Fraud Article

Leveraging video analysis for enhanced fraud prevention: A comprehensive guide in 2024

In an era where cyber threats are constantly evolving, safeguarding assets and data has become paramount for businesses. Advanced security measures, such as video analysis technology, are revolutionizing fraud prevention by providing robust protection without compromising user experience.

In today’s digital age, protecting assets and data through advanced security measures is a top priority for any business. Video analysis technology is a cutting-edge solution that significantly enhances fraud prevention efforts. Video analysis offers a new array of effective security measures without causing extra friction to the end-user. This guide explores how adding video analysis can effectively strengthen security and mitigate risks of fraud.

1. Video analysis: A wide-ranging tool for security and operational efficiency

Video analysis, in its widest form, is a powerful tool with applications ranging from security and compliance to customer service and operational efficiency. By leveraging AI-driven algorithms, video analysis can monitor and interpret visual data, providing real-time insights and automated responses. This technology can be used in various industries to enhance security measures, streamline operations, and improve user experiences. From identifying suspicious activities in retail settings to analyzing customer behavior in commercial spaces, video analysis offers unparalleled capabilities for detailed observation and action.

2. The evolution of fraud prevention technologies

The landscape of fraud prevention has evolved dramatically, moving from traditional manual verification processes to more sophisticated, automated systems powered by artificial intelligence (AI) and machine learning (ML). These advancements have paved the way for the integration of video analysis technologies, which offer unparalleled insights into suspicious behaviors by analyzing video data in real-time.

Video analysis, also known as video content analysis (VCA), employs AI to examine video feeds and identify specific patterns or behaviors indicative of fraudulent activities.

3. Implementing video analysis for fraud prevention

The adoption of video analysis technology requires a strategic approach encompassing the following key steps:

Technology selection: Choosing the right video analysis solution is crucial. It must be capable of integrating seamlessly with existing systems and be scalable to adapt to future advancements in fraud prevention.

Data privacy compliance: Organizations must ensure that the implementation of video analysis technologies complies with data protection and privacy laws. This involves securing consent where necessary and safeguarding collected data against unauthorized access.

Continuous learning and adaptation: To remain effective, video analysis systems must continuously learn from new data and adapt to evolving fraud tactics. This necessitates regular updates and training of AI models to recognize new patterns of fraudulent behavior.

Cross-functional collaboration: Successful implementation of video analysis for fraud prevention requires collaboration across various departments within an organization, including IT, security, compliance, and operations.

4. Top benefits of video analysis in identity verification

Video analysis, often complemented by advanced technologies such as AI and computer vision, provides a multifaceted approach to identifying and preventing fraudulent activities across various sectors.

Why is video analysis so important in fraud detection during identity verification? Some of the top benefits:

- Enhanced Fraud Detection: Offers more comprehensive insights compared to static data, significantly improving fraud detection.

- Liveness Detection: Video analysis also boosts the reliability of checks for end-user liveness during verification procedures, confirming that individuals are physically present and actively engaging with the system.

- Additional Insight: using video provides additional context of what is happening during the user verification process. Is someone telling the user what to do, helping them, or influencing them?

- Data Integration: Video analysis systems can integrate with other data sources (e.g., biometric systems, databases) to cross-reference and confirm information swiftly.

5. Overcoming challenges

That’s not to say that video analysis isn´t without its challenges. Perhaps most notably, fraudsters continuously improve their methods, using sophisticated techniques such as deepfakes, video replay attacks (e.g., stolen video replays), and high-quality forgeries that sometimes bypass video analysis systems.

Although a powerful tool, video analysis isn’t the sole determinant of verification decisions. Instead, it provides additional context and insights for decision-making and enhances the overall accuracy of our processes.

For example, this could include improving the ability to detect liveness and offering a better sense of the environment where the user is taking the selfie. All of this adds additional layers to the accuracy of our approach.

DOWNLOAD NOW!

Explore the latest insights into digital fraud trends with the Veriff Fraud Index 2024.

