Fraud Article

Combating threats: Business-centric strategies for identity theft and fraud protection

Identity fraud is a growing threat that demands robust protection strategies. High-profile cases like the Tinder Swindler, which was detailed in a Netflix documentary, highlight the need for vigilance. This article explores the nuances of identity fraud and theft, and how businesses can safeguard sensitive information. Additionally, tax-related identity theft is a significant concern, where identity thieves use stolen Social Security numbers to file fraudulent tax returns and claim refunds.

1. What are identity fraud and identity theft?

Identity fraud and identity theft pose severe consequences for individuals and organizations around the globe. According to the US Department of Justice, the two terms are “used to refer to all types of crime in which someone wrongfully obtains and uses another person’s personal data in some way that involves fraud or deception, typically for economic gain”.

While identity theft and identity fraud are closely linked, there are important distinctions. Identity theft refers to the unauthorized acquisition of personal information, such as someone’s name, Social Security number, or credit card details, without their consent. The victim doesn’t even need to be alive – crooks will happily steal the details of the deceased.

Identity fraud encompasses a broader spectrum of crimes that go beyond simple information theft. It involves using stolen details to commit financial fraud or other illicit activities by impersonating the victim or fabricating a false identity. In fact, the identity can be totally fictitious as well. This fictitious identity may not resemble an actual person but is crafted with realistic personal details.

2. What are the signs of identity fraud?

If you’ve become a victim of identity fraud, you’ll likely notice that:

- There’s suspicious activity on your credit card and bank statements

- There’s something inaccurate on your credit report

- Unfamiliar devices have gained access to your online accounts

- You can no longer access your online accounts

- You’re receiving suspicious phone calls, voicemails, texts, or emails

- You’re receiving unexpected mail or some of your expected mail is missing

- Your personal documents have been lost or stolen

As a victim of identity theft, it is essential to keep detailed logs of all communications, place fraud alerts on your credit reports, file police reports, and work closely with financial institutions to resolve any fraudulent activities.

If you notice any of these signs, contact the fraud department of your financial institutions and file an identity theft report to address issues with financial institutions and law enforcement.

It’s a scary situation, but there are ways that customers can keep their information safe and prevent identity theft. For example, they should refuse to share personal information on social media; choose complex and unique passwords for each online account; and be careful on public wi-fi or securing their home wi-fi.

It’s vital, of course, to protect your personal information. But businesses – especially financial institutions – bear a key responsibility to deter fraudsters.

3. Types of identity theft

Identity theft and fraud can manifest in numerous ways, each posing unique challenges and risks. Understanding these various forms is crucial for both individuals and businesses to protect themselves effectively.

Credit card fraud: This involves using stolen credit card information to make unauthorized purchases or withdraw funds from a victim’s bank account. Credit card fraud is one of the most common types of identity theft.

Account takeover fraud: Identity thieves use stolen personal information to hijack bank accounts, credit cards, cellular phone services, and even email or social media accounts. This can lead to significant financial losses and privacy breaches.

Online shopping fraud:

This type of fraud involves using stolen card numbers, expiration dates, and security codes to make unauthorized online purchases.

Tax identity theft: This occurs when a stolen Social Security number is used to file a tax return in someone else’s name, stealing their refund. Victims of tax-related identity theft should report the issue to the IRS and complete Form 14039, the Identity Theft Affidavit.

Biometric identity theft: Hijacking security measures such as facial recognition and fingerprint recognition to gain unauthorized access to accounts or devices.

Synthetic identity theft: Creating a new, false identity by combining stolen information from one victim with other real or invented information.

4. Regional identity fraud insights

United States

Understanding these types of identity theft can help businesses and individuals take proactive steps to protect their sensitive information and prevent fraud.

