Fraud Article

Bank card fraud: The emerging threat of emulator and injection attacks in 2025

Bank card fraud is evolving, and 2025 brings new challenges. Emulator and injection attacks are on the rise, targeting vulnerabilities like never before. Are you prepared to face this emerging threat?

Introduction

Fraudsters are constantly evolving their tactics, and the rise of emulator and injection attacks has brought a new dimension to bank card fraud. These attacks leverage sophisticated methods to exploit vulnerabilities in digital banking systems, creating significant risks for both businesses and consumers.

In this blog, we’ll explore what emulator and injection attacks are, how they are used in bank card fraud schemes, and steps you can take to protect against these threats.

What is bank card fraud?

Bank card fraud encompasses various illegal activities where criminals gain unauthorized access to debit or credit card information to make fraudulent transactions. This type of fraud has seen a dramatic rise with the shift to online banking and digital payments.

The latest innovation in these fraudulent methods? Emulator and injection attacks. By allowing users to bank online and monitor their accounts more frequently, online banking has made it easier to detect unauthorized transactions.

Understanding emulator and injection attacks

Emulator attacks

An emulator mimics the behavior of legitimate software or devices. In the context of bank card fraud, fraudsters use emulators to:

- Clone legitimate apps to simulate user behavior.

- Access sensitive cardholder data from mobile banking apps.

- Bypass authentication measures, such as one-time passwords (OTPs).

Injection attacks

Injection attacks occur when malicious code is “injected” into an application to manipulate its normal processes. In bank card fraud, these attacks:

- Intercept transactions.

- Alter transaction details to divert funds.

- Capture card details during the payment process.

Why do emulator and injection attacks demand attention?

The emergence of emulator and injection attacks poses a serious threat to business growth, regulatory compliance, and customer trust. Organizations must prioritize scalable and compliant solutions that effectively mitigate these risks while maintaining operational efficiency.

Fraud prevention strategies should leverage advanced detection systems to address sophisticated threats, deliver measurable results, support compliance objectives, and improve processes without introducing unnecessary complexity.

Additionally, fraud prevention solutions must integrate seamlessly with existing technology infrastructures, ensuring robust security and minimizing vulnerabilities, while maintaining reliability and scalability.

The connection between emulator and injection attacks and bank card fraud

Emulator and injection attacks represent a significant evolution in bank card fraud tactics. Here’s how:

- Data theft: Attackers capture sensitive cardholder information.

- Transaction manipulation: Fraudsters bypass traditional security measures to authorize fraudulent transactions.

- Automation: Emulator-based attacks enable large-scale fraud operations by automating processes that mimic legitimate user activity.

Real-world examples

Challenge:

Cogni, a leading digital banking platform, faced significant challenges in ensuring secure and seamless onboarding for its diverse user base. The platform needed to maintain a high level of compliance with stringent financial regulations, while combating sophisticated fraud attempts and protecting user data. Cogni required a solution that could balance robust security with a frictionless user experience.

Solution:

Cogni partnered with Veriff to implement a cutting-edge identity verification solution tailored to the needs of digital banking. Veriff provided Cogni with advanced fraud detection capabilities and a scalable platform that ensured compliance with regulatory requirements. By leveraging Veriff’s technology, Cogni enhanced its ability to detect and prevent fraudulent activities, such as identity theft and unauthorized access.

Impact:

With Veriff’s support, Cogni significantly improved its onboarding process, reducing fraudulent account registrations and maintaining a user-friendly experience. The collaboration ensured compliance with financial regulations and reinforced user trust in the platform’s security measures. This enabled Cogni to focus on delivering innovative banking solutions to its customers.

Veriff’s use of advanced AI and machine learning algorithms to verify the identity of customers during registration was an absolute must. We’ve been really impressed by Veriff’s seamless integration process, user-friendly UI, and the speed of each ID verification session.

