Fraud Article

Streamlining KYC: A guide for fintech startups and SMBs with KYC best practices

Navigating the fintech world isn’t easy—startups and SMBs are constantly juggling strict regulations while trying to deliver a flawless customer experience.

In the fast-paced world of fintech, startups and SMBs often face the challenge of balancing regulatory compliance with offering a seamless customer experience.

Know Your Customer (KYC) processes are essential for meeting regulatory demands, such as AML regulations, and avoiding massive risks like fraud, illegal activities, and money laundering and terrorist financing. However, for startups with limited resources, the process can be cumbersome and expensive.

Key takeaways:

- KYC (Know Your Customer) is a legal requirement that fintech startups must adopt to prevent fraud and ensure AML compliance.

- Streamlining KYC procedures involves automating document verification, outsourcing tasks, and leveraging tools designed for the financial sector.

- Neobanks that want to be successful need specific KYC strategies, such as using digital identity verification tools and balancing fast onboarding with security.

- Tools like AI, biometrics, and third-party platforms can simplify and scale the KYC process.

The future of KYC will involve technologies like blockchain, machine learning, and more adaptive regulatory frameworks, which can further mitigate reputational damage.

1. What is KYC and why does it matter for fintech startups?

KYC, or Know Your Customer, refers to the process of verifying the identity of your customers to ensure they are who they claim to be. In the fintech world, KYC is not just a regulatory requirement for any financial institution—it’s a way to protect your business from fraud, money laundering, and other illegal activities.

For fintech startups and SMBs, implementing a robust KYC system is crucial because it ensures compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations.

In 2023, global financial institutions faced significant fines for violations of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, totaling approximately $6.6 billion. This represents a +57% increase from the $4.2 billion in fines reported in 2022.

Failing to comply with KYC procedures can lead to hefty fines, reputational damage, and even the shutdown of a business. The KYC process also helps fintech companies foster trust with their customers by demonstrating a commitment to security and privacy.

1.1 KYC requirements and regulations

KYC requirements are designed to prevent financial crimes such as money laundering and terrorist financing. Financial institutions must comply with these regulations to ensure the integrity of the financial services industry.

The Customer Identification Program (CIP), mandated by the Financial Crimes Enforcement Network (FinCEN), requires institutions to verify the identity of the customer and conduct ongoing monitoring of accounts to flag suspicious activities.

1.2 Challenges of implementing KYC for startups and SMBs

While KYC compliance is essential, fintech startups often face challenges like:

- High costs: Compliance audits and manual KYC checks can strain limited budgets.

- Balancing user experience with compliance: Lengthy procedures can deter customers.

- Scalability: Growing companies struggle to adapt their processes to increasing demands.

Adopting an efficient KYC process with tools like Veriff’s Self-Serve can address these hurdles.

2. How to build a great KYC onboarding process

Building a streamlined KYC onboarding process is critical. Here’s a checklist tailored for fintech startups:

- Customer identification: Collect essential details such as full name, address, and ID.

