Fraud Article

AI fraud detection: How startups and SMBs can stay ahead

In the race against fraud, AI is the game-changer businesses need! Discover how cutting-edge technologies can boost security, streamline operations, and outsmart fraudsters.

The essential guide to AI fraud detection for small and growing businesses

AI fraud detection empowers startups and SMBs to fight online fraud with speed, accuracy, and trust. Learn how modern solutions reduce risk, boost security, and support business growth.

Key takeaways

- Reduce losses: AI fraud detection significantly reduces financial losses and reputational damage by catching fraud in real time.

- Build trust: For startups and SMBs, a secure and smooth user experience is critical for building customer trust and loyalty.

- Stay competitive: Scalable AI tools allow smaller businesses to access enterprise-level security without the high cost, enabling them to compete safely.

- Adapt continuously: Machine learning models constantly adapt to new and evolving fraud patterns, keeping your business protected against future threats.

What is AI fraud detection?

AI fraud detection is the use of artificial intelligence and machine learning to analyze user behavior, verify identities, and identify fraudulent activities in real time. Unlike rule-based systems that only check for known fraud patterns, AI models learn from vast datasets to spot subtle anomalies and new threats that humans would miss. For a startup or SMB, this technology acts as a powerful, automated defense system that protects revenue and builds a foundation of digital trust.

The key benefits for businesses include:

- Increased accuracy: AI drastically reduces “false positives”—the incorrect flagging of legitimate customers—improving user experience and conversion rates.

- Enhanced speed: Decisions are made in seconds, not hours, allowing for instant and secure user onboarding.

- Proactive defense: Machine learning algorithms predict and identify emerging fraud tactics before they cause significant damage.

Why startups and SMBs need AI fraud detection

Small businesses are often seen as easy targets by fraudsters who assume they lack sophisticated security measures. The cost of fraud for these companies isn’t just financial; it can be catastrophic. A single significant security breach can lead to devastating financial losses, regulatory fines, and irreparable damage to customer trust.

According to a report from Gartner, the sophistication of fraud is increasing, making manual review processes and outdated systems ineffective. AI fraud detection levels the playing field. It provides startups and SMBs with an affordable, scalable way to protect their platforms without needing a large, dedicated fraud prevention team. This allows them to focus their limited resources on innovation and growth, confident that their business is secure.

