IDV Article

How Identity Verification technology is transforming the digital payments sector

The financial industry is evolving rapidly, with technology reshaping how we make payments, borrow, invest, and bank. From mobile wallets to cryptocurrencies and robo-advisors, these innovations are transforming traditional financial services in both developed and emerging markets.

Introduction

Over the past decade, the banking and financial landscape has undergone a dramatic transformation, particularly in payments, lending, wealth management, and retail banking. This disruption has not been driven solely by financial technology (FinTech) startups; digital payment solutions, mobile wallets, peer-to-peer (P2P) payments, alternative lending, cryptocurrencies, and robo-advisors have gained widespread acceptance across both developed and emerging markets.

As digital payment solutions continue to reshape financial transactions, the industry faces an escalating challenge—digital payment fraud. Cybercriminals are constantly evolving their tactics, exploiting vulnerabilities in online payment systems to commit payment fraud through unauthorized transactions. From phishing scams and account takeovers to sophisticated malware attacks, fraudsters are leveraging advanced methods to bypass security measures and defraud businesses and individuals alike.

With the global digital payments market projected to reach $16.63 trillion by 2028, the scale of potential fraud risks is growing alongside this expansion. Simple fraud prevention solutions often fail to protect businesses from sophisticated fraud, making it crucial for businesses to stay ahead of emerging threats by implementing robust fraud prevention strategies, enhancing identity verification measures, and adhering to evolving regulatory requirements.

Discover the most common types of digital payment fraud, how they affect businesses and consumers, and the smart strategies you can use to stay one step ahead of the risks!

What is digital payment fraud?

Digital payment fraud is a type of financial crime that involves the unauthorized use of digital payment methods, such as credit cards, debit cards, mobile wallets, or online banking platforms, to commit fraudulent transactions. This form of fraud often occurs without the physical presence of the card or payment device, making it easier for cybercriminals to exploit vulnerabilities in online systems. Different types of fraud happen through various methods, including friendly fraud, phishing, skimming, and chargeback fraud, where fraudulent actors exploit sensitive payment information. Chargeback fraud is another significant issue, where a customer disputes a legitimate transaction by claiming it was unauthorized or defective, placing a financial burden on businesses.

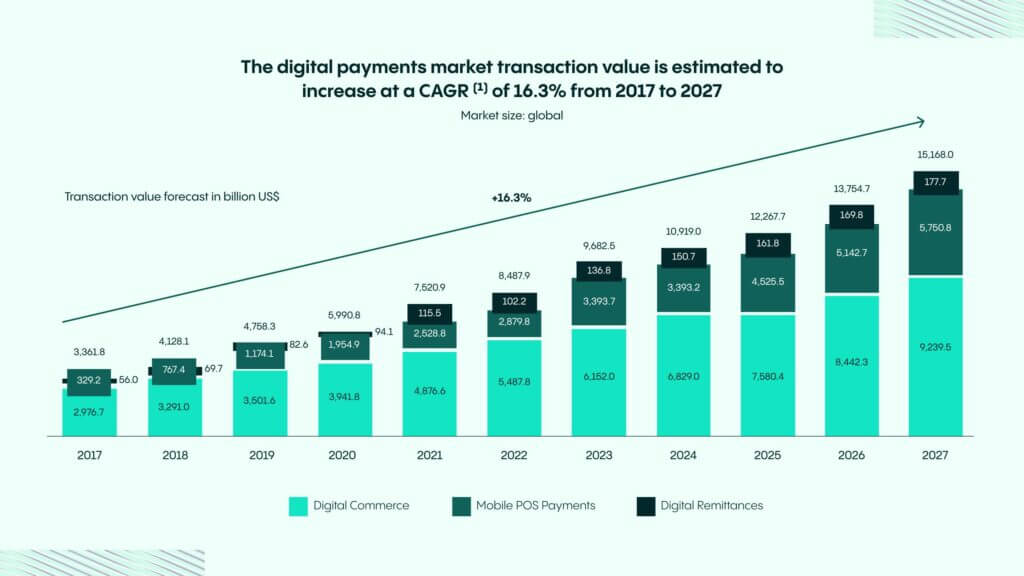

According to Statista’s Fintech Report (2024), the global digital payments market will grow at a compound annual growth rate (CAGR) of 15% from 2017 to 2028, highlighting the sector’s rapid expansion. This growth is driven by the increasing adoption of digital commerce, mobile point-of-sale (POS) payments, and digital remittances. In 2017, the total transaction value stood at $3.57 trillion, with digital commerce dominating at $3.18 trillion. By 2028, the market is expected to reach $16.63 trillion, with digital commerce rising to $10.34 trillion, mobile POS payments rising to $6.11 trillion, and digital remittances contributing $180 billion.

The steady rise in digital payment solutions highlights growing consumer dependence on technology driven by fintech advancements, increased smartphone usage, and the demand for secure, seamless payment experiences globally. Peer-to-peer (P2P) payments are seeing significant expansion, as more consumers rely on smartphones for banking, shopping, and transferring money. While P2P payments provide faster, cost-efficient services with instant transfers, they also pose heightened fraud risks due to high transaction volumes, limited regulatory oversight, and instant processing.

