Fraud Article

FinCEN alert: Counterfeit U.S. passport cards in identity theft and fraud schemes

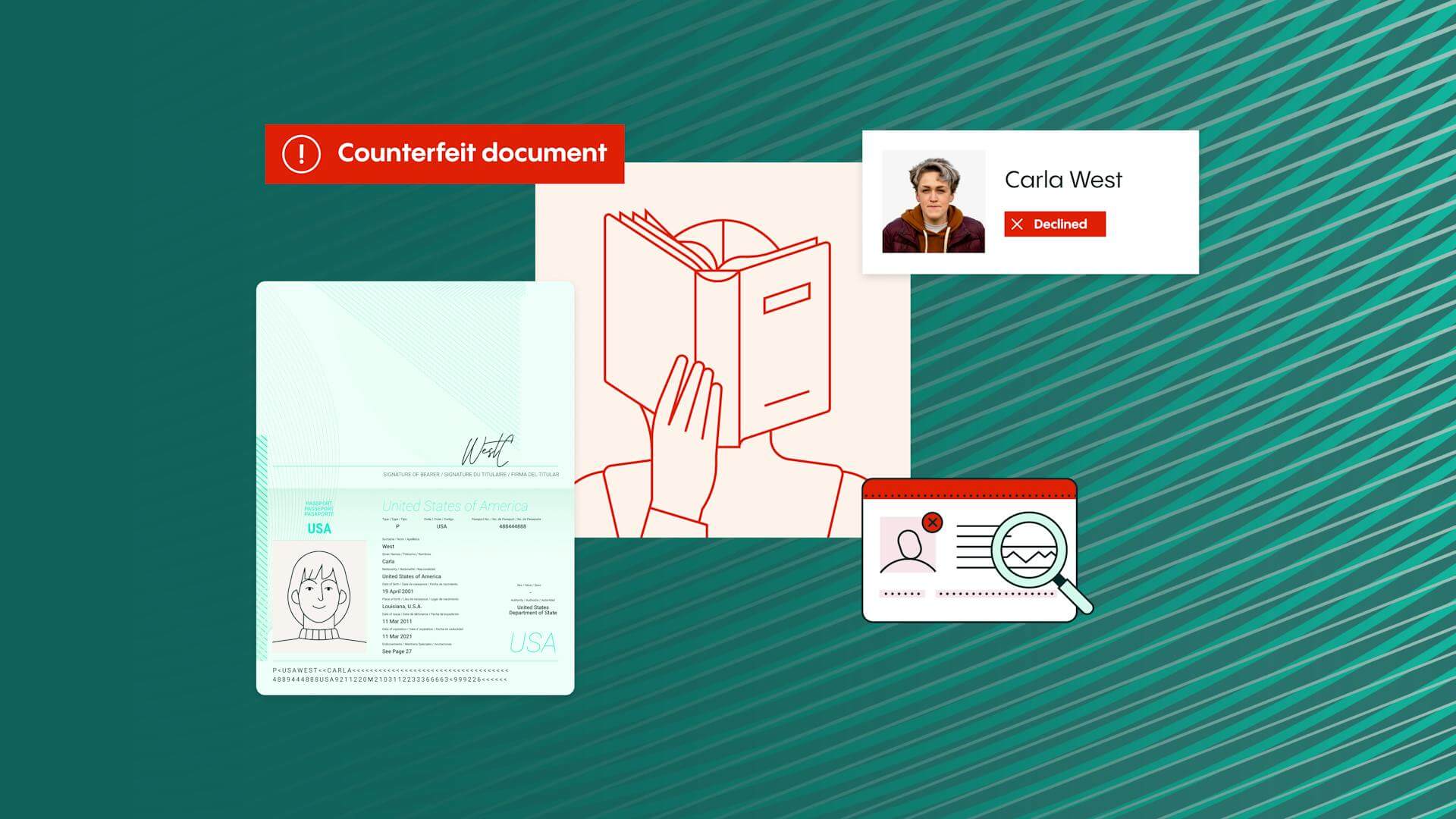

Financial institutions are under siege in today’s digital economy. U.S. passport card scams have caused $10 million in losses and $8 million in attempted losses from 2018 to 2023, affecting over 4,000 victims. Actual losses could be higher, says law enforcement, urging more reporting. On April 15th, FinCEN warned of a surge in fake passport card fraud, highlighting the need for cutting-edge security and vigilance.