6. How Veriff can help?

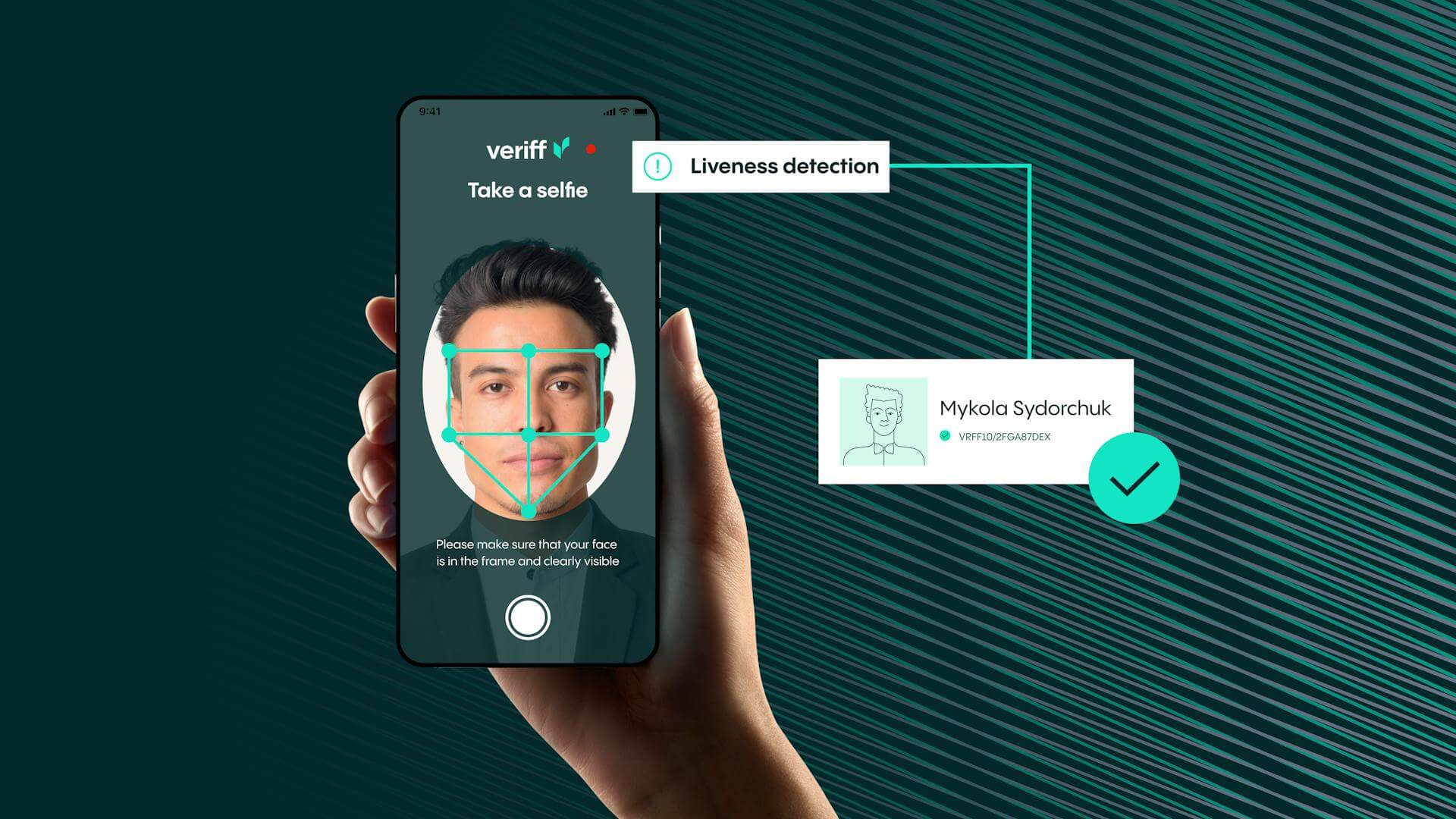

At Veriff, we provide optional video recording as a tool for our customers in our identity verification (IDV) and biometric authentication solutions. While its use is not enabled by default, those who select video recording can experience enhanced fraud detection capabilities.

Veriff also uses cutting-edge technology, including liveness detection and device analysis, to differentiate between genuine users, synthetic identities, or manipulated videos.

We believe in transparency every step of the way. Video is seamlessly integrated into our verification process, with recordings initiated automatically during each session.

Video offers unparalleled value for businesses seeking to bolster their fraud prevention measures. It provides an added layer of security and insight, enabling businesses to stay one step ahead of fraudsters.

7. Case study: how Veriff solved a critical business problem for Webull

In the fast-paced world of digital trading and finance, ensuring secure and efficient user onboarding is paramount for platforms like Webull. As an online trading service that offers commission-free trades of stocks and exchange-traded funds (ETFs), Webull’s user base is diverse and tech-savvy, demanding an experience that is both seamless and secure. However, like many digital platforms operating in the finance sector, Webull faced significant challenges in verifying the identities of their users quickly and accurately without compromising on security.

This is where Veriff stepped in with its advanced identity verification solutions. By leveraging Veriff’s AI-driven technology, Webull was able to enhance its KYC (Know Your Customer) processes, significantly reducing fraudulent account registrations and ensuring compliance with regulatory standards. Veriff’s robust system checks document authenticity, cross-references user data, and uses biometric analysis to confirm user identities in real-time. This comprehensive approach not only fortified Webull’s security measures but also expedited the onboarding process, providing users with a frictionless registration experience.

The implementation of Veriff’s solutions has had a profound impact on Webull’s operations. It has minimized the risk of financial fraud, safeguarded user data, and ensured that legitimate users can access their trading accounts swiftly and securely. By solving these critical business problems, Veriff enabled Webull to maintain its competitive edge in the crowded fintech market while enhancing user trust and satisfaction. Brendan Fuller, Webull Chief Risk Officer, emphasizes:

“Providing our users with a safe and secure platform has always been a top priority at Webull, and Veriff has helped us to do so. Compared to previous partners, Veriff has been able to support us in identifying fraudulent activity accurately and effectively – even as platform user numbers climbed.”

Providing our users with a safe and secure platform has always been a top priority at Webull, and Veriff has helped us to do so. Compared to previous partners, Veriff has been able to support us in identifying fraudulent activity accurately and effectively – even as platform user numbers climbed.