Uncover the Latest Fraud Trends in 2025!

Fraud is evolving—are you keeping up? The Veriff Fraud Report 2025 reveals the latest insights, regional fraud trends, and key takeaways to help businesses stay ahead of identity fraud.

Types of digital payment fraud

Digital payment fraud takes various forms, each posing significant risks to individuals and businesses. Understanding these fraud types is essential for implementing effective security measures. Below are some of the most common types of digital payment fraud:

1. Credit card fraud

Credit card fraud occurs when a fraudster gains unauthorized access to a credit card’s details to make purchases or withdraw funds. This information is often obtained through phishing scams, data breaches, card skimming devices, or hacking. Once acquired, fraudsters use the stolen details for online transactions or create counterfeit cards for in-person purchases. Beyond financial loss, victims may also experience credit score damage and lengthy disputes to recover lost funds.

2. Debit card fraud

Debit card fraud functions similarly to credit card fraud, but directly affects a victim’s bank account. Fraudsters steal debit card details, including the card number, expiration date, and PIN, through techniques like skimming, phishing, or malware attacks. Since debit card fraud involves direct withdrawals from the victim’s account, recovering lost funds can be more challenging than credit card fraud, where issuers often offer better consumer protection.

3. Chargeback fraud (Friendly Fraud)

Chargeback fraud, also known as friendly fraud, occurs when a legitimate customer disputes a transaction with their bank to get a refund—despite receiving the goods or services. Some fraudsters exploit this process to obtain free products or services, causing financial losses for merchants. Chargeback fraud can also occur due to misunderstandings, unauthorized transactions by family members, or buyers regretting their purchases.

By recognizing these types of digital payment fraud, individuals and businesses can take proactive measures to secure their transactions, such as multi-factor authentication, monitoring transactions, and employing fraud detection systems.

How do fraudulent transactions happen?

Digital payment fraud can occur through various sophisticated methods, each presenting unique challenges for detection and prevention. Card-not-present fraud is a significant and increasing concern in the digital payment landscape, occurring when unauthorized users make purchases without physically possessing the card. Fraudsters determine if a card is active by using it to sign up for services that perform an authorization check, which reveals whether the card can be successfully used for transactions:

- Phishing scams: Fraudsters send deceptive emails, texts, or fake websites to trick individuals into revealing sensitive information, such as payment card numbers, login credentials, or banking details.

- Skimming and malware attacks: Cybercriminals use hidden devices or malicious software to capture payment information from compromised ATMs, POS systems, or online platforms.

- Account Takeover (ATO): Hackers gain unauthorized access to user accounts using stolen credentials, allowing them to initiate fraudulent transactions through digital payment methods.

- Card cloning: Criminals copy payment card data onto counterfeit cards or digital payment platforms to conduct unauthorized purchases, often bypassing basic security measures.

- Identity theft: Personal information is stolen through data breaches or social engineering tactics, enabling fraudsters to create fake accounts or perform unauthorized digital transactions.

The impact of digital payment fraud

The consequences of digital payment fraud go far beyond immediate financial losses. Victims of digital payment fraud face significant challenges, including emotional and financial repercussions. Businesses suffer from damaged reputations, loss of customer trust, and higher costs for fraud prevention and chargebacks. For individuals, the recovery process can be stressful and time-consuming, often involving account closures and disputes over fraudulent charges.

Unfortunately, the net fraud rate – the total of all types of fraud combined – remains alarmingly high. According to the Veriff Identity Fraud Report (2025), 5% of all verification attempts in 2024 were fraudulent. In certain financial services sub-verticals, such as crypto and payment platforms, the rate has been nearly double the global average, reaching as high as 13.4%.

Proactive fraud prevention strategies, like strong authentication protocols, real-time transaction monitoring, robust identity verification solutions, and tools like Veriff, are critical to reducing these risks and protecting both businesses and individuals.

Industries most at risk of digital payment fraud

While digital payment fraud can impact any industry, certain sectors are particularly vulnerable due to the nature of their transactions and the volume of sensitive data they handle:

E-commerce

Online retailers face significant risks from digital payment fraud, including card-not-present (CNP) fraud and account takeover (ATO) fraud. The high volume of online transactions and reliance on digital payment gateways make e-commerce platforms prime targets for fraudsters. Additionally, the use of credit and debit cards in online transactions increases the risk of fraud, necessitating robust security measures.

Financial institutions

Banks, credit unions, and fintech companies are top targets for digital payment fraud due to the sensitive financial data they process. Common threats include credit card fraud, debit card fraud, and phishing attacks aimed at compromising customer accounts. Financial institutions must implement comprehensive fraud prevention strategies to mitigate these risks.

Retail

Both brick-and-mortar and online retailers are susceptible to fraud. In physical stores, skimming devices and card-present fraud pose risks, while their online counterparts face challenges related to payment gateway breaches and fraudulent chargebacks.