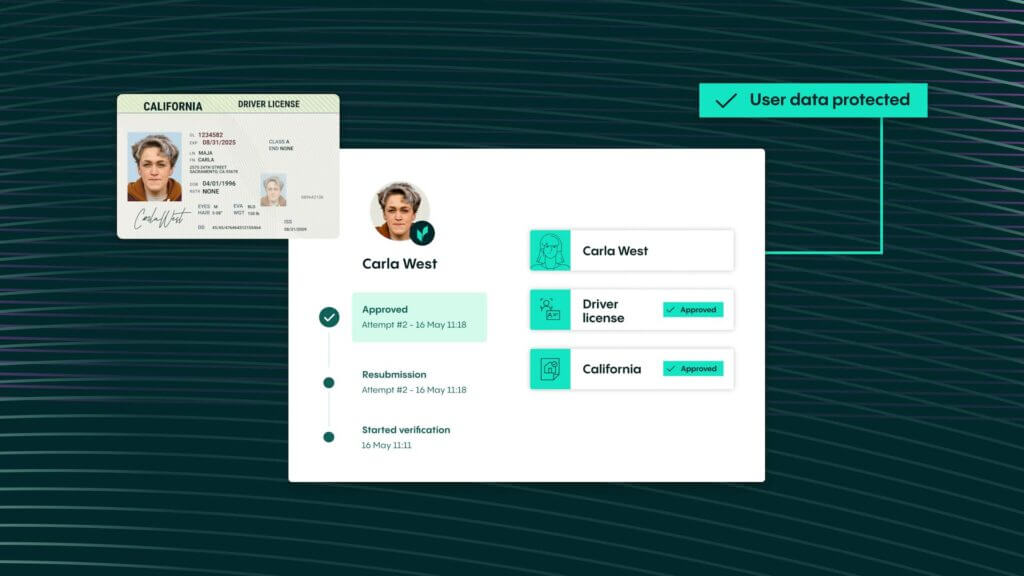

- Document verification: Automate verification with AI-powered tools to simplify customer KYC.

- Risk assessment: Evaluate customer risk profiles to prevent money laundering and terrorist financing.

- Ongoing monitoring: Continuously monitor for suspicious behavior.

The key to overcoming these challenges is to adopt a streamlined KYC process that maintains compliance while remaining efficient and cost-effective.

Efficiency tips

- Automation.

Automating document verification and risk assessments can significantly reduce manual labor. Think about this: according to McKinsey, banks typically employ around 10 % of the workforce in financial-crime-related activities - Outsource where possible.

Managing the compliance and operational process of KYC can be a daunting process. It requires a lot of effort, the necessary skillset and appropriate technology infrastructures. Providers like Veriff’s Self Serve can handle parts of your KYC process, especially document verification and risk analysis. - Streamline user experience.

Use digital identity verification tools to reduce the friction for customers during onboarding.

Having a great onboarding and verification process can be life changing - Recent statistics prove that over 68% of consumers abandon a financial application during initial digital customer onboarding

- One in five users abandoned the process because it dragged on too long and with a poor User Experience.

500% of KYC costs

are people-related. You can automate KYC with Al and reduce both time and costs.

100+ minutes

This is the average time of completion of non automated KYC.

68%+ of consumers

Abandon financial apps during initial digital customer onboarding

SECURE YOUR BUSINESS

We help you onboard new customers from all over the world and frow your business

3. KYC for fintech startups: Best practices

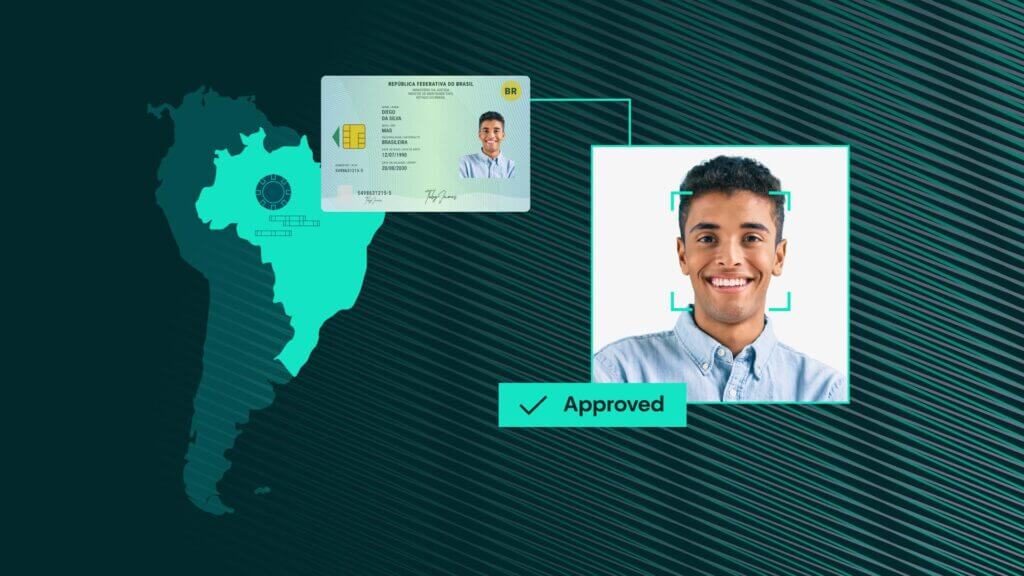

Fintech startups, operating entirely online, need digital identity verification tools to offer fast, secure onboarding.

