financial services to government programs. While the specific requirements may differ depending on the agency or organization, certain documents are widely accepted for verification purposes. Below is a list of primary and secondary documents commonly used to confirm identity in the US, including state-issued IDs, passports, Social Security cards, birth certificates, military IDs, and tribal IDs.

While standard identity documents like driver’s licenses and passports are well-known, some lesser-known documents offer unique identification options for financial services companies. These documents may serve specific communities or purposes, and could be encountered in verification processes.

Here, we explore five of the most uncommon but important identity documents in the United States:

1. Tribal ID Cards

Tribal identification cards serve as official proof of enrollment and membership within a tribe. Only those issued by federally recognized tribes are authorized for identity verification (IDV), ensuring compliance with recognized standards. Cards from unrecognized authorities are not accepted for IDV, underscoring the importance of trust and security in identification processes. A federally recognized, tribal-issued ID card is also a valid form of government-issued photo identification in many places, though some may be unaware. For example, a tribal ID card is valid at federal buildings, airports, and banks. Regulatory Compliance Officers must ensure their systems can support verification of these documents, as they are increasingly accepted in financial services for KYC purposes. Their cultural and legal significance adds an extra layer of importance in correctly verifying and accepting these IDs.

Use case: Customer verification in underrepresented communities

- Financial institutions can use tribal ID cards for KYC purposes to verify identity for individuals from federally recognized tribes, which is especially relevant in areas with larger Native American populations.

- Tribal IDs support inclusivity in banking services by providing access to individuals who may not possess standard forms of identification. They are also valuable for verifying customers accessing tribal-specific benefits like healthcare and education services, adding compliance security for both the institution and the individual.

Key use

Access to tribal services and benefits, such as healthcare and education, with varying acceptance outside tribal contexts.

2. The Merchant Mariner Credential (MMC)

The Merchant Mariner Credential (MMC) is an official identification document issued by the United States Coast Guard, certifying an individual’s qualifications to serve aboard U.S.-flagged vessels. It consolidates multiple credentials into a single document, including endorsements for deck and engineering positions, medical certificates, and safety and security certifications. This credential is essential for maritime professionals, confirming their training, proficiency, and legal authorization to work on both commercial and government vessels, as well as supporting national security through access to restricted maritime zones.

Use case: Verification for maritime and security professionals

- Financial institutions serving maritime professionals can use the MMC for identity verification in KYC processes. This is especially relevant for institutions located near ports or serving clients in maritime industries.

- The MMC’s consolidated credentials verify eligibility and security clearance, supporting identity checks for professionals involved in both commercial and government-related maritime work.

Key use

The MMC authorizes and verifies maritime professionals’ qualifications to work on U.S.-flagged vessels, allowing access to secure areas and execution of critical duties for operation and safety.

3. U.S. Passport Card

Compliance consideration

While less common than the traditional U.S. passport, the passport card is used for land and sea travel in North America. It serves as a convenient identity document within the U.S. Regulatory Compliance Officers should note that while it may be used for travel purposes, it cannot be used for international air travel. However, it is valid for KYC processes, offering a compact, wallet-friendly alternative for identity verification.

Use case: Verification for cross-border customers

- Financial services can use the U.S. Passport Card to identify customers who frequently travel between the U.S., Canada, Mexico, and the Caribbean. It’s a wallet-friendly alternative to traditional passports for domestic identification.

- This card aids institutions in serving customers who may prefer it over bulkier travel documents, especially for KYC processes in border regions or international travel-focused financial services.

Key use

Travel between the U.S., Canada, Mexico, and the Caribbean, as well as general identity verification in financial services.