The data on identity theft complaints in the United States for 2022 highlights the alarming prevalence and diverse nature of identity theft crimes. According to the Federal Trade Commission, the most reported type of identity theft was credit card fraud, with 441,822 complaints, underscoring the growing vulnerability of financial systems to fraudulent activities. Following this, 326,590 cases fell under “other identity theft,” indicating a broad spectrum of illicit activities not confined to traditional categories. Bank fraud and loan or lease fraud also represented significant portions, with 156,099 and 153,547 complaints respectively, showcasing how financial institutions remain key targets. Employment or tax-related fraud, with 103,402 complaints, highlights the exploitation of sensitive personal data, while phone or utilities fraud and government benefits fraud, at 77,284 and 57,877 complaints respectively, reveal the extent to which identity theft impacts everyday services and essential aid. This data underscores the critical need for robust identity verification and fraud prevention measures to protect individuals and businesses from these pervasive threats.

United Kingdom

In the United Kingdom, identity fraud has emerged as a significant and escalating threat, with recent data revealing concerning trends. According to Cifas, the UK’s leading fraud prevention service, Identity fraud remains the most reported case type, accounting for 59% of filings to the National Fraud Database (NFD) in the first six months of 2024. There has been a 4% increase compared to 2023, driven primarily by impersonations related to mobile phone products (up by 102%) and personal current accounts (up by 19%). Fraudsters are employing sophisticated social engineering techniques, including researching LinkedIn profiles to impersonate financial institution employees. The use of synthetic identities is also on the rise, with attackers investing significant time in building fake profiles to access financial products.

These findings underscore the importance of robust identity verification measures, greater consumer education, and investment in advanced fraud detection technologies to combat the sophisticated and growing threat of identity fraud in the US and the UK. Businesses must adapt to these emerging challenges to protect their assets, customers, and reputations.

Veriff Identity Fraud Report 2025

Our 2025 report shares the insights our expert fraud team has discovered on the front line of fighting fraud — giving you the tools to protect your business and keep you ahead of the fraudsters. Just fill out the form to receive your copy!

5. How can businesses prevent identity fraud?

Identity theft is a significant concern for Chief Compliance Officers, Heads of Fraud, and IT Security Leaders, as it directly impacts their ability to protect assets, maintain compliance, and retain customer trust. Fraudsters’ evolving tactics pose risks such as financial losses, reputational damage, and regulatory penalties. This makes it essential for these professionals to safeguard sensitive data, meet stringent regulatory requirements, and mitigate fraud-related risks. Failure to protect information or comply with Know Your Customer (KYC) regulations can lead to severe fines, legal consequences, and loss of customer confidence. Additionally, businesses should encourage customers to place fraud alerts on their credit reports to prevent identity theft. Beyond financial losses, ensuring security can irreparably damage a business’s reputation, with long-term consequences for trust and operational success.

Employee education and awareness

Employee education and awareness are critical components in the fight against identity theft and fraud. By educating employees, businesses can significantly reduce the risk of data breaches and other security incidents.

- Types of identity theft: Employees should understand the different types of identity theft and fraud, including credit card fraud, account takeover fraud, and tax identity theft.

- Warning signs: Recognizing the warning signs of identity theft, such as unexplained charges or collections notices, can help employees take swift action to mitigate damage.

- Prevention methods: Educating employees on how to prevent identity theft is essential. This includes using strong passwords, monitoring credit reports, and being cautious with personal information.

- Reporting procedures: Employees should know how to report identity theft, including contacting the Federal Trade Commission (FTC) and filing a police report. Clear reporting procedures can help contain and address incidents quickly.

- Company policies: Understanding company policies and procedures for preventing and responding to identity theft is crucial. This ensures a consistent and effective approach to security.

- Best practices: Following best practices for protecting sensitive information, such as using encryption and secure networks, can help prevent data breaches and other security incidents.

By prioritizing employee education and awareness, companies can create a culture of security that protects both their business and their customers’ sensitive information.

