KYC Article

The importance of KYC in gaming: Avoiding pitfalls and leveraging Veriff

As well as providing benefits for businesses, KYC in gaming also provides benefits for customers, too. Much like how a reputable company must provide its users with fair games and a secure gaming environment, these companies must also show their users that their personal information is being handled appropriately and then safeguarded.

Operators in the online gaming industry must comply with ever-changing regulatory requirements. But they must also be able to onboard customers quickly – while providing a safe, secure environment for players.

Meanwhile, know your customer (KYC) regulations are also incredibly important in gaming and cannot be overlooked. Not only do they protect the company from bad actors, but they also help protect users and their personal information. KYC makes the online gaming industry a safer place for everyone.

What exactly is KYC in gaming?

KYC stands for “Know Your Customer.” It is a process used by platform operators to verify the identity of their users to prevent fraud, money laundering, and ensure compliance with legal requirements.

Why is KYC in gaming important?

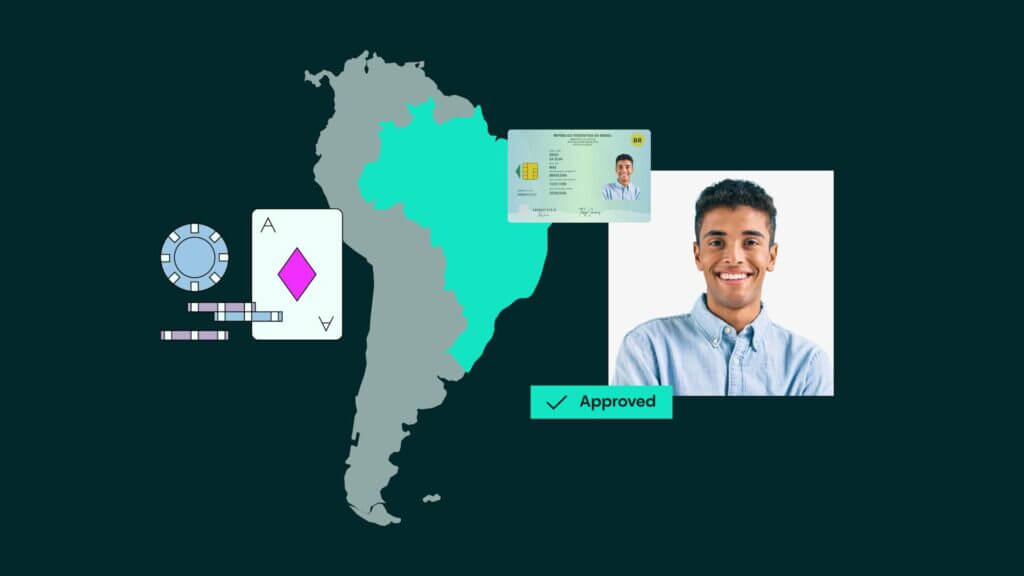

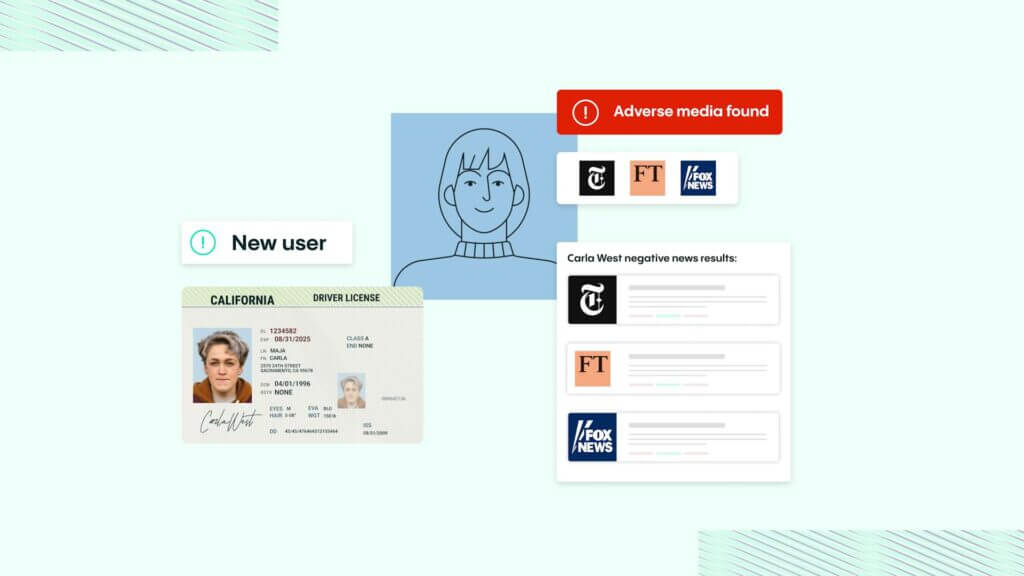

Companies in the online gaming industry are obligated to verify a user’s identity, age, location, and source of funds.