4. Enhanced Driver’s License (EDL)

Compliance consideration

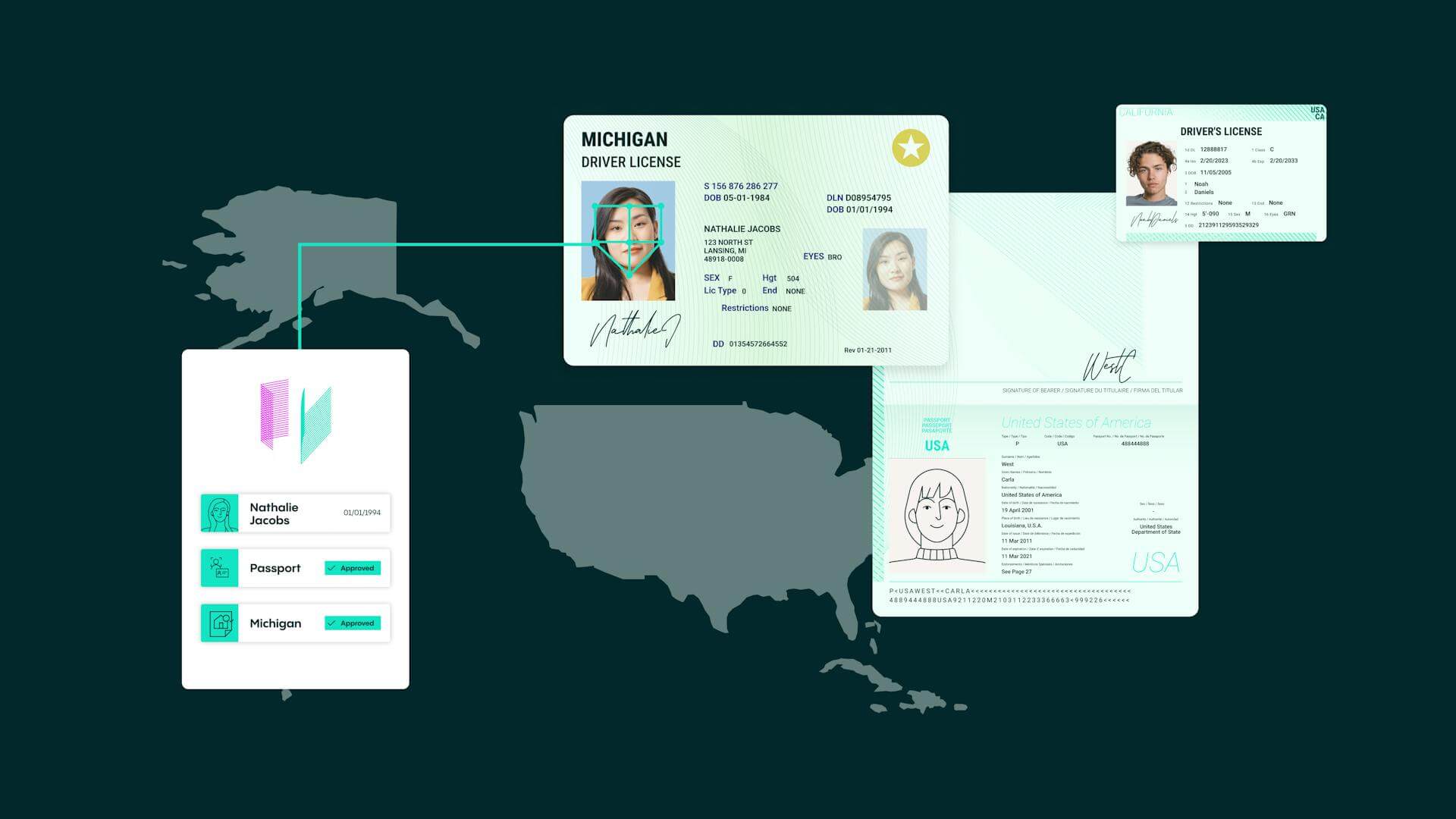

Available in states like Michigan, Minnesota, Vermont, New York, and Washington, the Enhanced Driver’s License (EDL) allows re-entry into the U.S. from Canada, Mexico, and the Caribbean by land or sea, serving as both a driver’s license and a passport alternative. It includes advanced security features, such as RFID technology, which Regulatory Compliance Officers must be aware of when verifying these documents in cross-border transactions. Ensuring compliance systems are equipped to handle EDLs is critical for institutions near U.S. borders.

Use case: Cross-border transactions and identity verification

- The EDL supports verification for customers frequently traveling across the U.S. border to Canada and Mexico, making it ideal for financial institutions near these borders.

- Its RFID technology enables advanced security, aligning with regulatory standards for cross-border transactions, especially for financial services in border states. It allows efficient KYC checks for customers engaged in international business or travel.

Key use

Facilitating travel and identity verification, particularly for cross-border customers in participating states like Michigan and New York.

5. REAL ID-compliant Driver’s License or State ID documents

Compliance consideration

As the U.S. transitions to mandatory REAL ID compliance by May 2025, these documents will become essential for domestic air travel and access to federal facilities. Regulatory Compliance Officers should prepare their verification systems to handle the influx of REAL ID-compliant documents, ensuring they meet the stringent documentation and security requirements. REAL ID will become a standard part of the identity landscape, making it indispensable for KYC processes.

Use case: Enhanced compliance with national standards

- As REAL ID becomes mandatory, financial institutions will increasingly rely on these IDs to meet compliance requirements for domestic travel and federal facility access.

- REAL ID simplifies KYC processes by providing a universally accepted identification standard, ensuring financial services can verify identities with a secure, federally recognized form of identification. This is critical for institutions aiming to streamline verification while adhering to national security measures.

Key use

Domestic travel and federal facility access, reflecting heightened national security standards.

How Veriff can help

Veriff supports government-issued IDs from over 230 countries and territories. Our intelligent decision engine analyzes thousands of technological and behavioral variables, fostering trust from the first interaction.

Veriff offers robust verification services for various U.S. identity documents, helping financial institutions meet their KYC and AML compliance requirements.

Here’s a list of supported U.S. documents by Veriff:

- U.S. Driver’s License: Veriff can verify state-issued driver’s licenses from all 50 states, ensuring compliance with KYC processes.

- The Merchant Mariner Credential (MMC): Veriff’s identity verification solutions can streamline the application process for the MMC, ensuring secure and swift verification of applicants.

- U.S. Passport and Passport Card: Both forms are accepted, allowing institutions to cater to diverse travel and identification needs.

- State-issued ID Cards: Similar to driver’s licenses, these non-driver IDs are verified seamlessly through Veriff’s platform.

- Tribal ID Cards: Veriff acknowledges the importance of tribal sovereignty and offers support for certain tribal IDs, depending on system integration.

Supported countries by Veriff

Open the door to users in more than 230 countries and territories across the globe.