Blog Post

Your guide to KYC services and solutions for businesses

As technology continues to advance, the KYC services and solutions used by businesses continue to change. Now, rather than manually inspecting customer documents, businesses can harness the power of biometric data and artificial intelligence in order to better identify customers, run due diligence checks, and perform ongoing monitoring.

Regulated entities must use KYC processes to confirm the identities of their customers. These processes can also help businesses accurately measure the risks associated with entering a business relationship with each customer.

However, different KYC services suit different purposes, and each has a different goal. To help you understand which KYC services your business needs to employ and how each one can help you ensure regulatory compliance, we’ve created this detailed guide.

Customer identification programs

A customer identification program is a vital part of the know your customer (KYC) process for financial institutions. As part of a customer identification program, a business must verify that a customer is who they’re claiming to be.

A customer identification program sets the minimum requirements for onboarding new clients. However, depending on the size and location of your business, the exact processes involved will vary. For example, a large multi-national bank will need a more rigorous customer identification program than a local bank that only offers one product.

In the US, the customer identification programs are governed by the USA Patriot Act. This states that all financial institutions must have:

- A written customer identification program

- Four pieces of identifying information for each customer, including the customer’s name, date of birth, address, and identification number

- Robust identity verification procedures

- Detailed record-keeping process

- An ability to compare information with government lists

- Customer notices

Customer due diligence

Customer due diligence is a process used by financial institutions to collect and evaluate relevant information about a potential customer.

Overall, the customer due diligence process aims to uncover any risks that are associated with the business relationship. To do this, a company must analyze information from a variety of sources, including:

- The customer themselves

- Sanctions lists

- Public data sources

- Private data sources

Each customer poses a different level of risk. For this reason, there are three different levels of customer due diligence. These are:

- Simplified due diligence

- Customer due diligence (sometimes called standard due diligence)

- Enhanced due diligence

For the majority of clients, standard customer due diligence practices (which require you to identify and verify customer identities) are appropriate. If you believe standard due diligence isn’t appropriate because the customer’s risk level is too high, you should adopt enhanced due diligence. On the other hand, in a particularly low-risk scenario, you may decide that simplified due diligence will suffice.

Ongoing monitoring

As well as conducting checks on new customers during the onboarding process, financial institutions should continue to monitor their customers throughout the business relationship.

Ongoing monitoring (also sometimes called ongoing customer due diligence) is important because customer behavior will change over the course of a relationship. Similarly, risk profiles will evolve as new threats and regulations emerge.

Ongoing customer due diligence requires you to continually monitor your accounts and the risk they pose. This means you must review accounts, transactions, and risk profiles regularly and in real time, if possible.

Corporate KYC compliance

Just as individual accounts require identification, due diligence, and ongoing monitoring, so do corporate accounts.

However, there are some distinct differences between individual accounts and corporate accounts. For example, with corporate accounts, the legal requirements are different. Transaction volumes, transaction amounts, and other risk factors are usually more pronounced. This means more procedures are involved.

Although each jurisdiction has its own know your business (KYB) requirements in place, the same four steps are generally required to create an effective KYB program. These are:

- Retrieving the company’s vitals

- Analyzing the ownership structure and percentages

- Identify the ultimate beneficial owners

- Performing AML/KYC checks on the ultimate beneficial owners

eKYC

eKYC is the future of KYC verification. In order to provide businesses with the documentation required to open an account, customers used to schedule an appointment so their documents could be reviewed in person.

Now, eKYC allows businesses to receive information and documentation from the prospective customer digitally. Using tools and software, the business can check that all the information is accurate and legitimate without ever seeing the customer in person.

eKYC provides a number of advantages for businesses. It’s quicker and more accurate than traditional methods, it lowers costs related to compliance, and it improves the customer experience.

Mobile KYC

As technology continues to advance, the KYC services and solutions used by businesses continue to change. Now, rather than manually inspecting customer documents, businesses can harness the power of biometric data and artificial intelligence in order to better identify customers, run due diligence checks, and perform ongoing monitoring.

By combining mobile data with traditional data sources, businesses can add an extra layer of authentication. As well as improving the KYC process to boost compliance and include extra fraud mitigation methods, this step also helps deliver a convenient, immediate, and effortless customer experience.

Understanding KYC law

KYC is now considered to be an obligatory procedure for a wide variety of firms, including:

- Financial institutions

- Banks

- Fintech companies

- Credit unions

- Gambling entities and casinos

- Wallet providers and cryptocurrency exchanges

KYC law is a key part of wider AML laws, which vary around the world. However, the Financial Action Task Force (FATF) provides guidance for both KYC and AML. To date, more than 190 countries follow FATF guidance.

