Blog Post

How Veriff can help your business comply with the new INFORM Consumers Act

The INFORM Act states that online marketplaces must collect and verify specific financial and identifying information from “high-volume” third party sellers. This new law went into effect on June 27, 2023, which means businesses need to find a path to compliance quickly, or face hefty fines.

The INFORM Consumers Act, or the Integrity, Notification, and Fairness in Online Retail Marketplaces for Consumers Act, has just been passed by Congress in the United States. This new legislation states that online marketplaces must collect and verify specific financial and identifying information from “high-volume” third party sellers. This new law went into effect on June 27, 2023, which means businesses need to find a path to compliance quickly, or face hefty fines.

Who is affected by this new INFORM Consumers Act legislation?

These new requirements will affect some of the biggest marketplaces, as well as smaller platforms. The scope of “online marketplace” within the new law encompasses persons or businesses that operate a “consumer-directed platform” that allows third parties to participate in the “sale, purchase, payment, storage, shipping, or delivery of a consumer product in the United States.”

According to the FTC, the reason for the new law is the uncertainty of the identity of the seller. The FTC said the goal of the INFORM act is “to add more transparency to online transactions and to deter criminals from acquiring stolen, counterfeit, or unsafe items and selling them through those marketplaces. The Act also makes sure online marketplace users have a way to report suspicious conduct concerning high-volume third party sellers.”

What does the INFORM Consumers Act mean for online marketplaces?

According to the FTC, there are five steps to complying with the new law:

- Collection: Online marketplaces must collect bank account information, contact information, and a Tax ID number from high-volume third party sellers.

- Verification: Online marketplaces must verify the information they get from high-volume third party sellers. They also must require sellers to keep their information current and to certify it as accurate at least once a year.

- Disclosure: For high-volume third party sellers that meet a certain level of sales on a platform, online marketplaces must disclose in the sellers’ product listings or order confirmations specific information about the seller.

- Suspension of non-compliant sellers: Online marketplaces must suspend high-volume third party sellers that don’t provide information the law requires.

- Reporting mechanism: Online marketplaces must provide high-volume third party sellers’ product listings a clear way for consumers to report suspicious conduct.

How can Veriff help?

Veriff’s solutions can help solve some of the bigger hurdles in complying with the new law — specifically verifying valid, government-issued IDs for any individuals acting on behalf of the seller. Additionally, on occasion it will require verification of a tax document that includes the business name and the physical address of the seller.

The law doesn’t have specific verification steps, but the method used must enable the marketplace to “to reliably determine that any information and documents provided are valid, corresponding to the seller or an individual acting on the seller’s behalf, not misappropriated, and not falsified.”

Remote Identity verification is clearly a huge challenge for online marketplaces, but it can also be a huge selling point, when done correctly. Part of the challenge for smaller marketplaces is that they don’t necessarily have the deep pockets needed to develop their own verification processes.

Instead, the most cost-effective way to address identity fraud is to partner with a market-leading solution provider, which has the industry reputation, expertise and experience to deliver the secure and seamless experiences that customers expect and demand.

For example, recent research by Forrester shows that Veriff’s IDV platform cuts revenue lost to fraud by 20% – which is great news for marketplaces and security-conscious buyers and sellers alike.

Additionally, a U.S. based Market Services company tested Veriff’s IDV solutions and saw 81% of all verifications delivered in near real-time (<30 seconds) as well as 96.6% verification accuracy and 95.7% extraction accuracy rates. This company is now a Veriff customer.