By carrying out these checks, a gaming company can stop bad actors and fraudsters from accessing their platform. They can also stop their services from being used to launder money.

KYC in gaming also provides benefits for customers, too. Much like how a reputable company must provide its users with fair games and a secure gaming environment, these companies must also ensure users’ personal information is being handled appropriately and safeguarded. Due to this, companies must demonstrate to customers that their processes aim to:

- Protect both the company and its users from bad actors and fraudsters

- Comply with the latest global regulations

- Deliver a seamless, trustworthy, and user-friendly experience

What risks could be avoided with KYC for gaming industries?

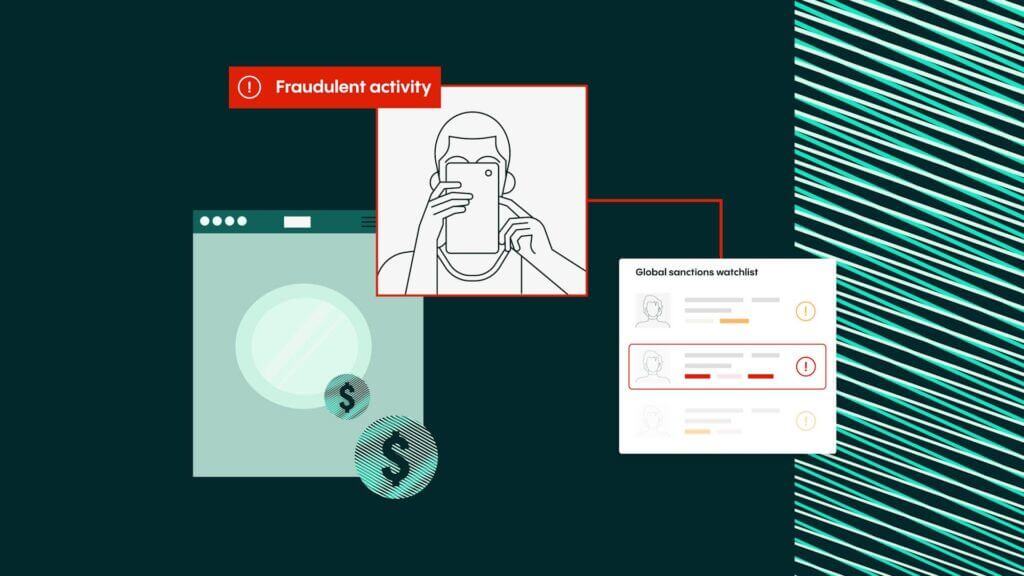

Online gaming providers, online casinos, and online gambling platforms deal with a high number of financial transactions on a daily basis – leaving them open to being targeted by money launderers.

Without robust onboarding, customer monitoring, and KYC processes in place, high-risk customers may find it easier to set up accounts. For example, between 2005 and 2008, the Corozzo Network ran illegal gambling and loan-sharking services through four online gambling sites, laundering more than $10 million in the process. They achieved this by deliberately losing games and then claiming ‘clean’ prize money.

As technology advances, the challenges faced by online gaming providers will only mount further – with bad actors increasingly able to create schemes that are complex and difficult to spot. As a result of the introduction of virtual credit cards, prepaid mobile credit and alternative payment gateways such as PayPal, for example, micro-laundering is now easier than ever.

What documents are required for KYC verification?

