Blog Post

How to choose an effective Identity Verification solution (IDV) for your neobank

Swift and accurate identity verification (IDV) will be central to the future success of your neobank, so it’s vital to consider your options carefully and make the right choice from day one.

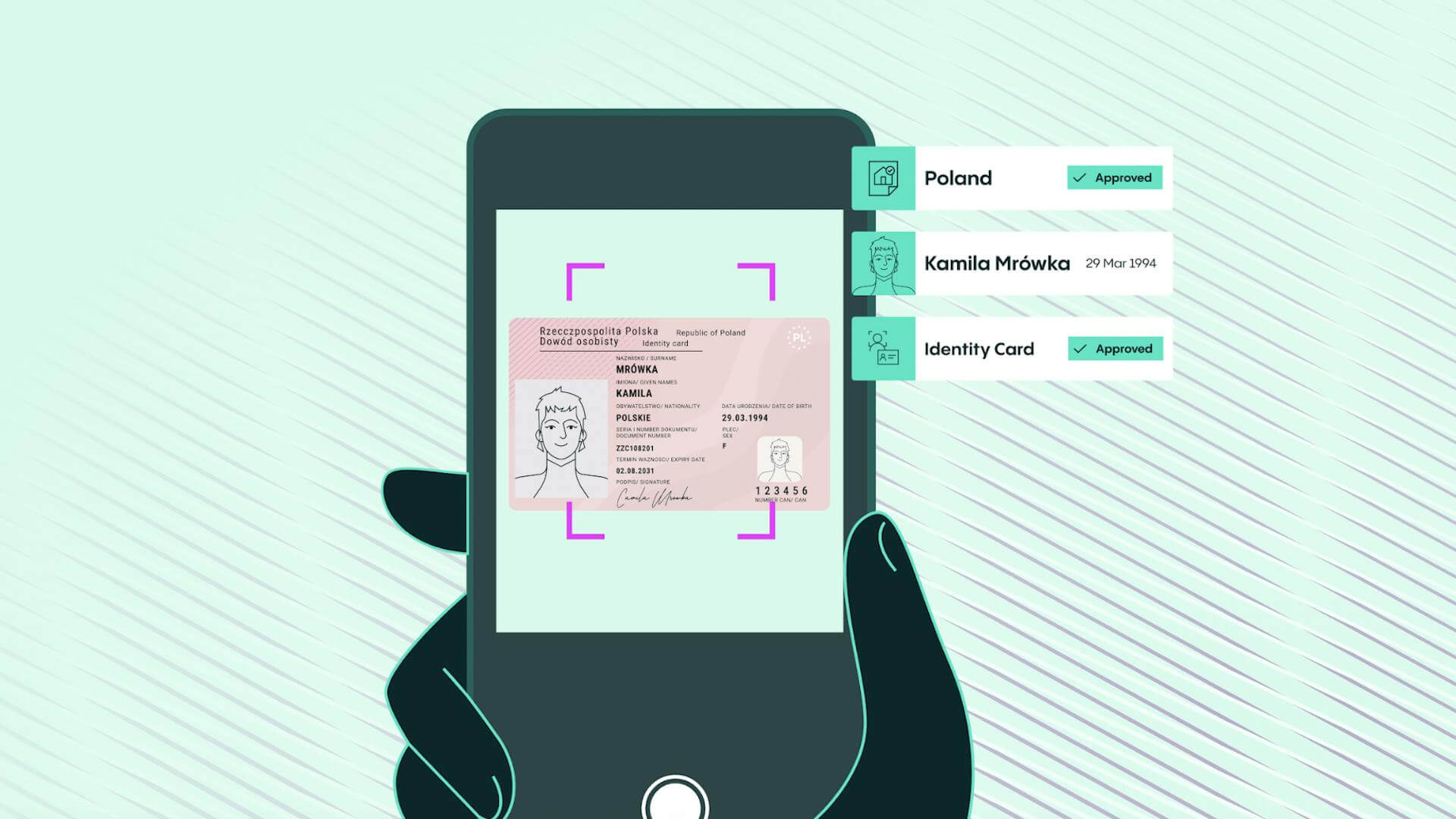

Compared to traditional banking institutions, neobanks offer a hugely beneficial range of services for today’s customers. Everyday tasks like ordering new debit cards and credit cards, or looking over checking and savings accounts, can be done though a mobile app, eliminating the need to visit physical branches to complete a physical identity verification check. The rise of the digital bank has disrupted the financial services industry, but there remains the challenge of creating a secure, seamless, and swift customer experience. As such, many neobanks are now turning to an innovative verification solution to achieve KYC and AML compliance, where customers can prove their verifiable identity by completing checks such as liveness detection.