How to detect bank card fraud

Monitor account activity for suspicious transactions

Regularly reviewing your bank statements and account activity is crucial to detecting bank card fraud. Look for unfamiliar transactions, such as unauthorized purchases or withdrawals that you did not make. Check your bank account balance and recent debit card transactions daily, either through online banking or your bank’s mobile app. This consistent monitoring can help you spot any discrepancies early. Additionally, setting up account alerts can notify you of any suspicious activity, allowing you to take swift action if needed.

Set up banking alerts for unusual activity

Setting up banking alerts is a proactive way to detect bank card fraud early. Most financial institutions offer customizable alerts that can notify you of unusual activity, such as large withdrawals, purchases outside your usual spending habits, or transactions occurring in different locations. You can also set up alerts for changes to your account information, such as a change of address or phone number. These alerts can be sent via email, SMS, or push notifications, providing real-time updates on your account activity and helping you respond quickly to potential fraud.

How to protect against bank card fraud

For businesses: Collaborating with financial institutions

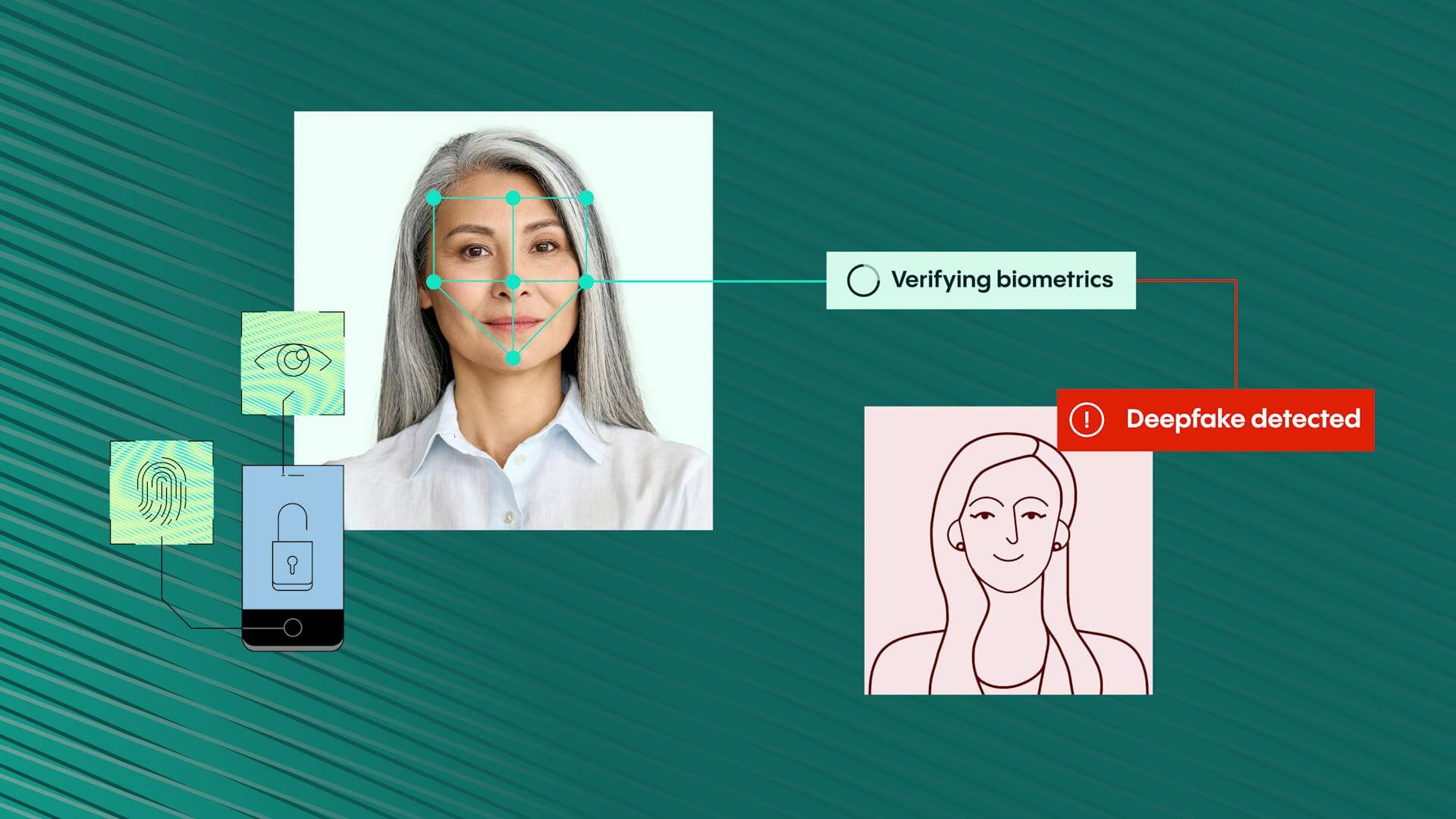

- Implement advanced authentication: Use multi-factor authentication (MFA) and biometric verification.

- Monitor for anomalies: Employ AI-driven fraud detection tools to identify suspicious activity in real-time.

- Regular security audits: Perform vulnerability assessments and penetration testing on all digital platforms.

Combat online fraud effectively and efficiently

Discover how Veriff’s identity verification solutions are shaping the future in Gartner’s exclusive report.

Fraud prevention strategies: Regional specifics

United States:

Strengthen compliance with federal and state laws:

- Implement solutions that adhere to the Bank Secrecy Act and other state-specific anti-fraud regulations.

- Stay informed about evolving compliance requirements, such as those related to digital identity under the Federal Trade Commission’s (FTC) oversight.

Consumer education campaigns:

- Launch nationwide awareness programs to educate users about the risks of emulator and injection attacks.

- Partner with federal agencies like the FBI’s Internet Crime Complaint Center (IC3) to share real-time fraud prevention tips.