Hospitality

Hotels, travel agencies, and other hospitality businesses often handle large volumes of transactions involving personal and payment information. This makes them vulnerable to credit card fraud, identity theft, and booking-related scams where stolen payment credentials are used.

Investing in fraud detection can help merchants minimize chargeback risks and associated fees, making it essential for them to adopt comprehensive fraud prevention strategies.

Regulatory compliance challenges

Regulatory compliance presents significant challenges for businesses operating in the digital payments sector, as they must navigate complex and evolving legal frameworks across different jurisdictions. In Europe, the revised Payment Services Directive (PSD2) imposes new legal responsibilities on payment providers, holding them accountable for online payment fraud across their sellers. In the US, regulations likethe Bank Secrecy Act (BSA),FinCEN’s AML rules, and theUSA PATRIOT Act impose stringent requirements for anti-money laundering (AML) measures,customer due diligence, and transaction monitoring to detect and prevent financial crimes. Meanwhile, businesses in the UK must comply withthe Payment Services Directive 2 (PSD2), the Proceeds of Crime Act (POCA),the UK Fraud Act 2006, and the AML Regulations 2017, which mandate strong customer authentication, fraud prevention protocols, and reporting obligations. These regulations require continuous adaptation as financial crimes become more sophisticated. Payment providers must implement advanced identity verification technologies and comprehensive compliance strategies to mitigate risks, avoid hefty fines, and maintain operational integrity.

Choosing the right payment fraud prevention solution

Choosing a payment fraud prevention solution can be a daunting task. Businesses must consider various factors, such as the type of fraud they want to prevent, the level of risk they’re willing to take, and the cost of the solution. To make an informed decision, businesses must learn about the different types of payment fraud prevention solutions available, such as risk assessment, transaction monitoring, and authentication. They must also consider the success stories of other businesses that have implemented similar solutions. By understanding the different options and their effectiveness, businesses can choose a solution that best fits their needs and enhances their fraud prevention efforts.

The role of Identity Verification in payment fraud prevention

Identity verification plays a crucial role in payment fraud prevention. By verifying the identity of customers, businesses can ensure that they’re not dealing with fraudsters. This can be achieved through various means, such as biometric authentication, document verification, and behavioral analysis. Additionally, businesses must invest in antivirus software to protect themselves from malware and other types of cyber threats. By doing so, they can improve their chances of success in preventing payment fraud. Implementing robust identity verification measures not only enhances security but also builds trust with customers, ensuring a safer digital payment environment.

Identity verification plays a crucial role in payment fraud prevention. By verifying the identity of customers, businesses can ensure that they’re not dealing with fraudsters. This can be achieved through various means, such as biometric authentication, document verification, and behavioral analysis.Identity verification plays a crucial role in payment fraud prevention. By verifying the identity of customers, businesses can ensure that they’re not dealing with fraudsters. This can be achieved through various means, such as biometric authentication, document verification, and behavioral analysis.

How Veriff’s AI-driven Identity Verification technology helps prevent credit card fraud

Veriff can detect fraud at different stages in the fraud lifecycle from preventing fraudulent customer access at onboarding or account authentication, account recovery or re-authenication process; or at a transaction level and preventing unauthorized access and account takeover. Veriff can also be used in Step Up Authentication use cases to verify that withdrawals are done by the genuine account holder.

For instance, in its partnership with Juancho Te Presta, Veriff enabled faster, more secure onboarding in a high-risk lending environment, effectively reducing fraudulent loan applications while maintaining a seamless user experience. Veriff employs advanced techniques such as device and network fingerprinting, crosslinking of sessions, and both manual and machine learning-driven anomaly detection to identify and prevent organized fraud attempts. Additionally, Veriff’s dynamic risk assessment helps reduce false positives through advanced risk analysis, ensuring legitimate users are not blocked while stopping fraudsters. This balance between security and user convenience was key to helping Juancho Te Presta grow its customer base without compromising on fraud prevention:

“Biometric authentication, which helps us to automatically check if a new user is already on our system under another account, is one of the most powerful Veriff tools that we use.” – Juan Esteban Saldarriaga, Founder and CEO

Veriff employs advanced fraud prevention techniques such as device and network fingerprinting, crosslinking of sessions, and both manual and machine learning-driven anomaly detection to identify and prevent organized fraud attempts. Veriff also helps reduce false positives through advanced risk analysis, ensuring that legitimate users are not blocked while stopping fraudsters.

Biometric authentication, which helps us to automatically check if a new user is already on our system under another account, is one of the most powerful Veriff tools that we use.

FAQs

1. How is identity verification impacting the digital payments industry?

It enhances security, reduces fraud risks, and ensures compliance with regulatory requirements like KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. This fosters greater trust among users and payment providers.

2. Can identity verification slow down the payment process?

Modern identity verification technologies are optimized for speed and efficiency. While adding an extra step, they are designed to be seamless and user-friendly, often completing verification in seconds.

3. What types of identity verification methods are used in digital payments?

Common methods include biometric authentication (fingerprints, facial recognition), document verification, one-time passwords (OTPs), and liveness detection.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.