FRAUD PROTECT

Block fraud before it happens. Blending advanced machine learning and deep fraud expertise, our software spots threats early for industry-leading fraud prevention without adding friction for trusted users.

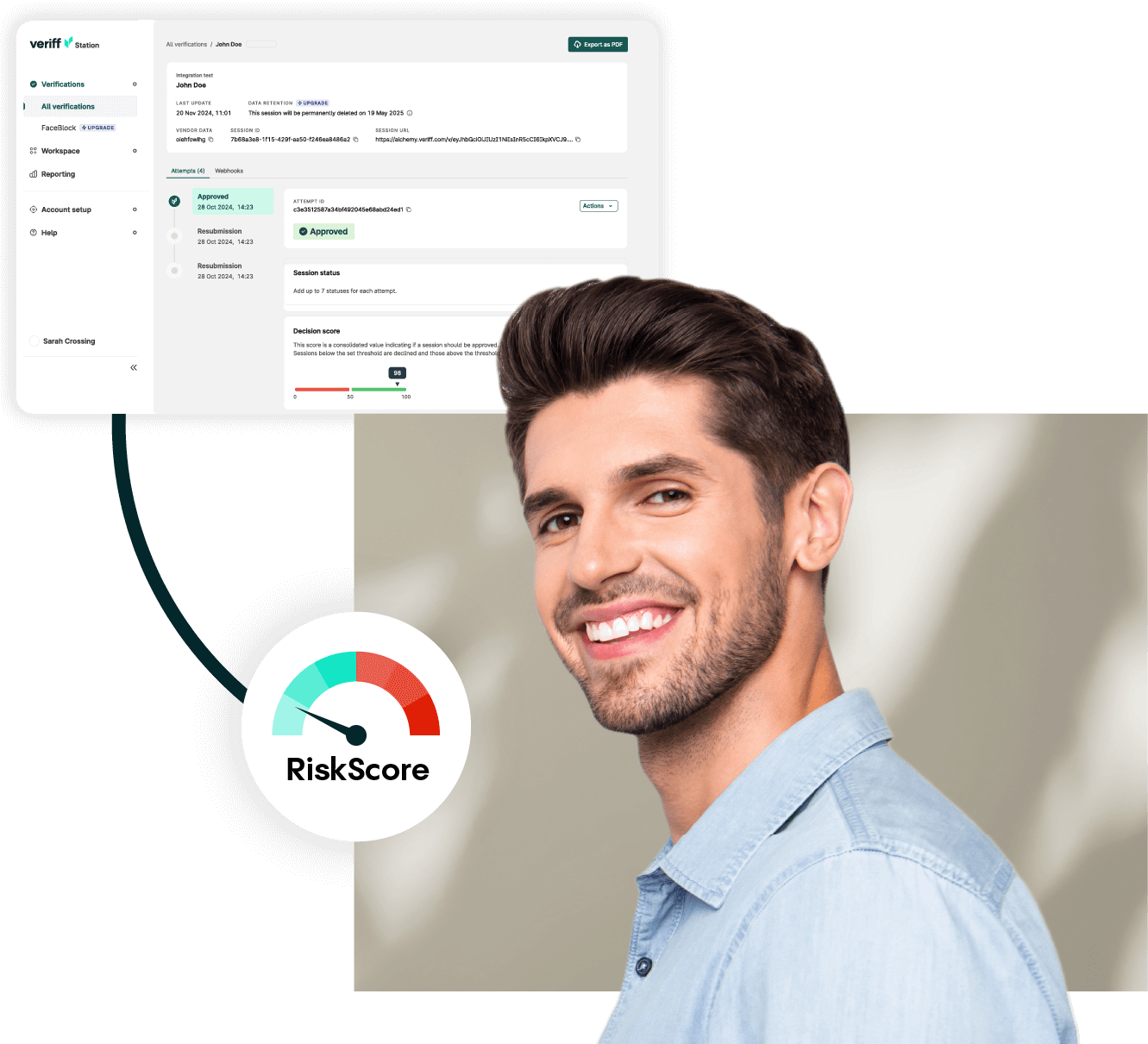

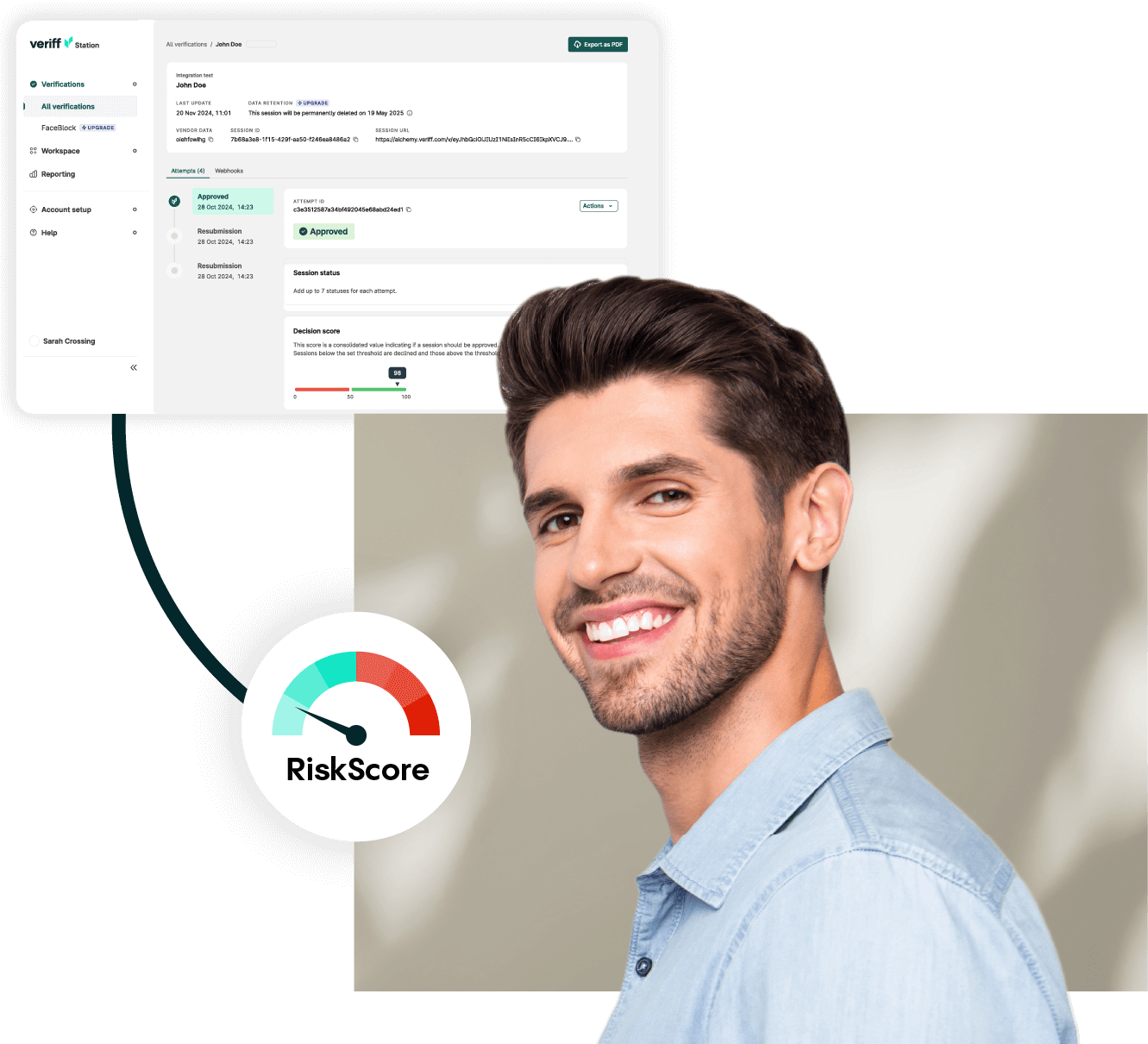

FRAUD INTELLIGENCE

Strengthen your fraud prevention with actionable risk insights. Our software delivers powerful analytics tools plus a consolidated RiskScore to enable better investigation and decision-making.

>0

%

verified on the first try

>0

second verification

>0

K+

documents supported

>0

languages & dialects

Start building with Veriff for free

Your journey toward faster, more accurate identity verification starts here.