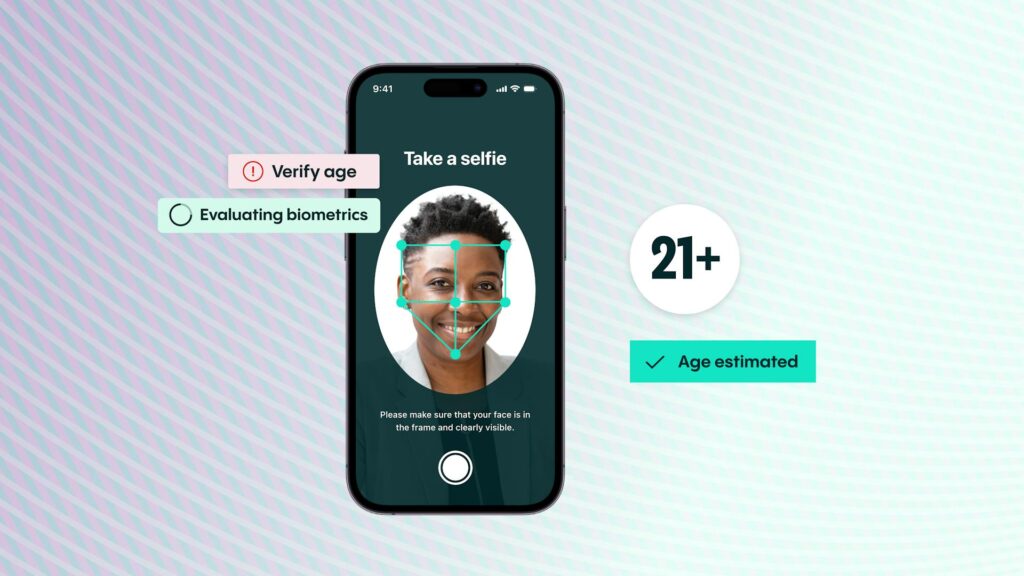

Typically, documents required for KYC verification include a government-issued ID (passport, driver’s license, national ID card), proof of address (utility bill, bank statement), and sometimes a selfie or photo for facial verification.

Interested how Veriff can help your business?

Our identity verification experts are ready to optimize the ideal ID verification experience for your business and help you deploy in a single integration.

How long does the KYC verification process take?

The verification process can vary but usually takes between a few minutes a few days, depending on the operator’s procedures and the completeness of the submitted documents.

How Veriff supports the safety of online gaming with KYC?

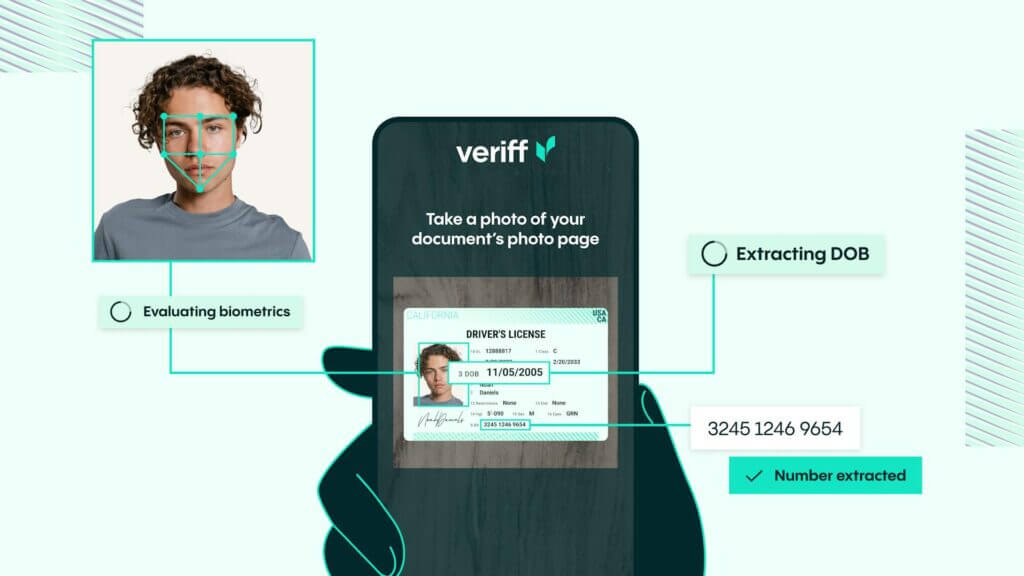

Our identity verification solution can help gaming providers safely and confidently welcome genuine players from across the world. With an unprecedented document database and a seamlessuser experience, Veriff helps you sign up players quickly and conveniently.

With Veriff, you can conquer new markets, keep regulators happy, and onboard new players quickly. As well as ensuring KYC compliance and fraud prevention, you can also build trust with your customers and ensure that genuine players find it easy to access your service.

With the help of device and network analytics, automated ID review, biometric authentication, and liveness checks, you can lock out fraudsters. But because the identity verification process is secure and simple, you’ll also have no problem assisting new players and showing them that their money and data are safe.