6. How does identity verification help prevent identity theft?

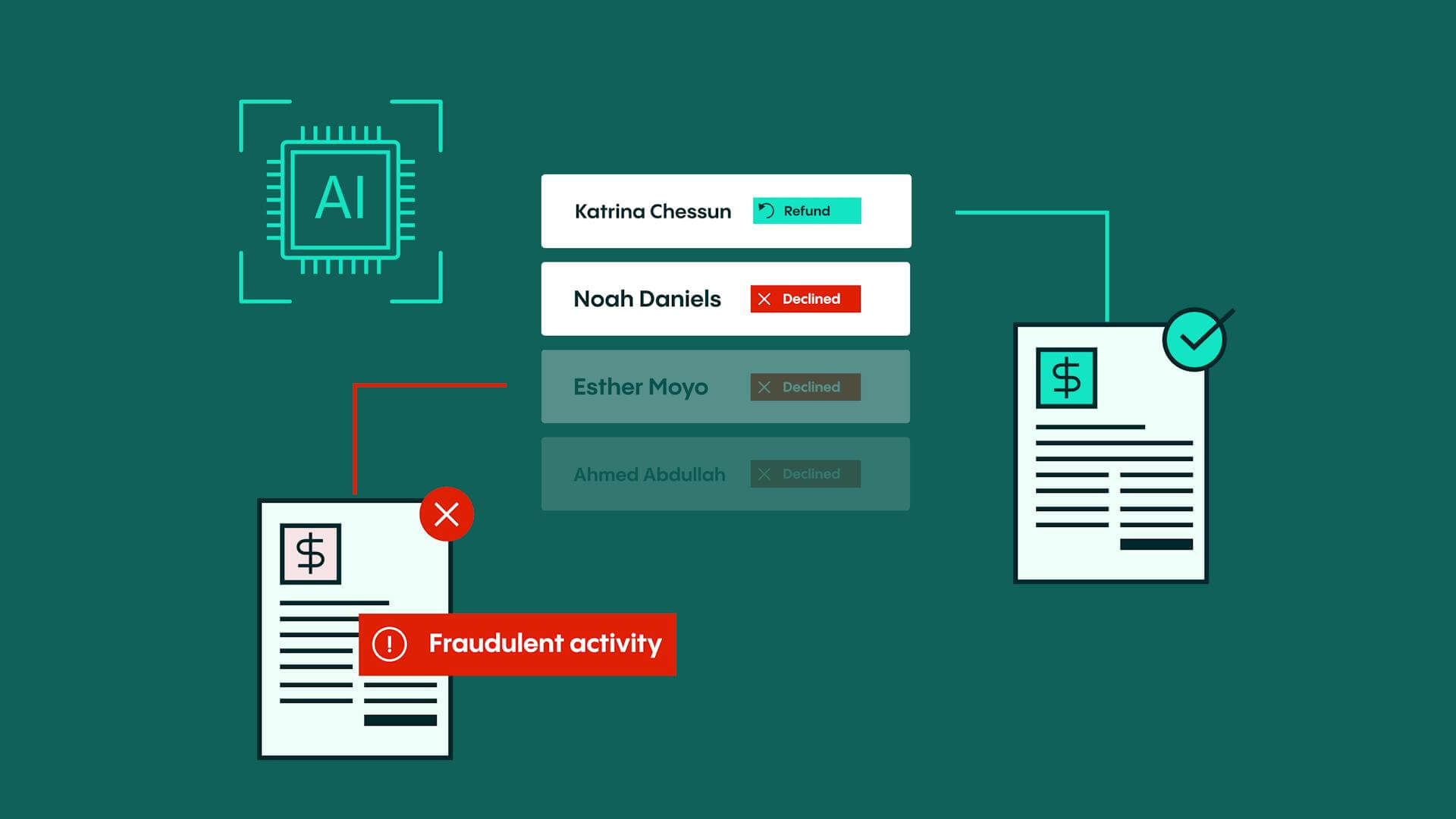

How can businesses effectively combat fraud? Identity verification (IDV) solutions are a powerful ally, enabling swift and accurate detection of fake IDs, verification of document authenticity, biometric authentication, and mitigating velocity attacks. These tools reduce the likelihood of fraudsters gaining access to accounts or services.

