IDV Article

What is my digital identity: A comprehensive guide to secure online verification

Your digital identity shapes how you access, verify, and protect yourself online. From logging into accounts to securing transactions, it’s essential in today’s digital world. As cyber threats rise, understanding and safeguarding your digital identity has never been more critical. Let’s explore what it is, why it matters, and how to protect it.

McKinsey’s article on digital identity begins with a thought-provoking question:

What would you do if you had a copy of yourself? A digital doppelgänger, identical to you in every way, in an accurate digital rendering of your home, workplace, neighborhood, or city? Even better: What if the digital version of you—your digital twin—was impervious to injury, pain, or embarrassment? The mind boggles at the possibilities. Suffice it to say, you’d probably be able to make decisions for yourself with a lot more certainty of the outcome.

While this idea may sound futuristic, aspects of it are already shaping the way we interact online. Every time you log in to an account, verify your identity, or complete a digital transaction, you’re engaging with your digital identity—a virtual representation of who you are. But what exactly does that entail, and why is it so crucial in today’s interconnected world?

What is my digital identity?

In an increasingly digital-first society, digital identity is the foundation for secure interactions, transactions, and access to online services. A digital identity is a collection of electronically stored information that represents an individual, organization, or device in the digital world.

This includes personal data, biometric identifiers, online credentials, and authentication methods that verify your identity when accessing digital services.

Core components of digital identity

- Personal data: Name, date of birth, address, and government-issued IDs.

- Biometric identifiers: Fingerprints, facial recognition, iris scans.

- Authentication credentials: Passwords, two-factor authentication (2FA), one-time passcodes (OTP), and mobile driver’s licenses.

- Behavioral biometrics: Keystroke patterns, voice recognition, device usage patterns.

- Digital twin representation: A relatively new concept in identity verification, digital twins serve as real-time, data-driven representations of an individual’s identity attributes, helping organizations detect anomalies and prevent fraud.

It is important to note that ‘digital identity’ and ‘user’ are distinct concepts. A digital identity encompasses the electronic data associated with a person for online verification, while a user refers to the individual who interacts with digital platforms.

Types of digital identities

Digital identities come in various forms, each serving a distinct purpose in the digital ecosystem:

Human-centric identities

These focus on the core attributes and data that make up an individual’s online persona. This includes personal information, such as name, email address, and social media profiles, which are used to authenticate and verify a person’s digital identity.

Software- and system-centric identities

These are concerned with how applications and connected devices recognize and manage digital identities. Examples include hardware identifiers and cryptographic certificates that ensure secure communication between devices and systems.

Application-centric identities

These pertain to the digital identity of an online service or application, such as a mobile app or website. They help manage user access and ensure that only authorized individuals can interact with the application.

Understanding these types of digital identities is crucial for navigating the digital world securely and efficiently.

The role of digital identity in business

Businesses rely on digital identity to authenticate users, prevent fraud, and streamline operations. In industries like financial services, eCommerce, healthcare, and government services, digital identity verification ensures compliance with regulations and secures sensitive information.

Industry applications:

Financial services

- KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance, fraud prevention.

eCommerce

- Secure transactions and bot prevention.

Healthcare

- Protection of electronic health records.

Government services

- National ID programs and e-government access.

Gambling

- Compliance with age verification laws and fraud detection measures.

Verifying digital identity

Verifying digital identity is a critical step in ensuring the security and integrity of online interactions. Several methods are employed to verify digital identity, each offering a different level of assurance:

