Blog Post

How identity verification (IDV) is powering the future of banking

Today’s banking firms must meet the expectations of customers and regulators alike, while minimizing the threat of bad actors. Legacy security processes can prove to be a hindrance, while identity verification (IDV) enables firms to overcome challenges and scale. Read Veriff’s new eBook to find out more.

Online fraud is an ongoing and evolving threat, with banking firms and their customers proving to be prime targets for bad actors. Mitigating risk and ensuring regulatory compliance requires a security approach that is both rigorous and agile. However, at the same time, the onboarding process and ongoing user experience should be as seamless and swift as possible.

As such, moving from knowledge-based authentication (KBA) to automated identity verification (IDV) is key to satisfying customer expectations. Nonetheless, customers are rightfully concerned about their day-to-day security when using services, and nowhere is this more evident than at banks.

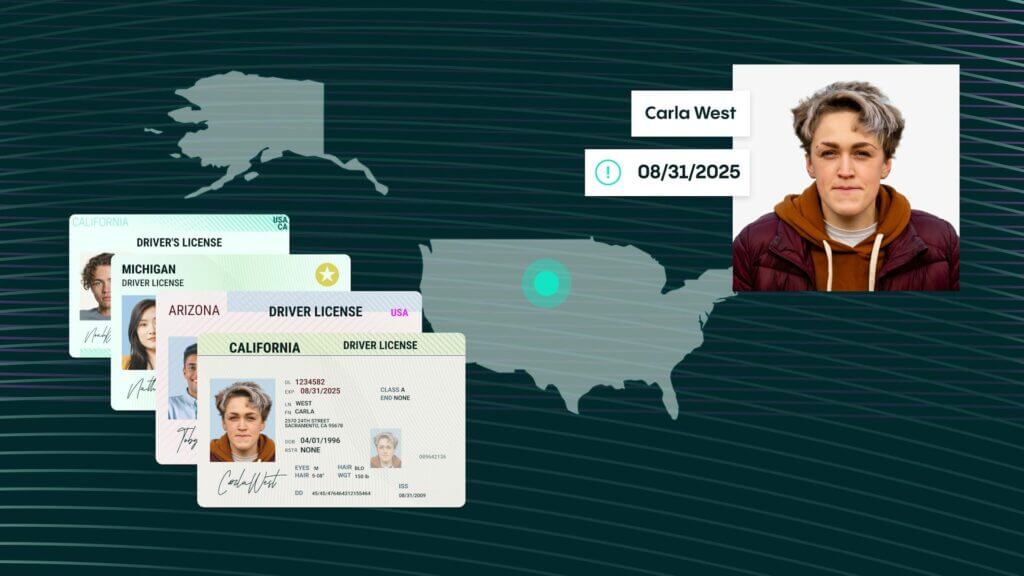

Compared to legacy security processes, selfie-based IDV is a much more secure approach, utilizing facial recognition technology in combination with government-issued identification to match a customer’s face to their ID. IDV providers use a variety of networks, devices, documents, videos, biometrics, and behavioral information for maximum effectiveness.

With new firms starting up and developing at speed, quickly and efficiently verifying customer identities can be the difference between success and failure for neobanks.

By using such a variety of information, it’s possible to maintain a balance between speed, accuracy and effective fraud prevention, ensuring verification is both quick and accurate. Furthermore, the application of machine learning to the verification process means that the more data systems gather, the more accurate they become.

Modern IDV software eliminates the need to manually fill out and process forms. It delivers decisions in seconds, minimizes friction, and significantly reduces the risk of losing potential customers the onboarding process. With new firms starting up and developing at speed, quickly and efficiently verifying customer identities can be the difference between success and failure for neobanks.

In this new eBook from Veriff, discover how IDV is driving innovation in the banking sector, enables banking firms to scale effectively, and how the technology enables to banking firms to stay ahead of bad actors.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Ready to download?

Discover further insight into this topic and much more in Veriff’s new eBook. Click below to download it.