United Kingdom:

Leverage FCA guidelines:

- Adopt advanced fraud detection systems that align with FCA regulatory requirements, ensuring secure digital payment processes.

- Focus on integrating fraud prevention measures into Open Banking APIs.

Improve authentication protocols:

- Transition from SMS OTPs to more secure biometric authentication methods.

- Utilize AI-powered behavioral analytics to identify anomalies in consumer spending patterns.

Conclusion

Bank card fraud remains a critical challenge in the digital landscape, with emulator and injection attacks posing significant threats to business growth, regulatory compliance, and customer trust. These sophisticated attacks highlight the need for advanced security measures and proactive collaboration between businesses and consumers.

Organizations must adopt scalable, compliant solutions that not only mitigate these risks, but also maintain operational efficiency. Fraud prevention strategies should leverage cutting-edge detection systems to address complex threats, deliver measurable results, support compliance objectives, and streamline processes without adding unnecessary complexity.

Solutions like Veriff play a key role in combating these threats by seamlessly integrating with existing technology infrastructures. This ensures robust security, minimizes vulnerabilities, and provides reliability and scalability, safeguarding the integrity of digital transactions and protecting both businesses and consumers.

How Veriff can help?

Veriff can play a pivotal role in combating emulator and injection attacks by providing cutting-edge identity verification solutions tailored to the unique challenges of digital fraud. With its advanced AI-powered platform, Veriff ensures secure authentication through biometric verification, real-time fraud detection, and behavioral analytics. By seamlessly integrating into existing systems, Veriff helps businesses identify and block suspicious activity, such as emulator-based automated fraud attempts or malicious injection of code during transactions. Additionally, Veriff’s compliance with stringent regulations in the US, UK, and beyond ensures that organizations meet legal standards while safeguarding customer trust. Through scalable and reliable solutions, Veriff empowers businesses to stay ahead of sophisticated fraud tactics, ensuring robust protection for both companies and consumers.