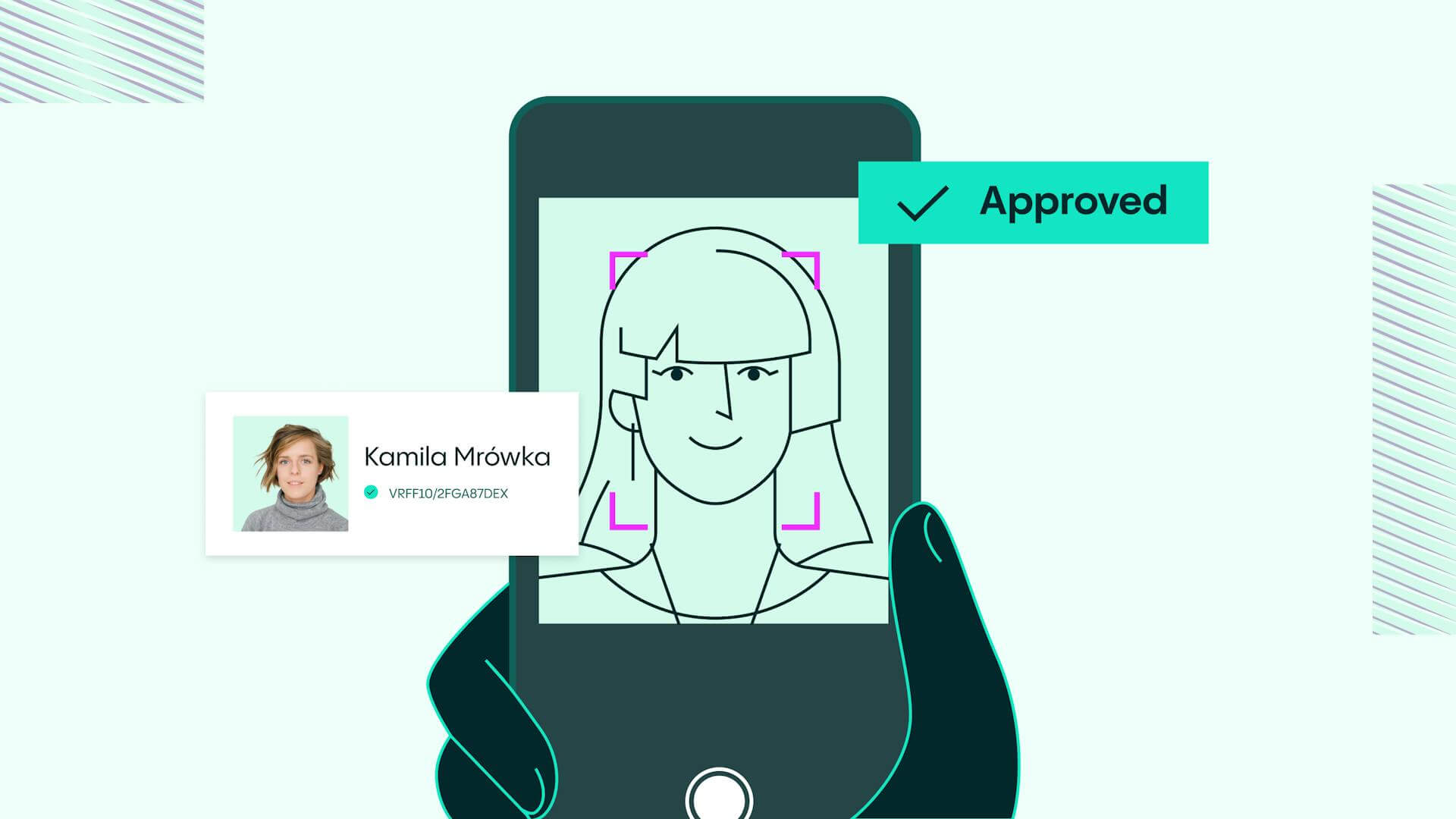

Biometric verification

This method uses unique physical characteristics, such as facial recognition, fingerprints, or voice recognition, to verify an individual’s identity. Biometric verification is highly secure and difficult to forge.

Document checks

This involves verifying the authenticity of government-issued documents, such as a driver’s license or passport. Document checks are commonly used in identity verification processes to ensure the legitimacy of the provided information.

Personal identifying information (PII) checks

This method involves verifying an individual’s data, such as name, address, and social security number. PII checks are essential for confirming the identity of individuals in various online services.

Database checks

This involves verifying an individual’s identity against a database of known individuals. Database checks help cross-reference information to ensure accuracy and prevent identity fraud.