How AI fraud detection works

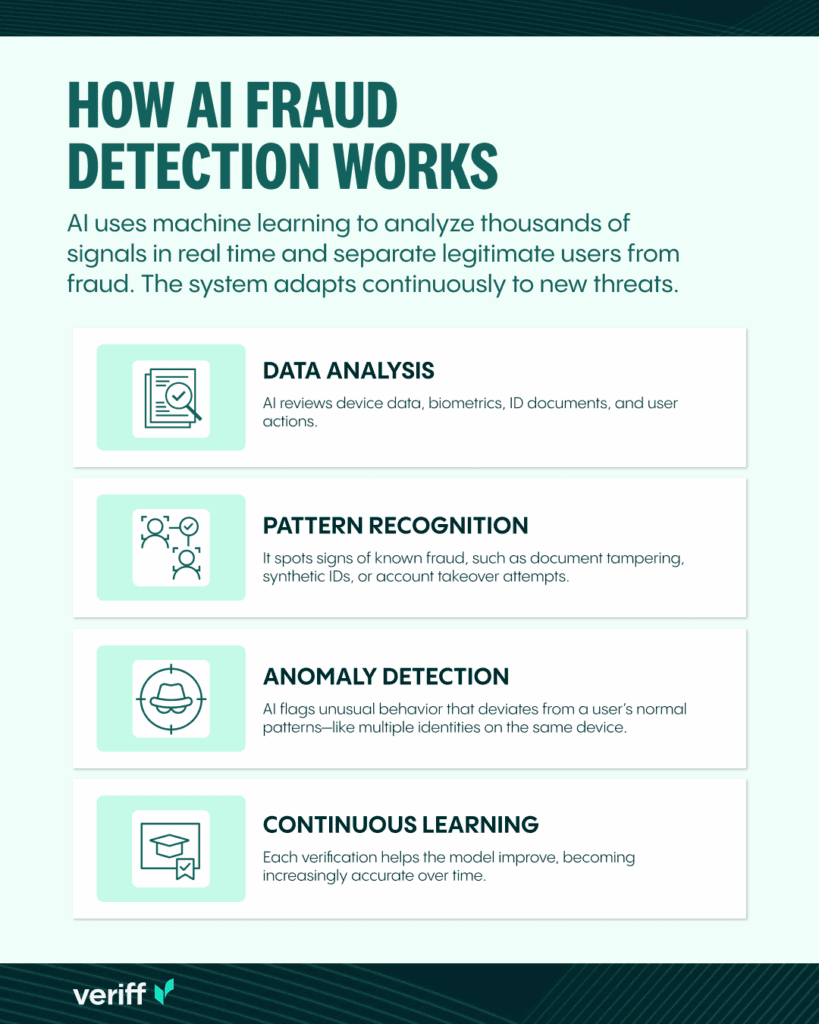

AI fraud detection works by using machine learning models to analyze thousands of data points in real time and distinguish between legitimate and fraudulent behavior. The process is continuous and adaptive.

- Data analysis: The AI model processes information from various sources, such as user device data, biometrics, ID documents, and transaction behavior.

- Pattern recognition: It identifies patterns consistent with known fraudulent activities, like document tampering, synthetic identities, or account takeover attempts.

- Anomaly detection: More importantly, it flags unusual activities that deviate from normal user behavior, even if the pattern is entirely new. For example, it might spot a user trying to log in with multiple identities from the same device.

- Continuous learning: With every verification, the AI model refines its understanding of both legitimate and fraudulent patterns. This self-improvement loop means the system gets smarter and more effective over time.

Explore this infographic to see how AI fraud detection works.

How Veriff helps startups and SMBs fight fraud

For startups and SMBs, choosing the right fraud prevention partner is critical. Veriff provides a powerful, AI-driven fraud detection engine designed to help smaller businesses grow securely and with confidence.

Veriff’s solution combines multiple layers of AI-powered analysis to stop fraud at the source. This includes advanced document authenticity checks, biometric matching, and liveness detection to ensure that every user is who they claim to be. Our machine learning models are trained on a massive global dataset, allowing them to recognize fraud patterns from around the world and adapt instantly to new threats. This means your business is protected not just from today’s fraud, but from tomorrow’s as well. By automating the verification process, Veriff helps startups and SMBs reduce manual workloads, cut operational costs, and onboard legitimate customers faster, creating a secure environment for sustainable growth.

“Veriff’s AI-powered solution helped us reduce fraudulent sign-ups by over 90% while improving our good user approval rate. It’s security we can trust as we scale.”

— Head of Operations, Fintech Startup

“Veriff’s AI-powered solution helped us reduce fraudulent sign-ups by over 90% while improving our good user approval rate. It’s security we can trust as we scale.”

Case study: How a small e-commerce platform reduced fraud

SaaS Production partnered with Veriff to protect a computer hardware e-commerce marketplace. The platform was struggling with costly chargeback fraud. By integrating Veriff’s AI-powered identity verification, fraudulent sign-ups were blocked instantly. Within months, the marketplace eliminated chargeback fraud, saving thousands in losses and restoring customer trust. Read the case study.

More examples of Veriff’s impact

- Fintech lender: After introducing Veriff, a fintech startup halved its loan-default rates by catching synthetic identity fraud at onboarding. Read case study

- Payments platform: Veriff integrated in just two weeks, enabling faster onboarding, stronger compliance, and a 50% reduction in manual work. Read case study

- Cryptocurrency exchange: Using Veriff’s anomaly detection, the platform detected and blocked a bot-driven account farming operation before users could monetize illicitly gained accounts. Read case study

AI Fraud detection’s impact across industries

AI-powered fraud detection isn’t just for fintech or e-commerce. Its reach spans a wide array of industries:

- Financial services/fintech: Stopping money laundering, detecting account takeovers, and ensuring compliance with complex regulations.