INFORM Consumers Act + IDV

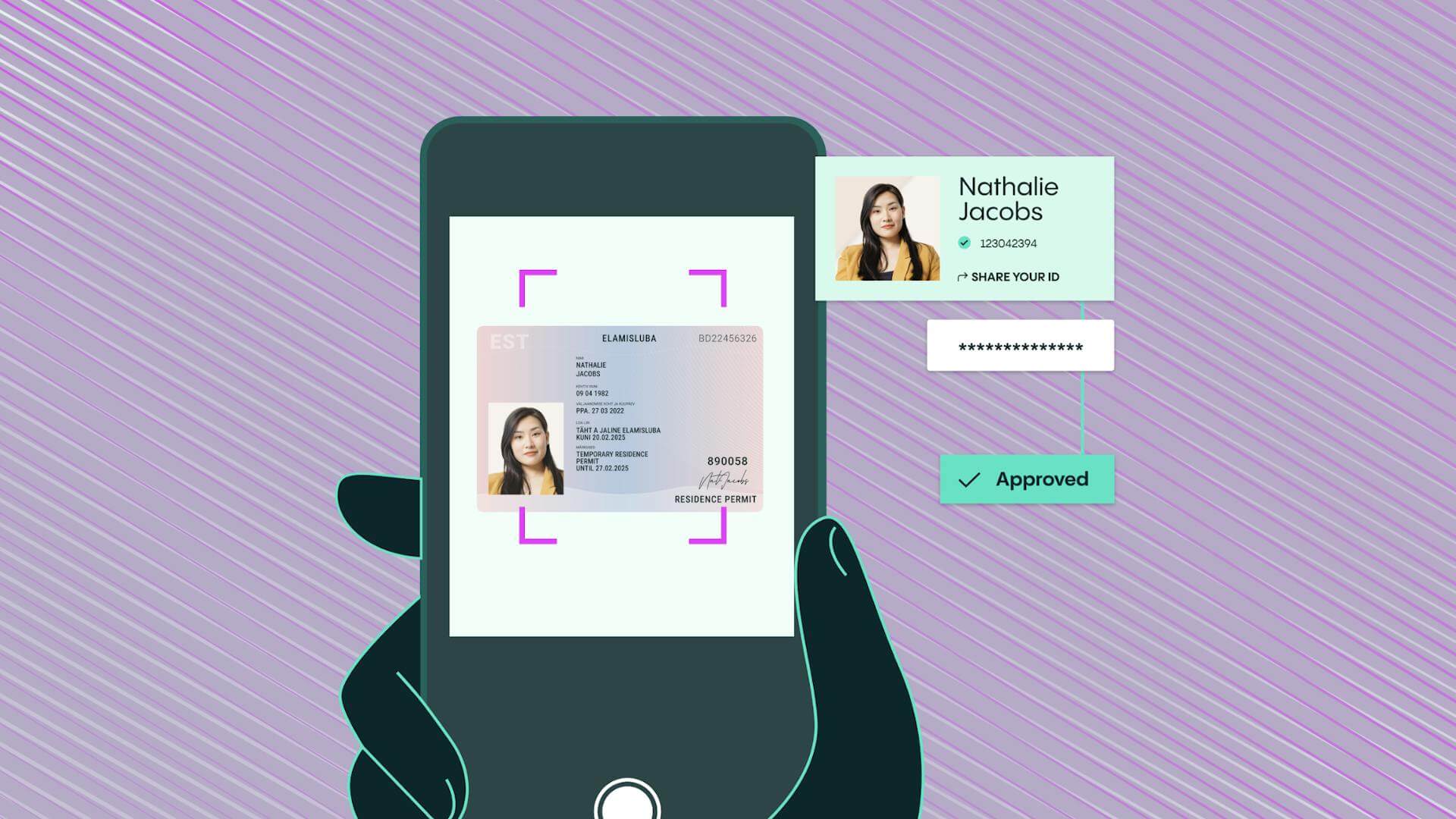

Our solution uses biometrics and facial recognition to simplify the process of validating the identity of returning customers, preventing fraudulent activity, such as account takeover and ID theft. The automated system asks customers to take a quick selfie using their smartphone or tablet.

This replaces the need to remember answers to security questions (which can be easily guessed or forgotten), one-time passwords and email authentication.

An AI algorithm checks the selfie for liveness and realness in real time by comparing it to live video taken from the customer’s device with their express permission. The selfie is then compared to photographs from the customer’s government-issued identity documents.

The Veriff IDV solution provides a fully automated authentication decision which is 99.99% accurate and provides a first-time match 99% of the time.

Document tampering and synthetic fraud

With more than 12,000+ government-issued documents in our database, Veriff can authenticate documents from nearly every jurisdiction globally. Our in-house AI- powered technology detects if they have been faked or illegally altered.

Veriff also uses device and network fingerprinting to analyze customer behavior and detect fraud. We crosslink user behavior to identify abnormal, high-risk activity and this helps to combat so-called velocity abuse, which involves the same identity, device or document being used to open multiple accounts.

Proof of Address

Know that people are who they say they are — and where they live — by adding Veriff’s Proof of Address Capture to your business’ real-time identity verification flow. Verify real customers in seconds.

Businesses must ensure that customers are living within the locations and regions they’ve been approved to operate by regulators, as well as comply with local customer due diligence requirements. This process typically entails capturing a customer’s address from another document, like a credit card or utility bill.

Our identity verification experts work with you to determine which data inputs Veriff should gather from your users, as well as what checks to conduct depending on your conversion and compliance needs. End-user flows can be as simple as an automated ID check, or as advanced as a fully recorded and manually reviewed session, including selfies and a photo with their selected ID.

As a fraud prevention measure, Veriff analyzes the device and network used for a verification session and assigns each a fingerprint. Along with hundreds of other parameters, including personal data on the ID, the data can then be cross-checked with PEP and sanctions lists, past behavior, and other inconsistencies before a decision is made.

Veriff can determine if a session or user is real without unnecessary activity from the user. These checks involve analyzing photos and video (if enabled) and are conducted behind the scenes. Your customers won’t have to complete any additional steps for liveness detection.

If you’d like to find out more about how we can support you with the INFORM Consumer Act, you can contact us here.