In the dynamic landscape of the global digital economy, the security frameworks of financial institutions are relentlessly challenged by advanced fraudulent activities. According to the data from the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN), between 2018 and 2023, fraud involving U.S. passport cards led to actual losses of $10 million and attempted losses of another $8 million, affecting over 4,000 victims across the United States. However, the Department of State Services (DSS) and other law enforcement agencies assess losses associated with U.S. passport card fraud and associated identity theft as likely significantly greater and seek increased reporting by financial institutions to identify additional illicit activity. On April 15th, the FinCEN issued a Notice on the use of counterfeit U.S. passport cards, highlighting a concerning trend: the advanced use of fake U.S. passport cards to commit identity theft and fraud targeting banks and other financial institutions. This development underscores the need for cutting-edge security measures and vigilant monitoring systems to safeguard financial integrity and consumer trust.

“We are issuing this Notice to help financial institutions and their customers from becoming victims to this crime, and to remind them to remain vigilant in identifying and reporting related suspicious activity,” said FinCEN chief Andrea Gacki.

What is a U.S. passport card?

U.S. passport card is a REAL ID-compliant identity and travel document issued by the U.S. Department of State for use by U.S. citizens. The passport card, introduced by the U.S. Department of State in July 2008, serves as a more affordable, compact, and convenient option compared to the traditional U.S. passport book. It is valid for establishing identity, proving U.S. citizenship, domestic flights, and entering the United States by land or sea from Canada, Mexico, the Caribbean, and Bermuda. This alternative travel document is especially beneficial for frequent travelers to these regions.

Key technical indicators from the FinCEN Notice for financial compliance teams

FinCEN, in consultation with DSS, has identified the following red flag indicators to help detect, prevent, and report potential suspicious activity related to the use of counterfeit passport cards in identity theft and fraud schemes. Financial institutions and their dedicated compliance teams must exercise heightened vigilance to identify the following critical technical indicators that suggest the presence of a counterfeit U.S. passport card:

- Precision in Image Borders vs. Irregularities: Authentic U.S. passport cards are characterized by a laser-engraved grayscale portrait with precise borders. In contrast, counterfeit cards may exhibit anomalies such as white, blurry edges or dark gray squares surrounding the photograph.

- Consistency in Visual Identity: Any discernible discrepancies between the photograph on record and that on the presented U.S. passport card warrant immediate scrutiny for potential fraud.

- Tactility of Text: Authentic U.S. passport cards are distinguished by tactile text features, especially noticeable in the date of birth and other critical information areas, a feature absent in counterfeit iterations.

- Integrity of Holographic Seals: The absence or improper substitution of the holographic seal issued by the U.S. Department of State clearly marks a fraudulent document.

- Clarity of Secondary Portraits: Genuine U.S. passport cards incorporate a secondary portrait that includes micro-printed personalized details, whereas counterfeit cards may present a secondary portrait lacking clarity and these detailed features.

Financial institutions are tasked with the critical role of safeguarding against fraud. Recognizing these technical red flags is paramount in maintaining the integrity of financial operations and ensuring clients’ trust in the security measures upheld by their chosen institutions.