- Digital-first verification: Use tools like biometrics for identity verification.

- Fast onboarding: Balance efficiency with fraud prevention.

- Scalable solutions: Automated tools ensure compliance as your customer base grows.

Digital-first verification

Since fintech startups operate entirely online, they should prioritize using AI-driven tools for identity verification. These tools allow customers to complete the KYC process without visiting a physical branch, wherever they are. The most successful neobanks use technologies like facial recognition and document verification via smartphone cameras to make the onboarding digital and easy to complete. Here are some tips to improve digital verification processes in financial services.

Fast onboarding but with secure verification

Startups in the fintech sectorthrive on providing a frictionless customer experience. Balancing quick onboarding with robust security is crucial. By using real-time ID verification and biometric checks, neobanks can enhance the speed and security of the KYC process.

Since the pandemic, fraud has increased nearly 50% , and it costs organizations up to 9% of their annual revenue on average. Furthermore, every $1 in fraud costs financial services firms in the United States $4.So being able to correctly balance a smooth onboarding with fraud prevention is key to keep healthy revenue streams.

Balancing compliance with growth

As fintech startups scale, their KYC processes must evolve to handle growing customer bases while ensuring strict compliance with regulations. Automated tools can help manage this growth by reducing manual efforts and improving accuracy.

4. Technologies and tools to streamline KYC

Fintech startups can optimize their KYC procedures by integrating technologies like:

- AI and automation: Simplify risk assessment and AML compliance.

- Third-party providers: Outsource KYC checks to platforms like Veriff.

- Biometric verification: Enhance security with tools to verify identities and prevent fraud.

AI and automation

Artificial Intelligence (AI) and machine learning can automate various parts of the KYC process, from document verification to fraud detection. By using these technologies, startups can drastically reduce the time it takes to onboard customers, as well as the manual effort required for compliance checks.

Approximately 60% of financial institutions have adopted at least one form of AI, and 1 in 4 have adopted machine learning for fraud detection, according to a recent McKinsey report.

Third-party KYC providers

Outsourcing KYC tasks to specialized providers like Veriff allows fintech startups to focus on their core business while ensuring regulatory compliance. These providers offer pre-built solutions that integrate with your platform, making KYC implementation seamless and scalable.

Digital identity and biometrics

Biometric verification, such as facial recognition, enhances security by ensuring that the person providing the ID matches the one opening the account. Startups can implement these tools to add an extra layer of security while maintaining a smooth customer experience.

Moreover, biometrics and liveness checks are both great solutions to prevent AI deepfakes fraud attempts.

4. Veriff Self-Serve: KYC and ID verification for startups and SMBs

For fintech startups and SMBs, one of the biggest challenges is balancing compliance with a smooth customer onboarding experience. Veriff’s self-serve identity verification (IDV) product is designed to help businesses overcome this challenge by offering fast, accurate, and scalable KYC solutions. By focusing on ID verification (IDV) and KYC, Veriff enables startups to onboard customers quickly while maintaining high compliance standards.

Here is how it can help you:

- Quick setup. Veriff’s Self-Serve KYC solution can be implemented with minimal IT resources, in less than 2 minutes, making it ideal for startups without large technical teams.