It’s little exaggeration to say that being able to confirm your customer is who they say they are quickly and efficiently can mean the difference between success and failure for any neobank. Effective IDV processes will go some way to ensuring compliance, minimizing risk and maximizing conversion. In contrast, a clumsy or inaccurate IDV process could not only leave you exposed to bad actors but also act as a huge roadblock to your growth plans. Taking some time to understand what makes a good solution will ensure you make IDV an asset and not a liability.

Minimize friction

If you’ve ever come close to missing a flight while queueing at an understaffed airport security control, you’ll understand the inconvenience an inefficient approach to risk prevention can cause. Fortunately, the use of AI has vastly improved the speed and accuracy of the best IDV solutions, while the ongoing application of machine learning means that they are getting even better with every check. You should make sure any solution you consider uses automation effectively to expedite IDV as rapidly as possible. This will avoid customers having to endure clunky processes such as having to swap out of an app to get an email or one-time passcode, having to scroll through a list of documents to find the one they have, and not being able to use a preferred device or platform.

An experienced provider will be able to help you through the entire process, from defining success, through creating optimal IDV workflows, to designing and implementing a solution that delivers fully on your requirements.

Don’t compromise on security

While providing a seamless onboarding experience is important to maximize your conversion rate, it shouldn’t come at the expense of security. As a bank, you need to make sure you comply with the legal requirements of Know Your Customer (KYC) regulations in the jurisdiction where you plan to operate. Beyond regulatory compliance you want to minimize the potential financial and reputational risk that fraud and other illegal activity could present to your business.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

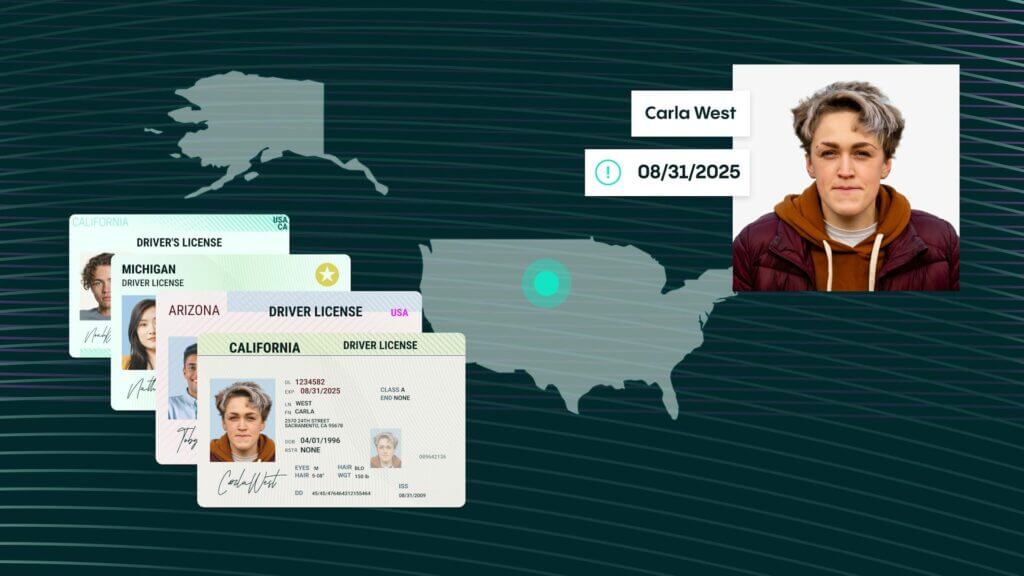

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Make sure your future needs are covered

Your IDV solution will be integral to the KYC process, so you need it to be able to evolve with your business. The ability to cope with a wide range of document types is non-negotiable. At the same time, choosing a solution with international coverage will ensure that when the time comes, venturing into new markets is as smooth and painless as your IDV process itself as you will be able to accept potential customers whose identity documents have been issued in other countries or territories. That means that as well as being able to recognize and assess documents from a range of jurisdictions, your solution should also support multiple languages.

There is also a need here for a resilient solution that can scale with your business and manage planned or unexpected spikes in customer applications, all while being secure and adaptable to evolving fraud threats. Part of this includes sandbox environments where new products and solutions can be made and tested prior to launch.

Ensure it integrates seamlessly

Of course, IDV doesn’t exist in isolation. To ensure the required balance between slick user experience and a solid security protection against evolving threats, you need a plug-and-play solution that offers seamless integration with the rest of your tech stack. Ideally, the provider you choose should offer developer-friendly APIs or a software development kit and tools to make both implementation and maintenance easier. Trial licences and supported demos will help you make the decision with confidence.

Don’t pick a product, select a partner

An experienced provider will be able to help you through the entire process, from defining success, through creating optimal IDV workflows, to designing and implementing a solution that delivers fully on your requirements. More than that, they will continue to work with you as your business grows, providing new fixes and additional capabilities as your needs evolve. In short, they will become your IDV partner.

Get more details

Discover more about how IDV is powering Neobank growth and customer acquisition.