This may sound complex, but it doesn’t need to be. Simplifying the identity verification process can enhance the user experience while ensuring stringent security measures. IDV software can make the process swift, efficient, and accurate.

With the help of IDV software, you can:

- Detect fake and tampered IDs

- Extract and verify document data

- Make it easy for users to prove their fake identity

Victims of identity theft should also report the crime to their local police department to officially document it. This is necessary for disputing fraudulent accounts and debts, and obtaining necessary documentation to protect their credit.

7. The Veriff approach

Veriff’s IDV solution is built on AI-powered automation and deep domain expertise. Our extensive document coverage supports more than 12,000 identity documents in over 230 countries and territories. To prevent fraud, Veriff uses machine learning-powered checks, advanced fraud network mitigation strategies, and our team of trained experts to help protect your organization against fraud.

Veriff advises contacting fraud departments from major credit reporting agencies to ensure that credit reports are properly flagged.

We are committed to fighting identity fraud. Our recent work provides enhanced detection techniques, comprehensive compliance solutions, and user-friendly identity verification. For example:

- Our Fraud Protect package helps mitigate the threat of impersonation, synthetic identities, and identity document fraud, among other dangers. We use CrossLinks to uncover fraud patterns and provide access to our trained fraud experts

- The Fraud Intelligence offering expands this offering, offering a RiskScore to determine the risk associated with an IDV session, among other tools

- We take a holistic approach. For example, our efforts to educate the public and their customers through the Fraud Education Center, alongside real-time intelligence and tailored solutions, demonstrate a holistic approach to combating fraud

These efforts are rooted in expertise and continuous innovation. The collective work of Veriff’s fraud prevention team reflects a commitment to excellence and adaptability in the face of evolving digital threats.

If your business would like to know more about how to prevent identity fraud and the steps it can take to stop bad actors from accessing its services, book a consultation with Veriff today. We’ll explain exactly how we can help you keep your businesses and customers safe.

The case study of Comun, a digital banking platform serving immigrant communities in the United States, highlights the transformative impact of Veriff’s identity verification solutions. Comun faced significant challenges with identity theft, particularly fraudulent attempts to open accounts using stolen Social Security numbers. By integrating Veriff’s advanced verification technology, Comun successfully mitigated these risks, safeguarding its platform and ensuring compliance with regulatory requirements. This partnership not only enhanced security but also streamlined the onboarding process for legitimate customers, fostering trust and accessibility.

For Veriff, the collaboration with Comun underscores the company’s commitment to empowering financial institutions to combat fraud while enabling inclusive banking solutions for underserved communities. This case demonstrates Veriff’s ability to adapt its solutions to meet the unique challenges of diverse markets, solidifying its position as a trusted leader in identity verification.

FAQs: Identity theft

1. What are the signs of identity theft?

- Unexplained charges or withdrawals from your accounts.

- Denial of credit applications for no apparent reason.

- Unexpected bills or credit card statements.

- Notifications of data breaches involving your personal information.

- Suspicious activity on your credit report.

2. How is identity theft affecting businesses?

Businesses face financial losses, reputational damage, and regulatory penalties when fraudsters use stolen identities to commit fraud, open fraudulent accounts, or gain unauthorized access to systems. Businesses must implement robust identity verification systems to protect against these threats.

3. What is the difference between identity theft and identity fraud?

- Identity theft: The act of stealing someone’s personal information without consent.

- Identity fraud: Using that stolen information to commit crimes such as opening fraudulent accounts, making purchases, or impersonating someone else.

Download report now

Get all the latest global identity fraud data and insights you need to keep your business safe