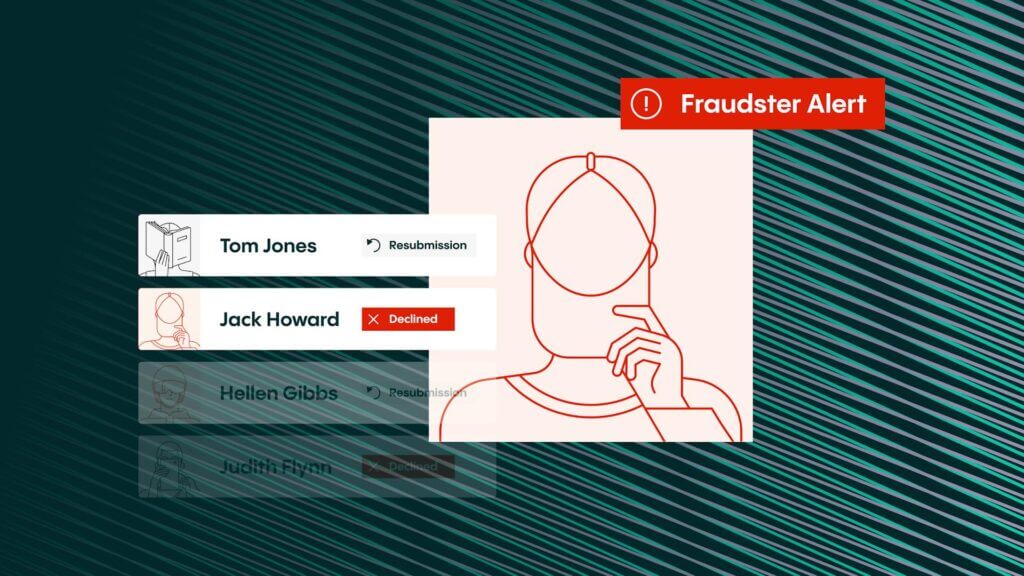

- AI-Powered verification. The system automatically detects fake IDs, fraudulent documents, and suspicious behaviors, ensuring compliance while protecting against fraud.

- Scalability. Whether verifying a few customers or thousands, Veriff’s solution scales with your business needs, making it suitable for both small startups and fast-growing fintech companies.

- Boost conversions. With superior accuracy and user experience, Veriff’s KYC solution can lead to up to 30% more customer conversions during onboarding, helping businesses grow without sacrificing security.

- Cost-effective. Veriff offers tailored pricing plans that meet the budget constraints of startups and SMBs, providing affordable access to enterprise-level KYC tools.

By choosing Veriff, fintech startups can implement a streamlined, automated KYC process that boosts conversions and compliance without the typical cost and complexity. Explore Veriff’s AI-driven self-serve plans to learn more about how it can support your KYC and IDV needs.

SECURE YOUR BUSINESS

We help you onboard new customers from all over the world and frow your business

5. Conclusion

For fintech startups, streamlining KYC processes is essential for compliance and growth. By leveraging tools like AI, automation, and digital identity verification, companies can reduce costs, enhance efficiency, and mitigate reputational damage.

Discover Veriff’s scalable Self-Serve solution to simplify KYC compliance and grow your business while protecting against illegal activities.

KYC FAQs for startups and SMBs

1. What documents are needed for KYC?

Typically, KYC verification requires a government-issued ID (such as a passport or driver’s license) and proof of address (utility bill, bank statement). Additional documentation may be needed based on local regulations or the customer’s risk profile.

2. How can startups reduce the costs of implementing KYC?

Startups can reduce KYC costs by adopting fintech KYC software that automates the process. This reduces the need for manual labor and speeds up verification. Using third-party providers like Veriff can also help cut costs by offering scalable solutions.

3. What are the most common KYC mistakes?

Common KYC mistakes include relying on manual processes, which can introduce human error, and not conducting ongoing monitoring of high-risk clients. Another common mistake is creating a complicated onboarding process, which can lead to customer drop-offs.

4. How often should KYC be updated?

KYC should be updated regularly, particularly for customers with a high risk profile. Startups should integrate continuous monitoring systems to automatically flag suspicious behavior and update customer data. This is where automating KYC for fintech plays a crucial role.

5. How can fintech startups improve KYC during onboarding?

To improve KYC during onboarding, fintech startups can explore software that automate and streamline the process.

Solutions that use AI-driven document verification can enhance accuracy, reduce the time needed for identity checks, and help prevent fraud.

By implementing such tools, startups can create a more efficient and seamless onboarding experience, which can reduce friction for users and potentially increase customer conversion rates.

Get the Veriff Identity Fraud report 2025

Discover global data on consumer attitudes to fraud, risk, and digital identity.