In the US, firms must comply with the Bank Secrecy Act 1970 and the USA Patriot Act 2001. Although these are the two key pieces of AML legislation, firms must also be familiar with other important AML regulations, including:

- Money Laundering Control Act 1986

- Money Laundering Suppression Act 1994

- Money Laundering and Financial Crimes Strategy Act 1998

- Suppression of the Financing of Terrorism Convention Implementation Act 2002

- Intelligence Reform and Terrorism Prevention Act 2004

How Veriff supports you with KYC compliance

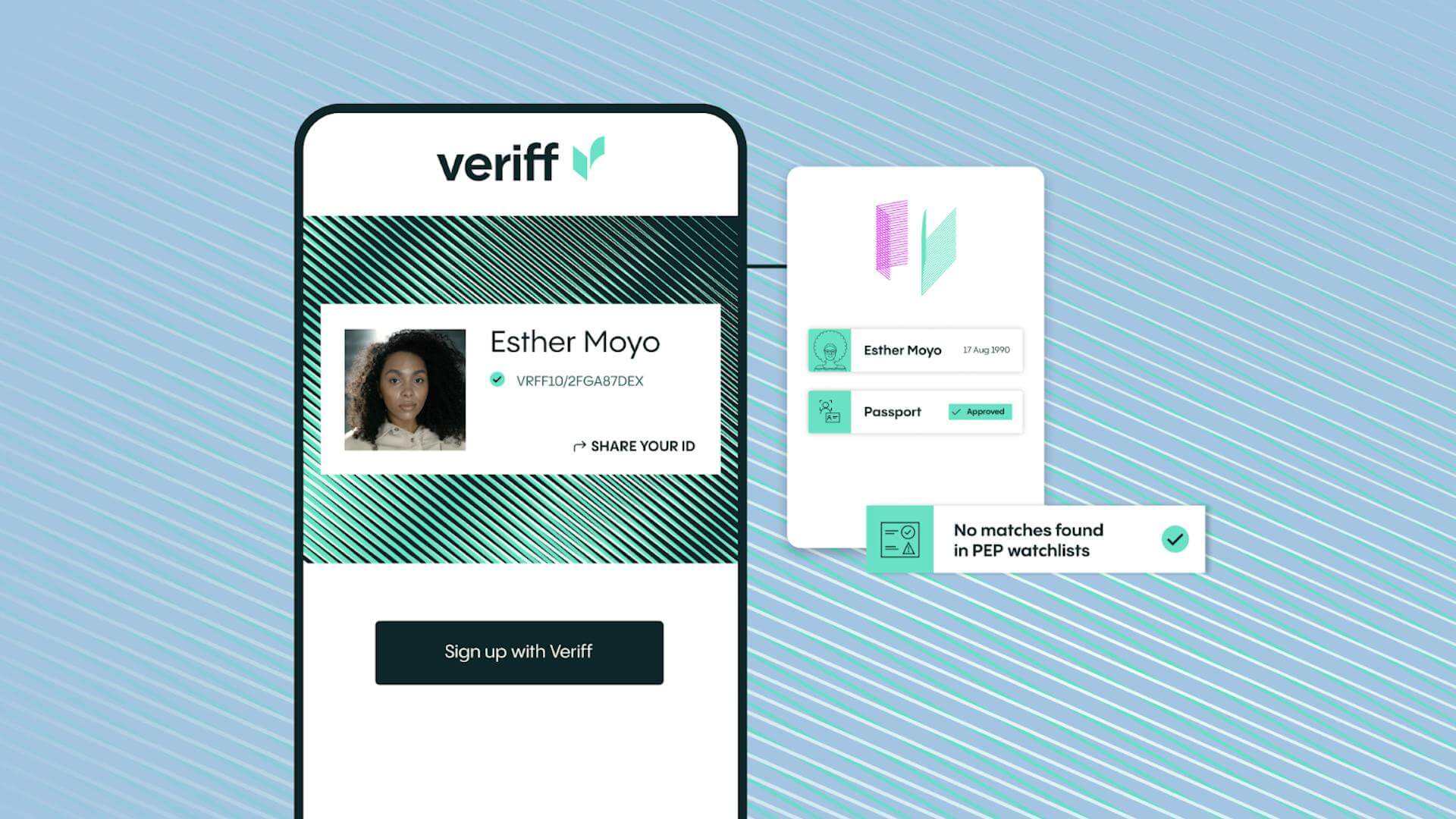

Here at Veriff, we’ve developed a number of state-of-the-art solutions that can help you achieve KYC and AML compliance. For example, our AML screening solution can not only help you stay compliant, but it can also improve conversions.

By deploying an identity verification service alongside politically exposed persons (PEP) and sanctions checks, adverse media screening, and ongoing monitoring, it reduces risk for your business at every turn.

With the help of our solution, not only can you guarantee compliance, but you can reduce false positives by up to 70% and convert up to 30% more customers.

See how Veriff’s KYC solutions can help you – Book a demo

Interested in learning more about how our KYC solutions can help your business meet its regulatory requirements? Speak to our expert team today. We’d love to give you a bespoke demo that shows exactly what our KYC solutions can do for you.