- Travel and hospitality: Preventing fraudulent bookings, fake reviews, and payment scams.

- Healthcare: Flagging insurance scams, duplicate policies, and identity misuse.

- Education and Edtech: Authenticating exam-takers and verifying student identities to prevent cheating and financial aid fraud.

- Gig economy and marketplaces: Protecting against fake worker profiles, payout fraud, and account takeovers.

- Gaming and gambling: Preventing bonus hunting, multiple account fraud, and underage access.

Each industry faces unique challenges—AI’s flexibility and adaptability makes it the ideal foundation for scalable security.

The future of AI in fraud detection

The future of fraud detection is autonomous and predictive. As technology evolves, experts at firms like McKinsey predict that AI systems will become even more adept at anticipating fraud before it happens. For startups and SMBs, this means security solutions will become more efficient, requiring less human oversight while providing even stronger protection. Building a foundation with a forward-thinking AI partner is essential for staying ahead of the curve and ensuring long-term security and success.

Conclusion: Grow your business with confidence

Fraud is a persistent threat, but it doesn’t have to be a barrier to growth. AI fraud detection offers startups and SMBs a powerful and accessible way to protect their revenue, build customer trust, and scale their operations securely. By leveraging machine learning, businesses can move from a reactive to a proactive security posture. Implementing a robust solution like Veriff allows you to focus on building your business, knowing you have a world-class defense system working for you around the clock.

Secure Your Business

We can help you onboard customers all over the world and secure your business.

Frequently Asked Questions (FAQs)

What is AI fraud detection?

AI fraud detection is the use of machine learning algorithms to analyze data and identify fraudulent activities in real time. It helps businesses prevent financial losses and protect their customers by spotting unusual patterns and verifying user identities with high accuracy.

How does AI detect online fraud in real time?

AI systems analyze thousands of data points per transaction or sign-up, including device information, user behavior, and biometric data. They compare this information against known fraud patterns and historical data to make an instant decision, blocking suspicious activities before they are completed.

Why is AI fraud detection critical for startups and SMBs?

Startups and SMBs are prime targets for fraudsters. AI provides an affordable and scalable defense that doesn’t require a large security team. It protects revenue, prevents reputational damage, and allows small businesses to compete securely with larger enterprises.

What features should a business look for in an AI fraud detection tool?

Look for a tool with high accuracy in detecting fraud while minimizing false rejections of good customers. Key features include scalability, easy API integration, real-time analytics, and support for global compliance standards.

How accurate are AI fraud detection systems compared to manual checks?

AI systems are significantly more accurate and faster than manual checks. They can process vast amounts of data without human error or bias and can identify complex, new fraud patterns that manual reviewers would likely miss.

How does Veriff use AI in fraud prevention?

Veriff uses a multi-layered AI approach that includes document authenticity analysis, biometric matching, liveness detection, and device and network analytics. Our models are continuously trained to identify and block emerging fraud threats, ensuring a secure onboarding process for our clients.

Generative AI can identify fraudulent activities, but also create convincing counterfeit documents, which can fool traditional ID verification methods. Fraudsters are evolving faster than ever, making it critical for startups and SMBs to use advanced identity verification solutions that go beyond manual checks.

Historical data plays a crucial role in training AI systems to detect fraud and fake documents. By analyzing previous cases of fraud and non-fraud, these systems can improve the precision of risk rules and optimize fraud prevention strategies.

Veriff’s insights on document fraudemphasize the importance of leveraging AI-based document verification systems that can detect even the most sophisticated forgery techniques.

Secure Your Business

We can help you onboard customers all over the world and secure your business.