By employing these methods, organizations can effectively verify digital identity and protect against unauthorized access and fraudulent activities.

The importance of digital identity in security, compliance & identity verification

With cyber threats and identity fraud on the rise, digital identity plays a pivotal role in ensuring trust, security, and compliance across industries. Organizations leverage identity verification (IDV) to comply with regulatory frameworks such as KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR (General Data Protection Regulation). Additionally, as businesses shift toward online-first operations, decentralized identity frameworks are emerging to reduce dependency on centralized databases, enhancing both security and privacy.

Emerging technologies shaping digital identity

Recent industry insights, such as Veriff’s US Fraud Industry Pulse Survey 2025, highlight the rapid growth of fraud tactics and the increasing dependence on AI-driven identity verification to combat them.

Quote: “Just as the fraudsters are happy to use AI, it’s clear that businesses can also deploy the technology to build their defenses,” says Iryna Bondar, Fraud Platform Lead at Veriff. “This is a very encouraging trend and mirrors what we see in our customer interactions.”

Online fraud is surging, and AI has become both a tool for attackers and a powerful weapon for defenders. Reports indicate businesses are integrating AI-powered verification to detect fraudulent behavior in real-time, mitigating risks before they escalate.

As technology advances, new digital identity solutions are enhancing security, privacy, and efficiency:

Artificial Intelligence & Machine Learning

AI-driven identity verification enhances fraud detection by analyzing vast amounts of behavioral and biometric data.

Blockchain-based Identity Management

Provides decentralized and tamper-proof identity credentials, reducing the risk of data breaches.

Digital Twins for Identity Verification

Digital twins create a dynamic, evolving digital representation of an individual, improving real-time risk assessments and adaptive authentication.

Biometric Authentication

Advanced biometric methods, such as vein recognition and gait analysis, are making identity verification even more secure.

Zero-Knowledge Proofs (ZKP)

Allows identity verification without exposing unnecessary personal information, enhancing privacy.

Discover the True Cost of Identity Fraud in 2025

Uncover key trends, data, and expert insights from Veriff’s latest Identity Fraud Report. Learn how fraud is evolving—and what your business can do to stay ahead.

The future of digital identity

As digital interactions continue to evolve, the future of online identity is shifting towards greater security, flexibility, and user control. The rise of self-sovereign identity (SSI) and decentralized verification is giving individuals full control over their digital credentials, reducing reliance on centralized entities vulnerable to breaches.

Technologies such as blockchain-based digital identities ensure verifiable, tamper-proof credentials, while AI and machine learning make identity verification more seamless and adaptive. With regulatory frameworks like eIDAS 2.0 and NIST Digital Identity Guidelines advancing, businesses and individuals must prioritize digital identity solutions that balance security with user privacy. Future trends include the widespread adoption of passwordless authentication, digital wallets, and AI-driven identity proofing, ensuring that online identities remain trustworthy and user-centric.

The role of AI and biometrics in digital identity verification

As digital interactions become more prevalent, the need for secure and seamless identity verification has never been greater. The rise of AI-driven authentication and biometric verification methods—such as facial recognition, fingerprint scanning, and behavioral biometrics—has transformed the way individuals prove their identity online. As highlighted in this video, AI enhances identity verification by detecting anomalies and preventing fraud, making digital transactions more secure. These advancements align with the core principles of digital identity, where personal data, authentication credentials, and biometric identifiers work together to create a trustworthy online presence. By integrating AI-powered digital identity solutions, businesses can reduce fraud risks, improve compliance, and ensure a frictionless user experience while maintaining the highest standards of security.

Digital identity and privacy

Digital identity and privacy are closely intertwined concepts. As individuals interact online, they leave behind a digital trail of data that can be used to verify their identity. However, this data can also be vulnerable to security threats and misuse. To protect digital identity and privacy, individuals and organizations must implement robust security measures, such as encryption and secure data storage. Additionally, regulatory compliance with laws, such as the General Data Protection Regulation (GDPR), is essential to ensure the secure handling of personal data.