“We are issuing this Notice to help financial institutions and their customers from becoming victims to this crime, and to remind them to remain vigilant in identifying and reporting related suspicious activity,”

Verifying security features

The FinCEN notice includes comprehensive guidelines on verifying the security features of U.S. passport cards. Financial institutions are urged to conduct visual inspections, tactile verifications, and ultraviolet light examinations to authenticate these documents accurately. However, relying on manual checks and specialized expertise to spot these sophisticated forgeries could burden onboarding processes, extending the time required for customer verifications and increasing operational costs.

How can Veriff help?

Enter Veriff – a cutting-edge solution designed to address precisely these challenges. Veriff’s Identity and Document Verification technology automates the detection of fraudulent documents and identity theft, enabling financial institutions to onboard more genuine customers swiftly and efficiently.

By incorporating Veriff’s advanced AI and machine learning algorithms, banks and financial institutions can achieve:

- High Conversion Rates: Veriff’s streamlined verification process ensures that genuine customers experience minimal friction, significantly improving conversion rates.

- Fraud Mitigation: With the ability to detect subtle anomalies and signs of forgery, Veriff substantially reduces the risk of fraud.

- Operational Efficiency: By automating the verification process, Veriff liberates compliance and onboarding teams from manual document checks, allowing them to focus on higher-value activities.

One of the main factors ensuring the accuracy of document fraud prevention is our proprietary specimen database. It contains more than 12,000 identity and government document specimens from over 230 countries and territories. Thanks to our extensive document database, we have a good idea of how documents should typically look. Through the meticulous classification of documents characteristics, we expedite the process of detecting any anomalies or unusual components in the identity documents. The database is updated regularly as we collaborate with government agencies worldwide and do in-depth research pertaining to documents

We use a number of checks to ensure the authenticity of documents. This entails using machine learning algorithms to examine document characteristics and find irregularities or indications of manipulation in the ensuing categories:

- Document material integrity

- Portrait photo

- Data cross-referencing

- Format validation

- Data dependencies

- Document font

Veriff also has a team of highly skilled verification specialists who make thorough checks in cases where the automated systems were not able to make a definitive decision. These manual agents leverage their expertise to carefully examine the documents and identify any signs of tampering to complement automated systems tampering detection. This multi-layered approach, combining advanced AI-powered automation with human expertise, helps Veriff ensure a high degree of accuracy and security in the identity verification process.

In the light of the FinCEN advisory, it’s clear that modern financial crime requires modern solutions. Veriff’s technology offers a proactive stance against identity theft and document fraud, reinforcing the security framework of financial institutions without compromising customer experience.

Upgrade your Security measures with Veriff

The financial landscape demands ongoing vigilance and adaptation to counteract emerging threats. With Veriff, institutions gain not just a tool but a partner in the ongoing battle against fraud. Protect your operations, your customers, and your reputation by integrating Veriff’s Identity and Document Verification solution into your security protocol today. Together, we can build a safer financial system for everyone.

FAQ

1. What is the purpose of FinCEN?

The Financial Crime Enforcement Network focuses on protecting the financial industry and protecting national security.

2. What must be reported to FinCEN?

To comply with FinCEN’s reporting requirements, entities and individuals must report various types of information, primarily focusing on suspicious activities, beneficial ownership, and foreign financial accounts. Below is a summary of what needs to be reported:

- Financial institutions must file a Suspicious Activity Report (SAR) when they detect potentially suspicious activity that might signify money laundering, fraud, or other financial crimes.

- Companies are required to report information about the individuals who ultimately own or control them. This includes identifying beneficial owners and the persons who formed the entity.

- U.S. persons having a financial interest in or signature authority over foreign financial accounts must file an FBAR if the aggregate value of those accounts exceeds $10,000 at any time during the calendar year.

FinCEN forms and instructions provide detailed guidelines for each type of report, ensuring that all necessary information is accurately and completely filed.

3. Who must register with FinCEN?

Under the new Corporate Transparency Act (CTA), which went into effect on January 1, 2024, many U.S. companies are required to disclose detailed information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). The Act aims to combat illicit financial activities by increasing transparency in business ownership structures.