Blog Post

How to embed IDV into your security strategy

An effective security strategy is vital for businesses to protect users and prevent the risk of online crime. The identity verification (IDV) sector has evolved to meet these challenges; in a new how-to guide from Veriff, discover how it can be harnessed by businesses today.

Download the eBook

As online fraud evolves at a dizzying speed, there has never been a better moment to review your security strategy and ensure it is appropriate for the current digital environment, able to protect against a multitude of new and emerging threats, and compliant with legal requirements.

Bad actors are constantly searching for new ways to breach the defenses of vulnerable organizations. This is especially true in industries where the enormous potential rewards far outweigh the relatively low danger of being discovered. Industries that process huge sums of money and sensitive user data, like fintech, gaming, and cryptocurrency, have become major fraud targets, creating substantial legal, financial, and reputational risks for organizations.

Legacy processes like knowledge-based authentication have been undone by fraud trends like data breaches and phishing, leading to innovations in identity verification.

To prevent crimes like money laundering and terrorism financing, anti-money laundering (AML) and Know Your Customer (KYC) regulations make identity checking a legal requirement for a range of industries. Legacy processes like knowledge-based authentication (KBA) have been undone by fraud trends like data breaches and phishing, leading to innovations in identity verification (IDV).

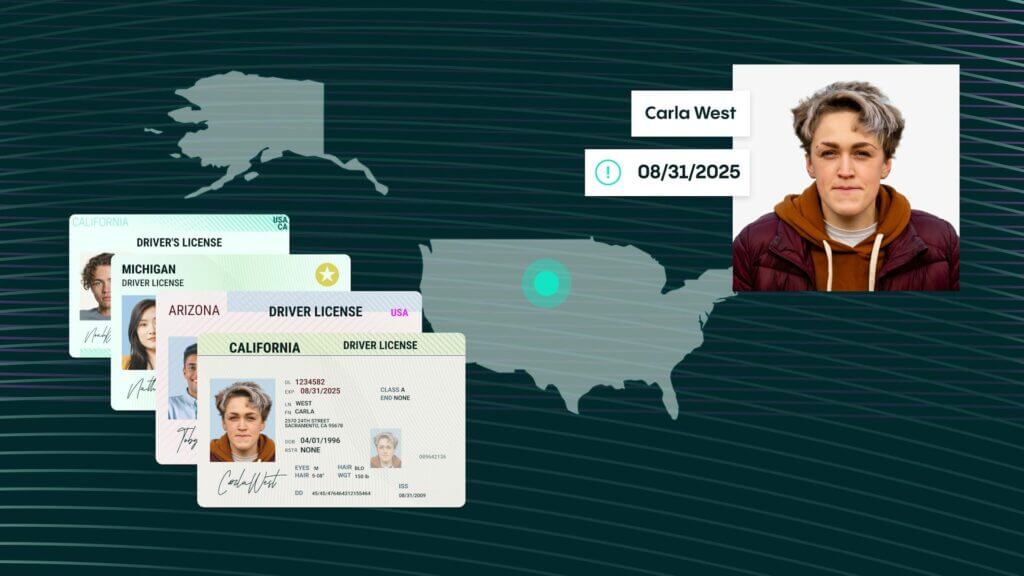

IDV covers two bases: it verifies that a potential customer who wants to use a service is who they say they are, not a robot or synthetic identity, and it requires them to prove their validity before they can access data or system. These basic processes alone can prevent fraud by preventing people from using false or stolen personal information to access goods, services, or products.

To discover how IDV can enhance security strategy, insight into the verification process, and top tips to beat identity fraud, download Veriff's new ebook for free from the link below.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.