In today’s digital world, protecting your digital identity is essential. By understanding, verifying, and using new technologies, individuals and organizations can secure online interactions and safeguard their identities.

Regulatory compliance & digital identity standards

Digital identity verification must align with global regulatory standards to enhance trust and security. Digital identities play a crucial role in managing access to sensitive data sets, ensuring that only authorized users can access specific data sets while maintaining regulatory compliance and trust in digital communications.

United States:

- NIST Digital Identity Guidelines (SP 800-63-3) – Best practices for identity verification and authentication.

European Union & United Kingdom:

- EU eIDAS Regulation – Sets standards for digital identity authentication across the EU.

- UK Digital Identity and Attributes Trust Framework – Ensures secure and trustworthy digital identity solutions.

LATAM regulations:

- Brazil’s LGPD (Lei Geral de Proteção de Dados) – Governs digital identity protection and privacy.

- Mexico’s Federal Data Protection Law – Enforces digital identity security measures.

How Veriff can help?

Veriff plays a key role in supporting digital transformation. With AI-powered identity verification solutions that help our customers meet regulatory standards, Veriff enables businesses and governments across Europe and abroad to build secure, interoperable digital identity systems. By providing real-time risk assessment, biometric authentication, and compliance supporting verification flows, Veriff helps ensure trust, reduce fraud, and foster seamless cross-border interactions in line with EU ambitions.

As a leader in identity verification, Veriff provides cutting-edge digital identity solutions that enhance security, streamline compliance, and reduce fraud. By leveraging AI-powered verification, biometric authentication, and real-time risk assessment, Veriff ensures businesses can authenticate users with confidence.

Additionally, recent reports from Biometric Update and industry analysts highlight Veriff’s position as a trusted partner in the booming identity verification (IDV) market. With compliance-ready solutions tailored for KYC, AML, and GDPR, Veriff empowers businesses to stay ahead of evolving regulations while delivering a seamless customer experience. Whether in financial services, eCommerce, healthcare, or government sectors, Veriff helps build trustworthy, user-centric digital identity ecosystems that protect both businesses and individuals.

As a leader in identity verification, Veriff provides cutting-edge digital identity solutions that enhance security, streamline compliance, and reduce fraud. By leveraging AI-powered verification, biometric authentication, and real-time risk assessment, Veriff ensures businesses can authenticate users with confidence. With compliance-ready solutions tailored for KYC, AML, and GDPR, Veriff empowers businesses to stay ahead of evolving regulations while delivering a seamless customer experience. Whether in financial services, eCommerce, healthcare, or government sectors, Veriff helps build trustworthy, user-centric digital identity ecosystems that protect both businesses and individuals.

Biometric authentication has revolutionized digital identity verification, reducing fraud risks while enhancing security. With the rise of synthetic identity fraud, businesses must adopt multi-layered verification strategies to safeguard user data.

Revolutionizing remote notarization: Veriff and Legitify’s secure Identity Verification Partnership

Veriff’s collaboration with Legitify showcases its ability to revolutionize identity verification for remote notarization. By integrating Veriff’s AI-driven identity verification solutions, Legitify provides a seamless, secure, and legally compliant digital notarization process. This partnership enhances trust in online document verification, ensuring that users can authenticate their identities with ease while preventing fraudulent activities. With Veriff’s technology, Legitify has been able to accelerate its digital transformation while maintaining compliance with industry regulations and strengthening the integrity of online transactions.

Listen to the full conversation with Aida now here!

As more and more transactions move online and as more and more transactions happen cross-border, ensuring that the digital identities used are secure and can be trusted is fundamental.

Conclusion: Strengthening digital identity security

The digital identity landscape is rapidly evolving, driven by emerging technologies and regulatory requirements. Organizations must implement multi-layered identity verification solutions to prevent fraud, ensure compliance, and create trust in digital interactions. As digital twins and AI-driven verification gain traction, businesses and individuals must embrace secure, decentralized, and privacy-first digital identity solutions to navigate the modern digital ecosystem confidently.